WIPEOUT!!

2021 Results:

March Portfolio and Results:

2021 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

Stock Comments:

For the first time since November 2019, I end a month with more than 10 holdings. Okta departs while Etsy and Upstart enter with starter allocations. I would ideally like 10 or fewer positions but find myself still trying to sort through exactly what the market is giving me right now. I see four reasons for the temporary creep:

My conviction is a bit in-between on some of my larger companies. As revenue and market caps have soared for many in the past year, it has become tougher to see their opportunities for continued hypergrowth (e.g. Zoom and DocuSign). In a broad sense, that makes them better fits as smaller positions rather than 15%+ allocations.

Many smaller, interesting companies are coming public with such hype their market caps aren’t much different than bigger, more established businesses with similar profiles. Firms with half the performance of say CRWD or ZM at the same stage are IPO’ing at 2 or 3 times the valuation. That makes it tougher for me to get excited about these names right out of the chute. While I don’t pay nearly as much attention to valuation as most, there does become a point where my gut says, “Nah, I’m just not paying that.” Snowflake continues to stick in that particular craw for me though it’s getting closer after its recent haircut.

While we all know the world will generally look different post-COVID, there is little clarity on the specifics. It’s all just a guess. Is the next surge in fintech, e-commerce, security, streaming...maybe cruise lines?!? With multiple companies having interesting post-COVID theses, smaller bets spread among a slightly larger number of names might make more sense than piling larger dollars into a few. I’m still mulling this one over.

Investing is hard. And it always has been despite what you might have heard from April through December of 2020.

Though I’m in no rush, I do expect to consolidate a name or two as things clear up.

CRWD – The minor CrowdStrike news this month was the official closing of the Humio acquisition. As detailed last month, Humio’s tech allows CRWD to better manage the insane volume of incident data it is handling as its platform scales. The final cost of this transaction is $352M in cash (net of cash acquired) and $40M in stock and options.

The major and much more important news was the release of CrowdStrike’s March 16 earnings report. So, how did it go?

If there’s such a thing as a boring-excellent company, present day CrowdStrike is it. I bought my first shares the day of IPO – June 12, 2019 – and CRWD has done nothing but churn out dominant quarters since. This time around revenue totaled $265M for 74% YoY growth. Subscriptions came in at $245M (+77%). Annual recurring revenue (ARR) finished at $1.05B with a record net add of $143M in Q4. According to management, that makes CrowdStrike the third-fastest cloud native SaaS company to reach $1B in ARR after Salesforce and Zoom. That’s nice company to keep, and as luck would have it two CRWD clients.

Speaking of clients, customer and usage trends suggest the stellar performance won’t end any time soon. CRWD now boasts 9,896 subscription clients with a record 1,480 added this quarter. That’s the third consecutive record-setting quarter after 1,186 in Q3 and 969 in Q2. CrowdStrike now serves 58 Fortune 100 clients, 177 of the Fortune 500, and 12 of the top 20 global banks. Its Threat Graph database now processes more than 5 trillion events per week to keep customers safe. This is quickly becoming a virtuous cycle in which more customers leads to more events which leads to better protection which leads to more customers. So, all good there.

Even better, these customers are showing more enthusiasm than ever for CrowdStrike’s products. 63% of current clients use 4 or more modules (vs 61% in Q3), 47% use 5+ (vs 44%), and 24% use 6+ (vs 22%). Biopharmaceutical giant Pfizer just signed on with an initial purchase of 7 modules. (As an aside, I wonder if those modules will be injected all at once or in two doses three weeks apart. 😏) In 2019 CRWD was able to turn every $1 spent by customers on initial incident response into $3.73 of ARR. This year’s final tally was $5.51 along with a Q4 Net Retention Rate of 125%, the 12th consecutive quarter over the company’s 120% target. Management noted “demand for our solutions was well-balanced between new customers and expansion business and between large enterprises and mid-market and smaller accounts.” So, hitting on all cylinders as the kids like to say.

Given just about every corporation and government on the planet is currently taking a looooong look at security, it is hard not to get excited about the future. With a global partner channel that grew 85% this year and partner-sourced transactions that doubled, CrowdStrike has clearly inserted itself into a large number of these conversations. Amazon Web Services (AWS) was a partner standout with ARR from the AWS Marketplace growing 650% this year and transaction volume increasing 300%+. These partnerships have a chance to really pay off going forward, particularly as CRWD expands its international footprint.

Not surprisingly, all this top line performance is creating a crazy amount of operational leverage. Q4 expenses came in at just 64% of revenue vs 68% last Q and 78% last year. It is a testament to just how quickly CRWD has scaled that both R&D and G&A margins are already within management’s long-term target range less than two years after going public. With Remaining Performance Obligations of $1.36B, there is plenty of future business in the pipeline as well. This efficiency has grown gross profit much faster than revenue, which in turn has led to an exploding bottom line. Check this out:

As the figures above show, in the last 12 months CrowdStrike has blown right past dabbling with profitability to churning out double-digit profit margins and massive cash flows. In fact, Q4 was CRWD’s ninth consecutive quarter of improved operating performance on both a dollar and margin basis. Booyah!! Right now, there are few companies in any market able to match CrowdStrike’s combination of growth, profitability and cash flows. That’s one of the main reasons it has grown into such a large portion of my portfolio.

When speaking about the future, CEO George Kurtz has been very open about where he sees the puck going. CrowdStrike’s simple mission is “stop breaches,” and that means in all environments. With recent attacks proving complete security goes beyond just endpoint devices, CRWD is quickly expanding into observability, workload protection and even identity management. The recent Preempt and Humio acquisitions will broaden CrowdStrike’s offerings in all these areas. Says Kurtz:

We are building what we believe will be the fastest, most cost-efficient, and extensible cloud data platform that will deliver best-in-class visibility for security as well as observability for IT operations.

