Wait…May is over?!? OK, gimme a sec. I need to catch my breath.

Those who read my April recap know I spent a decent chunk of it mulling over the back half of our portfolio. I concluded we owned some companies I liked but didn’t love and wondered if that might be diluting my standards:

Well, two factors have brought things to a head. First, I ended April really wanting to streamline my process. Second, May began a blitz of all 11 holdings releasing earnings over 30 days ending June 3. With this flood of new info on the way, I thought it the perfect time to make each company reclaim its spot our portfolio.

Consequently, I resolved to exit earnings owning no greater than my top 10 ideas AND THAT’S IT!! This choice is as much about how I want to invest as a reflection on any company. I want to maintain only the highest standards for our portfolio. There’s no significance to the 10-idea limit other than it is lower than the 11 we held at the end of April. Cutting at least one is a guaranteed way to force tougher conditions for inclusion. There’s nothing to say that number won’t eventually tighten further or creep back up. But 10 feels like the right mix of opportunity and accountability for now.

While some might see this decision as restricting, I discovered the exact opposite. It has been both liberating and brutally simple. The are no rules to the exercise other than finishing this stretch with no more than my best ten ideas ordered by conviction. No current holding is safe – well, OK, some are safer than others 😏 – and no name currently outside our portfolio is excluded. Basically, if handed 100% cash how would I reallocate it using the information at hand? And I had 30 days to figure it out (just 3 more to go!). I must confess to seeing some things with fresh eyes. I also believe I’ve improved my process. And most importantly, I consider our portfolio in a better place as a result.**

** Totally subject to change once Zoom, CrowdStrike, and DocuSign report. Pretty slippery of me, eh?

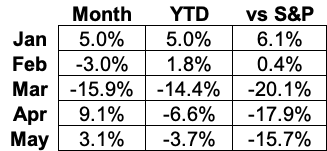

2021 Results:

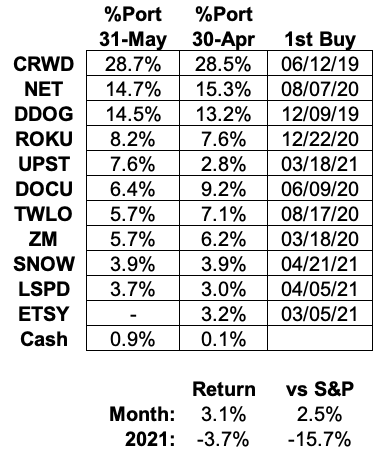

May Portfolio and Results:

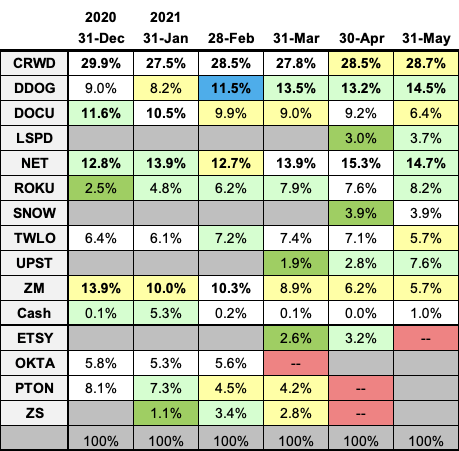

2021 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

Stock Comments:

Not surprisingly, this month’s reclaiming exercise has led to some changes. While I always review earnings releases and transcripts, I found I had a much more critical eye this time around. That’s a trait I plan to keep.

Every investment thesis should be both regularly updated and checked against the original. With so many reports piled on top of each other, this was as much head-to-head thesis competition as I’ve ever had. UPST, ROKU, and LSPD strengthened their spots. DDOG, NET, SNOW, and TWLO held serve (in that order). ETSY tripped itself up and unfortunately had to go. ZM, CRWD and DOCU face their individual music over the next three days.

The method behind the May madness can be found below.

CRWD - CrowdStrike churned out quite a bit of positive news while gearing up for June 3 earnings. First, the company won several accolades at the 25th Annual SC Awards. The SC Awards “are considered the industry gold standard of accomplishment for cybersecurity professionals, products and services.” CrowdStrike won Best Cloud Computing Security Solution (CrowdStrike Falcon), Best Managed Security Service (Falcon Complete), and the inaugural Security Executive of the Year (CrowdStrike Chief Security Officer Shawn Henry). Yeah, I’d never heard of the SC Awards either. But if someone’s gonna win ‘em, I’m glad it was CrowdStrike.

Next, CRWD was named a 2021 Leader in the Endpoint Protection Platform category by Gartner Research. As the illustration below shows, it ranked first in Completeness of Vision and second in Ability to Execute:

CrowdStrike and Microsoft have clearly separated themselves from the rest of the category pack. Given the increasing attention being paid to cybersecurity, best in class is always a good place to be.

CrowdStrike also expanded its partnership with Google Cloud. The updated deal “will tightly integrate [CrowdStrike’s] Falcon platform with Google Cloud’s suite of security products” to better protect customers. CrowdStrike’s Threat Graph database already processes over 5 trillion events per week. A deeper integration with a partner as large as Google should only strengthen that dataset.

Finally, CrowdStrike entered a new "strategic alliance" with Ernst & Young (EY), one of the world’s largest professional consulting firms. Under this arrangement, EY has recognized the Falcon platform as a preferred security solution for the following risks:

Ransomware Readiness and Resilience

Incident Response, Recovery and Remediation

Zero Trust

CrowdStrike’s partner channel is an important part of its business as evidenced by partner-sourced transactions doubling over the last year. Teaming with a global powerhouse like Ernst & Young only strengthens this effort, especially internationally. At first glance, it’s hard to view this arrangement as anything but a win-win.

