Man, that was the best March ever!

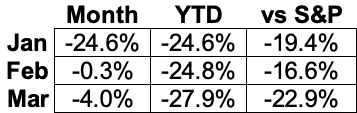

2022 Results:

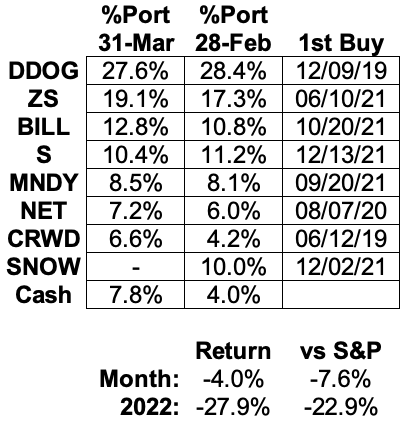

March Portfolio and Results:

2022 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2018 (the one that got things started)

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

December 2021 (contains links to all 2021 monthly report)

Stock Comments:

Our final three holdings reported in March. I’d call one a pleasant surprise, one about as expected, and one a mild disappointment. Here’s how I saw it as far as who did what…

CRWD – I’d consistently labelled CrowdStrike’s March 9 earnings a do-or-die report. I’m relieved to say I thought it was a do. Coming into the quarter I anticipated roughly $428.5M in revenue with a Q1 top end guide around $462M. CRWD delivered $431M and $465.4M. Even better, management’s initial guide for 49% FY23 growth will likely end up closer to the mid-50’s. With all the recent hubbub about cybersecurity tailwinds, that’s kinda what we’ve been waiting for.

The strong Q4 result was led by a record $217M in net new Annual Recurring Revenue (ARR). The resulting 28% sequential ARR growth is the fastest in nine quarters and third best during the last four years. In fact, CrowdStrike ended FY22 generating $5.71 in customer ARR for each $1 spent on an initial incident response, which was up from $5.51 last year. With a total ARR of $1.7B and $2.7B in Remaining Performance Obligation, CrowdStrike’s pipeline appears to be in great shape.

Digging deeper, it’s not just new clients driving increased usage. Existing customers are spending more as well. During Q4 69% employed 4 or more modules with 57% using 5+ and 34% at 6+. Each of these figures has accelerated the last five quarters. Likewise, CRWD’s 124% net retention rate marked the 16th consecutive quarter meeting its 120%+ benchmark. With CrowdStrike offering 22 modules and counting, there should be plenty of room for additional growth in this area.

Not surprisingly, the top line strength is creating considerable leverage at scale. Expenses as a percentage of revenue hit a record-low 58% this quarter. That in turn produced all-time highs in operating cash flow ($160M), free cash flow ($127M), operating margin (19%), and net margin (16%). With this year’s initial operating and net margin guides already above FY22’s finish, I’d expect several new records along the way. Says CEO George Kurtz:

There are powerful tailwinds driving our markets, and we do not currently see any indication that these trends will abate anytime soon. The adversaries are certainly not slowing down, actually, quite the opposite.

Even a non-techie like myself can see the obvious truth in this statement. These tailwinds present an enormous opportunity, not only for CrowdStrike but any company in the sector. That opportunity was bolstered by the recent passage of a $1.5T (yes, trillion) US spending bill specifically mandating increased attention to cybersecurity. While some of these requirements will be phased in rather than immediate, the bill strongly reinforces the belief cybersecurity momentum is building. Said Kurtz on potential government spend:

And when we think about CISA [the Cybersecurity and Infrastructure Security Agency], it's a fantastic validation for us in the Federal government. I've spent time in Washington, I was just there recently. And there's a lot of excitement about our technology finally being able to be deployed there. As you know, you have to go through a lot of different compliance and accreditations to get to sell in the Federal government, and we worked through those. We continue to work through those at different levels. And it opens up a massive opportunity for us, that we've seen a big pull from customers' interest in that particular vertical because of the aging technologies that they've been saddled with in the past. So more to come on that, but very excited about the opportunity today and in the future.

At its current size CrowdStrike’s story isn’t about accelerating growth as much as maintaining the growth it already has. After this update I can reasonably see CRWD pushing 60% during the first half of FY23 while continuing to churn out record cash flows and profit. Any uptick in government contracts – which certainly seems likely – would simply be icing on the cake. I thought this report was not only good enough to keep CRWD around but grab a few extra shares post-earnings. CrowdStrike has very sneakily provided our portfolio’s only market-beating return so far in 2022. Here’s hoping that trend continues.