It’s a true one-stop shop vision, and Kurtz suggests CrowdStrike will let no competitor get in its way.

To that end, he continues to throw shade at “adversaries” – his word – SentinelOne and Microsoft. In what seems to be an ongoing tit-for-tat, Kurtz highlighted a win replacing SentinelOne due to “efficacy issues…a [non-]scalable solution…degraded performance…[and] instability...impacting developer productivity.” He also detailed the “crisis of trust within the Microsoft customer base” due to recent incidents reportedly affecting more than 250,000 clients worldwide. Kurtz’s first shot was fired during recent US Senate hearings when he identified Microsoft’s “antiquated” architecture as the vulnerability in recent breaches. When asked again on this quarter’s call, he doubled down:

Brian Essex - Goldman Sachs Analyst

And maybe as a follow-up, you mentioned in your prepared remarks a crisis of trust within the Microsoft customer base. Could you provide a little bit of context around that? I mean, is it strictly with regard to endpoint? Or do you see that across identity management, email with the recent Exchange server attack? I mean, how pervasive do you think it is and how might that affect not just your business but others across the ecosystem?

George Kurtz -

You know, I think it's across the board. We're seeing it. We're hearing it from CISOs. We're hearing it from CIOs.

Boards are concerned. When you look at the latest breaches around SUNBURST and you look at the Exchange zero-day vulnerabilities, just about every incident response we do involves Microsoft technology. So obviously we're focused on being able to protect it, but there's a lot of customers that are looking at this and saying, ‘Hey, we need to derisk our environment, and we need another provider.’ The proverbial, ‘I don't want the fox guarding the henhouse.’ And I think just over the last couple of months has really highlighted the risk in using sort of a monoculture for both security and operating systems.

Essex -

Got it. Thank you very much for that color. That's very helpful.

“Color” indeed. Sounds to me more like confidence bordering on braggadocio. But I gotta hand it to ‘em. CrowdStrike sure has put its money where its mouth is so far. Kurtz believes recent incidents have “raised awareness at the board level and will serve as an additional tailwind to the industry over the long term.” That makes total sense to me, so I’m glad to be invested in a company I believe will be at the forefront of this trend. Exiting this quarter, I see no reason why CRWD shouldn’t remain my biggest position for the foreseeable future.

DDOG – How did Datadog go a whole month with nothing hitting my radar? Yeah, I have no idea either. It looks like they did present at a couple of investor conferences though (audio here). If we’re lucky, the analysts at Raymond James and Morgan Stanley were so impressed they’ll tell all their clients to buy DDOG in April.

DOCU – DocuSign’s March 11 earnings wrapped up its fiscal year. Before commenting on the future though, I’d like to take a moment to recognize just how incredible DocuSign’s 2020 was (oldest to most recent quarter):

Revenue Growth: 39%, 45%, 54%, 57% (FY $1.45B; +49% YoY)

Subscription Revenue: 39%, 47%, 54%, 59% (FY $1.38B; +50% and 95% of total)

Billings: 59% 61%, 64%, 46% (FY $1.7B, +56%)

International Revenue: 46%, 59%, 77%, 83% (FY $287M; +67% and 21% of total)

Contract Liabilities – Current: 43%, 55%, 62%, 54% ($780M)

Total Customer Growth: 31%, 40%, 46%, 51% (892,000 !!!)

Total Customers Added: 72K, 88K, 73K, 70K

Enterprise Customer Growth: 48%, 55%, 64%, 67% (125,000 !!!)

Enterprise Customers Added: 14K, 10K, 14K, 12K

Op Expenses as a % of Revenue: 71%, 68%, 66%, 63% (FY 67% vs 74% last year)

Net Retention: 119%, 120%, 122%, 123% (a record high and 7th straight increase)

Gross Profit: 37%, 45%, 54%, 60% (FY $1.15B; +50%)

Subscription Gross Profit: 36%, 44%, 53%, 61% (FY $1.16B; +49%)

Operating Margin: 8%, 10%, 13%, 17% (FY $181M; 12%)

Net Margin: 8%, 10%, 12%, 18% (FY $182M; 13%)

EPS: $.12, $.17, $.22, $.37 (FY $.90; +190%)

That’s a pretty impressive run for any company but particularly one this large. Just how many customers flocked to DocuSign over the last 12 months? Well, its customer addition rate ended more than double last year. In fact, DocuSign added nearly as many customers this year as it did in its first 15 full years of operation. That’s a boatload of customers.

Management’s goal is leveraging this eSignature momentum to build out its new offerings. On a smaller scale, DOCU released the general version of its online notary service for companies employing internal notaries. The version for independent, third-party notaries should be released by the end of the year. As I’ve mentioned in the past, this won’t be a huge money maker but should seriously enhance the stickiness of the platform as a whole.

The major 2021 driver will be establishing DocuSign’s Contract Lifecycle Management (CLM) offering. CLM is designed to drive automation at every stage of the contract cycle, and initial wins are starting to trickle in. CEO Dan Springer described a Latin American client whose implementation of CLM and e-signature across 30+ subsidiaries reduced contract times from 23 days to just one hour. He also singled out a global manufacturing customer who bundles CLM and e-signature to manage workflows across its entire organization. While Springer continues to stress CLM is in the early stages, it is nice to see early lands with large customers. He also threw us some additional crumbs regarding initial uptake:

Our view, though, coming out of fiscal year 21, particularly coming out of Q4 here, is we're seeing that the build, the pipeline build again. And so, we're quite optimistic that we're going to see sort of that reacceleration that we saw a little over a year ago with CLM in particular.

DOCU’s international progress is also intriguing. International revenue was up 83% YoY in Q4 and ticked up to 21% of total revenue. In the Q&A session, Springer said every single foreign geography exceeded its plan and is growing similarly to the rapid early US adoption. DocuSign is now available in 100+ countries with a core focus on eight. The former CFO is specifically leading this effort, and Springer implied enough progress is being made to see that core expand by a country or two in 2021. That’s promising.

