Are we having fun yet? 😁

2020 Results:

March Portfolio and Results:

Past recaps:

December 2019 (contains external links to monthlies)

Stock Comments:

I entered March with nine positions and 3.3% cash from my 2/27 Anaplan exit. Then things turned very interesting very quickly. Half my companies released earnings during a stretch where we not only suffered a historic market collapse but saw the world literally shut down. Let’s just say it ended up being quite the month. I goosed some higher-conviction names during the initial slaughter. I added a new position in LVGO while axing SMAR. I double-clutched my way into WORK. PAYC came and went. Finally, I switched from MDB into ZM. I know some tried to trade the volatility, but I didn’t. One, I have too much going on besides my portfolio to pay the necessary attention. Two, that’s simply not my game. I have none of the time, skill nor most crucially temperament. I’m fortunately still in a position to make my regular April contribution. That purchase might not find the bottom, but it will almost certainly be at a nice discount.

AYX – Despite a putrid month for the stock my conviction in Alteryx remains the same. I never thought I’d add to such an already large allocation, but I bought yet another ~0.5% when AYX fell more than any other holding in the mid-month bloodbath. My working thesis is there will still be plenty of data to crunch when this is over, so I’ll take my chances things will eventually work out in my favor.

COUP – I swapped a small amount of COUP for LVGO when Livongo dropped twice as much in the 3/9 carnage. It wasn’t any dislike for Coupa as much as liking Livongo’s 2020 prospects better. I also wanted a slightly smaller COUP allocation heading into earnings given how quickly the coronavirus might change the business landscape. It’s unclear how much a business on lockdown will need to procure, so I was curious to hear how management saw 2020 shaping up.

The Q4 headline numbers reflected a lot of the things that drew me to Coupa in the first place. Revenue growth came in at 48.8% for the quarter and finished at 49.7% for FY20 (vs 39.4% in FY19). Subscriptions grew 46.1% this quarter and accounted for 88.6% of total FY20 revenue. COUP continues to show improved leverage, posting double digit operating (12.0%), net (13.5%) and FCF (18.1%) margins for the second quarter in a row. It was also their second consecutive quarter of $20M+ in operating and free cash flows. COUP hasn’t traditionally reported NER other than a 110-112% target. With add-on module sales increasing the CFO now says, “we think over time we can get that closer to 120%. In Q4, I will say it was meaningfully above the historical range, but just given the strength of Q4, I'm not at this point ready to call a new range, but the trend is definitely up.” Plugging everything in, COUP’s fundamentals appear to be in very good shape.

I felt the call was appropriately thoughtful with excellent answers. As expected, many of the questions revolved around the effects of the coronavirus on future business. Management expressed confidence in their foundation. They even stated, “we are looking at ways to help folks, particularly suppliers, that don’t have a great deal of cash flow or may need cash flow”. To that end they’ve offered clients free use of their digital checking service through 4/20. Remember that Coupa’s Community Intelligence feature not only allows customers to see best business spend practices in real time but also links buyers with suppliers to find the best fits. Management says although it’s not material they’ve seen clients switch heavily to purchases of safety equipment, sanitization supplies, face masks, etc. On the downside (and no surprise), they are seeing a marked decrease in purchases of long-term items like property building and engineering services. All this information is recorded and available to users as they go. Coupa’s ability to facilitate that kind of agility should be extremely valuable in what will be a rapidly changing business environment. From an investor perspective, it was an eye-opening example of just how flexible and responsive Coupa’s platform can be. This isn’t to say COUP won’t be affected over the next couple quarters, but they are clearly lining themselves up to be in a strong position when this all passes. Looking at it conservatively and using a smaller beat than normal, I’d expect Q1 revenue growth of ~45% with profit margins in the 5%-8% range. So, Coupa should have a firm base to work from as 2020 unfolds. I’m comfortable keeping my shares.

CRWD – All hail, Mighty CrowdStrike! Approaching earnings, I was hoping the accelerating customer growth from Q2 and Q3 would find its way into this quarter’s results. That not only turned out to be the case, but CRWD blew the 80% growth I anticipated entirely out of the water. In fact, this quarter was nothing short of amazing.