Cybersecurity has without a doubt become one of 2021’s hot button issues. Even before US President Biden’s recent Executive Order on the matter, high-profile incidents like the SolarWinds hack and Colonial Pipeline shutdown raised the stakes for everyone involved. Institutions worldwide are scrambling to ensure security systems are safe and up to date. It only stands to reason companies like CrowdStrike are in a great position to benefit. Sector mates Palo Alto and ZScaler have already posted outstanding quarters which were well received by the market. Given our outsized allocation – which has already been trimmed several times when bumping 30% of our portfolio – I am obviously expecting CRWD to do the same. Fingers crossed for Thursday. 🤞

DDOG – Datadog posted what I thought was a great quarter May 6. The top line numbers were once again strong with $198.6M in revenue (+51%) and DDOG’s usual solid profitability. More importantly, the underlying business continues to bounce back and even accelerate in some areas from last year’s Q2 COVID drop.

In addition to releasing two more products, Datadog gained another 1,000 customers. That includes a record 184 now spending >$100K a year to raise that total to 1,437. Since last March’s COVID dip, sequential growth in this category has accelerated from 5.7% to 9.1% to 13.2% to 14.7%. Management also highlighted a “strong uptick” in customers spending $1M+. The new customers and increased spend helped DDOG add over $100M in new Annual Recurring Revenue (ARR) during a single quarter for the first time. That included record new ARR in all three core product lines – infrastructure, application performance monitoring, and logging. A full 75% of customers now use 2 or more product modules, up from 63% last year. Customers using 4+ finished at 25% versus just 12% a year ago. Net retention rate was 130%+ for the 15th consecutive quarter, and “usage growth from existing customers was stronger than expected and above historical levels.” Remaining performance obligation (RPO) accelerated to +81% growth YoY ($464M) while average contract length has increased. So, business appears to be strengthening across the board.

From an execution standpoint, expenses were slightly up and gross margins slightly down due to increased R&D spending. That’s understandable, however, as the company continues to develop products and build out data centers. Management directly addressed this topic by stating it has plenty of levers to pull if optimizing gross margins suddenly makes more sense than maximizing product and infrastructure investment. Besides, it’s not as if the gross margin dip did much harm to the bottom line. Net and operating margins held steady at 10% while generating record operating ($52M, 26% margin) and free cash flow ($44M, 22%). That’s a quality combination for what is still very much a hypergrowth company.

In conjunction with earnings, Datadog announced the appointment of Adam Blitzer as Chief Operating Officer. Blitzer joins DDOG from Salesforce, where he was most recently Executive VP and GM of Digital leading much of Salesforce’s cloud efforts. In explaining the move, CEO Olivier Pomel emphasized Datadog’s goal of scaling quickly and its desire to proactively address the “number of problems to solve along the way.” He also stated, “it was always a given that we would need to grow the bandwidth of the senior management team” as the company evolved. As a shareholder, I applaud the mindset. I’d much rather see DDOG strategically add talent while things are going well than make a reactionary hire if and when things go astray.

Coming off its “very, very strong Q1,” management guides with “our usual conservatism” for $123M in revenue and a slight acceleration to 52% growth in Q2. It also significantly raised the FY21 revenue guide from $835M to $890M (38% growth to 47%). Much of DDOG’s bull thesis includes lapping last year’s Q2 dip and returning to 60%+ growth. I’m glad to say a beat similar to either of the past two quarters would do just that. If Datadog pulls it off, a return to 60%+ growth for the remainder of the year looks very doable.

Datadog has always been an outstanding business. Unfortunately, the stock has mostly languished in recent months while grinding its way back around from the 2Q20 pullback. We’re finally here though, and I’d anticipate the rebounding business to eventually make its way to the stock. Regardless, Datadog did everything it needed to do this quarter to remain a core holding in our portfolio.

DOCU – DocuSign’s May highlight was being named a Leader in the Contract Lifecycle Management (CLM) category by Gartner Research. This is DOCU’s second consecutive year on the Leader list, this time ranking highest on Ability to Execute and among the highest on Completeness of Vision. Gartner defines Leaders as being “in the strongest position to influence the market’s growth and direction.”

That’s good to hear because I consider DocuSign’s entire June 3 earnings as being about its influence over the CLM market. As noted last month, CEO Dan Springer recently dropped some Analyst Day hints that the Agreement Cloud/CLM suite “will become noticeable as a growth driver this year” rather than the initial 2022 estimate. If signs do indeed point to CLM being early, there’s a good chance DOCU sticks around. If not, DocuSign is in grave danger of losing its spot and heading back to the watch list.

ETSY – My easiest recap in months:

Q1 revenue fell short of my expectations even with the unexpected stimulus bump.

Management’s 25% Q2 growth guide would be a slight decrease sequentially, which has no appeal to me at all.

I wasn’t screwing around about tightening things up. Et-see ya later.

LSPD – You might want to settle in for this one…

Lightspeed kicked off May by joining forces with the U.S. Small Business Administration (SBA) to expedite relief to the hospitality industry. This arrangement lets Lightspeed’s users easily access loan forms for the SBA’s new $28.6B Restaurant Revitalization Fund. Helping customers transition from COVID on solid financial footing is very smart business for LSPD, and I’m sure affected clients appreciate it as well.

In the same ease-of-use vein, Lightspeed announced a deal integrating several Google merchant tools. The new services include Google Local Inventory Ads, Google Smart Shopping Campaigns, and Google My Business. Each of these will make it easier for merchants to reach local customers whether looking to shop online or in store. Increasing merchant visibility only makes Lightspeed’s platform stickier, so I’d call this another positive move.