It is these potential avenues for growth that keep me holding DocuSign. Customer growth remains excellent, and Springer says there are no signs of significant slowing post-COVID. Management also expects considerable cross and upsell opportunities when the huge number of 2020 customer adds comes up for renewal this year. Yes, DOCU’s long-term thesis relies heavily on CLM leading the next surge. At the same time, the massive customer increase, record NRR, and faster growing international business should keep current growth attractive as we wait. Says Springer:

DocuSign went from a crisis response solution last year to a business-as-usual solution today…We don’t believe our new or expanded customers will be going back to paper, even after the pandemic recedes…We call the products and services supporting this trend the ‘anywhere economy.’ We believe we’re a key pillar, and it’s only just beginning. You’ll hear more from us about this in the coming weeks.

I remain interested in sticking around at least long enough to hear what DOCU has to say.

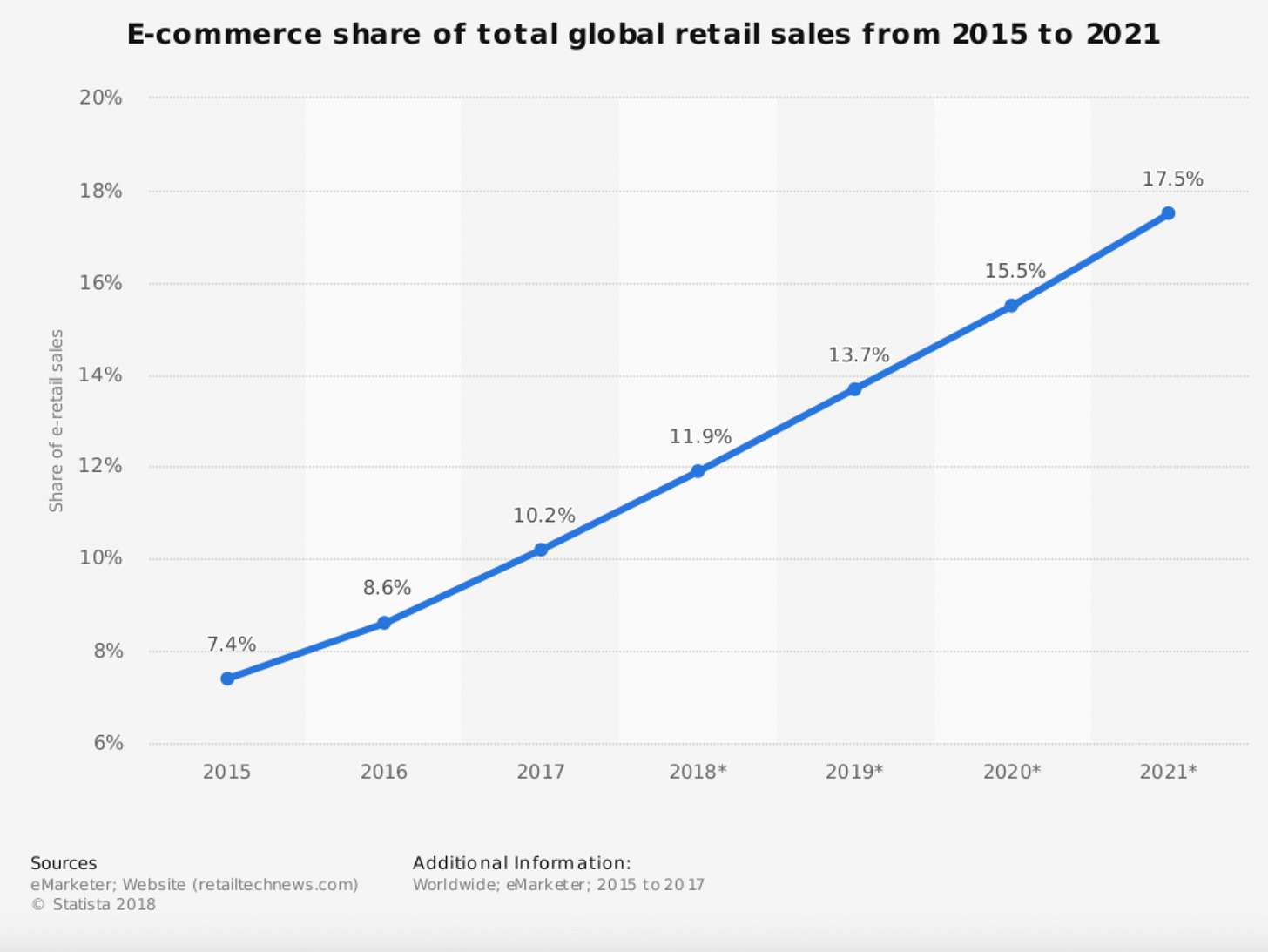

ETSY – After spending the last couple months bouncing around the top of the watch list, Etsy finally forced its way into my portfolio. I’ve thought a lot in recent months about adding some e-commerce exposure. For those who may not have been paying attention, e-commerce has kinda become a thing:

COVID-19 has helped pull online shopping forward in a big way, and Etsy has clearly benefitted.

Just how big has that benefit been? Well, as I am inclined to do at times, let’s take a look. Here are the headline numbers the last four quarters (oldest to most recent):

Revenue Growth YoY: 35%, 137%, 128%, 129% (with a 135% top end guide next quarter)

Revenue Growth QoQ: -16% (post-holiday seasonality), 88% (LOTS of masks), 5%, 37%

Gross Merchandise Sales (GMS): $1.35B, $2.69B (masks for everyone!), $2.63B, $3.61B (Happy Holidays!)