Revenue growth accelerated sequentially from 88.5% to 89.1% at a <b>record</b> run rate of over $600M. They added a record $98.7M of new ARR and finished FY20 at a record total of $600.5M (+92.1% YoY). Subscriptions grew 90.2% at a record-high subscription gross margin of 76.5%. NER came in at 124% and operating expenses came in at a record-low 77.9% of revenue. Anyone else notice a lot of record figures in there? Most impressive of all they added a record 870 customers this quarter meaning customer growth has now accelerated four consecutive quarters. Check out this progression coming off 4Q19’s rate of 102.6%:

As if that wasn’t enough, CRWD churned out $50.8M of free cash flow in Q4 for an FCF margin of 33.4%. It was their second consecutive FCF-positive quarter and helped them finish FY20 at 2.6%. Working off their “appropriately prudent” guidance, I’d expect growth to again challenge 80% or better next quarter. That’s remarkable at this scale. As CRWD ends its first year as a public company, it is not only knocking on the door of profitability but quickly lining itself up to be a cash printing machine.

Not surprisingly, the call comments were enthusiastic and confident despite the circumstances. Cyber security will become even more important as the world sees a rapid increase in remote workers. In fact, the CEO stated “the dynamics of the competitive landscape are the best I have seen in my 27-year career.” CRWD feels it is well-positioned for this challenge and has already instituted two free programs to assist customers. One allows customers to install Falcon Prevent on home systems. The other lets clients more easily onboard remote workers. Their examples of this rapidly changing landscape included a large enterprise customer “who recently rushed to buy 12,000 new laptops for newly remote employees” and will be using CRWD to protect them. Management still sees a steady need for its products and is kicking off a tour to meet with 100 customers and prospects in 100 days via…wait for it…Zoom. CrowdStrike has moved its sales operation to fully remote and has “been able to actually increase our first business meetings by 13%...as people are around in home and we’re able to get in front of them”. CRWD realizes things are changing drastically, and I’m impressed with their early efforts to adapt. I added ~2% at just under $50 immediately after earnings. The subsequent rise combined with AYX’s slump has now pushed CRWD to my #1 spot. I fully expect CrowdStrike to spend the foreseeable future in lockstep with Alteryx at or near the top of my portfolio.

DOCU – Though still a watch list stock, DocuSign posted solid earnings with a confident call. There’s a very real argument the work from home movement will accelerate adoption of their CLM (contract lifecycle management) platform, which the company sees as the next big thing alongside its flagship e-signature offering. If that’s indeed the case, DOCU should handily beat the market for many years to come. Anyone owning it care to give a more detailed breakdown?

DDOG – I entered March looking to increase my Datadog position if the opportunity presented itself. I gladly pulled the trigger on 2.5% more when the price dipped ~12%+ on 3/9. I added another ~1% later in the month. I thought February’s earnings were a home run and was glad to add shares at what I believe will eventually be viewed as a discount. I’m not exactly sure how this downturn affects DDOG’s usage, but shouldn’t the number of events to log and monitor surge as a slew of common interactions moves at least temporarily online? For those more technically inclined, is that the right way to think about it? Either way, on numbers alone DDOG should maintain a strong spot in my portfolio.

LVGO – A new name added after my end of February Anaplan sale. Livongo moved from watch list to buy after a great earnings report on 3/2. LVGO is a SaaS company offering a monitoring service for people with chronic health conditions. Their platform uses AI to track patients and send personalized “nudges” to help relieve symptoms and encourage healthier habits. They have modules for diabetes (main offering), hypertension, prediabetes weight management and behavioral health. The company’s clients include self-insured firms, government, unions, health systems and pharmacy benefit managers. They work with 30%+ of Fortune 500 companies and just announced a significant expansion of their nationwide agreement with CVS Pharmacy. From a numbers standpoint, Livongo has posted strong growth with rapidly improving bottom line leverage. I thought this quarter's results and conference call were both excellent.