Both these updates were secondary, of course, to May 20 earnings and whether LSPD deserves a spot in our portfolio. Being honest, I consider Lightspeed more at the mercy of COVID and the broader economy than any of our other holdings. Does owning a post-pandemic recovery play make sense before we see more concrete signs of, you know, an actual recovery? That was the question I kept asking myself heading into earnings. My initial answer is Lightspeed fits the bill.

Headline numbers were strong with early signs of a much-anticipated recovery peeking through. Total revenue was $82.4M for 127% YoY growth including acquisitions. Subscriptions and transactions – the stuff we want to see – was even better at $75.3M, 137% growth, and a record 91.4% of total revenue. For the full year, the subscription portion was $119M and 54% of total revenue versus 51% last year. Payments contributed $83M for 37% of revenue and 195% growth YoY. This is the first time I’ve seen management break out these components, but my guess is we’ll continue to get this split as payments become a larger part of the business.

Gross Transaction Volume (GTV), which is the total amount of business processed by LSPD’s platform, increased 75% overall and 25% organically. Not surprisingly, e-commerce was the biggest contributor to GTV with volume almost doubling from a year ago. Retail was up 65%. The hospitality segment was understandably down 15% from 2020 but is picking up as things reopen. Hospitality grew 10% from February to March and another 14% from March to April. That trend should continue even if e-commerce slows a bit as we go. Gross margins were down noticeably, but management attributed this to the surge in lower-margin payments revenue along with discounts to new customers adopting Lightspeed’s platform. I’m OK with some short-term margin compression as long as it continues to be offset by higher GTV and triple-digit revenue growth.

Operationally, management is seeing several positives. COVID lockdowns heading into Q4 were loosening by quarter’s end. Business has steadily picked up in the US, UK, and Australia. March and April were particularly strong, especially in Europe and the hospitality segment. As management hoped, reopening has allowed economies of scale to kick in for its recent acquisitions. This is particularly true for payments, which CEO Dax Dasilva highlighted as one of the major reasons for this quarter’s outperformance. Lightspeed added a record number of payment customers with revenue from this segment increasing “well over 300%” on the year. The increased leverage from LSPD’s acquisitions let management renegotiate terms with current payment vendors and generate an unexpected $7M in Q4 revenue. This not only hastens management’s timeline toward long-term estimates but should bolster short-term revenue while switching acquired customers to Lightspeed’s own payment platform. If nothing else, getting a bigger piece of the payments pie earlier than expected bodes well for the rest of the year as reopening increases payment volumes.

We also received an encouraging update on Lightspeed’s fledgling supplier network. This program lets merchants and suppliers easily link inventory and ordering with shopper engagement and payments. In fact, management says current suppliers “want to go faster than we can go today.” The Google partnership should only strengthen this relationship whether post-COVID consumers decide to conduct business in person or online. This could be a huge differentiator for Lightspeed’s platform, and I give management a ton of credit for making it easy to understand their vision in this area.

Does that mean LSPD is all sunshine and rainbows? Well, not exactly. A couple things temper my enthusiasm, and in some respects they tie together. The first is just how acquisition driven Lightspeed’s business model is. It has made three major purchases in just the past few months, and management must prove it can fit everything together even while claiming it won’t be shy about the next deal. The ShopKeep and Upserve additions are on track so far, but full integration timelines are always tough to gauge. That’s something to keep in mind.

Second, I have found some of management’s presentation the last few months shall we say inconsistent. While I get their broader plan, the details have at times been scattered. For instance, I noticed the “subscription and transaction-based” revenue which was such a large part of this quarter’s discussion was labelled “software and payments” in prior reports. A quick email to Investor Relations confirmed this amount is still being calculated the same way for tracking purposes. Regardless, you’d think there’d be a quick mention somewhere of rebranding such a major metric.

And that’s not the only irregularity I’ve encountered trying to piece Lightspeed together. In Q3 management noted 15% of US GTV ran through its payment platform. This quarter’s figure was “approaching 10%” of total GTV. Last quarter management touted organic total revenue growth of 53% with 47% growth in software and payments. This quarter mentioned 48% organic in the newly renamed subscriptions and transactions while total revenue was noticeably absent. (Was it because the consensus seems to have it at roughly 41%? Probably.) Sometimes management references Average Revenue Per User (ARPU) in its materials. Sometimes it doesn’t. In fact, several press releases define ARPU in the footnotes without ever mentioning it anywhere else. And nowhere have I been able to find historical ARPU despite its semi-frequent mention (I’d happily take some assistance if anyone has it). Likewise, Adjusted Net Loss was introduced last quarter and Adjusted Cash Flows this one with no real context given for either. While I appreciate the need to occasionally present new metrics – especially for a firm evolving as rapidly as this one – I also consider it management’s responsibility to clearly explain why these metrics matter for monitoring the health of the business. In my opinion LSPD has fallen short in this area.

To be clear, I’m not implying any dishonesty. I like what Lightspeed is doing. It’s just that I don’t believe its messaging has been as tight as it could (should?) be. Yes, this story will evolve given the acquisitive nature of the business. And yes, management is likely still finding its public footing having just IPO’d in September. However, other firms I’ve followed since IPO have not had this issue even when acknowledging they haven’t been as acquisitive as LSPD. This certainly hasn’t been the case for past or present portfolio stalwarts like CrowdStrike, Zoom, or Datadog. Maybe that’s an unfair standard - there’s that standards thing again - but it’s one LSPD will eventually have to meet to be a core holding in our portfolio. A fairer comp might be Upstart, which I find delivers much clearer messaging while also being a young IPO digesting an acquisition. I believe one of the keys to running a concentrated portfolio is being able to plainly understand and follow the companies you own. Hopefully, Lightspeed’s ability in this area smooths out as we go.