Gross Profit Growth: 25%, 159%, 157%, 160%

Gross Margin: 64%, 74%, 73%, 76% (a record)

Take Rate (Etsy’s cut of the action): 16.9%, 15.9%, 17.1%, 17.1% (a record)

But the real catch in my opinion is just how many more people around the world discovered Etsy’s platform:

Active Sellers Growth YoY: 26%, 35%, 42%, 62% (almost 4.4M sellers)

Active Seller Growth QoQ: 4%, 12%, 17%, 19%

Active Buyers Growth YoY: 16%, 41%, 55%, 77% (almost 82M buyers)

Active Buyers Growth QoQ: 3%, 26%, 16%, 18%

% of GMS from International: 36%, 32%, 37%, 40% (and growing faster than domestic at 145%)

Yeah, but aren’t people just visiting Etsy to buy masks and then disappearing?

GMS Excluding Masks: $1.0B, $2.2B, $3.3B

GMS Growth YoY Excluding Masks: 93%, 93%, 118%

Mask Sales as a % of GMS: 14%, 11%, 4%

Hmm. While a flood of buyers undoubtedly came to Etsy for the masks, it appears many have decided to stick around for the other offerings. In fact, non-mask GMS seems to be accelerating while mask sales are rapidly decelerating. That’s a good sign in my opinion, especially when non-mask GMS more than doubled this past quarter. Management noted 160% growth in “habitual buyers” during 2020, which is defined as 6 or more purchases totaling at least $200 in the last 12 months. Even better, Etsy is seeing acceleration in almost all its non-mask categories.

Etsy has now become the fourth largest e-commerce site in the US by monthly visits behind only Amazon, Ebay and Walmart. That’s a lot of visits. And as fast as e-commerce is growing – just take another look at the chart linked above – Etsy grew 2.5 times faster than that during 2020. With traffic soaring, Etsy has expanded beyond simple storefronts into payment processing, purchasing on installments, and placing offsite ads for its merchants across various channels. Management has also invested heavily in its internal search engine to better match buyers and sellers. These efforts seem to be bearing fruit, as evidenced by Etsy placing offsite ads tied to 9% of total GMS during the second half of 2020. Management expects even more of this high-margin business as it proves its value to sellers.

Not surprisingly, 2020’s surge has been just as profitable for shareholders as merchants. Already a consistent moneymaker, Etsy churned out record EBITDA ($549M; 32% margin), operating income ($424M; 25%), net income ($349M; 20%), free cash flow ($672M; 39%) and EPS ($2.69) this year. While the post-COVID landscape remains uncertain for just about every business, it is hard to see how Etsy doesn’t continue to profit from the remarkable strides made this year. I’m happy to grab a starter position and follow along for a while.

NET – Cloudflare began the month by earning some security street cred when Forrester Research named it a leader in DDoS Mitigation Services. Most of you already know I have zero chance of explaining what DDoS Mitigation is, but Forrester says Cloudflare’s doing some commendable things in “threat detection, burst attacks, speed of implementation, product vision, performance, response automation, and security operations centers.” Being honest, I can’t say I understand all those phrases either though they sound pretty positive. I’ll just have to take solace in the fact future business performance will almost certainly fill in the gaps and tell me all I need to know.

NET followed up with Security Week, the most recent installment of the company’s “Weeks” series. CEO Matthew Prince kicked things off with a detailed post of things to come. And come they did…

Monday saw the release of a partner program for the Cloudflare One platform along with new "Magic WAN & Magic Firewall" capabilities. It’s all magic to me, but WAN apparently has something to do with routing and connectivity while the firewall has to do with protecting the network as a whole. Those definitely sound like something worth improving, so nice job.

Tuesday was an antivirus and malware update for Cloudflare Gateway. NET also released an update giving Cloudflare for Teams users better web browsing protection. Finally, Cloudflare announced device security partnerships with several providers including newly proclaimed rivals CrowdStrike and SentinelOne. I’m glad to see at least Cloudflare knows how to play nice in the sandbox.

Wednesday was all about preventing data loss and better protecting the API's that let the software world go ‘round.

Thursday was a better way to secure network routing and protect individual info like credit cards or passwords used for internet transactions.

Friday’s updates included defending against automated bots and even more API protection.

Saturday…Wait, they kept it up even on Saturday?!? Yup. Saturday gave us updates on encryption keys and the electronic certificates which let us safely browse the internet, securely transfer money online, and keep our passwords private.

It even bled over into a second Monday when Cloudflare released a new Web Application Firewall update just as it was being recognized by Gartner Research as a "Customers' Choice" winner in the very same product category. While the extra announcements make me question Cloudflare’s ability to define a “week”, I’ll never quibble with a company improving its product line.

The end result of all this activity is quite a lot of links to read. Good luck with that if you’re so inclined. If not, the tl;dr summary is Prince’s stated desire for Cloudflare to be a “lean, mean innovation machine” in 2021 is off to a roaring start. Of course, my stated desire is that all these enhancements eventually make the company a lean, mean revenue and earnings machine as well. As my allocation suggests, I like NET’s chances.

OKTA – Okta entered March as my earliest buy, having joined my portfolio in June 2018. It exits as my latest sale, getting the boot after what I thought were disappointing March 3 earnings. First, revenue growth came in slightly below my expectations and is likely headed firmly below 40% going forward. Next, nudging the FY22 revenue guide from $1.07B to $1.09B is just as much a rounding error as a raise. It didn’t help when the outgoing CFO admitted this subdued guide is at least partially due to management overreacting when cutting investments early in the pandemic. That is a far cry from his boasts about the business and pipeline last quarter. Fortunately for me – and unfortunately for him I guess – I tend to write this stuff down.