BILL – The big news for Bill.com this month was an expansion of its partnership with CPA.com. This new arrangement designates BILL as CPA.com’s “new exclusive partner for expense management, corporate cards, and spend management.” Accounting firms and their clients will now be able to:

Automate previously manual, time-consuming tasks, such as expense reports

Have real-time visibility and insight into business spend

Control budgets and spending activity in real-time from a mobile phone

Manage Divvy corporate cards with simple, easy-to-use, integrated software

Benefits to accounting firms include:

Easy access and real-time visibility into client spend and expenses

Exclusive promotions and rewards for firms and their clients

Tailored training and content to support firms’ success with the new solution and capabilities

Dedicated partner support and resource hub complete with templates and materials to enable client success

Co-marketing and promotional opportunities including customer success stories and more

Client benefits include:

Free, award-winning spend and expense management software

Exclusive Divvy and Bill.com offers and incentives

This deal looks like a perfect way to leverage and cross sell last year’s Divvy acquisition. If successful, it could simultaneously expand BILL’s reach while increasing its stickiness. That could in turn create a powerful network effect between users and clients. With so much of Bill.com’s revenue relying on transaction volume, this looks like a smart deal. I added a smidge to this position on the recent dip back below $220.

DDOG – Datadog’s big news was an expansion of its relationship with Microsoft. Through this deal Datadog becomes a formal partner in Microsoft’s Azure Cloud Adoption Framework, a program recommending tools, best practices, and documentation to new Azure users. It also recognizes DDOG’s monitoring and security tools as a preferred option for all Azure customers. That’s good stuff and not at all surprising given Datadog’s recent performance.

MNDY – March’s monday.com news was the formal announcement of its strategic alliance with audit giant KPMG. Management initially discussed this partnership during its February earnings call, but the release provides further details. The deal “combines the business insights of KPMG with the technological innovation of monday.com’s no-code/low-code platform to build customized solutions and apps that empower global KPMG member firms to deliver strategic operating models and solutions on top of an agile work operating system.” Being honest, that sounds like an awful lot of buzzword and catch phrase gibberish. What I find more relevant is the exposure and credibility KPMG’s backing lends to monday.com’s solutions.

For better or worse, MNDY has put itself in the position of having to reestablish its beat-and-raise bonafides this year. Despite the PR gobbledygook, I’d consider this KPMG deal a step in the right direction. Now it only needs to execute.

NET – It’s almost like Cloudflare is on a mission to lead these recaps in most links provided. This month’s first update was a blog post detailing NET's role in Apple’s enhanced internet privacy service. Cloudflare will provide a portion of the relay infrastructure for this new system ensuring “no single party handling user data has complete information on both who the user is and what they are trying to access.” Given the sheer amount of traffic run through Apple devices, this looks like a nifty little win.

Next, Cloudflare joined with CrowdStrike and Ping on a new Critical Infrastructure Defense Project. This collaboration “is designed to enhance defenses against key areas of enterprise risk and eligible organizations will have access to the full suite of Cloudflare Zero Trust solutions, endpoint protection, and intelligence services from CrowdStrike, and Zero Trust identity solutions from Ping Identity.” The direct result of a Department of Homeland Security directive for US businesses to strengthen cybersecurity, this looks like a win-win-win arrangement.

That defense project was a great lead into Security Week, the first installment in Cloudflare’s 2022 Innovation Weeks series. Security Week was designed “to tackle the broad topic of cyber security with a simple goal: ensure security is no longer an afterthought.” A daily breakdown of the topics and discussions can be found by scrolling here.

Highlights for the week included:

Details on enhanced email and Zero Trust tools resulting from Cloudflare’s acquisition of Area 1 Security

NET’s designation as a Leader in the commercial CDN vendor category in an industry report from IDC MarketScape

The release of API Gateway, a simple, fast, and effective way to protect and control APIs [application programming interfaces]. With more and more transactions moving online, this product will provide extra protection for roughly half of Cloudflare’s current traffic.

Cloudflare also forged a separate CrowdStrike partnership bringing increased Zero Trust protection to devices, applications, and networks. The new deal will provide combined endpoint, logging, and network protection for all joint customers.

The longer I own Cloudflare, the more I come to appreciate the slow, steady, unyielding progress of almost everything it does. March was no exception. Yeah, I know NET’s pricey. Even so, I’m comfortable keeping it at a mid-sized position.

S – SentinelOne (S1) began March with yet another partnership, this time joining with detection and response firm eSentire. This continues an impressive string of collaborations and integrations to start 2022. As a young company still establishing its platform, SentinelOne deserves a ton of credit for the stable of partners it has gathered thus far.