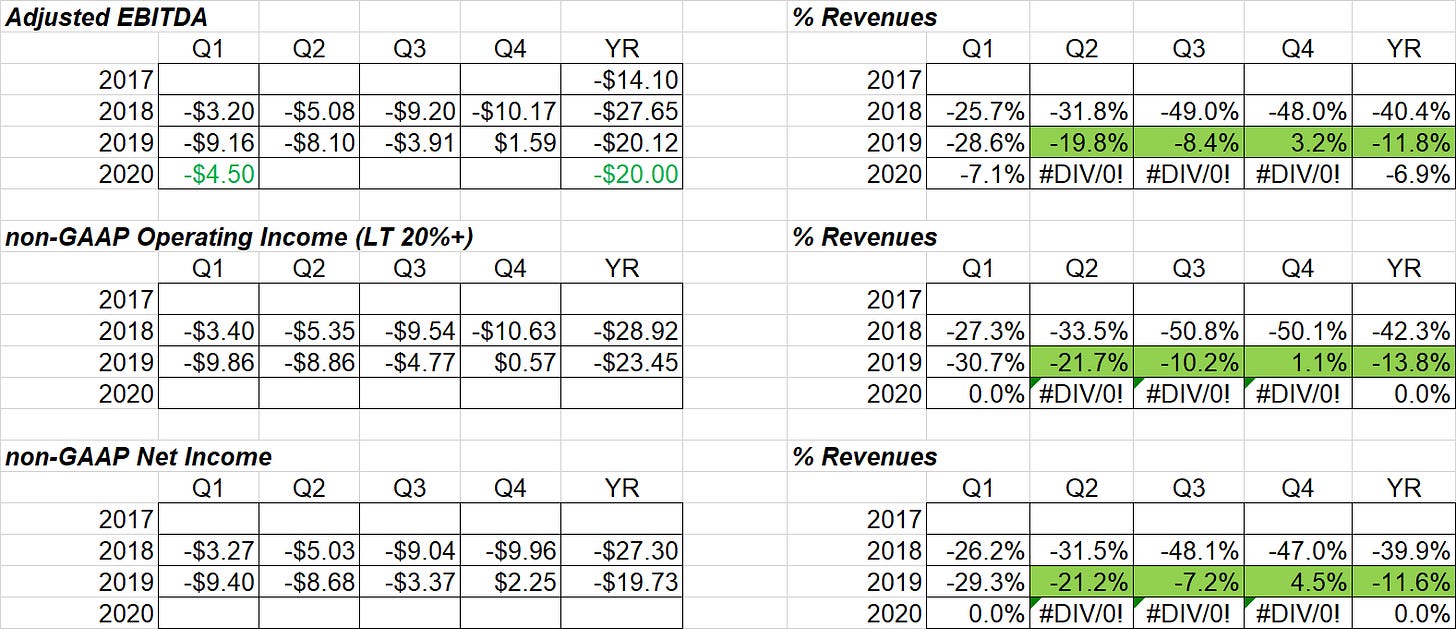

As shown below growth has been impressive, particularly the accelerating gross profits. Gross margins are improving rapidly as well, though it’s fair to point out the Q4 jump was artificially enhanced by a one-time adjustment. The company targets 72-74% gross margins long term, which should be plenty good enough. Green text are 2020 comments or company guides, which I’d expect to be beaten. Green shading represents trends that jump out to me:

Client and customer counts are growing steadily as well. Management noted on the call they’ve already launched 424 new clients in the first two months of 2020 versus 231 in all of 1Q19:

Most notable to me – and what sealed the deal as far as initiating a position – is how quickly LVGO is moving toward profitability. Again, any 2020 numbers are top end guides:

As you can see above, it appears LVGO might have turned a corner. Leverage has really picked up the last couple quarters after languishing through 2018 and the first half of 2019. Management is confident this improvement will continue and sees sustainable EBITDA profitability by 2021. A recent plug on CNBC gave the company some nice exposure as well. Given the recent business momentum and leadership’s clear excitement about their prospects, I’ve decided LVGO is worth a supporting spot in my portfolio as I follow along. I started with a ~3.3% buy 3/3 and added another 1% on 3/9. The uptick in allocation since is entirely due to LVGO’s price holding up better than most of the names around it. I hate to say it given the circumstances, but Livongo is likely to come in very handy for clients forced to monitor themselves at home the next few weeks. My guess is those users will be paying very close attention to their nudges. For their health’s sake I hope they do.