In the end, I liked this report and believe in the direction Lightspeed is headed. We know economies are reopening. We also know as they do consumers want to keep the flexibility of buying online or in person. Lightspeed makes it easy for merchants to serve both channels. As Dasilva says, “we've always felt good around the after-COVID world and everything we see now confirms what our thoughts have been, which is after COVID, Lightspeed is even more relevant given how strong our platforms are for the physical world. And…if March is a reflection of what the year is going to look like, we’re very happy.”

Of course, that would make shareholders very happy as well. While I believe LSPD has more “could be” in its thesis than most of our holdings, its upside is very intriguing. In some ways, Lightspeed reminds me of where Roku was a few quarters ago. It is juggling multiple products and revenue streams which are slightly different but play off each other very well when in sync. Pulling it together might take time, but leverage and economies of scale could really kick in if things fall into place (again, like Roku). That’s why management sees “reason for plenty of optimism.” So do I. Therefore, Lightspeed not only holds its spot but has seen its allocation bumped up a tick. This is a position I’ll likely push further as the opportunity presents itself.

NET – In a lesser piece of news, Cloudflare began the month by making Fast Company’s 2021 list of Most Innovative Companies. NET finished #2 behind fellow portfolio mate Twilio (foreshadowing!). Cloudflare was singled out for its free offering of Teams to small businesses during the COVID crisis and its work to protect political candidates from hackers during the 2020 elections.

In news much, much more relevant to my task at hand, Cloudflare posted another strong quarter May 6. Revenue finished at $138.1M, slightly accelerating growth to 51%. The company added a record number of total users during the quarter and now touts over 4.1M free and paid (+46% YoY). After a record 10,000+ gain in paying customers during Q4, another 8,000+ joined this one for a total of 119,206 (+34%). It also welcomed 117 clients to the >$100K/year club, bringing that group to 945 (+70% YoY; +14% QoQ). So, Cloudflare appears to have plenty of new customers signing up for all those new products.

On the call, CEO Matthew Prince highlighted as many big wins as any quarter I can remember. He also observed, “since we aren't dependent on usage-based billing, we see no indication that as the world comes out of the effects of COVID, our ability to sell more products to customers is slowing down.” That’s nice to know. Even better, the recent results have his back. An impressive 88% of customers now use four or more Cloudflare products. Management emphasizes four since “usage data suggests once someone is using that many products, customers consider us a core platform that is very sticky and difficult for any competitor to match.” (Note to self: Keep this in mind when other companies like CrowdStrike and Datadog report similar metrics.) Net retention rate (NRR) accelerated for the third straight quarter to a record 123% as larger customers continue to expand spending. Management expects NRR to continue ticking up over time, which is a great sign for the business.

In addition to what appears to be increasing stickiness, the pipeline looks very strong. Remaining performance obligation grew 14% sequentially and accelerated to +88% YoY. The CFO noted “sales cycles are actually getting a bit shorter, but our contract duration is moving out.” That bodes well for future cash flows and revenue growth, which I would anticipate accelerating closer to 55% next quarter. Prince emphasized NET’s subscription-based model means it won’t be fighting the tough comps of usage-based firms which saw COVID-related bumps in 2020. That suggests possible second half tailwinds if Cloudflare’s recent customer and NRR momentum continue.

The only real chink I saw in the armor is management guiding for a slightly larger FY21 operating loss (from -$21M to -$24M). Fortunately, that’s being offset by rapidly improving cash flows. NET churned out a record $23.5M in operating cash flow this quarter for a margin of 17%. Free cash flow was also a record at -$2.2M and -2%. In the big picture, I have no problem with NET pushing investment in growth particularly given its insane amount of recent innovation. That’s doubly true if it keeps churning out positive cash flow. That being said, I fully expect current losses to narrow and hopefully break even or turn positive by end of year. In the meantime, I believe Cloudflare has as many avenues for growth as any company we own, and it will continue to hold its core spot.

ROKU – Wow. Roku freakin’ killed it. Entering May 6 earnings, I was looking for ~$525M in total revenue, ~$400M in platform revenue, moderate profits, and a Q2 guide of ~$575M to consider the story intact. Instead, Roku blew the doors off with $574M in total revenue, $466M in platform revenue, strong profits, and a top end guide of $620M.

I hate simply reposting last quarter’s recap with another number tacked on the end but can’t think of an easier way to show just how well Roku is executing (oldest to most recent quarter):

Platform Revenue Growth: 72%, 73%, 46%, 78%, 81%, 101% (!!!)

Platform Gross Margins: 63%, 56%, 57%, 61%, 64%, 67%

Platform Revenue as a % of Total: 63%, 72%, 69%, 71%, 73%, 81% (a record)

Platform Gross Profit Growth: 49%, 39%, 26%, 73%, 85%, 139% (a record)

Total Gross Profit Growth: 44%, 40%, 29%, 81%, 89%, 132% (a record)

Adjusted EDITDA Margin: 4%, -5%, -1%, 12%, 17%, 22% (a record)

EPS: -$.13, -$.45, -$.33, $.09, $.53, $.54 (a record despite a history of very large seasonal Q1 declines)

In addition to the performance above, accounts grew 32% to 53.6M and streaming hours 49% to 18.3B. With 81% of this quarter’s revenue driven by Roku’s higher margin platform, total gross margin of 56.9% smashed the old record of 49.6%. That led to $125.9M in adjusted EBITDA, which is almost quadruple the $34.0M guide. Management attributed the beats to “outperformance in platform monetization,” which to be honest is kinda what shareholders have been waiting for all along.