More important to me though was the effect of these partnerships on SentinelOne’s March 15 earnings and outlook for the year. S1 began that day with the acquisition of identity security firm Attivo Networks. The deal is scheduled to close during Q2 at a cost of $616.5M in cash and stock. Attivo’s technology will improve S1’s ability to “keep passwords safe, admin privileges restricted, and user identity intact.” It also adds identity protection to SentinelOne’s existing catalog of endpoint, cloud, IoT, and data services. In addition, the release detailed the following highlights:

Expands SentinelOne’s total addressable market by $4 billion in the fast-growing, critical identity security category

Extends Singularity XDR capabilities to identity-based threats across endpoint, cloud workloads, IoT devices, mobile, and data wherever it resides

Highly differentiated identity security platform with a rapidly growing business of over 300 global enterprises including Fortune 500 organizations

Additive to SentinelOne’s hypergrowth; accretive to GAAP and non-GAAP gross margin

From a sales standpoint, Attivo brings immediate cross sell opportunities. SentinelOne CEO Tomer Weingarten said: “We’ve been partnering with Attivo more than a year now, so we kind of see already the demand that’s being generated jointly by the companies.” While there’s always risk with acquisitions, the early signs suggest Attivo will fit nicely into S1’s current plans.

As for earnings itself, I thought the report was solid. With $65.6M in revenue SentinelOne ended both the quarter and year at 120% YoY growth. The performance was driven by new records in customers added, Annual Recurring Revenue (ARR), ARR/customer, $100K+ customers, and $1M customers. The company also closed its largest ever new contract during the quarter.

Gross margin for the year improved to 63% from 58% with an initial FY23 guide of 65-67%. The bulk of that improvement should come in the second half once current customer data has been migrated to S1’s new platform. Cash flow margins improved significantly as well with operating at -9% (versus -30% in Q3 and -37% last year) and free cash at -11% (versus -78% and -87%). So, strong trends with what looks like more to come. That’s exactly what we’re looking for from a young hypergrowth firm.

The strong numbers were backed by positive call comments. While I wouldn’t say this management team possesses any dynamic speakers, its message was confident, consistent, and on point. The CFO sees “absolute positive momentum, and we expect that to continue.” Weingarten added the pipeline “shows that our large new progression is here to stay, and it’s going to expand and hopefully be more meaningful if you kind of progress towards the next quarters.” The initial guides for 101% Q1 and 81% FY23 growth include zero revenue from Attivo (which won’t be added to estimates until the deal closes). That means even smallish beats and raises should have SentinelOne challenging triple-digit organic growth for the year. I liked the quarter enough to briefly consider bumping S1 post-earnings but ultimately decided to hold out for the first set of combined numbers. For now, I’ll sit and wait.

SNOW – Long story short, I didn’t like Snowflake’s March 2 report. Based on prior trends I expected something around $371M in product revenue with a $415M Q1 guide. We got $360M and $388M instead. That’s no bueno no matter how many reasons management gave for the decline. I can’t ignore this quarter moved SNOW from one of my fastest sequential growers to one of the slowest with another decline likely on the way. Frankly, that's not a good look for the firm carrying our highest multiple.

The main culprit for the shortfall was a surprise platform optimization decreasing short-term fees to potentially increase higher-margin workload revenue in the future. Management estimates an approximate $100M FY23 revenue hit while waiting for the workload switch to kick in. The CFO suggests a 1-to-6-month lag for this process. Combined with the previously stated 9-to-12-month lag in onboarding customers, Snowflake just got a lot more complicated. For all intents and purposes, it has also compounded the usual law of large numbers with an intentional decision to forgo revenue along the way. Regardless of the rationale, this creates a miss on Snowflake’s existing trend with the slope of the new one still to be determined. While I see the arguments for continuing to hold SNOW, the additional uncertainty greatly lessens the premium I’m willing to pay.

Is that nitpicking for a company performing so strongly in so many other areas? Maybe, but I don’t want to fool myself about the game I’m playing. These stocks are expensive – and rightly so – because they are doing things other companies in the market simply can’t. Of course, that requires they keep performing well enough to maintain that premium. My current read is Snowflake took a step back by trading short-term certainty for long-term but uncertain potential. I’m OK sitting on the sidelines until we see clearer signals on how this workflow bet plays out.

ZS – ZScaler’s March highlight was the release of several enhancements to its Zero Trust Exchange. The new features include:

Private app protection: Leveraging over 10 years of inline inspection expertise in securing internet traffic and SaaS apps, Zscaler’s platform provides new preventive and proactive security controls to stop compromised users and adversaries from exploiting vulnerable private applications and services. These innovations include in-line inspection of private app traffic to stop the most prevalent attacks, including the OWASP Top 10, with continuously evolving defenses from Zscaler’s ThreatLabz research team and custom signature support.

