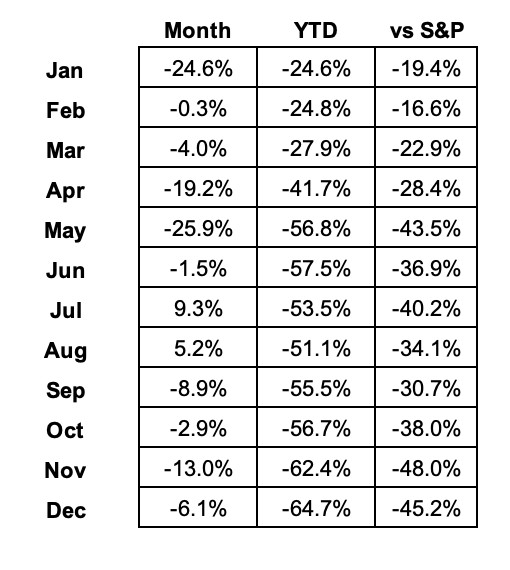

December 2022 Portfolio Review

Total Return: -64.7% YTD (-45.2% vs S&P)

I’m glad that’s over.

Well, it’s not really over, but you catch my drift. While December 31 is just as random a date as any, it’s also widely recognized as an ideal time to stop, breathe, and check in on the world around you. Accordingly, my December recaps tend to review lessons on the year. Thinking it through though, I can’t help but consider 2022 one big, relentless lesson. Relentless tension. Relentless macro. Relentless geopolitics. Relentless inflation. Relentless interest rates. Relentless fear. Relentless doubt. And most of all relentless uncertainty. We humans simply aren’t wired for uncertainty, and neither is the market.

In many ways 2022 was historically relentless, and it was only exacerbated by our 24/7/365 news cycle. Everywhere you turned, this year’s market and economy were likened to <insert similarly dreadful year here>. Stocks? Ouch. Bonds? Yuck. Crypto? Ugly. That safe, boring 60/40 portfolio? One of the worst if not the worst year in our lifetimes (see below, especially that bonds comment). Real estate? Don’t worry, the pundits assure us its turn is coming.

What the heck kind of lessons can be taken from such a broad-based beatdown? Well, I’m taking two:

“Having a certain temperament is more important than brains. You need to keep raw irrational emotion under control. You need patience and discipline and an ability to take losses and adversity without going crazy.” – Charlie Munger

Yeah, finding a way to stay sane was a big part of 2022. Personally, this was our portfolio’s biggest bloodletting since 2008-2009 (and far worse in raw dollars). We didn’t spend a single day in the green on the year, which I’m guessing was true for many. While that certainly sounds terrible, the broad market wasn’t much better. The S&P spent all of two days in positive territory during 2022 before starting this seemingly endless plunge. The other indices roughly followed suit.

Unfortunately, we know downturns are part of the game. Some like the current one are especially bad. Just because I’ve survived a few previously doesn’t make it any less painful. That experience does, however, provide some optimism the investing world isn’t coming to an end. Which brings me to the second lesson:

2. “Know what you own and why you own it.” – Peter Lynch

This certainly mattered in 2022. In stretches like this where almost no asset is safe, it’s even more important to understand why you believe your holdings will get through to the other side. While some have tried short selling to chase a return, I’ve learned that’s simply not part of my game. It fits neither my mindset nor long-term outlook, so there’s no sense lamenting what could’ve been if only I’d been more pessimistic. That’s just not me. For better or worse, I believe the market will eventually resume its usual grind up and to the right. It's comforting to know I have history as my strongest ally.

From a broader perspective one of my most interesting takeaways of 2022 was not a lesson but a thought exercise. With our family being further along in our journey, I was struck by a July GauchoRico post on capital growth versus capital preservation. During 2021’s highs I came close to having this thought process come into play. Alas, not so much now. Regardless, I believe that article makes me better equipped during the next bull run. Here's hoping that starts sometime during 2023.

Happy New Year, everyone. We’ve definitely earned it.