Digging deeper, business does indeed appear to be booming. Roku powered smart TV’s gained market share in the US, Canada, and Mexico. Its operating system (OS) remains #1 in each of the first two countries and #2 in Mexico behind the Samsung OS embedded in Samsung’s top-selling TV’s. It’s worth noting Roku holds Mexico’s top spot for licensed OS’s in non-Samsungs.

On the platform side, Roku now offers more than 50 premium channels including new services like HBO Max, Disney+, and Discovery+. Subscriptions initiated through Roku’s platform more than doubled from a year ago. Management explained content producers are “reorienting their business models around streaming, even to the extent of taking some theatrical releases and releasing them directly to streaming.” Producers tend to follow consumers, and today’s consumers are increasingly demanding a streaming option. Now that the direct-to-consumer spigot is open, it is unlikely producers will be able to turn it off. That’s great news for Roku.

Roku’s in-house channel is seeing increased success as well. Traffic on The Roku Channel, which now reaches an estimated 70 million people, once again grew more than twice as fast as the overall platform. That’s saying something considering how fast the platform grew. In some respects, The Roku Channel is becoming the streaming proxy for the free ad-supported channels of traditional TV. Management envisions a flywheel where “viewer engagement attracts advertisers, and advertiser spend in turn allows us to invest in more content”. There are early signs this effort is paying off. The shareholder letter notes over 85% of 18-49 adults on The Roku Channel in Q1 were unreachable through traditional TV. Since 18-to-49-year-olds tend to buy a lot of stuff, it’s no surprise more and more advertising dollars are finding their way to Roku’s platform.

As its platform scales, Roku is not only providing prime advertising real estate but adding “better data, better targeting, better measurement, [and] newer ad products over time.” Ads placed directly through Roku’s OneView service nearly tripled YoY while total impressions from any selling source increased >3X. The technology from the recent Nielsen acquisition gives even deeper consumer insight “whether connected through traditional TV, streaming, desktop, or mobile.” Offering advertisers that type of reach creates a ton of leverage in targeting and pricing. Consequently, Average Revenue Per User hit a record $32.14 this quarter, accelerating on both an annual (+32%) and sequential (+12%) basis. I’d expect that number to grow considerably.

Analysts were clearly excited on the call. Likewise, I thought CEO Anthony Wood – who often comes off like he can’t wait for these things to end – sounded more like a proud papa on this one. Wood has consistently described Roku’s vision as three-pronged: grow accounts, increase engagement, monetize. COVID greatly accelerated prongs one and two. I believe we are now witnessing the early rush into prong three as advertisers chase viewers over to streaming.

Just how much money is making the switch? A lot, apparently. While linear TV saw an 11% decline in overall spend during Q1, Roku’s monetized ad impressions “more than doubled” year-over-year. On one hand, management has used this same generic phrase for several quarters without giving more specifics. On the other, recent EBITDA and EPS trends suggest those doublings are now significant enough to start seriously moving the needle. Even better, there’s nothing to suggest the outperformance won’t continue.

Even with its usual prudence, management issued Q2 midpoint guides for 73% growth in total revenue and 104% in gross profit. That means platform growth should once again be significantly higher in both categories. Given the recent strength, management has upgraded its prior message of tough second half comps to “a mix of headwinds and tailwinds” for the rest of 2021. The obvious headwinds are indeed those upcoming COVID comps. Management freely admits it expects growth in accounts and viewing hours to be less than 2020’s peak. No surprise there. The silver lining is management also expects “net adds of both active accounts and streaming hours to be above pre-COVID-19 levels” suggesting the broader move from traditional TV is far from over.

The main tailwind, of course, is the potentially massive amount of ad spending which could make its way to streaming. After Roku’s surprisingly strong Q3 last year, I got the impression even management was caught off guard by the speed of advertising’s rebound from the Q2 COVID crater. That led to a nice run for the stock. I felt a similar vibe listening to Wood & Company break down this quarter’s stunning results. If this influx of ad dollars holds, even pre-pandemic customer growth should be plenty good enough to drive substantial revenue and gross margin gains for the remainder of the year.

So, did COVID pull forward some of Roku’s business? Absolutely. But the reality is the shift to streaming was happening with or without the pandemic. Cord cutters aren’t going back, which means content producers and advertisers won’t either. As luck would have it, Roku’s platform easily caters to all three. Consequently, I’m very optimistic about its future and have pushed our allocation as a result.

SNOW – Being one of the more expensive stocks around, big things were expected from Snowflake’s May 26 earnings. I’m glad (relieved?) to say SNOW didn’t disappoint. It maintained its stellar rates for revenue growth (+110% YoY), remaining performance obligation (+206%), and net revenue retention (168%). For a company with a considerable amount of dominance already priced in, I’m not sure you could ask for much better results.

Beyond the headlines, the underlying business showed impressive strength as well. Snowflake reached a milestone in Q1 by processing over a billion queries in a single day with the overall number more than double on the year. International business, while still a relatively small portion of the total at 16%, is growing rapidly. Management touted outperformance in all international regions with European bookings up over 200% and Asia Pacific above 300%. In addition, its partner channel is growing like gangbusters. CEO Frank Slootman noted Deloitte, Snowflake’s lead consulting partner, has gone from facilitating $0 to $100M in business in just over a year. He called it an “absolutely ripping…trajectory.” I’d say that’s a pretty apt description.