MDB – Despite a surprisingly strong YTD run into March, Mongo had been gnawing at me. Disappointing reports led me to trim each of the last two quarters, and I found my Spidey senses tingling again as 3/17 approached. I continue to believe the march toward NoSQL is inevitable long term but admit I was having trouble matching MDB’s recent business performance to that narrative. Management had already suggested tough 4Q comps while emphasizing 4Q19’s revenue spike was “not reproducible or replicable”. Reviewing the numbers, I estimated ~40% Q4 revenue growth, another slowdown in 1Q21 and a FY21 guide that might start in the low-30’s. That would represent a severe drop off from 52% in FY18, 61% in FY19 and the ~55% I was carrying for FY20. I projected Atlas growth to slow considerably as well, dropping under 100% for the first time. Combining these potential declines with losses that had remained flat for several quarters, I decided to swap ~3.1% for a new position in WORK. I was willing to let the remaining shares ride into the report, but they would be on a short leash if the numbers disappointed.

I thought it was a mild disappointment, but a disappointment nonetheless. The good news was a surprisingly strong beat on revenues at 45% for Q4 and 58% for FY20. Unfortunately, I found the rest lacking. Their CTO, who was also a co-founder, will be stepping down in July. It sounds amicable, but nonetheless that’s quite the brain drain. Atlas growth slowed even more than I anticipated, and the comps only get tougher from here. Losses continue at a steady rate and likely won’t narrow any time soon. Rather than the low-30’s FY21 revenue guide I was expecting, MDB announced just 25.7% at the top end. Coming off 58%! Not exactly what I was looking for.

What bothered me most was MDB going out of its way in the release to estimate a $1-$2M Q1 revenue hit and $15-$25M for the FY due to coronavirus. Being honest that rubbed me the wrong way. Maybe it’s just me, but I find it a bit too convenient to cut that much revenue a few weeks into this thing and authoritatively blame the virus. By no means am I saying businesses won’t be affected. I’m just observing MDB took a much different tack than most firms reporting this month. Shouldn’t recurring revenue lend some initial support here? Don’t existing subscriptions and an NER of 120%+ for the 20th consecutive quarter buy any time to assess what’s going on? While other firms parroted the seemingly prudent “we’re generally comfortable but paying very close attention”, Mongo went full bore on blaming the virus for upcoming FY21 weakness right out of the chute. Did anyone else do that? I know none of COUP, CRWD, DOCU, SMAR or WORK did. Some analysts complimented the effort to bake the virus into the guide, but for whatever reason I had the exact opposite reaction. Despite all the “stickiness” management touted on the call Mongo has already projected the biggest negative impact of any company I track. It struck me as slightly disingenuous at best and flat out dishonest at worst. Others might disagree, and I have no issue if you do. As for me I decided to sell my remaining shares after hours to buy more CRWD and a starter spot in ZM. 2020 was already lining up as a transition year for Mongo. Now management has lowered those expectations even further. That puts me on the sidelines for now.

OKTA – Ho hum. Another quarter, another rock-steady report. Okta posted an impressive top line beat with revenue growth holding firm at 44.9% (vs 45.0% in Q3). Management is seeing contracts that “tend to be larger in value and longer in length”. They set new single-quarter records by adding 550 total customers and 142 with an ACV above $100K. Okta also saw contracts greater than $1M increase 80% vs 4Q19. Subscriptions grew 46.1% and now account for a record 94.7% of revenues. Operating (-3.3%) and net (-1.0%) margins continue to improve, and both have a chance to at least challenge breakeven at some point during the upcoming year. Finally, the company’s record 10.8% FCF margin marked their fifth positive quarter in the last six. FCF is expected to remain positive even as Okta continues to invest in growth.

Looking ahead, Okta continues to show strong business momentum even as the company has reached a ~$670M run rate. CEO Todd McKinnon stated they are “really well positioned…the right place, the right time”. These recent growth rates seem to back that up heading into YF21:

Revenue: 48.5%, 45.0%, 44.9% (I’d estimate ~45% again next quarter)

Deferred Revenue: 52.2%, 48.8%, 48.7%

Billings: 42.4%, 41.6%, 41.6%

RPO: 68.0%, 67.9%, 66.0% ($1.21B this quarter)

Current RPO (within 12 months): 52.0%, 52.0%, 53.6% ($592.3M this quarter)

NER: 118%, 117%, 119%

After last quarter I wrote Okta seemed to be settling in as “a consistent 40%+ grower crossing over into steady profitability before too long”. Given this report, I have no reason to waver from that opinion. In fact, I added a tick towards the end of the month and will happily continue holding my healthy slug of shares.

