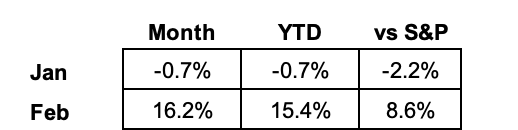

2024 Results:

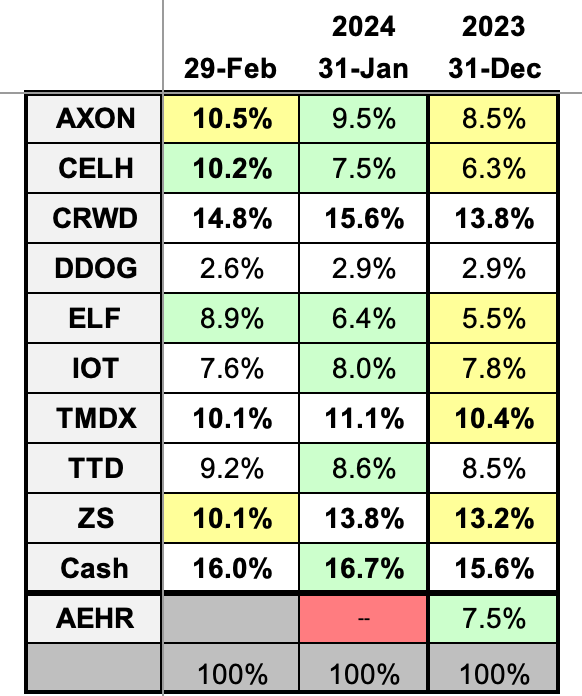

2024 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

*Please note: I rolled an old 401K worth ~2.5% into the cash balance of this portfolio to start 2024. I’ve shaded that cell to make sure the new cash is represented accurately (and honestly to remind myself as well).

Past recaps:

December 2018 (the one that got things started)

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

December 2021 (contains links to all 2021 monthly reports)

December 2022 (contains links to all 2022 monthly reports)

December 2023 (contains links to all 2023 monthly reports)

Stock Comments:

Phew! Earnings reports came in fast and furious this month. Luckily, there was significantly more good news than bad…

AXON 0.00%↑ – Axon kicked off February by acquiring Fusus, “a global leader in real-time crime center technology.” Already an Axon partner since May 2022, Fusus’s technology seamlessly integrates live video, data, and sensor feeds from virtually any source. Axon believes this acquisition strengthens its offerings as it expands into retail, healthcare, private security, and the federal space. Given the companies’ familiarity with each other, this seems like a smart tuck in.

It followed up with a rock-solid February 27 earnings report. Axon continues to churn out boringly good results. Management is doing exactly what it says, and the company is slowly but surely expanding into a larger number of international and enterprise areas. Things appear all systems go entering 2024, and I see no reason Axon shouldn’t keep its current healthy allocation.

CELH 0.00%↑ –Celsius’s early news was an exclusive, multi-year sponsorship deal as a Team Partner and official energy drink with the Scuderia Ferrari Formula 1 Racing Team. I like this move for two reasons. First, it aligns with the active lifestyle CELH is trying to market (which competitor Red Bull has also done with extreme sports). Even better, Formula 1’s distinctly global audience seems to be a very smart target given CELH’s international ambitions the next few years.

It followed up by earning the 7-Eleven 2023 Supplier of the Year award for non-alcoholic drink partners. I can’t say I’d ever heard of the 7-Eleven Awards but will gladly take it given part of CELH’s thesis is continuing to expand shelf space with its partner network.

Next Celsius added Canadian rights to its sponsorship deal with Major League Soccer after serving as a US-only sponsor last year. This expanded deal dovetails nicely with CELH’s formal launch in Canada in January of this year. The link also mentions it has increased its MLS club-level partnerships from three teams to five while also inking individual deals with several of the league’s players. Celsius’s marketing team “cited the sport’s appeal to younger consumers as a driving factor” in these deals.

Lastly, as a cherry on top, Celsius delivered a knockout quarter. I’m still relatively new to this management team, but my experience so far has been nothing but consistent messaging, consistent execution, and most importantly consistent performance. As a shareholder, there’s not much else I can ask for. The post-earnings pop now pushes CELH to a double-digit position in our portfolio. After reviewing this report, I’m 100% content with that outcome.

CRWD 0.00%↑ – CrowdStrike had a busy month. First, CRWD and Amazon Web Services partnered to select 22 firms for their joint startup accelerator program. The winning companies “will receive customized mentorship, technical expertise and partnership opportunities from the AWS Startup Loft Accelerator (SLA) program, with a potential to receive funding from CrowdStrike’s strategic investment vehicle.”

Next, CrowdStrike was the only vendor named an Overall Customers' Choice in the 2024 Gartner Peer Insights Voice of the Customer report in the Vulnerability Assessment category. CrowdStrike beat out seven other firms to earn the designation, extending a nifty little streak of external accolades in recent months.