2022 Results:

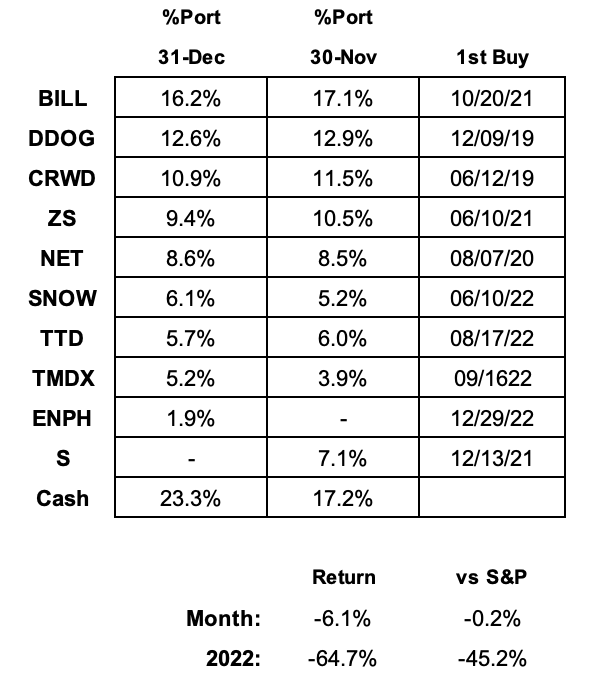

December Portfolio and Results:

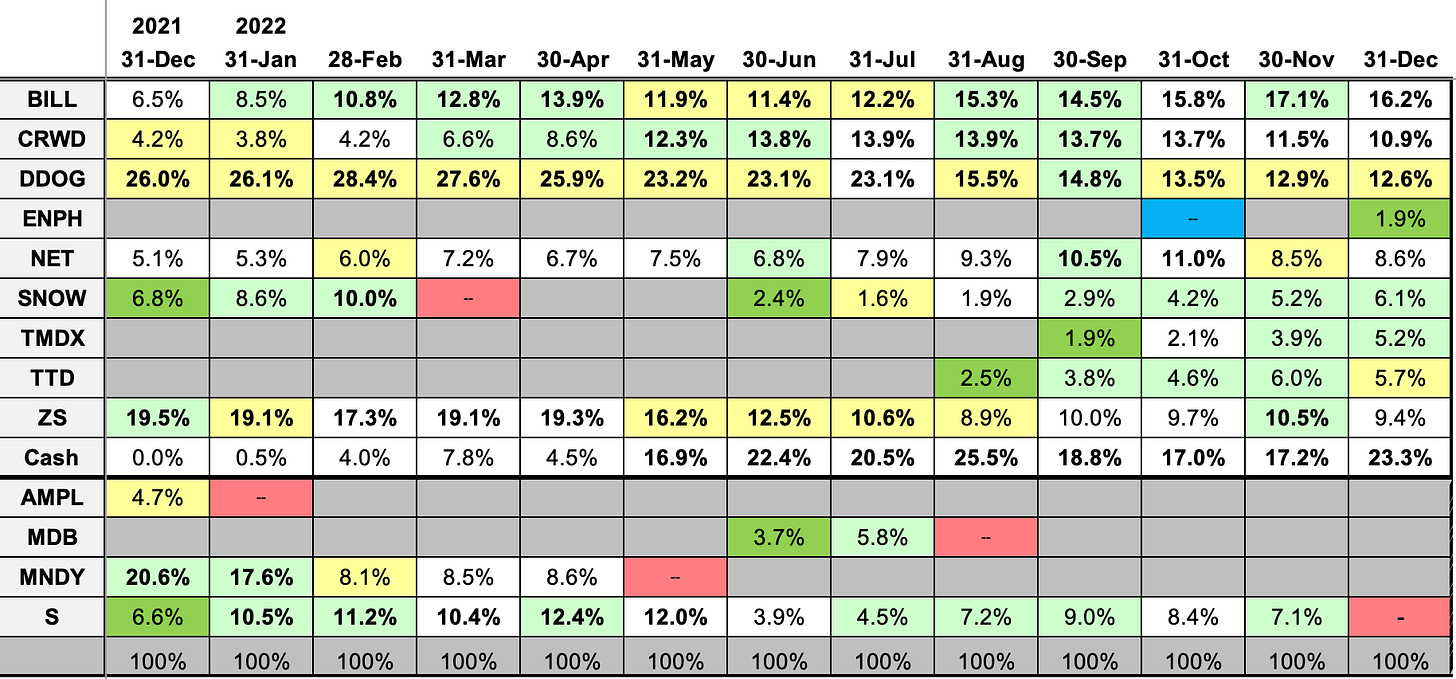

2022 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2018 (the one that got things started)

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

December 2021 (contains links to all 2021 monthly report)

Stock Comments:

The month began with our last set of earnings reports. It ended with little in the way of updates. I guess some firms just wanted to get the year over with. I can’t say I blame them.

BILL – I’ve seen nothing from Bill since its early November earnings, mid November closing of the Finmark acquisition, and late November appearance at a couple investor conferences. Despite the quiet month, I’m comfortable with BILL as our largest position heading into 2023.

