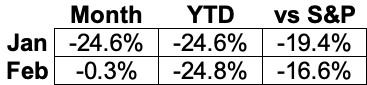

February 2022 Portfolio Review

Total Return: -24.8% YTD (-16.6% vs S&P)

So, how’d February go? Well…

2022 Results:

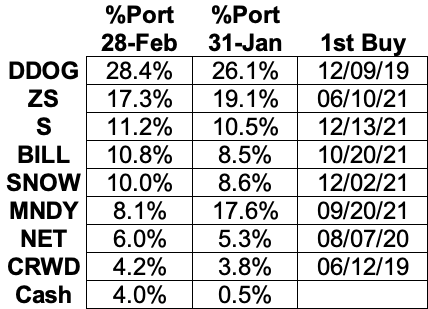

February Portfolio and Results:

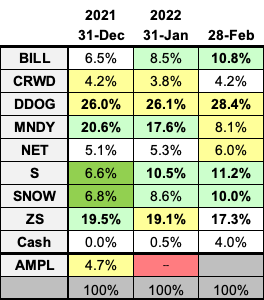

2022 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2018 (the one that got things started)

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

December 2021 (contains links to all 2021 monthly report)

Stock Comments:

February kicked off earnings season…and unfortunately the market mostly kicked back.

In the big picture I’d say we saw our usual mix of beats, meets, and misses. In the small picture though, moody investors found reasons to hammer just about any firm daring to report. Trying my best to hold the long view, below is a blow-by-blow of the business results as I see them.

CRWD – CrowdStrike has been remarkably quiet heading toward March 9 earnings. With the recent uptick in cybersecurity headlines, this will be an important update. As I said in December, this is likely a do-or-die quarter as far as CRWD staying in our portfolio.

BILL – After a sleepy January I wrote I hoped Bill.com woke the market with a raucously loud February 3 earnings report. I’m pleased to say that’s exactly what it did.

BILL blew away estimates with $156.5M in revenue and 190% YoY growth. Yes, recent acquisitions pad that total, but organic growth has now accelerated five straight quarters from 1Q21’s 31%: 38%, 45%, 73%, 78%, and 85%. Subscription growth surged from 43% last quarter (39% organic) to 85% (51%) this time around. Total payment volume (TPV) through BILL’s platform increased a sequential record $9.5B to $56.4B (+62% YoY; +20% QoQ). This total “significantly outperformed our expectations…driven by engagement from our customers and expansion in share of wallet given more payment choices and the impact of a slightly larger average customer.” Even better, this TPV jump is entirely organic excluding any contributions from the Divvy and Invoice2go acquisitions.

The increased volume helped push gross margin to a record 85.3%, which was higher than anticipated. In response, management raised its FY gross margin forecast from 77-79% to 79-81%. It also noted the expected rise in interest rates will increase the higher-margin float revenue BILL earns from holding funds while customer transactions clear. For context, the CFO estimates a 1% rate increase would generate $30-$35M more in annual float revenue. While that’s relatively small potatoes at a $600M+ run rate, I’m a firm believer free money is always good money. Regardless, BILL appears to be leveraging multiple revenue streams as it scales.

Recent acquisition Divvy – a credit card platform for managing business expenses – contributed strongly this quarter with standalone growth of +188% YoY. CEO Rene Lacerte is very happy with the early integration and says Bill.com’s existing customers are showing increased interest in the service. To help seize this opportunity, Divvy Co-Founder Blake Murray will now lead the unified sales team as Chief Revenue Officer. This move makes a ton of sense as BILL looks to aggressively leverage Divvy’s offerings.

It also makes sense when you consider BILL’s rapidly expanding customer base. A record 8,100 net new clients joined its platform this quarter, bringing the count to 135K. It also lists 15.5K Divvy users and 223K Invoice2go subscribers across 100+ countries. As Lacerte noted, “as of the end of Q2, more than 350,000 businesses were leveraging our solutions to simplify and automate their back offices.” That total is augmented by partnerships with six of the top ten financial institutions and 5,500+ accounting firms including 85 of the US’s top 100. BILL now estimates its reach at more than 3.2 million members. With just over 2% of US small-and-medium-sized businesses (SMB’s) using it, BILL is certainly in the “early innings of an enormous opportunity” (as all the hip CEO’s like to say).