PAYC – A quick buy and sell. Paycom is a stock I owned during 2019 and have continued to follow closely. The company put itself back in my portfolio after announcing an expanded stock repurchase program on 3/12, which suggests the current market might be undervaluing the shares. As the CEO stated, the “increase in our repurchase program further underscores our confidence in the strength of our business and our long-term growth prospects, irrespective of macroeconomic factors that may affect our stock price from time to time.” Revenue growth isn’t nearly as high as some other SaaS names, but PAYC is a poster child for consistently high margins and profits. Management has always remained hyper-focused on two things: providing value to customers and operating efficiently. Paycom’s platform is designed not only to assist HR personnel but also serve as an interactive benefit portal for every single client employee. This makes it both user friendly and hard to displace. That should help in weathering a downturn as long as too many of Paycom’s customers don’t disappear over the next few months (which is admittedly a risk if this drags on too long).

I believe cash flow and profits will matter to this market the next couple quarters. Part of Paycom’s appeal is it has consistently shown both in spades. It’s not only embedded with clients but possesses a balance sheet hearty enough to withstand a lull. PAYC also has an extra week of Q3 revenue coming due to a quirk in the 2020 calendar which should help upcoming comps. With the stock at a 40%+ discount at the time of my initial purchase, I viewed it as a good mix of stability and growth potential at the back of my portfolio while everything shook out. As things developed and I continued to work through it, I decided to pocket a lucky 10% gain and put the funds into more ZM and WORK.

ROKU – There’s simply no sugar coating it. After being a portfolio standout through Fall 2019, Roku’s been a serious drag since. I spent most of February trying to figure out why since I thought earnings were fine and the overall thesis remains intact. In early March the price finally reached a point where I felt the market began to throw out Roku’s platform baby with the hardware bathwater. I think some of the initial hit was supply chain concerns for Roku TV's and sticks, then it was compounded by concerns over ad sales. I also believe their international expansion might take a slight pause given the current climate. However, TV’s and Roku sticks are not where the money lies. They are just the gateways to eyeballs. Ads will decrease but won’t disappear, and streaming hours are very likely to skyrocket. Ad impressions through The Roku Channel should surge as well. I shook the couch cushions to add a tiny 0.1% in my taxable account when the stock dropped below $80. I know others have added as well. Despite Roku’s terrible YTD, I can’t see how there’s not room for considerable upside from these levels. With the shares this beaten down I see no harm in holding through early May’s earnings and reassessing. I’d expect some rebound with an even moderately optimistic outlook. If not, it’s likely time to move on. Hopefully people won’t decide to stop streaming television while they are on lock down between now and then. 😏

SMAR – Smartsheet became a sacrificial lamb during the 3/9 bloodbath when it declined less than AYX, DDOG and WORK. No offense to SMAR, but it was my lowest conviction position and I simply liked the other three more. Even while owning it 12 of the past 14 months, I’ve always viewed Smartsheet as more of a very useful tool than a business necessity. I admire the numbers and believe current clients will stick around in a slower economy because the platform tends to save both time and money. It will also help in keeping things organized as people work remotely. However, I openly wondered how new customer growth would hold up in a downturn since SMAR’s offerings aren’t as clear a “must have” as many other companies.

Being it remained firmly on my watchlist I was still paying attention when SMAR reported on 3/17. To their credit they turned in another steady quarter. Revenues came in a slight tick under my estimate, but the secondary top line numbers held up well. Billings, deferred revenues and growth in larger customers ($50K+ and $100K+) all accelerated sequentially. NER ticked up from 134% to 135%. Losses should narrow a smidge this year (though likely still in the -15% margin range) and SMAR is looking to challenge breakeven FCF for the year. In general, this was a solid showing that included a confident call.

One thing to note is Smartsheet lacks a strong beat-and-raise history. Revenue surprise has ranged from just $0.5-$1.5M each of the last four quarters. It’s also worth noting profitability and FCF margins have deteriorated versus 2019 each of the last two quarters. Given the coronavirus uncertainty, it’s hard to tell exactly where these might go in FY21. So, I’ll be paying equally close attention to results and guides going forward. SMAR hasn’t traditionally built in as much margin for error as most SaaS firms, and I’m not sure what a misstep might mean given the lack of profitability. That leaves me in watch mode for now.

