Phew…a positive month! I was beginning to wonder if my “+” key even worked any more.

2022 Results:

July Portfolio and Results:

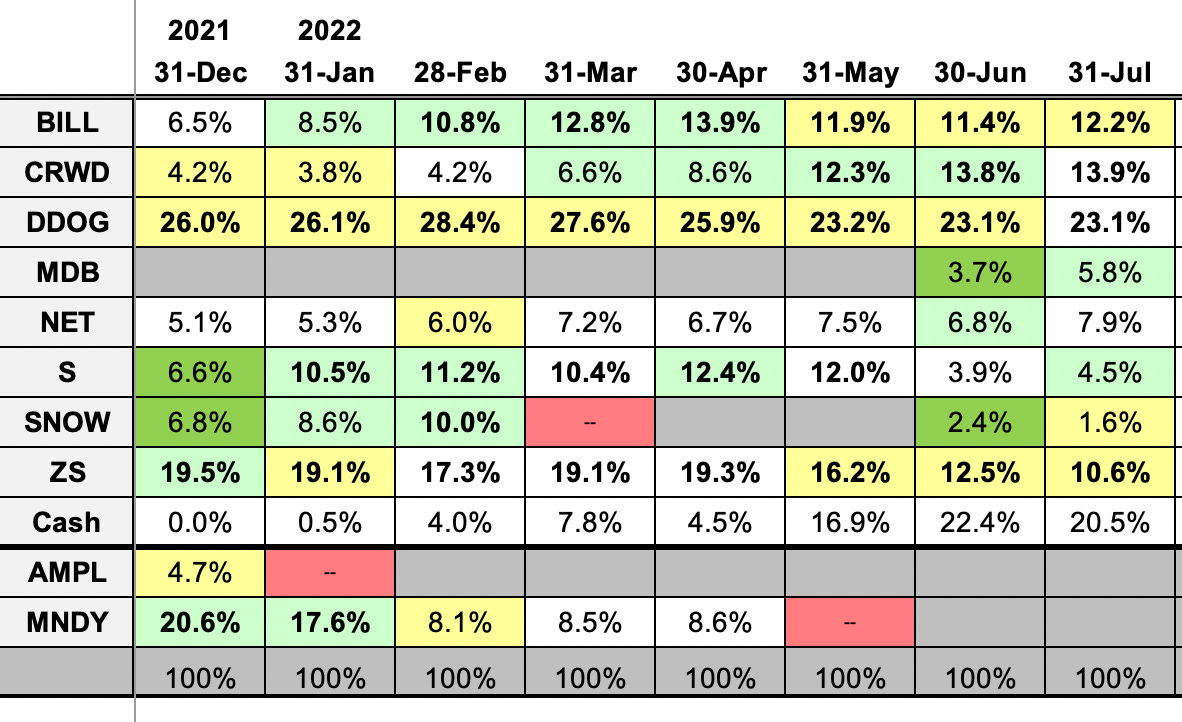

2022 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2018 (the one that got things started)

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

December 2021 (contains links to all 2021 monthly report)

Stock Comments:

With many companies in the quiet period before earnings, July saw only a smattering of news. That shouldn’t diminish the importance of this quarter, however. The bull thesis for many software and data firms includes products less likely to be abandoned by customers during tougher times. Not “recession proof” per se, but at least “recession resilient.” We are currently seeing that idea put to the test.

It is encouraging to know the major cloud providers (i.e. Microsoft, Google, and Amazon) showed steady performance. More importantly, all three management teams balanced any comments about short-term prudence with confidence long-term digital trends remain intact. That certainly fits the resilient narrative. Here’s hoping it applies to our holdings as well.

BILL 0.00%↑ – Bill.com has been eerily quiet this month. With any luck, that’s only because management has been busy firming up the details of a solid Q4 report. We’ll find out August 18.

CRWD 0.00%↑ – CrowdStrike’s July was spent bolstering its cloud capabilities. First, it released Falcon OverWatch Cloud Threat Hunting, “the industry’s first standalone threat hunting service for hidden and advanced threats originating, operating or persisting in cloud environments.” Next, CrowdStrike upgraded its Cloud Native Application Protection Platform (CNAPP) for customers using Amazon Web Services. This upgrade will better “identify any vulnerabilities, embedded malware, or stored secrets before they are deployed.”

Since any cloud advantage is a good one in today’s cybersecurity environment, it’s encouraging to see CRWD continue to improve on its industry-leading platform.

DDOG 0.00%↑ – Datadog provided a few updates this month. First, it announced a Sydney, Australia customer summit on August 16. Featuring “engineers and developers who were able to transform their organizations” with Datadog, this summit will be separate from the firm’s worldwide customer conference in October. I take it as a positive DDOG is generating enough global interest to merit a secondary event.

I’d also say Datadog’s blog was a little more active than usual this month. For those more technically inclined, there are several recent articles detailing the features associated with DDOG’s new Observability Pipeline product. The main gist is customers can now get a deeper look and even more protection for workloads on Datadog’s platform.

The most relevant news though was the announcement earnings will be released pre-market August 4. The expectation here is Datadog will continue its string of quality performances.

MDB 0.00%↑ – MongoDB followed its big June customer conference with some interesting July tidbits. First was a blog entry detailing the migration of a large European energy company from Microsoft’s Azure database offering to MongoDB Atlas. This looks like a sizable win.