On the call Lacerte revealed BILL has also jointly released a new accounts payable/receivable solution with Bank of America (BofA). It debuted in several markets during Q2 with the nationwide rollout continuing throughout the year. This is not only a significant expansion of BILL’s current BofA relationship but also a direct result of customer feedback and demand. Management has enough confidence in future adoption it has raised a prior projection of 4-5K new customers per quarter to 6,000 going forward. That’s excellent news.

The top line outperformance was good enough to generate a surprise $3M operating profit, BILL’s first ever profitable quarter. Net loss shrunk to $220K, so just short of breakeven. Cash flows remain negative (-$13M operating; -$16M free cash) but are quickly getting back in line as final acquisition costs are absorbed. With $2.8B in cash, the balance sheet is plenty strong enough to cover any additional cash burn as things smooth out.

All in all, I thought it was a great report. Though Q3 tends to be seasonally weak, the drivers behind BILL’s recent success look very strong. The CFO said about the usual conservative guide, “While we don’t see an impact on our overall SMB base at the moment, we continue to monitor the situation closely. Our fiscal 2022 outlook update assumes there won’t be a material negative impact to our business from pandemic macroeconomic or supply chain issues faced by our customers.” That’s almost identical language to last quarter when the 60% organic growth guide was eventually trounced by an 85% result. I can’t help but notice this quarter’s guide is 67% even with the appropriate prudence. Management also raised FY revenue $60M while moving its FY organic growth estimate from 55% to 69%. Those bumps certainly suggest confidence in where the business is heading. That makes me confident as well.

As mentioned when purchasing Bill.com, its recent acquisitions and variable transaction revenue make it more complicated than most of our holdings. Even with the added complexity though, the numbers don’t lie. The best businesses tend to accelerate when hitting their stride, and BILL is doing just that. However, its heavy reliance on transactions – which naturally fluctuate more than its subscriptions – limits how high I’ll push this allocation. While consecutive 27%, 12%, and 19% beats are certainly exciting, they also suggest management has less visibility into its near term than other firms with steadier guiding histories. Don’t get me wrong. Beats this large can lead to very pleasant surprises (like BILL’s 40% post-earning jump or the bulk of my Upstart and Zoom experiences). The tradeoff is shortfalls are severely punished once Mr. Market starts demanding a never-ending string of outsized beats (as eventually happened with both UPST and ZM). Fortunately, all current signs point to BILL continuing its hypergrowth ways. I’m content to let this one ride as long as that’s the case.

DDOG – Daaaaamn, Dawg!!

Really, what else can you say after Datadog crushed yet another quarter? And doing it at scale I might add. DDOG nailed it with $326M in revenue for 84% YoY and 21% QoQ growth. That means YoY growth has jumped from 51% to 67% to 75% to 84% the last three quarters. That’s phenomenal at any run rate let alone one now $1.25B+. Even better, the stellar top line was backed by record metrics all over the place:

Gross Margin: 80.3%

Operating Expenses as a % of Revenue: 59%

Non-GAAP Gross Profit: $262M and 24.8% QoQ growth (both records)

Operating Cash Flow Margin: 35.5%

Free Cash Flow Margin: 32.7%

Operating Margin: 21.6%

Net Margin: 21.5%

Much like the headline numbers, there were product and customer count records as well. Datadog exited the year with 13 generally available products, up from nine at the end of 2020. It released 80+ platform integrations in 2021 to pass 500 overall. A record 1,300 new customers signed on to reach 18,800. Several were six- and seven-figure deals including Datadog’s largest new ARR contract ever. Q2 ended with a record 2,010 clients spending $100K+ per year (+64% YoY) and 216 crossing $1M+ (+114%). 78% of customers now use 2 or more products up from 77% last quarter and 72% last year. 33% are now at 4+ versus 31% and 22%. Lastly, business is growing rapidly enough management introduced a 6+ cohort at 10% versus 3% in 4Q20. With a net retention rate of 130%+ for the 18th consecutive quarter, it doesn’t appear customer appetite for Datadog’s products will be decreasing any time soon.

