Buying Low, Selling High and Understanding the S-Curve

Trying to build a framework for what is always a judgment call...

Buy low and sell high. It’s pretty simple. The problem is knowing what’s low and what’s high. ~ investor Jim Rogers

Ah, the Holy Grail: “Buying low and selling high.” Every investor’s endgame neatly summed up in five words. But what’s the right path to get there? It can quite literally be a million-dollar question. For most investors the answer is entirely dependent on the time, effort and energy you are willing to put into managing your portfolio. If you enjoy juggling numbers and can stomach volatility, growth stocks might be your game. If you prefer less work or more stability, you might build your holdings around a mix of larger brands you already know and use. And if you’d rather do absolutely anything other than manage your portfolio, you should probably buy a low-cost index fund as early as possible, dollar cost average and stay the hell out of the way.

As for my path, I’ve spent a lot of time examining my style since deciding to take more control of my portfolio. I recently tried to articulate my views on the difference between growth investing and momentum investing. After considering it carefully, I believe I land in the growth camp. I’m still at a stage where maximizing returns is more important than preserving capital. Given my philosophies and risk tolerance, I’ve decided a concentrated portfolio of carefully selected growth stocks is the best avenue for attaining my goals.

One of my biggest epiphanies along the way was realizing I am committing to a company and not just buying a stock. The upside of this idea is obvious. Finding the next Microsoft, Apple or Amazon early enough in its trajectory could set you up for life. The downside is very few of these companies exist, and the increased risk of trying to identify them early can result in large losses if you’re not paying careful attention. So how do we figure out which companies to select and where they sit on that trajectory? The first thing I learned was a process to set expectations and track company performance. The second was a basic understanding of the S-curve.

The best and simplest explanation I’ve found for the S-curve and how it relates to investing can be found in this 2016 Motley Fool article by Simon Erickson. I’d highly recommend giving it a read if you’re unfamiliar with the concept. The article explains in very clear terms why young companies can sometimes show exponential growth, which in turn can lead to exponential returns. As Erickson puts it:

…for innovative companies in evolving markets, the profit stream is significantly less predictable. Founders and managements are making decisions to gain a foothold in markets that may not even exist yet. Customers are still familiarizing themselves with the new products and figuring out how best to incorporate them into their existing processes. The inputs for Wall Street's spreadsheets have a high degree of uncertainty, which can result in price targets that are all over the place.

In short, it almost never works to forecast based on linear assumptions for growth companies.

As such, when a growth company "beats estimates," it often does so in spectacular fashion. Once the mass market starts adopting the company's products, sales and profits can shoot up quickly over a short period of time.

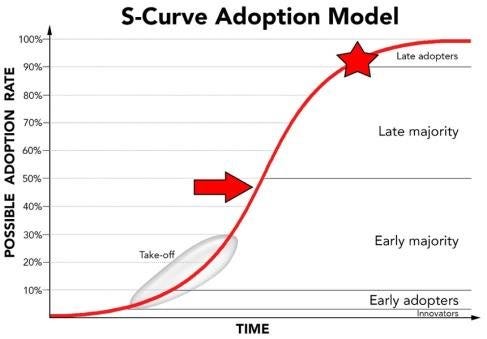

The accelerated growth phase leads to a company's performance and stock price resembling an "S curve," which looks more like this:

If a company reaches the middle section of the S-curve, other investors get more comfortable and jump onboard as well. This tends to push the stock price even higher.

This is a phenomenon that is to the advantage of the growth investor. Our goal is to find and buy companies today that exhibit signs of reaching the middle of the S-curve tomorrow.

I agree 100% with that last sentence. As my style evolves, I’ve come to view the S-curve as the sweet spot for what most investors are trying to do. Every press release or earnings report is a chance to assess where you believe a company resides on that curve and then buy, sell, or hold accordingly. While we don’t always get it right, I believe most of us want to own companies during their period of greatest growth and hopefully by extension their greatest returns. We want to purchase a firm in the early part of its upward trajectory and exit before business maturity flattens returns. You know, buy low and sell high.

The difficulty, of course, is determining exactly where a company sits on that curve. Unfortunately, there is no formula. It always has been and always will be a judgement call. Successful investors are those who make the correct call more often than not. How do they do it? In my experience they pay extra close attention to new information. They interpret it well. They double check their theses regularly and adjust conviction levels as needed. Finally, they act decisively and with purpose. I’ve tried to do the same, though with admittedly mixed results. Believe me when I tell you that’s a lot harder than simply buying an index fund and going to sleep.

One of the uncomfortable lessons I have learned first hand is it’s remarkably easy to screw things up. In fact, mistakes are unavoidable. Imperfect information will inevitably lead to misjudgments about a company’s spot on the curve or its likelihood of success. So, when you realize you’ve made an error don’t delay. A sunk cost is a sunk cost. There is no sense hanging around trying to prove you are right or hoping things will bounce back. The market simply doesn’t care about you or your feelings. You are better off pivoting quickly because downward volatility waits for no one, especially in the growth arena. Abandoning a mistake might feel unsettling, but it shouldn’t. Exiting a mistake before further damage occurs can actually increase your chances of success. And who doesn’t want that? The name of the game is consistently holding businesses on the right part of the S-curve…and ruthlessly culling those that prove they aren’t. It’s that simple and that complex all at the same time.

Thanks for reading and good luck out there.

new follower and appreciate the reality of your posts (practical and transparent)...fully agree with this post and i read the same motley fool article years ago and made it the cornerstone of my trading...a post on your stock selection criteria would be awesome...thanks in advance...