In conjunction with the strong top line, SNOW’s secondary metrics are improving at a rapid rate. Expenses as a percentage of revenue have declined from 107% to 97% to 91% to a record-low 84% over the past four quarters. And the improvement has come while still aggressively spending on R&D, which is a great sign for a company trying to become the go-to platform for data management. Gross margin was a record 72%. Cash flows have turned positive each of the past two quarters, and management expects breakeven on the year (I’d expect better). Best of all, operating margin has gone from -44% to -30% to -24% to -16%, which means Snowflake isn’t creeping toward profitability as much as barreling toward it. As a hypergrowth investor, that’s exactly what you want to see.

One expense to note this quarter was a $13M charge for new storage compression algorithms. In non-techie speak, that seems to mean a better way to store data which also lowers costs. As it has done in the past, Snowflake will pass these storage savings on to customers. In the short term this means a small revenue hit which has been accounted for in future guides. In the long term, this is a smart move. Snowflake earns higher margins on compute revenue than storage, so lower storage fees let customers spend more on compute within the same budget. Management believes shifting customer spend toward more compute could eventually push that record 72% gross margin closer to 75% while improving future profitability. Sounds good to me.

Operationally, Snowflake continues to lay out an ambitious plan. Management has identified six key business verticals: financial services, healthcare, retail, advertising/media, technology, and public sector. The company is focusing its services, sales and partnerships on these sectors which should strengthen the entire business over time. Slootman called out advertising/media as the biggest vertical because its direct-to-consumer nature leads to more usage. Finance is also growing rapidly. Within the public vertical, management expects to obtain ITAR security certification for its international business by mid-year and FedRAMP approval for US business by year’s end. In the big picture management sees multiple pipelines with room to expand in all of them.

One of the advantages of Snowflake is it allows literally any customer in any industry to run unlimited queries on the same data in real time. Slootman says the only thing limiting users is “imagination and budgets.” To that end data sharing among customers is up significantly. In order to track this dynamic, Snowflake has designated each customer sharing relationship as an “edge”. What’s important here is edges aren’t one-time projects but rather sharing arrangements management considers “durable and stable” enough to generate consistent consumption on its platform. A full 15% of customers currently have active edges versus 10% a year ago. And the number of total edges grew 33% from Q4. That implies Slootman’s customer imagination is starting to take hold. Let’s hope those budgets follow.

The one possible glitch I see is customer growth. The highlight was a record 27 new customers spending >$1M a year, bringing the total to 104 (+117% YoY). However, growth in total customers and Fortune 500 companies both finished at record lows. While there’s seasonality to this count, the 393 customers added in Q1 was just 67% growth versus 73% last quarter and 128% a year ago. It was also the first time ever sequential customer growth dropped below double digits at 9.5%. And fluke or not, adding only one Fortune 500 customer after 17 (year ago comp), 10, 13, and 19 the prior four quarters is disappointing no matter how I look at it. Being honest, management’s explanation of a “very, very long sales cycle” and staff wanting to close as many Q4 deals as possible to beat year-end commissions didn’t do much to put me at ease. I mean, those same long sales cycles and Christmas bonuses were in play last year too, amirite?

My reason for being so wary here is the relationship between SNOW’s customer growth and future revenue. Management has consistently stated it takes 6 to 9 months for new customers to fully reach contracted usage rates. That lag means we will likely see a flood of new revenue during Q2 and into Q3 from the record number of customers just added in Q4. I feel Q2 guidance reflects that, so no problem there. My concern is just how large a role the lowish Q1 figures might have played in the soft FY raise. These Q1 customers will be the main cohort for new revenue in Q3 and Q4. Was the Q1 customer add maybe lower than expected? And will this group contribute enough during the second half to let Snowflake maintain the revenue growth we’ve come to expect (and likely need to maintain its current valuation)? That’s still TBD in my opinion.

If I’m going to own a stock priced for perfection, I can’t gloss over the potential pitfalls. I consider customer growth something to watch here. Virtually every software company pursues a “land & expand” revenue strategy combining new business with upsells into its existing base. The strategy works best when both halves contribute steadily to that mix. Between last year’s Q4 and Q1, SNOW saw a 28% seasonal drop in new customers (458 to 328) with 17 Fortune 500 adds. This year’s drop was a larger 33% (585 to 393) with just one Fortune 500 add. If nothing else, Snowflake seems to be entering this year with less wiggle room for underperformance in the “land” part of the equation during the second half. That could hypothetically put pressure on upsells to make up the difference. Frankly, I’d rather not test that thesis and will be paying close attention to these numbers in Q2.

Even with my customer caution, I can’t help but give SNOW full credit for another excellent quarter. There’s no doubt the need to collect, store, share and analyze data is growing exponentially. Snowflake is quickly positioning itself at the literal intersection of these huge and potentially lucrative trends. I know the stock carries a crazy-high premium, but that’s what happens when a company keeps posting crazy-good performance with a management team that seems crazy-focused on dominating its niche. The current price keeps this allocation on the smaller side for me, but SNOW did more than enough to stay in our portfolio.

Our next peek at Snowflake’s future will be its Investor Day on June 10. I’m super curious to hear what new things management has to say.

TWLO – After a very quiet April, Twilio had a jam-packed May. The headline event was May 5 earnings. Revenue growth came in at 49% organic and 62% overall including the Segment acquisition. Customer growth held firm and now totals 235,000. Gross profit, which management considers a key measure for overall health, grew 58% while net expansion remains excellent at 133%. Twilio expanded its partner network to 400+, leading to partner-generated revenue more than doubling on the year. International revenue ticked up to 29% of total versus 27% in Q4 and 28% in 1Q20. I’d expect that number to drift upward as Twilio aggressively enters India. All in all, I thought TWLO delivered plenty to like.