CRWD – CrowdStrike followed its lackluster November 29 earnings with a sluggish December. However, the company blog did feature some updates worth mentioning. First was CRWD’s Falcon platform achieving 100% malware detection and prevention in Apple devices running the macOS operating system. What’s most noteworthy here is CrowdStrike was the only vendor to achieve this milestone in 2022. Next was a post outlining Falcon's identity protection capabilities for government customers. It contains quite a bit of tech-speak but does a nice job laying out CrowdStrike’s main selling points in the space. Lastly, CrowdStrike won numerous end-of-year awards from customer review sites G2, PeerSpot, and TrustRadius. If nothing else, current customers seem to be satisfied.

Unfortunately, I believe CrowdStrike ends 2022 on a sour note. I haven’t sold any shares (many are taxable at a lower cost), but it definitely enters the new year on a shorter leash. While its cash flows and profits give it some buffer, CRWD must prove its non-endpoint offerings can gain enough traction to maintain decent growth. If not, a company I’ve literally owned since its first day of IPO might be in danger of losing it spot.

DDOG – Datadog’s only December update was designation as a Leader by Forrester Research in the category of Artificial Intelligence for IT Operations. Forrester not only singled out DDOG’s data insight and visualization capabilities but said its R&D boasts the “highest number of data scientists dedicated to machine learning and artificial intelligence product advancements.” For a company priding itself on innovation, it is nice to see Datadog get recognition for putting its money where its mouth is. In that respect, the core business seems to be fine. However, we are likely to see continued choppiness until customer usage optimization subsides and DDOG comes back around to easier comps.

ENPH – Enphase returns to our portfolio after a brief October appearance. Operating in the solar energy space, its main products are microinverters (think control switches for solar panels) and batteries. ENPH’s traditionally strong profits and cash flows have been juiced the last two years by increased revenues as the world continues its march from fossil fuels to alternative sources.

That October in-and-out ended up being one of our few 2022 wins. I added ~1.5% at $248.50 coming into Q3 before exiting at $298.50 on a post-earnings pop. While I thought the report and guide were fine, I just couldn’t see the rationale for the jump. The revenue beat was just 0.3% after 2.0% in Q2 and 0.7% in Q1, so it didn’t appear to be surprise outperformance. In addition, some due diligence questions remained unanswered after the report. Would European momentum continue as gas reserves filled up and late Fall temperatures spurred hope of a mild winter? Would supply chains hold up as demand increased? Would additional production capacity in Q1 arrive as promised?

In the end things were a bit too muddled for a firm I was still working to understand. With the potentially lumpy nature of the business and so little feel for where next quarter’s initial FY23 guide might go, I decided to pocket the quick bump and go back to watch-and-learn mode instead. Since then, Enphase has announced expanded deployments in Nevada, North Carolina, Oregon, Northern California, Florida, and Colorado. It also increased its presence in Belgium and the Netherlands. These updates helped push the stock to an all-time high at just under $340. Alas, the end-of-year swoon has pushed ENPH back down this week, and limit orders put us back into some shares at $267.50. Yes, Enphase sells widgets. Fortunately, those widgets seem to be hitting a practical and often government-subsidized sweet spot in a world looking to wean itself off fossil fuels. That would seem to be a <gulp> tailwind heading into 2023. Let’s hope this one lasts longer than the now infamous cybersecurity tailwind of 2022.

NET – Cloudflare’s December was highlighted by Impact Week, the last of its 2022 Weeks series. NET has long touted its “build a better internet” mission. Impact Week is how the company sees itself influencing the internet’s “potential to do good, especially if it is founded on respect for certain values like security, privacy, interoperability, and wide availability.”

The two main Impact Week announcements showed Cloudflare’s altruistic side. First was offering its Zero Trust tools for free to all at-risk public interest groups and government election sites who qualify. Next, it introduced Project Safekeeping providing free Zero Trust Security to small and medium critical infrastructure organizations around the world. The program “aims to protect under-resourced organizations that provide a critical community benefit but are at high risk for cyberattacks…such as local health clinics, energy providers, or local utilities.” A more thorough list of Cloudflare’s Impact efforts throughout the year can be found here.

Philanthropy aside, more relevant to me were two announcements with a larger chance to impact the top and bottom lines. First was the release of a new pricing structure which should help both revenue and cash flows. Next was Cloudflare finally receiving its long-awaited FedRAMP Authorization. This designation lets a new batch of US agencies and vendors consider Cloudflare for handling sensitive information. Both updates have the potential to increase NET’s business in 2023. Fingers crossed.

S – This season’s earnings theme has definitely been:

a pressured top line;

a softish guide;

a deep dive to see how underlying trends are holding up.