Next was the release of MongoDB for Startups in a partnership with Amazon Web Services (AWS). This program will give early-stage companies access, credits, and support for MongoDB’s platform through AWS’s Activate startup program. Through this deal MDB will provide “dedicated technical advice, shared marketing opportunities, and partnership opportunities to help startups grow their customer base.” This should be an excellent way for MDB to land new customers and hopefully expand with them as they grow.

Late July saw the release of MongoDB version 6.0 with enhancements allowing users to “build faster, troubleshoot less, and cut out complexity.” The upgrades should let MDB handle more use cases while also making relevant data easier to manage. After focusing so heavily on developers at last month’s customer conference, it’s nice to see the company follow up so quickly with a new suite of developer-friendly tools. I really like what MDB has done recently and have bumped this allocation a tick as a result.

NET 0.00%↑ – July’s only formal news was Cloudflare’s release of its August 4 Q2 earnings date. As usual though, its blog continues to churn out almost daily updates on NET’s initiatives. July’s emphasis was on security and Zero Trust as NET aggressively looks to establish its presence in this space. I’d expect Zero Trust to be a hot topic for CEO Matthew Prince and friends on the upcoming earnings call. Hopefully, the present numbers will be strong enough to let management focus on the future.

S 0.00%↑ – July was apparently Amazon Web Services (AWS) Month for SentinelOne (S1). First, S1 was added to the AWS Gravitron Service Ready Program, meaning S1 customers can now use Amazon’s full suite of tools with full security protection while deploying faster than ever. Next was an integration with AWS’s Elastic Disaster Recovery to better protect against ransomware attacks. Last was the release of Storage Sentinel for Amazon’s Simple Storage Service. Storage Sentinel will “prevent, detect, and respond at machine speed to malicious files entering Amazon S3.”

As a smaller firm, these are exactly the type of deals SentinelOne needs to be winning for additional exposure on the major cloud platforms. In that respect, well done. S1’s next earnings update will likely be the last week of August or first week of September.

SNOW 0.00%↑ - It’s been very quiet on the Snowflake front. Its last significant update was a June 30 blog post with the 4 key takeaways from its Summit customer conference:

Saving time and resources with new data capabilities.

Building, monetizing, and using applications in the Data Cloud.

Increased choice and cloud-agnostic experiences regardless of cloud provider.

Increased data governance and security without sacrificing access or readability.

Full credit to Snowflake for staying focused on its goal of making it easier for customers to migrate additional workloads to its platform. Our next update on just how many of these new workloads are arriving should be late August.

ZS 0.00%↑ – ZScaler’s only July announcement was a large contract win with global manufacturing firm Coats Group. The deal protects 18,000 employees in facilities across six continents and involves multiple ZS products. Said Coats’ VP of Cybersecurity:

Data and data integrity are critical to running a competitive modern manufacturing enterprise. With the accelerating adoption of IIoT [Industrial IoT], AI-powered robotics, and other connected industrial systems in collaboration with human experts, Zscaler will help us provide secure access for OT applications and workloads, as well as users and devices, based on a zero trust approach.

What I find most interesting about this deal is Coats manufactures…wait for it…sewing thread, zippers, and fasteners. While cutting edge security hardly seems needed for sewing supplies, this just goes to show how embedded cybersecurity has become in our interconnected world. It’s this tailwind that likely keeps companies like ZScaler growing for quite some time to come. Based on last year’s Q4 reporting date, we’ll likely get ZS’s end of year report in early September.

My current watch list…

…at this point is basically keeping a soft eye on monday.com ( MNDY 0.00%↑ ) and ZoomInfo ( ZI 0.00%↑ ). For now, I simply don’t have enough conviction either’s products are critical enough to maintain new customer growth in the current economic environment. However, I’d happily reconsider if proven wrong. We should get updates on both in August.

And there you have it.

What a strange month. On one hand, another historically high inflation number and subsequent 0.75% interest rate hike dominated the negative headlines. On the other, the market posted one of its best months in recent memory, which suggests most of the pain might have already been priced in. Does this mean the tide is finally turning? Heck if I know. I only know every update inevitably moves us closer to the bottom of this cycle (or further past if we’ve already bounced). I’m sure I’m not alone in saying that can’t come soon enough. Regardless, this earnings season should go a long way toward clarifying the business landscape for the remainder of 2022. Here’s hoping you get good news no matter what you own.

Thanks for reading, and I wish everyone a great August.

I usually consider portfolio reports as just fluff....I fondly call them "portfolio porn". However, your portfolio report is one of the very few (1 or 2) that I actually look forward to and read diligently - because you do not go into way more technical detail than needed (snore zzzz) and you don't dwell on past "glorious" performance from pre-2019, 2020 and 2021. (ever since I started investing in 1st grade, my portfolio has risen one million x!...insert mini me emoji here).

I like your focus on what is relevant - this year and the now and just the right amount of info to truly understand what is going on with your companies.

Much appreciated, my friend.

Hi Novice...I noticed you trimmed your already small pos in SNOW to something even smaller. At this point, it hardly seems "needle moving" in your port. Are there concerns or did you just want to further top off S and ZS? Thanks for the update!!