Then CRWD was named a founding member of the U.S. Department of Commerce’s National Institute of Standards and Technology’s (NIST) Artificial Intelligence Safety Institute Consortium. In this role, CrowdStrike will serve as a contributing voice “to advance the safe, secure and trustworthy development and use of AI.” CRWD’s success has already positioned itself as a leader in AI. This role should give it tremendous insight into where the space itself is heading. That should be a useful advantage in the quarters and years ahead.

It followed up by announcing a strategic distribution agreement with Ignition Technology in the UK. CrowdStrike has always focused on building and maintaining a best-in-class partner channel. This looks like a nice add to that roster.

CrowdStrike then opened a new headquarters in India. The 52,000 square foot facility nearly doubles the size of its previous facility and “significantly [strengthens] the company’s presence in the region.” Given CRWD still has plenty of room for international growth, this move and the Ignition Technology partnership both look like solid moves in that direction.

Lastly, CRWD announced the general availability of its Charlotte AI and Falcon for IT products These modules make it easier for customers to combine and integrate internal Security and IT programs, which in turn improves coordination and speed when reacting to cybersecurity threats.

Phew. That’s a lot to digest. If nothing else, it sets up what will likely be a most interesting March 5 earnings report.

DDOG 0.00%↑ – I felt Datadog delivered a mixed Q4 report February 13. While the headline numbers were fine, DDOG did little to alleviate my previous concerns regarding customer growth. That puts it in a precarious spot as far as our portfolio is concerned. It is still holding its spot, but I plan on taking a deeper look at it against the top names on our watch list after everyone’s reports are in.

ELF 0.00%↑ – e.l.f. Beauty posted what I thought was a great quarter February 6. Top line growth continues to accelerate at the same time ELF is grabbing market share hand over fist. Almost everything under management’s control is moving in a strongly positive direction. I fully intend on ELF holding a healthy allocation as long as that remains the case.

IOT 0.00%↑ – Compared to the other names in our portfolio, Samsara almost took February off. Earnings March 7.

TMDX 0.00%↑ – TransMedics’ February appetizer was the purchase of its thirteenth airplane February 2. That puts it well on its way to its stared target of 15-20 planes at some point during 2024.

The main course, however, was what I thought another stellar report. As we move deeper into 2024, I believe TransMedics has positioned itself as the most underpromise/overdeliver company we own. CEO Waleed Hassanein & Co. have done everything they’ve said, and I have no reason to think that dynamic won’t continue. I’m perfectly content to keep this one a core position and see where it runs.

TTD 0.00%↑ – Apparently, The Trade Desk gonna Trade Desk. I’d call its February 15 report another business as usual effort. TTD’s thesis is one of the more straightforward I own. The upcoming US elections will almost certainly give the company its usual election year second-half boost. The wildcard is where traditional ad spending goes during 2024. If the economy stays stable (which looks like a reasonable baseline), it should be a good year. If macro improves, however, it could be a great one. Given the Q1 outperformance, I’m more than willing to stick around to see how things play out.

ZS 0.00%↑ – Zscaler recently posted some interesting news. Though it did not issue a press release, ZS filed a notice with the SEC announcing the resignation of Chief Operating Officer Dali Rajic. Rajic ended up resurfacing shortly after as the new COO of startup Wiz. The concern here is CEO Jay Chaudhry spent considerable time in ZS’s November earnings call talking about Rajic’s revamped responsibilities after hiring new chief revenue and marketing officers. Remember, Rajic was the key figure brought in to fix Zscaler’s sales stumble in 2019/2020. With only a reiteration of the full year’s billings guide last quarter, I wasn’t exactly sure what to make of this chain of events. If nothing else, the way this came about suggests the separation wasn’t all unicorns and rainbows.

Given that backdrop, I’ll admit the management change and a disappointing report from cybersecurity competitor Palo Alto Networks gave me some pause heading into ZS’s February 29 earnings report. Coming out, I am at least comfortable Zscaler is on much firmer ground than Palo Alto. In golf terms I’d say it took an easy swing and hit this one right down the middle. As usual, billings was the focus. Fortunately, the Q2 result and ever so slight bump to the FY guide leave ZS in a manageable spot. Overall, it appears to be chugging right along - I purposely chose “chugging” over “humming” - with a thesis I’d describe as almost determinedly intact.

My current watch list…

…in rough order includes monday.com (MNDY), Super Micro Computer (SMCI), MongoDB (MDB). Snowflake’s (SNOW) middling quarter bumps it out of this tier.

And there you have it.

Nice month. Like it says up top, I’ll take it. Even better than the stock performance was a strong set of earnings reports. After a looong stretch of macro fear, uncertainty, and doubt, it’s nice to hear management teams expressing some green shoots of optimism. While they of course still need to execute, I’m glad the broader macro economic environment finally seems to be cooperating. Fingers crossed.

As usual, thanks for reading, and I hope everyone has a great March.

Congrats, Stock Novice!