Finally, it was discouraging to see Okta follow its first ever profitable year with a projection for $55M in losses even if the shortfall is mostly due to a $6.5B acquisition announced with earnings. While many applauded the Auth0 purchase, I view it a bit differently. CEO Todd McKinnon issued a very honest mea culpa in December after Okta was called out by Gartner Research for a lack of innovation (click below for the whole thread):

A runaway winner in Gartner’s 2019 ranking for “completeness of vision,” Okta fell so far in 2020 it finished behind competitors Ping Identity and Microsoft. McKinnon promised to do a better job “explaining our platform vision” and hinted at future developments that would “blow them away.” Since then, exactly zero announcements have been made detailing new products or enhancements. Instead, it appears Okta “innovated” by dropping $6.5B worth of dilution on existing shareholders to take out a possible (likely?) competitor. Just last quarter Okta bragged that its customer identity products grew 72% and accounted for 24% of total revenue. Now it suddenly felt the need to drop major coin on…a customer identity company??? At this purchase price I can’t help but wonder if Okta’s own offerings might have been a little, shall we say, lacking. For better or worse this is not the “vision” I signed up for, and something just doesn’t sit right with me about that.

Having owned Okta nearly 3 years and written it up 28 times (holy crap!), I’ve always considered it ahead of the curve. For the very first time I no longer feel that way. In fact, Okta feels kinda stuck. Digital security is a scorching hot topic, so it only seems reasonable identity management should show momentum as well. Yet I’m just not seeing that as openly with Okta as other companies I own. Adding insult to injury, I believe the Auth0 buy makes Okta a more difficult story to follow. I’ve written before I think of conviction equaling numbers plus narrative. In this case stagnating numbers plus a more complicated narrative equals a lack of conviction in holding the shares. Therefore, Okta heads back to the watch list with “something to prove” scribbled beside it.

PTON – This month’s big Peloton news was expansion into Australia. Scheduled for the second half of 2021 – which coincidentally lines up perfectly with management’s estimates of shipping delays resolving – this marks PTON’s initial foray into the Asia Pacific Region. Customers will be able to purchase Bike and Bike+ along with accessing the Peloton App. Interactive showrooms are also planned for key cities including Sydney and Melbourne. This looks like yet interesting feather in Peloton’s ever-growing cap. It is also a rather large new market for PTON to fill with all that new manufacturing capacity.

I later ran across this Bloomberg article about four small Peloton acquisitions over the last few months. The article states the buys added “technology and expertise in wearable devices, artificial intelligence, digital voice assistants, and interactive workout mats.” Though there were no corresponding press releases from Peloton, management did confirm the buys for the article. A recent regulatory filing noted PTON paid $78.1M for three of these companies during Q4. The fourth company was not included in this amount as it was just added in February.

Meanwhile, back at the ranch I keep wondering how many Bikes and Treads were delivered this month? I sure do hope it’s a lot.

ROKU – In true March Madness spirit, Roku spent the month putting a full-court press on expanding its advertising clout. First was a strategic alliance with Neilsen, the traditional TV ratings company. As part of this arrangement, Roku acquires Nielson’s video advertising business. This nifty little tuck-in broadens Roku’s service for TV ad buyers. In addition, “Nielsen and Roku will enter into a strategic partnership to integrate complementary Nielson ad and content measurements into the Roku platform.” In the words of Roku’s VP of Product Management this allows it “to deliver the benefits of TV streaming advertising to traditional TV.” Roku has already proven adept at leveraging its first-party viewer data on its streaming platform. If I have it right, this move will let Roku access these viewers while watching traditional, off-platform TV as well. In essence, the company is positioning itself to target every single ad on a Roku TV regardless of user or channel. That could be a huge driver for future business.

Next was Roku acquiring the rights to the “This Old House” franchise. According to the release, Roku now owns the entire business “inclusive of its global distribution rights and all of its subsidiary brands, including the ‘This Old House’ and ‘Ask This Old House’ TV programs, the show libraries, all digital assets, and the television production studio.” New partner Neilsen tagged these shows as the two top-rated 2020 US home improvement programs. Both shows were already available for free on The Roku Channel, so it appears Roku simply decided to buy the programming outright.

As mentioned in past recaps, I’m paying close attention to these deals. Buying exclusive rights to existing content on the cheap isn’t a big issue for me. However, taking on the cost of creating original content without knowing whether there's an audience for it would be. I want to own a streaming platform, not a movie studio. To that end, management says it intends to target “cost-effective content that is well-suited to an AVOD (advertising-supported video on demand) business model.” This deal seems to fit that description in multiple ways. First, I’d have to think management is confident this will be cost-effective since the programs are already being broadcast on its platform. Next, it lets Roku continue monetizing the ~63M Roku Channel viewers without paying further rights fees for these programs. Finally, it lets Roku double dip on any Old House revenues from third-party channels still wishing to broadcast the shows. In that respect, this looks like a shrewd move.

Roku followed this move by launching an advertising brand studio “to produce new creative ad formats and TV programming tailored for marketers.” This new initiative “will help marketers go beyond the traditional 30-second TV ad spot and amplify big moments in the marketing calendar, including advertiser-commissioned short-form TV programs, interactive video ads, and other branded content on The Roku Channel.” If nothing else, the short-form TV snippet in that quote gives insight into some of Roku’s plans for the recently purchased Quibi content. I also view this as an aggressive follow up to last quarter’s disclosure that the top six ad agencies had all committed significantly more spend with Roku for 2021. This new venture is starting just in time for the next round of agency commitments, making it very clear Roku is looking to proactively attract even more traditional TV dollars to its streaming platform.

Mixed in among all this activity Roku raised $1B in a secondary offering (this SEC form and this article). While I’m sure at least some of the money was used to offset the deals above, there were few details from the company besides the SEC filing. This is pretty par for the course with Roku. I’ve found CEO Anthony Wood takes a fairly minimalist approach to disclosures and investor events by doing exactly what’s required and that’s about it. Lucky for shareholders, he also tends to do exactly what’s required as far as company execution. As long as that’s the case, I’ll somehow find a way give Roku a pass on the occasional lack of charisma.