One additional note post-earnings is Smartsheet offered its product as a 120-day free trial for any government agency dealing with the Covid-19 outbreak. They also “released a set of free Smartsheet templates, modeled after assets we built for our own use that can be used to create a COVID-19 operations dashboard containing CDC documentation and other resources. The dashboard serves as an information hub and a resource center for employees and can help any organization understand and assess risks and collect data on needs or health changes in their population”. Thank you, Smartsheet. That’s not only a shrewd business move, but simply the right thing to do. The more organized we are in trying to slow this down, the better.

TTD – My 2019 portfolio MVP, The Trade Desk was having a perfectly respectable 2020 until getting annihilated this month. Ad budgets are likely to be squeezed significantly during this slowdown, and TTD’s borne the brunt of it. The cancellation of live sports events and postponement of the Olympics haven’t helped either. The one thing not likely to fade is spending in what will certainly be a VERY active US election this Fall. TTD also just announced an ad partnership with TikTok in Asia. For those unfamiliar, short form videos like those on TikTok are all the rage these days. It’s pretty much a slam dunk TikTok will see a significant usage spike over the coming months. The first client to take advantage of this partnership was PepsiCo, so there’s obviously potential here. The question is how many others come on board.

While immediate cutbacks will no doubt hurt, TTD’s strong balance sheet and the remaining prospects for second half spend should (hopefully) set a floor for the stock. In the big picture, it’s hard to think the move to CTV and programmatic ads is suddenly going to disappear. However, the next couple of quarters are likely to be a very choppy ride. TTD hasn’t lost its spot in my portfolio (yet?), but I did trim it considerably for the third month in a row. This time around ~3.3% became a new position in WORK and ~1% each went into more DDOG, OKTA and ZM.

WORK – Put on your reading caps. This one’s a doozy…

After spending a few months on my watch list, Slack staggered and stumbled its way into my portfolio. I’d missed most of the recent ZM run but believe WORK could benefit from the same phenomenon. Most who have used Slack realize it is far superior to email or text for streamlining and organizing communications. I feel the same way. It’s easy to navigate and popular with those using it. The entire concept of work is evolving rapidly, and it’s fair to say Slack is one of the companies leading the way.

I’d avoided the stock thus far mostly due to losses and cash flow concerns. However, last quarter showed significant improvement in both while posting growth just short of 60%. In addition, I saw early signs of leverage peeking through. With all the above in mind, I built up a ~4.6% position about a week before earnings. As luck would have it, WORK held up well during the first couple of market plunges (I’m guessing others thought similarly to me). Unfortunately, that didn’t last as Slack dropped with everything else 3/12, then collapsed again post release. Revenue growth was 49%, about 3-4% less than I’d expected (oops). Losses were acceptable and FCF solid (OK, feeling better). Next quarter’s guide was adequate, particularly with their “prudent” comments suggesting a beat (I can live with that). Then I looked at billings (uh oh, let the queasiness commence). Management says to “focus on trailing 12-month billings and our full-year billings guidance as the best measures of underlying growth in our business.” Piecing it together, I’d estimate FY20’s quarterly billings growth of 47%-52% dipping more toward the low-to-mid 30’s in FY21. Not surprisingly, TTM billings would slow similarly. Even with solid beats I’d anticipate total FY21 billings growth of ~35% versus this year’s 48%. In my opinion that’s a significant decline for a firm still chasing consistent positive cash flow, especially in the macro environment that’s been thrust upon us.

On the positive side, I liked the call comments. Management showed some confidence and emphasized they “expect continued operating leverage in the year ahead”. I’m also intrigued by their new shared channel function, which lets users create channels that work seamlessly across two organizations. Slack plans to release the capability to link three or more organizations in a single channel sometime this year. That would be a huge add-on that would greatly expand their use cases. The challenge – which they have specifically outlined numerous times – is the messaging required to:

differentiate themselves from Teams within firms using Office 365 and

onboard/educate users on just how much their platform can do, which is vital for adoption beyond the free offering.

That messaging timeline likely wouldn’t be helped if potential clients enter hunker-down mode for an extended period.