Why would we expect SentinelOne’s December 6 report to be any different?

I entered anticipating ~$117.25M in revenue with a $127M Q4 guide. We received $115.3M and $125M. Close, but the 3.9% beat was SentinelOne’s smallest as a public company (another recurring theme).

So, how did the underlying trends I was looking for hold up?

An emphatic meet and hopeful beat of the “high-$50’s” projection for net new ARR [annual recurring revenue]. Ugh. Just $49M “as enterprises adjusted to macroeconomic conditions by tightening budgets.” Not a great way to start this recap. Using $56-$59M as a proxy, that’s somewhere between a 12.5% and 17% miss. That’s extremely disappointing for a projection given 30 days into a 90-day quarter just three months ago. Combined with CrowdStrike’s ARR gaffe, I have to wonder what the heck is going on with visibility in endpoint security. Is it really drying up that quickly? Management anticipates 20%+ sequential growth in new ARR next quarter (while admitting that’s roughly half the usual Q4 rate). In addition, the CFO pre-guided to 50%+ total ARR growth next year. I find myself underwhelmed with both figures. Not only does it suggest a huge organic slowdown in a key metric, but I’m not even sure how much to trust it given the current environment and this quarter’s obvious miss.

A solid beat of management’s 71% gross margin guide. Last quarter’s 72.2% cleared 70% two quarters earlier than expected. I’d like it to stay there. This came in at 71.5%, so not bad.

Continued shrinking of expenses as a percentage of revenue. Probably the best trend of the quarter. Non-GAAP expenses came in at 114% of revenue vs 129% last Q and 136% last year. Management’s comments suggest it’s very aware of staying on top of expenses.

Though Q2’s record 1,150 new customers was padded by the Attivo acquisition, management touted record organic adds as well. I’m looking for similar comments this quarter with $100K+ customer growth ideally remaining north of 100%. Frankly, I didn’t like the “over 600” new customer number at all considering this now includes both SentinelOne and Attivo. For context, Q2’s first combined number was 1,150 while the prior two quarters were 750 and 700 for SentinelOne alone. $100K customers didn’t wow either with 72 adds combined (+99% YoY) vs 164 last quarter (combined) and 68 last year (S alone). This was S’s first quarter ever with single-digit sequential growth in $100K customers at 9.5% vs 28% last quarter (inflated by Attivo) and 19.5% last year (S alone). Management suggests some of the issue is just business pushed to Q4, but it’s hard to see how that push dynamic won’t continue a while.

Net retention to hold most if not all last quarter’s jump from 131% to 137%. This finished at 134%, which is plenty good in this environment.

Cash flow margins closer to last year’s -30% operating and -37% free cash than last quarter’s -61% and -65%. Operating cash flow margin was -52% (-$60M) and free cash -56% (-$65M). So, a fail here. On one hand, S has plenty of cash on the books to cover the burn. On the other, that’s not much in the way of cash flow efficiency to offset the slowdowns in ARR and customer growth.

At least mild improvement over Q2’s -57% operating and -55% net income margins. I’m also hopeful the current -55% FY23 operating margin guide gets bumped after staying flat last quarter. Good here. This quarter improved to -43% operating and -39% net with the FY23 guide moved to -50%. Though the improvement was driven more by controlling expenses than revenue outperformance, management deserves credit for keeping this on track. It also floated profitability at some point in FY25 (two years from now)

Continued confidence from management the Attivo integration is going smoothly. Some specifics on business wins from all the recent partnerships wouldn’t hurt either. We didn’t get much here since most comments and questions rightfully revolved around the ARR weakness, cash flows, and tightening customer budgets. While management sounded appropriately prudent, I didn’t exit the call feeling much underlying confidence.

This was admittedly a tough recap to write. While smaller beats with softer guides have been the norm recently, SentinelOne also holds the distinction of the least stable cash flows and profits in our portfolio. That by nature puts more pressure on revenue growth and its underlying drivers to keep everything in check. Unfortunately, I’d label S’s biggest drivers as net new ARR and customer growth which both disappointed.

In my opinion, management now has two gaffes under its belt in the last three quarters. First was clumsiness articulating the initial joint S/Attivo guide. Now we have a significant whiff on an S/Attivo net new ARR guide set just 90 days before. Consequently, I find myself uncomfortable sticking around to see if Q4 bounces back enough to deliver a decent set of FY24 guides. Therefore, I decided to sell our ~7% allocation and reassess.

S did earn some positive post-earnings press when its Singularity XDR platform placed in the “Winner” category for CRN's 2022 Products of the Year. CRN is a “top technology news and information source for solution providers, IT channel partners, and value-added resellers.” Let’s see what business momentum, if any, that might create in 2023. In the meantime, I’m content to sit this one out.