TWLO – Twilio’s March started with a $750M investment in Syniverse. We don’t have a ton of details yet, but this deal has two aspects. First is the ownership component. According to this article, the new partnership “[combines] Twilio’s API communications expertise with Syniverse’s mobile carrier contacts to create this end-to-end communications system.” The article suggests Twilio also gets better access to Syniverse’s 4G, 5G and IoT networks. That should benefit both companies as customers seek the most versatile, flexible networks for their communications needs.

Second is a customer component. I noticed the SEC announcement included this line:

In connection with the closing of the Investment (the “Closing”), Twilio and Syniverse will enter into a wholesale agreement, pursuant to which Syniverse will process, route and deliver application-to-person (A2P) messages originating and/or terminating between Twilio customers and mobile network operators.

The exact benefit of this provision isn’t as obvious to me, but I’m guessing it either lowers Twilio’s A2P costs or creates synergies with Twilio’s other offerings. The recent Segment acquisition should already be accretive to revenue growth and gross margins. If this Syniverse deal somehow creates either cost savings or operational leverage, it is very possible Twilio’s bottom line could look even more attractive in the not-too-distant future. That’s admittedly pure speculation on my part, but I do believe it’s something to watch the next couple quarters.

The action continued when Twilio acquired ValueFirst, an India-based communications platform. ValueFirst connects more than 2,500 clients to consumers over both telecom and internet channels. Last I heard, at least a few people live in India (approximately 1.4B according to some deep 10-second research on the interweb). Maybe it’s just me, but that sounds like a lot of potential communication. Getting a leg up in this part of the world seems like a pretty smart move.

Immediately following this deal, Twilio replenished its cash with $1B in unsecured notes. Paying interest only rather than being convertible for shares, the notes include $500M at 3.625% due in 2029 and $500M at 3.875% due in 2031. As mentioned last month, I have no problem with CEO Jeff Lawson keeping cash on hand given the seeming success with recent purchases. I’m also glad management didn’t dilute current shareholders again after issuing $1.54B in new shares during February before Syniverse and ValueFirst. I just wish all this capital raising hadn’t happened so close together during what has turned out to be a crappy time in the market. Nonetheless, Twilio’s thesis remains strong, and I’m happy with this position.

UPST – Upstart moved from my watch list to my portfolio with a great March 17 earnings. Founded by former Google employees, Upstart is an AI-powered lending platform designed to "more accurately identify risk and approve more applicants than traditional, credit-score based lending models." Its algorithms are based on 1000+ variables and years of data from over 10.5M loan transactions. Initial studies suggest its model can approve 3 times as many loans at the same loss rates as traditional screens. In addition to default risk, Upstart can scan for identity fraud, income misrepresentation, loan stacking (borrowers taking out similar loans from multiple lenders), prepayment risk, fee optimization, and more.

Management noted COVID-19 was a huge economic test for its algorithms and believes its model has not only been validated but improved. That could clear a huge hurdle with potential customers wanting to see how Upstart’s platform would perform during a down economic cycle. Impressively – and important in this context – UPST says its screen was roughly 5 times more predictive than credit scores for identifying borrowers likely to have trouble making payments during the pandemic. And tests shared with the Consumer Financial Protection Bureau showed its “platform offers significantly higher approval rates and lower interest rates to every demographic group tested.” This means Upstart ultimately benefits consumers as well.

Most of Upstart’s business comes through two channels. The first is loan referrals to partner banks through its consumer-facing website. Second is licensing its AI technology directly to partners, which is the more interesting part of the thesis. Its largest market to this point has been unsecured personal loans, and it has recently expanded to auto lending. UPST’s platform is fully customizable to partner banks’ customer data, credit policies and risk appetite. Payments and fees from partners are determined by the loan amount, origination source, and length. Partners can tweak the model to focus on either growth or efficiency. Those banks looking to increase loan volume can target the algorithm to approve more loans at the same loss rate. Likewise, banks looking to minimize write downs can target a lower loss rate for the same volume of loans. This gives partners complete flexibility in adjusting targets for changes in current goals or the broader lending economy.

Like most financial companies, UPST’s 2Q20 business took a huge hit due to the onset of COVID and the unprecedented spike in unemployment which followed. As lending screeched to a halt, revenue crated from $64.0M in Q1 all the way to $17.4M in Q2. Despite a sharp rebound to $65.4M in Q3, Upstart still entered its December IPO in an uncertain economic environment. Therefore, this report was not only UPST’s first as a public company but our initial peek into its prospects coming out of COVID. I’m glad to say things appear to be going just fine.

Revenue grew 32.2% YoY but more importantly 32.7% QoQ to $86.7M. Upstart transacted 123,396 loans, representing 57% YoY growth and 52.5% QoQ. Improvement to its algorithms led to a record 17.4% of rate inquiries resulting in a successful loan. Likewise, a record 71% of loans in Q4 were instantly approved and fully automated with no additional paperwork needed. Since Upstart facilitates referrals and approvals without backing the loans, 97% of Q4 revenue resulted directly from fees with no credit exposure to the company. Early results suggest UPST’s business is already scaling as it posted positive net income for 2020 on both a GAAP and adjusted basis. This could obviously become very lucrative as the company adds partner banks and increases transaction volume.

In conjunction with the strong earnings report, UPST announced it will acquire automotive software company Prodigy Software. Upstart envisions combining its lending platform with Prodigy’s end-to-end purchasing software to “create a seamless and inclusive experience worthy of 2021.” Prodigy has facilitated more than $2B in vehicle sales at franchised dealers for top brands like Toyota, Honda and Ford. Scheduled to close in Q2, this acquisition will let the paired companies introduce UPST’s platform to the tens of thousands of US auto dealers initiating the majority of auto loans.