In fairness I like where Slack’s ideas are going. However, I was struggling to reconcile the declining growth with the fact its product or cash flows aren’t more established yet. I wasn’t sure it would get any easier for Slack to tell its story in an environment where people will almost certainly be less focused on listening intently. And Microsoft’s Team offering will receive additional attention as well, particularly among established Office 365 clients. Anecdotally, my company is going through its “Hey, what’s this Teams thing?” moment as we speak. I also think cash flow matters the next couple quarters, and that’s not necessarily Slack’s thing just yet. While content with WORK’s general thesis, I wasn’t convinced it has the leverage yet to withstand continued growth declines without potentially compromising medium or long-term plans. After a second, deeper dive including this quarter’s results I determined the numbers simply weren’t where I need them to be to feel comfortable holding the shares. So, I licked my wounds and exited 3/16. I swapped it into PAYC while Slack was down ~6% and Paycom down 12%+. WORK went back to my watch list. I knew its obvious benefits during this time could put it back in my mix soon, but I needed to take a step back and rethink it.

That step back lasted about 10 days. As the world has changed, the advantages of Slack’s platform have become even clearer. The thing that finally brought me back into the fold was this Twitter thread from their CEO:

From a leadership perspective I was impressed. The message was honest, thoughtful and appropriate in a time of clear uncertainty. It also lends credence to the idea Slack’s adoption curve and paid accounts could see an acceleration as people are required to work remotely. Simply put, the world is forcing people to find new ways to stay connected and better communicate, and Slack has a chance to benefit. So, I finally got the sign I was seeking. Unfortunately, it skipped right past the earnings report and showed up on Twitter instead. Although I’ve reentered at a higher price, I’m much more comfortable with how I built the allocation and more importantly the way I got there.

EPILOGUE: I learned a valuable lesson here. I wasn’t playing earnings when I made my original purchase but did know they were only a week away. And although I was familiar with WORK, I didn’t know it as well as most of the other companies I follow. Usually I come in at about 3% in these scenarios (like I did with LVGO). In addition, when this close to earnings I usually wait to confirm the thesis before jumping in (again, like I did with LVGO). I had already identified some uncertainty in Slack’s numbers and should have gotten the additional information before making my decision. In this case I deviated from my usual process at least twice and as a result inadvertently lowered my vetting standards. Being brutally honest I believe passing on ZM in December along with the recent sea of red in my other names poorly influenced my original entry into WORK. I didn’t care where Slack’s price went short term. A bad process is a bad process regardless of result. Rather than emotionally hold it while being annoyed at myself, I decided I was better off cutting my losses and starting with a clear head somewhere else. Ironically enough, that clear head eventually led me back to Slack. I know we are navigating a tough market, but that’s no excuse. If I’m doing this properly, market conditions should have limited influence on whether a company is a good candidate for purchase. In this instance I let too much noise clutter my initial thinking. I don’t plan on making that mistake again. Actually, let me rephrase that. I’ll almost certainly face this challenge again. Next time I’m confident I’ll be better prepared.

ZM - OK. I’m finally in. I’ve always admired Zoom’s overwhelming numbers but just couldn’t get comfortable with the price. I got lucky and was able to grab a starter spot mid-month at $110. I added two more lots this week. While I do believe other names likely rebound harder as this passes, there’s no denying ZM could end up a global phenomenon when the world eventually returns to normal. I’m not sure there’s a better combination of business momentum and balance sheet in this current environment, so I’m glad to have some skin in the game. Kudos to those who have owned it for a while now. I know ZM’s been the saving grace for a lot of people’s 2020 portfolios.

My current watch list in rough order is NET, DOCU, SHOP and SMAR. Second tier is TWLO, ZEN, MDB, AVLR and EVBG (benefitting from coronavirus buzz, but these are still complex deals to close). I’m tracking BILL without giving it a spot for at least another quarter.

I’ve tabled ENPH for now. First, I’m uncertain how this pandemic affects their supply chain. Second, I have zero idea what this does to their international business particularly in Europe. My guess is installing solar energy systems isn’t a top priority for most people these days. I figure now is not the time to dabble in a name or industry with which I’m this unfamiliar.

Finally, I took another look at TDOC. Teledoc’s clearly going to be popular in the short-to-medium term. Even though the stock has understandably done fantastic, its growth numbers are just OK and heavily influenced by acquisitions. My initial take is we won’t see any real impact on revenues until Q4 or even 1Q21 when companies seasonally adjust their health insurance offerings. As of now, TDOC’s main benefit is likely a spike in adoption and usage by existing clients. While that certainly won’t hurt, it’s a different dynamic than ZM or others who should see more immediate revenue benefits from people working from home. The current environment does make TDOC intriguing. However, I’m still a hold until TDOC’s narrative shows up as better organic growth. My guess is this conversation will continue.