The early Segment feedback has been “overwhelmingly positive.” Customers are quickly coming to appreciate the personalization possible with real-time customer data. The expanded insight this data provides lets Twilio change its product messaging from the simple execution of communication to proactively managing the entire customer conversation. CEO Jeff Lawson describes today’s consumer engagement as “increasingly personalized content based on what they’re doing – anytime, anywhere, and over their preferred channels.” It is not hard to see how Twilio/Segment’s combined offerings do just that.

Management initiated Q2 guidance of $601M in revenue and 50% growth. Even a smaller beat than this quarter would again push that number to 60%+. Acquisition or not, that’s excellent for a company this large. One thing the market didn’t seem to like (and I mildly agree) is a guide for a $22M Q2 operating loss as TWLO starts backfilling investments delayed by COVID. That would break a string of five positive quarters and represent a fairly sizable drop from this quarter’s $17.3M operating profit. I’m temporarily OK with that given the opportunities that seem to be brewing with the existing pipeline and Segment add. However, my leash here will be very short. At an almost $2.5B revenue run rate and a market cap approaching $60B, I believe it’s time for Twilio to start showing some operational leverage. My firm expectation is a return to profitability sooner rather than later.

Twilio was quite busy outside earnings as well. It made yet another acquisition by purchasing Zipwhip, a leading provider of toll-free messaging. Expected to close by the end of 2021, the cost will be $850M in an equal mix of cash and stock. This buy will bolster Twilio’s texting platform “to deliver more secure, high-quality toll-free traffic at scale.” More importantly, it is expected to be accretive to both revenue and gross margin. With more and more consumers preferring text as their primary mode of communication, this looks like a solid addition.

In a smaller move meriting a blog post rather than press release, Twilio acquired Ionic Security. Ionic, “a leading data security platform designed to help businesses enforce access and privacy requirements,” will improve data protection in Twilio’s products. The combined technologies “will empower developers to build applications to reach users all across the globe while prioritizing data security, privacy, and compliance.” Like most companies, Twilio must pay attention to meeting security regulations in different parts of the world as its business expands. Ionic will help this effort.

Management also conducted some balance sheet cleanup by retiring all outstanding convertible notes. Originally due in 2023, the remaining ~$136M of these notes will be closed for cash or shares by June 2. While any new shares will cause minor dilution, management clearly feels now is a good time to make this move. Once these notes are retired, TWLO’s only debt will be interest-only notes payable in 2029 and 2031. This will give management a lot of flexibility in the interim.

Finally, Twilio received a couple external accolades worth mentioning. First, it was named the #1 enterprise on Fast Company’s 2021 Most Innovative Companies list. It was recognized for “facilitating face-to-face communication during an era of social distancing and global lockdown.” Fast Company highlighted the use of TWLO’s omnichannel applications doubling during the year as one of the reasons for the award.

Later in the month Twilio was named one of the Fortune 100 Best Companies to Work For. I’ve always found CEO Jeff Lawson calling coworkers “Twilions” a bit cheesy, but Fortune apparently sees a happy bunch of employees. I’m partial to a happy bunch of shareholders myself, but I don’t see much for them to complain about either. Lawson & Gang have certainly delivered on most everything promised in recent quarters. As mentioned earlier, the next step is more leverage hitting the bottom line. While I ultimately view Twilio as more of a portfolio stabilizer than top-end driver, it did enough to stick around.

UPST – If Roku’s quarter was a “wow,” Upstart might deserve something a little stronger.

After posting a very strong March report in its first as a public company, Upstart outdid itself with its May 11 release.

Revenue of $121M represented 90% growth YoY and a whopping 40% QoQ. Partners transacted 169,750 loans through Upstart’s platform, which was +102% YoY and +38% QoQ. More impressively, that number was up 110% from just two quarters ago as loan volume has roared back since temporarily cratering when COVID hit in 2Q20. In total, over $1.7B in loans were issued through Upstart this quarter. It is important to note these numbers might have been even higher if government stimulus hadn’t slightly softened loan demand late in the period. That bodes well as the economy continues to loosen up. Upstart’s rate of converting borrower inquiries into actual loans was a record 22%, up from 14% last year and well above last quarter’s previous record of 17.4%. For the second consecutive quarter 71% of loans were fully automated and instantly approved, which is convenient for both lenders and borrowers.

The impressive headline numbers were matched by the bottom line. Upstart is one of those rare companies which was already pushing GAAP profitability when coming public. That trend continued with $15.6M in operating income versus $0.55M last year and $10.1M in net income vs $1.5M. Earnings per share of $.22 was more than triple last quarter’s $.07 and more than quadruple 1Q20’s $.05. So, growing like a weed and turning a tidy profit? Sign me up.

Predictably, management was super optimistic on the call. Upstart continues to improve the accuracy of its models, which helped drive the record conversion rate. It has also upgraded its marketing model, which led to more borrowers finding its platform. According to management, this has “allowed Upstart to grow loan volumes by a factor of 20 in the last four years while reducing acquisition costs and generating real profit.” The company now lists 18 lending partners and has reduced new partner onboarding to roughly 90 days. Adding partners is a major goal for 2021 and something to look for in future quarters.

In another positive, CEO Dave Girouard highlighted a recent fair-lending certification from the Consumer Financial Protection Bureau (CFPB). The CFPB’s testing “demonstrated once again that Upstart's platform improved access to credit in the form of increased approval rates and lower APRs for every traditionally underserved demographic tested.” That means more borrowers at lower rates, which can be a win-win for everyone involved. Girouard believes Upstart is helping set the standard for proactive communication between industry and regulators with regard to AI governance. That can only be viewed as an advantage in such a heavily regulated industry.