Upstart began auto lending in September 2020 through consumers looking to refinance expensive or mispriced auto loans. This program has expanded to 14 states so far and saved customers on average $72 per month. While management doesn’t expect auto financing to contribute materially in 2021, the Prodigy buy accelerates its effort to tap into a larger part of the auto loan market. Frankly, this has the potential to be a huge win. If Upstart can transfer even part of its success in the $92B personal loan market to the $626B auto loan market, today’s revenues and profits could look tiny in comparison.

As you would expect coming off a successful year, Upstart is very bullish about its future. The CFO states business has almost fully returned to where it was expected to be absent the pandemic, and management looks forward to expanding its current roster of 15 partner banks. To that end, Upstart has released its AI for general use by any interested bank under the name “Upstart Referral Network”. It also plans on releasing a Spanish language version “very soon” to address what it feels is an underserved part of the market. Most importantly, it expects lending volume to increase throughout 2021 as spending belts loosen post-COVID. As CEO Dave Girouard put it:

Banks in 2021 are swimming in deposits and are looking for more sophisticated tools to lend them out in a responsible and profitable manner.

Upstart feels it is in a great position to meet that need, especially as live banking slows and digital banking surges. Management guides for $124M (+84%) revenue in Q1 and a cool $500M (+114%) for FY21. Since Prodigy is not expected to contribute this year, this growth should be all organic. Any upside from auto loans would simply be icing on the cake.

In an increasingly digital world, there are few industries as ripe for disruption as traditional banking. Upstart seems to be making early headway into doing just that. I find what this company is doing interesting enough to add a starter spot to my portfolio and see where things lead.

ZM – March 1 was a big day for Zoom shareholders. Very few companies in the history of companies had ever…well…zoomed as much as Zoom zoomed in 2020. It went from a handy little videoconferencing tool to a global phenomenon in a matter of weeks. Predictably, the stock soared right along with it. But the market is always a forward-looking creature, and there has been a fair amount of hand wringing over ZM’s next act since last Fall’s COVID vaccine announcement. This earnings report would hopefully provide some clarity on that future.

As usual, the headline numbers were incredibly strong. Revenues came in at $882.5M, which was 369% YoY but more importantly 13.5% QoQ, so Zoom continues to grow at a healthy clip even at this scale. It now has 467,100 global customers with >10 employees. 1,644 of them have spent >$100K in the last 12 months with a record 355 joining that category in Q4. That is up 28% from last quarter and 156% YoY. It’s worth remembering in last year’s Q1 Zoom onboarded 500+ new customers at an annual rate >$100K. With management unable to count these customers while waiting for 12 months to elapse, next quarter’s $100K number should be another record by a not inconsiderable amount. It’s also worth noting Zoom doubled its number of >$100K Global 2000 customers yet has penetrated just 14% of these firms at that level. So, ZM appears to have a relatively large and stable customer base to grow into.

However, no one really doubts the strength of the videoconferencing product. Instead, most recent attention has focused squarely on Zoom Phone. Having just celebrated its second anniversary, Zoom Phone is considered a key revenue driver for 2021. The early returns are promising. CFO Kelly Steckelberg stated it was ZM’s fastest growing product in Q4 and recently passed 1M seats sold. In addition to some big individual wins, Phone already has 10,700 customers with >10 employees vs 2,900 last year (+269%). The company notes 40% of Phone sales thus far have been to customers with >1k employees, and eighteen of those purchased at least 10,000 seats each. Management is confident it has a huge customer base to sell into as people return to whatever form of work we settle into. Says Steckelberg:

With our base of approximately 467,000 customers with more than 10 employees and our growing channel presence, Zoom Phone is in a strong position as customers look to modernize their phone systems to an integrated communication platform.

With an estimated telephone market of $23B by 2024, there is plenty of room to grow. Of course, the literal million-dollar question for investors is just how fast that growth will occur. Accordingly, Zoom Phone’s adoption rate will be a major focus the next few quarters.

On a product side note, we also received a quick OnZoom update. OnZoom is a new one-stop platform for anyone considering a video-based business. The concept is to let anyone with a skill worth sharing connect with those interested in paying for it. CEO Eric Yuan’s analogy is, “I have a car and time, I become an Uber driver.” While there was initial speculation OnZoom might contribute at some point in 2021, the project is still in the beta stage. This suggests any monetization is still a long way off, so it shouldn’t be considered a factor this year.

Zoom’s rapid top line growth continues to generate amazing business leverage. Expenses continue to shrink as a percentage of revenue, and Zoom is printing gobs of cash. Gross margin remains down from 2020 due to the free school offering but is noticeably inching up as the platform scales. It should hold ~70% while the free education program continues with the long-term 80% target still intact. Zoom Phone is showing strong margins as well and is currently higher than videoconferencing including the school offering. Zoom has $1.75B in remaining performance obligations on the books, so it looks like the majority of customers aren’t leaving the service any time soon.

Not surprisingly, all this execution led to a fat bottom line. Zoom churned out $361M in operating and $365M in net income this quarter. That’s an astounding 41% margin on both. That lines up with $983M in operating and $996M in net income for the year (37% and 38% margins, respectively). Free cash flow was similar at $1.4B on the year (52.5% margin). Again, heady stuff. So, Zoom continues to rake in cash while already having a healthy $4.2B on the books. Management gave limited detail when asked – and analysts are always curious about $4.2B lying around – but it clearly knows the money is there. Both Yuan and Steckelberg implied Zoom would not be afraid to use the cash when the right opportunity presents itself. One can only hope.

As impressive as many of this quarter’s numbers were, I don’t think anyone can say it was a blowout or even unexpected. That is a credit (curse?) to Yuan and the rest of his team. The question was whether it enough for the market. The answer seemed to be a resounding “yes” when the stock soared 20% the day of earnings and immediately after hours, but the tide turned strongly “no” when ZM gave it all back the very next session. Unsurprisingly, the stock took it on the chin along with just about every SaaS name for the rest of the month. Thanks for nothing, 2021.