SNOW – All was quiet on the Snowflake front in December. Our last formal update was November 30’s Q3 report, which I found entirely reasonable in this environment. If there’s one company I’m comfortable will weather this storm operationally, it’s SNOW. It’s just a question of how much land it can grab while waiting for IT budgets and workload migrations to loosen up again. I’m willing to wait it out at our current allocation.

TMDX – TransMedics’ only December announcement was its upcoming participation in J.P. Morgan's 41st Annual Healthcare Conference on January 11. TMDX had a record-setting 2022, and management expects continued good things in 2023. I’m looking forward to our first update of the new year.

TTD – The Trade Desk has been quiet for most of the last two months. Its only formal announcement was naming a new Senior VP of Business Development for North America. The rest of the story is pretty straightforward. When advertising picks back up, TTD’s recent gains in market share should put it in strong position to benefit both in North America and elsewhere.

ZS – Zscaler’s December 1 earnings matched the season’s broader trend of decent reports and lighter guides. I anticipated $354.5M in revenue with a ~$375M Q2 guide. We got $355.5M (good) and $366M (not so much). As with most firms, the “elongated sales cycle” is rearing its macro-influenced head.

Zscaler did raise its FY23 revenue guide by $30M to 40% growth, so good news there. The worry was no raise at all to full year billings, which management continually touts as its best indicator of underlying health. That suggests some possible headwinds the next few quarters. Remaining Performance Obligation and customer growth came in a tick light as well, reinforcing this belief.

The two things holding steady were an eighth consecutive quarter of 125%+ net retention and a solid beat on operating profit. So, in that respect Zscaler appears to be maintaining operational efficiency. Things are tough all over, so there’s no reason to think ZS immune. The concern is early hints of weakness into tougher comps. ZS becomes less attractive if its strong US federal positioning is simply offset by slowing enterprise growth. Something to watch.

Post earnings saw two positive business updates. First, Zscaler received FedRAMP Moderate Authorization for its ZPA product. This makes “Zscaler the only cloud security service provider to have all core solutions…authorized through the U.S. Federal government’s FedRAMP program at High and Moderate levels.” That should be a nice selling point with government agencies and contractors.

Second, Zscaler has joined the Joint Cyber Defense Collaborative working to improve cybersecurity posture for the US and strategic international partners. Established by the US Cybersecurity and Infrastructure Security Agency, this collaborative “leads the development and implementation of joint cyber defense plans and operations through critical partnerships with the private sector, Federal government and state, local, tribal and territorial governments.” If nothing else, this designation earns Zscaler a seat at a very visible table. I’m hopeful that visibility lets ZS leverage all those FedRAMP approvals into some public sector wins during 2023.

My current watch list…

…includes holdovers Gitlab (GTLB), monday.com (MNDY), and MongoDB (MDB).

I’ve also starting poking around on Clearfield (CLFD), a company focused on rural broadband service. CLFD provides end-to-end fiber protection, management, and delivery services for cable providers and customers. It’s a small, profitable company which has benefitted from the push to expand broadband to underserved areas of the US. It is coming off years of 51% and 92% growth with an initial guide for 45% in FY23. That doesn’t include any contribution from recent infrastructure bills, which isn’t expected to be material until calendar 2024. The company also recently completed an oversubscribed secondary offering at $100/share, which shows institutional confidence in its future is bright. Regardless, CLFD is interesting enough to keep digging. Anyone else familiar?

And there you have it.

Welp, another year in the books. It wasn’t what I wanted (at least from an investing standpoint), but there’s little I can do about that. One thing I’ve learned over time is separating what you can control (process and preparation) from what you can't (outcomes). The 2022 market only reinforces that message. All we dictate is our due diligence and allocation decisions. Macroeconomics, multiples, and short-term returns never have been and never will be under our control. Remembering that has served me well over the years, 2022 notwithstanding. I have no reason to think that changes heading into 2023.

Thanks for reading, and I wish everyone a very Happy New Year.

We are on the same page here. I have bought small amounts this year for what is probably a $170 cost basis overall. But every single chart I see has SNOW as not just an outlier but an outside-the-solar-system outlier. If 2022 has taught me anything it is that these high multiplier companies get hit harder than any of the others do. But when Saul, Gaucho, Poleeko, and Muji all have this fat positions I just wonder what I'm missing. In spite of thatI think I'll stay at 5.5% for the time being. Thanks Joe.

Happy New Year to you and your loved ones. May 2023 bring better days to all our portfolios.