I guess it’s possible CEO Olivier Pomel will eventually tire of repeating his “strong growth across all the products…in all business segments” line every quarter. I must admit, however, I’ve yet to get tired of hearing it. The CFO happily chimed in by noting Annual Recurring Revenue accelerated from Q3 in every global region (North America, Europe, and Asia). “With our usual conservatism applied” management guides for 71% Q1 growth and 48.7% for FY2022. Given DDOG’s recent beat history, I’d expect something closer to 85% next quarter with a chance to push 90% if things surprise. No matter how you slice it, that’s pretty daaaaamn good.

Needless to say, DDOG maintains its grip on our #1 spot. I even trimmed some for the third consecutive month, but its allocation keeps creeping up as others drift down. At this point I’m not inclined to sell any more until seeing our remaining reports. Hopefully, a blowout quarter or two will organically bring this allocation back toward the pack.

MNDY – There was a fair amount of speculation early this month surrounding monday.com’s debut Super Bowl ad. Was this the right move for such a small company? Why run such an expensive campaign? And for Pete’s sake, is the Super Bowl even the right place to hype an enterprise software tool? Depending on which scorching-hot take you ran into, this was either an ingenious way to spend a few extra million or a desperate attempt at a big splash before a Pets.com-type bankruptcy.

Personally, I couldn’t get too worked up about the reasons behind the ad. Why try to read management’s mind when I could simply wait ten more days until earnings? That would paint a much clearer picture than some random internet poll on the slickest Super Bowl ad. Besides, who even had a chance against Serena Williams, Peyton Manning, and Steve Buscemi?

Sadly, it looks like MNDY still has work to do to move from game time to prime time. In many ways Q4 capped a wildly successful FY21 (oldest to newest):

Revenue Growth: 85%, 94%, 95%, 91%

Operating Expenses as a % of Revenue: 129%, 104%, 102%, 100%

Net Retention Rate for all customers: 107%, 111%, 115%+, 120%+

NRR for customers with 10+ seats: 121%, 125%, 130%+, 135%+

Net >$50K customers added: 71, 135, 143, 180

QoQ >$50K customer growth: 27%, 40%, 30%, 29%

Operating Margin: -40%, -14%, -11%, -10%

Net Margin: -41%, -16%, -14%, -12%

Operating Cash Flow Margin: -1%, -1%, 5%, 14% (positive earlier than originally expected)

Adjusted Free Cash Flow Margin: -3%, -2%, 3%, 11% (ditto)

Hmm…that all looks pretty darned good. In addition:

Co-CEO Roy Mann lauded “strong revenue growth across all verticals, customer segments and geographies, with over half of our revenue coming from outside the US.”

Customers with 10+ seats (i.e. those customers demonstrating the most stickiness and reliability) now account for 72% of MNDY’s annual recurring revenue versus 63% last year.

Management announced two new products, a formal strategic alliance with audit firm KPMG, and plans to aggressively invest in what it considers a large opportunity.

Analysts were quite congratulatory during the call, particularly on the continued customer growth and positive cash flows.

So, given all that goodness why did the stock get pummeled?

The main problem appears to be a FY22 guide for 54% revenue growth with increased operating losses. The Q1 guide looks okay at 73% growth with a -40% operating margin. While -40% isn’t great, it’s not unreasonable considering 1Q21’s -39.5% result and the fact this year includes the one-time $8M Super Bowl spend. It’s the rest of the year a currently skittish market seems to dislike most. While every management has to leave room for four beats and raises in its initial FY guide, 54% growth with $142M in losses and a -30% operating margin just isn’t a good look coming off 91%, -$52M, and -17%. I too see this guide as disappointing – particularly the operating loss – mostly because of the preliminary message it sends. Guides for declining growth are usually balanced by at least some hint of narrowing losses and/or improved profitability. Conservative or not, these numbers simply don’t do that. Will MNDY eventually beat them? Almost certainly, and probably quite handily. Alas, that doesn’t change the rules of the game.