And there you have it. March was definitely not for the faint of heart. While this isn’t my first rodeo, I don’t feel I managed things as well as I could have. A handful of my bigger positions (AYX, DDOG, ROKU, TTD) got smoked, and I unfortunately compounded things by botching my initial entry into WORK. On the bright side I definitely learned a few things. From a portfolio standpoint I whipsawed from a February 19 all-time high to multiple entries on my biggest loss ever list. Volatility was insane with routine 5%+ swings in both directions all month long. I personally saw a 10%+ single-day gain and two single-day 10%+ losses over the span of about a week. As the dust settles, this month’s 20.0% decline now leaves me a healthy 28.8% below my ATH in about six weeks. And that’s after the strong rebound. I didn’t record my exact low point of this draw down but know it was somewhere south of -35%. My portfolio sank to levels last seen all the way back in early January 2019 before scratching back to where it sat last September. That’s quite a bit of giveback.

As you might have heard, the overall market experienced a similar shock. Years from now 2020 will be uttered in the same breath as the dot com bubble, 1987 and the mother of all crashes in 1929. We’d previously poked the bear a couple times. This time the bear mauled back with claws FULLY extended. In the big picture it’s events like these that truly hone our investing style, temperament and risk tolerance. Despite what I’d consider a subpar personal month I’m generally satisfied with my overall process. First and foremost, our living expenses and investment funds are in separate buckets that do not mix in any way. That lets me manage my portfolio and learn from the occasional misstep without worrying about paying the bills. And I still have a few years until retirement (still on track for early I hope 🤞). My style is to stay fully invested and add monthly, mostly because over the years I’ve found idle cash bothers me more than any regret over a lack of dry powder during pullbacks. That holds true even after this debacle since I fully plan on making my regular April purchase. And I once again appreciate the clarity these recaps provide. They are invaluable tools for mentally flushing the prior month and refocusing on the task at hand.

Looking back, I survived 2000-2002…2008-2009…late 2015/early 2016…October-December 2018…September 2019 (a personal -23.7% month even worse than this one)…and every other squiggle in between. And lest I forget this is now my third 30%+ portfolio pullback in less than two years. In the moment each of those periods felt somewhere between unpleasant and the end of the world. Yet every single time my portfolio somehow bounced back to new highs. EVERY. SINGLE. TIME. That’s not emotion speaking. It’s historical fact. This rebound admittedly might take quite some time, but it’s always nice to have history on your side.

Wrapping up, I can now proclaim I survived March 2020. That’s not to say I have any idea what the future holds. Things could certainly get much worse. Maybe this time really is different, but the odds are strongly against it in the long run. Mankind has survived pandemics before – many times in fact. We’ve also lived through multiple economic contractions, though I freely admit most weren’t as severe as this is shaping up to be. This just happens to be our first go at a pandemic and contraction unfolding simultaneously in real time over social media. Life sure does move fast in the digital age, doesn’t it? I take faith in the fact 1) the entire world is throwing its considerable resources into battling this and 2) we humans are resilient mofos. However, your guess is as good as mine as to how long this will take to play out.

While these kinds of losses suck – NO SHIT, SHERLOCK!! – I exit March believing in my holdings. These are excellent companies, and I remain confident many if not most will attain much higher prices down the road. Despite March’s epic beatdown, this is about the easiest stay the course of my entire investing career. If it’s your first time experiencing this steep a decline, I’d highly recommend this article for some historical perspective. For those who’ve been around awhile but still had their mettle tested the last few weeks, here’s a very honest first-person account by a 40-year investor who’s also a professor of business journalism. And finally, for those trying their darnedest to rationally prepare for whatever April brings, I look forward to continuing to break things down. Who knows? We might even stumble upon an opportunity or two along the way.

As I sign off, please do everything you can to stay healthy. It’s a VERY small silver lining, but this pandemic is a stark reminder that taking care of ourselves and our families is much more important than managing our portfolios. Thanks for reading and I hope everyone has a healthy April.