Integrated Deception: An industry-first, native deception evolves lateral movement detection for advanced attacks with built-in private app decoys. With this addition, Zscaler’s platform reduces alert fatigue with high-confidence alerts generated by decoys that instantly identify and contain compromised user and insider threats through integration with the Zscaler Zero Trust Exchange and security operations platforms.

Privileged Remote Access for Industrial IoT and OT systems: Building on our existing browser-based access capabilities, Zscaler’s platform has been enhanced with Remote Desktop Protocol (RDP) and Secure Shell Protocol (SSH) support from unmanaged devices, for both IIoT/OT devices and private apps. These capabilities enable secure, direct remote access for third-party users, allowing organizations to bring zero trust connectivity to IoT, as well as retire slow, costly VDI solutions for private apps.

I continue to believe ZS is positioning itself for a sneaky-good year. Therefore, I’ll continue to let this position ride.

My current watch list…

…is Upstart (UPST) and MongoDB (MDB) I guess. I say “I guess” because I don’t find myself in a rush to dump any of our current cash into either name just yet. We’ll see if that changes in April.

And there you have it.

2022 continues to be a grind for growth stocks. For many in these names, early March turned the usual stock picking and portfolio management test into a true gut check on conviction, patience, and temperament. Entering the month Morningstar noted every S&P 500 sector except Energy was negative for the year. The Dow and Nasdaq were down big as well with literally trillions of market cap dollars up in smoke. I’m usually not one for pithy quotes, but a couple sprung to mind as the month went on:

If you're going to be in this game for the long pull, which is the way to do it, you better be able to handle a 50% decline without fussing too much about it. – Charlie Munger

This one stands out for two reasons. First, in early March I passed the personal -50% mark from last November’s all-time high (bottoming around -57% and currently sitting at -43.7%). Second, no matter where I looked there was a whole lotta fussing going on. The Motley Fool, Twitter, print media, TV talking heads – everyone kept shouting the sky was falling (though I’d argue it was already down by that point). Likewise, phrases like “terrible”, “ugly”, and “historically bad” dominated the headlines. It turns out people have a natural aversion to loss. Who knew?

The second quote is:

You’ve got to be prepared when you buy a stock having them down 50 per cent or more and be comfortable with it — as long as you’re comfortable with the holding. — Warren Buffett

I find this one more relevant, mostly because I believe being comfortable with the holding is key during times like these. And “holding” means the company and not the stock. Why? Because most stocks are having a rough go in 2022. But think about it for a second…do we really believe all these companies are going to zero?

<Let me pause while you think about it for a second.>

Regardless of broader market conditions, there are always quality companies doing quality things. Pick any wipeout you’d like, and hindsight says it was a great buying opportunity if you find the right names. But you know when it doesn’t feel like a great opportunity? When we are right in the midst of it. How do I know? Because I’ve been fortunate enough – yes, I said fortunate – to experience many of the awful stretches those recent navel-gazing articles reminisce about. I remember swallowing hard and buying stocks in 2001 (anyone else ever own Yahoo [YHOO] or America Online [AOL]? 😜). I also remember being scared shitless clicking buy in 2008-2009 as our portfolio kept dropping by amounts that made me borderline nauseous. Well, those purchases of Marvel Entertainment (MVL) and Buffalo Wild Wings (BWLD) eventually became some of my most profitable ever. So, anecdotally at least I can vouch those were indeed excellent times to buy. But it’s important to note they absolutely, positively did not feel excellent at the time. Having somehow survived, I can now appreciate how those stretches greatly improved my temperament and approach (which ultimately improved my returns).

Has that made it any easier to navigate this year’s difficult start? Well, yeah, I guess it has. Not because the short-term churn is any less painful, but because I know the odds are in my favor this stretch will eventually become just another scary short-term historical blip in the long-term upward trend for the overall market and better companies within. Just like all those other times.

I’ve now experienced at least a half dozen 30%+ drops owning hypergrowth stocks…with an equal number of eventual rebounds to all-time highs. This one, however, has been the deepest and longest since starting this style. I’d also call it the toughest macro environment during that stretch. What appeared to be just another sector rotation in late 2021 has now been compounded by the broader market downturn to start 2022. That has switched historical comparisons from those 2016-2020 pullbacks to the deeper crashes of 2000 and 2008-2009. This is particularly true for the Nasdaq and tech stocks. Many of today’s tech firms, however, are a far cry from the zero revenue wannabes of the dot.com era. These are real businesses with real revenues, real cash flows, and many even with real profits. Will that be enough? Heck if I know. All I know is while multiples ebb and flow, strong fundamentals tend to win in the end. The market will eventually move up again. It always does. And just like 2000 and 2008-2009, I plan on hanging around until that happens.

Thanks for reading, and I hope everyone has an enjoyable April.