In mulling it over, I must admit to an allocation mistake here. When buying MNDY in September, I specifically noted its need to prove consistent leverage and the mission critical nature of its product. These were the same issues I previously identified in this space when owning Smartsheet and vetting Asana. Given this info, my usual conviction tiers probably should have capped MNDY around a 10-12% allocation. Instead, I pushed it closer to 20% when I felt the price became too low for a 90% grower. Hindsight is always 20/20, but that was a big (and costly) mistake. And it would be a mistake even if monday.com had soared after this report. Full disclosure, I decided prior to earnings MNDY was too large but felt the trends implied a good enough quarter to bail me out and let me adjust afterward. That obviously didn’t happen (insult, meet injury). Though I still like monday.com a lot, I also believe it’s given itself something new to prove. Consequently, it goes forward at what I believe is a more appropriate allocation.

NET – Ho hum. There are three things in life you can count on: death, taxes, and another ~50% quarter from Cloudflare. This marked NET’s dozenth straight with revenue growth between 48% and 54%. It also meant FY21 acceleration to 52% from FY20’s 50% as NET continues its drive toward bigger and better things.

The pleasant surprises went deeper than just the headlines:

Customers spending $100K+ increased 70%+ YoY for the fourth straight quarter, bringing the total to 1,416.

Those large customers contributed 54% of FY21 revenues versus 46% in 2020, suggesting increasing strength in NET’s enterprise offerings.

A record net retention rate of 125%.

Record cash flows of $40.6M operating and $8.6M free cash.

A second consecutive profitable quarter, NET’s first two as a public company.

On the record cash flows CEO Matthew Prince commented, “We’re proud that this is Cloudflare’s first quarter since we’ve been public to be free cash flow positive. It also won’t be our last.” He intimated the same for profitability. That suggests leverage is kicking in, which is exactly what we want from a young company as it scales.

In conjunction with earnings, NET announced a small acquisition improving its Zero Trust capabilities. It made another later in the month to strengthen email protection. While these acquisitions bolster Cloudflare’s existing platform more than add to the product count, both align perfectly with its mission of a better, faster, safer internet.

Cloudflare remains my most innovative company, and it’s determined not to lose that edge any time soon. On the call Prince unveiled plans for seven more Innovation Week sessions during 2022 (here’s a recap of 2021’s seven if interested). My wild-assed guess is at least a couple will be geared toward the public sector business NET expects to win in the second half. Regardless, Prince has once again thrown down the gauntlet on another wave of products, releases, and enhancements.

In total I’d label this yet another steady-as-she-goes Cloudflare quarter. And the early guides imply further strong performance. Prince emphatically stated:

…we’ve got a platform that sees more than anyone else, that is more responsive than anyone else, that is more trusted in the security and research community than anyone else, is able to react quickly and have as much goodwill in the community than anyone else, I think, speaks extremely highly of our team, what we’ve built and our ability to continue to execute.

He also said, “We’ve dialed in our business. We understand and we’re in control of its levers.” Over the next couple quarters those levers likely include continued work on capital investment and the FedRAMP approvals needed to position the company for the back half of the year. I’m totally OK with that. While I can’t call NET my most dynamic performer, I do rank it among my most consistent. That makes me very comfortable continuing to own it.

S – For the second month in a row, SentinelOne gave us a slew of positive business updates. First was an integration with Mimecast providing end-to-end protection for enterprise devices and email. This partnership “strengthens and accelerates incident response capabilities across all security layers, including email, endpoints, and cloud.”

Next was a partnership with Mandiant (Nasdaq: MNDT), a leading cyber defense and response firm. Mandiant will now use SentinelOne’s platform to help investigate and remediate breaches. This “enables joint customers to diagnose and remediate threats faster and more accurately through enhanced visibility, automation, and alert prioritization.”

SentinelOne also joined forces with portfolio mate ZScaler. This solution lets SentinelOne incorporate ZScaler’s data to provide visibility and protection, improving the Zero Trust offerings for both firms.