On the auto lending front, UPST is making “very fast progress.” First, it has extended its current auto refinance program from one state to 33 since January. This expansion means the program is now available to more than two-thirds of the US population. Second, Upstart formally closed the acquisition of Prodigy and its auto sales platform. Girouard described Prodigy as “Shopify for car dealerships, helping create the modern multichannel car-buying experience that dealerships need and consumers rightfully expect in 2021.” Already certified for sales of major brands like Toyota, Honda, and Ford, Prodigy was recently added to Subaru’s list of approved digital retailers:

Prodigy is growing fast, transacting almost $800M in Q1 vehicle sales and increasing its dealer footprint by 45%. The more the merrier as far as I’m concerned.

Management estimates auto lending as six times the size of personal lending but with many of the same mispricing and inefficiencies. Girouard calls it “one of the world’s largest buy-now, pay-later market opportunities.” Upstart’s vision is to eventually introduce its lending model to auto dealers nationwide through Prodigy’s platform. It’s a two-step plan that calls for pushing Prodigy’s market penetration and then leveraging it to increase loan volume. The beauty of this strategy is minimal loan acquisition costs since Upstart would simply be an automatic lending option embedded in Prodigy’s platform. While management doesn’t expect Prodigy to materially contribute until 2022, things do appear to be movin’ right along.

Given the quality performance, it shouldn’t be surprising management is confident about the future. Its initial top end Q2 guide is $160M. That’s a ridiculous +822% from last year, but the COVID crash makes year-over-year a useless comparison. The better measure is $160M would be an excellent 32% sequential gain from Q1. I’m personally expecting 35%+. UPST also raised its full year revenue guide from $500M to $600M. That’s a ridiculously strong raise and a whopping 157% over 2020’s final number. The main thing to remember is that entire amount is organic and coming solely from Upstart’s existing business. The potential from auto lending is nowhere in the present guide even though it should be a huge driver in 2022. If UPST can repeat even a small portion of its personal lending success in the auto market, this could be a monster company.

I’m impressed enough with Upstart I added several times both pre- and post-earnings. Fortunately, most were in the $80’s and $90’s before the stock’s recent run. While it lacks the large recurring revenue of a true software firm, Upstart is showing strong signs of disrupting an enormous market. It’s still very early with this one, but I could easily see UPST becoming an even bigger part of our portfolio as the year goes on.

ZM – Zoom’s main news was the unveiling of Zoom Events. Events is an all-in-one platform for producing and monetizing interactive events and conferences. It will allow users to produce ticketed, live events for internal or external audiences of any size. The OnZoom platform, the company’s current offering for creating and monetizing things like classes or presentations, will be moved from its current beta status and folded into Zoom Events. Management clearly has big plans for this release.

Digital communication is here to stay, and Zoom is leading the way into this new era. The company continues to innovate and certainly isn’t going away. That makes ZM a fit for almost any portfolio. The question is whether it’s a fit for mine. While all this innovation keeps Zoom relevant, I’m more concerned with its avenues for intermediate growth. That basically boils down to videoconferencing expansion and Zoom Phone adoption. The company has already won videoconferencing and likely sees a nice bump in the second half when its free education offer expires and thousands of schools renew with paid licenses. The question is how much Zoom Phone adds in the meantime. I consider upcoming June 1 earnings a big one. The Zoom Phone update pretty much determines whether ZM holds its spot. I guess we’ll find out soon enough.

My current watch list…

…is led by ZScaler (ZS), which had a great quarter and is pounding loudly on the door to reenter our portfolio. ZoomInfo (ZI) and FVRR (Fiverr) are next. OKTA (Okta), NARI (Inari), and PTON (Peloton) are on the outskirts but not much of an immediate threat.

And there you have it.

In most recaps, this is where I scatter some tidbits about stock price and portfolio performance. This month I decided not to do that. Rather than rehash returns plainly posted above, I’d like to tie together my broad introduction thoughts with the individual company updates in the middle.

First, I’d like to reemphasize – to myself just as much as anyone else – what we most control as investors:

Our due diligence.

Our buying/selling decisions.

Our allocations.

Our mindset, outlook, and temperament.

That’s about it. We have no control over macroeconomics, price multiples, or market sentiment even though they are shouted in our faces as often as we’ll listen. Those uncontrollables are nothing more than noise distracting us from the task at hand.

It’s widely accepted owning great businesses is the surest way to build a market-beating portfolio. With that in mind, I wanted this recap to focus solely on the businesses competing for a spot in ours. After putting each through its paces, I find myself even more confident in the ones that made the cut. I strongly believe the companies best facilitating the world’s move online are also among those best positioned for future success. And since successful companies tend to correlate with successful stocks, those are the ones I most want to own. Seven have passed the test so far. Zoom, CrowdStrike, and DocuSign are now on the clock…

Thanks for reading, and I hope everyone has a great June.

Ouch on that $ETSY sell.. Great write-up as usual!

What did you think of the docu earnings? I loved about everything except it seems CLM is further away than I hoped. The CFO in the CC noted "So, I would expect it to be a few years before it’s really a meaningful contributor. And when you think about kind of the results that we posted the last few quarters, they are primarily driven by eSignature. And just given the scale and the growth rate kind of on the core piece, it’s going to take a while for Agreement Cloud, even if it’s growing quickly within to really have be a meaningful contributor from a top-line perspective."