One good thing coming from this report is the market finally has Zoom’s initial FY22 guides. Management estimates $905M (+176% YoY) at the top end in Q1 and $3.78B (+43%) for the year. With Zoom being serial underguiders (not a word, but you catch my drift), I’d expect something more like 50% by the time we’re done. That’s a pretty big number following a year of arguably the biggest numbers ever for a company this size. And Yuan emphatically used “double down” multiple times, suggesting he’s not shying away from the challenge.

As Yuan puts it, Zoom wants to “transform our business from a killer app company to a proprietary company. We're not only a video conferencing company anymore.” I believe him. But my belief always comes with the disclaimer of doing what’s best for my portfolio. In this case, I still believe it’s worth a decent-sized position while waiting to see if Eric can do his thang.

Even with the cool gif though, I have to admit this is an allocation I would consider reducing if something shinier catches my eye.

ZS – ZScaler’s primary update was an expansion of its strategic partnership with CrowdStrike. This alliance includes a series of integrations delivering end-to-end protection from the application all the way through the user’s endpoint device. The new features emphasize a real-time “zero trust approach that encompasses data, people, devices, workloads, and networks.” This type of protection sounds a lot like what customers are clamoring for, so it’s nice to see two industry leaders I happen to own joining forces to meet those needs.

ZScaler’s secondary update didn’t actually come from ZScaler. Instead, I found it in this release from third-party company Telos (h/t to @MST401k for the link). What I find interesting is a significant portion of Telos’ business is conducted with the US government. Trying to play a little speculative connect-the-dots:

In early February ZS announced it was being prioritized for FedRAMP government certification at the High Impact level.

According to the Telos release, ZScaler has selected Telos for management and automation of its FedRAMP and Department of Defense authorizations.

I know from former holding Everbridge the bulk of government contracting occurs in the Fall. This gives agencies more control over year-end spending and better insight into the next year’s budget ask.

ZScaler is already on track to post excellent numbers next quarter. The question is just how strong the cybersecurity tailwinds will blow beyond that. The info above suggests ZScaler might be setting up some interesting dominoes for the second half of calendar 2021. If that’s indeed the case, it just needs to knock them over.

Some may have noticed I end March with a slightly smaller ZScaler allocation. This is not due to any less conviction in the company. I simply decided to take a loss on some taxable shares when everything tanked to lessen a pretty sizable bill from my Okta sale (I know most don’t like paying capital gains, but I’m a believer it ALWAYS beats the alternative). I can easily see myself bumping ZS back up a notch or two once the 30-day wash rule expires.

My current watch list…

…in rough order is LSPD (Lightspeed), NARI (Inari), SNOW (Snowflake), and FVRR (Fiverr). All admittedly look more attractive after the carnage, but then again so does everything I already own.

And there you have it.

Oof. This February and March turned out to be my first back-to-back negative returns since…<flip><flip><flip>…last February and March. This also marks the first month I end trailing the S&P 500 year to date since…<flip><flip><flip><flip><flip>…October 2018. Oh well, all good things must come to an end.

As has been the case for quite some time, volatility was once again king. Single-day portfolio gains of +5%, +6%, +7%, and +12.5% (!!!) were more than offset by multiple -4%, -5%, and -6% drops. I even had a couple -7.5% clunkers thrown in for good measure. Combined with the tech-heavy Nasdaq entering an official -10% correction from its February high, it was one of those textbook bloodbaths for growth stocks. This is now my fifth 30%+ portfolio drawdown in roughly 2.5 years, a distinction shared with many high-growth investors. GauchoRico recently wrote an excellent post detailing the drops including this one. No, really, it’s EXCELLENT!! Be sure to check it out.

Unfortunately, declines like this come with the territory. As the daily swings I rattled off might imply, I follow my portfolio quite closely. Ironically, I believe following this closely has made me (mostly) immune to these swings. While I still notice them as part of managing our portfolio, I long ago stopped obsessing about them as some sort of endgame. Over the years I’ve seen days of joyously great gains and painfully large losses.

These bigger moves seem even more frequent in this era of snap Twitter polls and algorithmic trading. Yet the truth remains even the biggest short-term swings become tiny long-term squiggles for those who can find and hold dominant companies. For anyone who might have forgotten already, I’d point to the bulk of 2020 as a prime example.

So, does that mean a -15.9% month doesn’t bother me? Don’t be silly. Of course it does! I have the same psychological flaws as anyone else, and it frickin’ sucks to watch literally years’ worth of living expenses evaporate in just a few weeks. At the same time, it’s only fair to acknowledge I’m just three short months from posting a +196.5% gain for a single year. Again, an experience shared by many. But if anyone still needs a pick-me-up after a rough few weeks, I recently came across a passage that helped a ton as far as keeping things in perspective:

When you have stocks that rise this much in such a short period, large pullbacks are a feature of a healthy market and not a bug. You simply need the stomach to endure the volatility. As soon as things settle – and they always do – the market will once again turn its attention to those businesses with the best execution. When it does, I have a strong suspicion the next leg up will be led by many of these same companies. At least that’s how it has gone in just about every other reset in recent history. In this case, it is hard to believe the market’s short-term reaction changes the world’s long-term trend. Things are quickly going digital, and there’s little to no chance we are going back. The only question is which companies will come out on top.

You know who wrote that? Yours truly. All the way back in November during my last end-of-the-world 30%+ drawdown. Since then, my portfolio set new all-time highs in December and again in February. In fact, even after this painful drop I’m still up quite a few percent from the time I originally typed those lines. That’s why it’s so worth it to write things down.

Don’t get me wrong. These last two months have been less than enjoyable for my stocks. As we exit another earnings season though, I can’t help but believe my companies are right on track. That is what matters most. It’s also what keeps me optimistic these businesses have a chance to be worth considerably more in the future than they are today.

Thanks for reading, and I hope everyone has a great April.

@InvestiAnalyst here - Love the comprehensive write-up and commentary! Lots of similarities.