Lastly, SentinelOne launched DataSet, a proprietary data analytics solution. This new product lets enterprise customers “ingest, store, and understand real time data at scale.” Further leveraging last year’s Scalyr acquisition, this expands SentinelOne’s use cases beyond cybersecurity toward general queries, analytics, insights, and retention. Said CEO Tomer Weingarten:

For cybersecurity to be effective, it must make split-second autonomous decisions because every millisecond matters. The way SentinelOne solves cybersecurity with data inspired us to apply our expertise beyond cybersecurity to a wide range of enterprise use cases. Our enterprise customers have the same data needs as SentinelOne – the ability to understand and action live data sets at speed. We’re announcing DataSet because we believe every business benefits from the power of understanding and acting on its data. Instantaneous, easy to use, and efficient understanding of a data set is the key to making better business decisions.

If DataSet gains traction, this could be a very big deal. The best software firms maintain growth by providing more and more solutions as they go. A successful offering for fast, secure data management could lead to all kinds of possibilities, especially for a company as small as this one. Giving credit where it’s due, SentinelOne has recently lined up some seriously interesting dominoes. We’ll get our first peek at how many they might knock down with March 15 earnings.

SNOW – Things have been fairly quiet on the Snowflake front. Hopefully, it’s because management has been so busy maintaining triple-digit growth. We’ll find out March 2.

ZS – In almost passing fashion this month, ZScaler announced it was designated a Leader in the Security Service Edge (SSE) category by Gartner Research. It was ZS’s eleventh consecutive year in the Leader category while also being ranked highest in Ability to Execute. That was nice to see. But with all due respect to Gartner, the ability to execute I was most interested in was February 24 earnings. I was looking for something in the neighborhood of $256M in revenue and a $271M guide with enough supporting info to suggest the thesis remains intact. How’d ZScaler do?

The headline print was $255.6M (+63% YoY) with a $272M guide. Bang on so far. What about the supporting info?

Well, there was good news:

ZScaler ended the quarter with 251 customers spending $1M+ annually (+85% YoY). It added 27 to this category versus 22 last quarter and 16 last year.

Net retention rate remains >125%.

Remaining performance obligation came in at $1.95B for a strong +90% YoY.

Average Revenue per User (ARPU) trended up this quarter with a good balance of 45% new business and 55% upsells.

ZS has added roughly 1,000 employees globally the last 6 months to help meet demand.

Cash flow and profit margins remain firmly positive.

…and some just OK news:

I thought the added $100K+ customers looked a little light. 135 joined this group after 125, 132, 166 (seasonally high Q4), and 136 the prior four quarters. With a top-down sales motion and longer closing times, some lumpiness should be expected. This bears watching, however.

Operating expenses as a percentage of revenue increased slightly from last quarter, though that’s not surprising given all the new hiring and the return of some travel expense.

Lastly, in what was likely the biggest culprit for the market’s reaction, billings growth declined to 59% YoY after four straight quarters above 70%. Despite this quarter’s $368M total and $120M sequential add both being records, management admitted billings were negatively affected by less than expected federal spend. The decline was notable enough two analysts specifically asked about it on the call. The exchanges are below:

Analyst Hamza Fodderwala

Remo, if I could direct my question to you first. I mean, Jay mentioned a lot of great things about the demand environment about some of the secular tailwinds that you guys are seeing larger deal sizes. If I look at the billings growth and 59% growth at this scale is obviously very impressive. It was a little bit below sort of the usual seasonality in the type billings growth that you guys were doing over the last 4 quarters. So I'm just curious, when we think about billings at this scale, is there anything that we should be mindful of in terms of seasonality going forward? Or anything that was perhaps one-timey a year ago or last quarter when we think about billings growth in relation to revenue growth over the next 4 quarters?

CFO Remo Canessa

Yes. I mean a lot of questions there. Yes. Let me try to answer it. So 59% billings growth, as you mentioned, is absolutely outstanding. If I take a look at Q2, if there's one area that didn't perform at the level that we [thought] was federal. Federal was low single digit of our new and upsell business. Now why is that? It's just the budget constraints, basically. So our feeling is that federal will be a big portion or a substantial portion of our business. We got the FedRAMP certification. Also, we've built up a strong team with the relationships. So -- but to call out one thing in the quarter that I would say was didn't [come in] as we expected would be federal. It was low single digits.

