Since the opening bell of the very first market, investors have longed for the ideal method to value stocks. This is hardly surprising. Finding the right company at the right price is the best way we know for earning outsized returns. In that respect valuation is indeed king. Consequently, any metric potentially identifying these names early is sure to grab our attention.

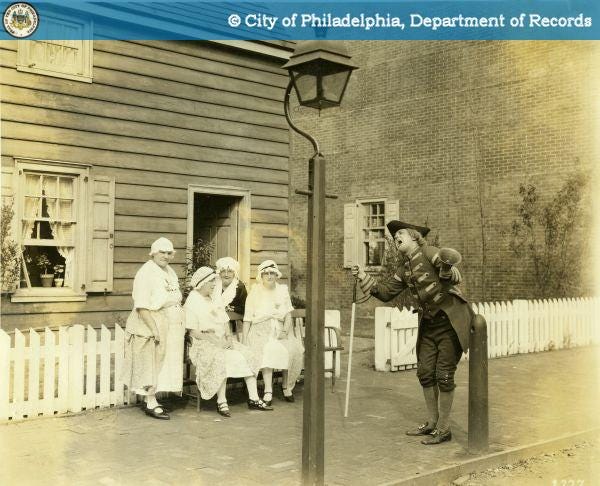

Historically speaking, valuation rose to the forefront of US markets with the founding of the Philadelphia Stock Exchange in 1790. Records are hazy, but anecdotal evidence suggests the first town crier started shrieking stocks were overvalued sometime in early 1791.

Those cries clearly found their mark as the quest for the perfect valuation method has raged ever since. Through the years literal reams of formulae, calculations and even straight up magic have been produced to assign a precise value to individual stocks. To prove my point, Googling “stock valuation methods” produced 46,200,000 results in 0.61 seconds including these ever-popular concepts:

Price to Earnings Ratio (PE)

PEG ratio

Enterprise Value/EBITDA

Enterprise Value to Sales

Price to Sales

Price to Cash Flow

Discounted Cash Flow (DCF)

Dividend Discount Model (DDM)

Rule of 40

Price to Book (P/B)

That’s the beauty of the internet. In just a few keystrokes I can scratch just about any valuation itch. So which to use? The benefits of the right choice are blatantly obvious. Find the magic bullet, and you can sweep your investing fears into the dustbin of history! Wouldn’t that be grand?

Yeah, well, things are never that easy. Therefore, valuation remains as hotly debated today as ever. This is especially true for the hyper-growth cloud and SaaS (Software as a Service) companies leading today’s market charge. As has always been the case, the difficulty is trying to cram disruptive present-day businesses into historical metrics that have never really worked that well to begin with. If value could be expressed in a single metric, don’t you think someone would have found it by now? Yet that won’t stop people from trying … or at least trying to convince us they have the answer.

Personally, I decided a few years ago to stop fighting the tape. The longer I'm in the market, the more I realize it provides patterns for certain companies or sectors. Not answers mind you but patterns which might help frame our investment choices. In this case, the pattern of recurring revenues, high gross margins and net expansion rates is earning many cloud/SaaS companies very high valuations. These valuations have in turn led to even higher prices. These high prices suggest investors consider these stocks some of the most attractive businesses in the market today. But has too much success already been priced in? It depends on whom you ask.

There was a time when cloud and SaaS companies were still somewhat hidden. Now they are all the rage. Every IPO is awaited with bated breath (Snowflake anyone?). Most see an upward spike the moment they hit the market. While some inevitably fade, others seemingly never look back. Prices and valuations have both soared as the broader market has roared back from its March 2020 plunge. This makes it even more difficult to decide exactly where to put your money. Being honest though, that has always been the case.

Historically, the best growth companies are almost always valued somewhere between expensive and nosebleed. While no one wants to or should pay nosebleed prices, it is often impossible to own or add to these names if you are not willing to cross your expensive line. That is simply the price of admission for many hyper-growth names. If you are not willing to pay, that’s perfectly OK. The market doesn’t care one way or the other. However, the risk is you end up like this author still waiting for that perfect Shopify pullback several hundred percent later. The link is for Seeking Alpha subscribers, but the summary is the author left gobs of money on the table by never actually buying a stock he wanted because he kept waiting for the perfect entry price. Sound familiar? It does to me.

None of this is meant to say you should just hold your nose and buy every hyper-growth stock at whatever price you see. It is only meant to illustrate that challenging your personal threshold for expensive is often required to build positions in the highest quality names. You will ALWAYS find commentary that prices are too high even in the deepest depths of a bear market. That's how permabears pay their bills, and it’s only fair to admit every so often they are temporarily right. Anyone following closely knows we have seen three cloud/SaaS pullbacks of at least 30% in under two years (Sept-Dec 2018, Aug-Sept 2019 and Feb-Mar 2020). Another will undoubtedly come at some point. Yet every single time excellent company performance and multiple re-expansion has pushed the best of these stocks back to all time highs. EVERY. SINGLE. TIME. I, for one, am more than willing to accept higher lows and higher highs while riding out the inherent volatility.

Please don't get me wrong. This is not a this-time-is-different-so-just-ignore-valuation argument. Instead, I am saying we can only play the hand we are dealt. We already know these stocks are expensive. They are expensive because they are doing things no other companies are doing. A high valuation is the market’s premium for what it believes will be a dominant business. Current holders are banking on rapid growth, high gross margins and smart execution to close any valuation gap as time passes. Fortunately, many of these firms are doing just that. Those that aren’t tend to be revalued both quickly and harshly. That is the trade-off. Higher valuation often comes hand in hand with lower margin for error, which is why most high growth stocks are so volatile and pullbacks so severe. As an investor you either accept that dynamic or not. Your choice.

As for me, past efforts to find cheap or comfortable stocks often led to lower returns. I am now a firm believer in the benefits of paying up for quality no matter the sector or asset class. And when I find the right candidate, let’s just say I’m much more willing to dip my toe in the deep end of the valuation pool.

Thanks for reading and good luck out there.

Stocknovice- I note your interest in SHOP following their recent report. I agree that one needs to pay for quality and regret not having done so when I made my decision not to buy last March when SHOP was at $340. But is the Q2 result a harbinger or is it just an a one time increase as a result of Covid. e-Commerce has perhaps jumped to a new plateau. Will it continue to jump? As for P/S the question I have is --how much is too much?