…and…

Analyst Patrick Edwin Colville

Can I just double click on the point you made earlier in the call around federal. You called out that federal was only low single digits of new and upsell. Can you just give us a framework to just compare what that was like last quarter or last year? So we can get a frame of reference. And can I also just ask, were there any deals that were pushed out that have subsequently closed after January 31 that you hope that we should be aware of?

CFO Remo Canessa

I'll answer the first part, and Jay can answer the part about the deals. But typically, federal has been mid-single digit. Sometimes, even high single digits. But I don't recall, Patrick, what it was last year. But you can think of federal being mid-single digit on average contribution of our quarterly new and upsell business, and this quarter to a low single digits.

CEO Jay Chaudhry

And in terms of pipeline and deals, is growing. -- pipeline is growing. We are well engaged. We're seeing more momentum coming from some of the new memos and initiatives being put in place. We got the architecture. We got certain certifications. I think one thing remains a little unpredictable is some of the federal budgets and the timeliness.

As with most cybersecurity companies, that federal outlay is a big part of ZScaler’s ongoing thesis. We know the money is coming but don’t know exactly where or when. We do know, however, the White House has formally put all federal agencies on the clock. Is it possible that White House schedule at least partially created Chaudhry’s “timeliness” pause? Maybe. But given ZScaler is one of the only firms with the highest security certifications, I can’t help but think the federal contribution to billings will quickly resume as the year goes on.

So, while this report wasn’t a slam dunk, there is still plenty to like. A typical Q3 beat would keep revenue growth in the same low-60’s range. Management also raised its FY guide to $1.05B and 56.0%. That means any outperformance at all would accelerate FY growth from last year’s 56.1%. How many companies can say that while raking in $1B+ in annual revenue? Not many, though Zscaler is clearly on that pace.

Putting it all together, I’m satisfied with the quarter even if the market wasn’t. Was it billings (most likely)? Customer growth? The guide? A combination of all three? At this point, who the heck knows? It’s impossible to tell when people are scared. All I know is after this report ZScaler looks every bit the 60% grower with budding cybersecurity tailwinds it did going in. Maybe even more so since recent geopolitics make it much less likely those federal agencies will find reasons to further delay that upcoming cybersecurity spend. Chaudry believes, “The market is there. Product portfolio is there. We have no competitive pressure, and it really needs to keep on executing.” I can’t disagree. Despite the post-earnings selloff, I see nothing in this report to suggest ZScaler has gotten strongly off track. As a result, I plan to keep this position right where it is for now.

My current watch list…

…is pretty much Upstart (UPST). Amplitude (AMPL) and ZoomInfo (ZI) moved themselves further from the mix with quarters I believe weren’t strong enough to challenge or displace my current holdings.

And there you have it.

Well, that sure took a turn for the worse. After a phenomenal start in which Datadog and Bill.com pushed our entire portfolio up 15%+, the back half of February saw Vlad Putin, monday.com, and ZScaler take it all back and then some. But it wasn’t just me. The S&P, the Dow, the Nasdaq – correction and bear market alerts were popping up all over the place. Heck, even the cash crowd was lamenting all the purchasing power it was losing due to surging inflation. Retesting market and personal lows was a recurring theme just about everywhere you looked the last couple of weeks.

But if I might step outside investing for a moment, there’s been a much bigger turn for the worse recently than most of our portfolios. Any market angst right now rightfully pales in comparison to what’s happening in Ukraine. These are real people under unimaginable stress facing losses far exceeding what any of us might see on a brokerage screen. Most of the issues are outside my lane, but the ability to help is not. I am grateful to be able to do so and chose World Central Kitchen and the Red Cross. But you do you. The bigger point is never stop paying attention to the perspective of the broader world around you. We’re literally all in this together after all. In the long run that matters much more than anything that can be covered in a monthly recap.

Thanks for reading, and I hope all of us see a more peaceful March.

Hi StockNovice,

first of all thank you for your complete and very clear monthly reports. It's always a pleasure to read them. I see that zoominfo has been on your radar for several months but you have never taken any positions. I wish I knew why? Indeed they are showing good growth and higher margins and a better valuation than most of your other positions. Is it just about the narrative of the company and the innovation in this sector?