[PLEASE NOTE: This post was originally published on April 13, 2020 and included recaps through March 2020. This intro is from that original write up.

I subsequently tacked on April-August 2020, at which time I exited the position. I reinitiated it December 2020. If interested, you can find updates from there in my monthly recaps starting at that date.]

I usually save longer company updates for my end-of-month recaps. However, we’re not even halfway through April yet and have already seen two big pieces of Roku news. The first was the continuation of the company’s UK expansion with the British release of The Roku Channel. As in the US, the channel is free for viewers and supported by ads. The UK version features “10,000+ free movies, TV episodes and documentaries [including] a selection of popular global and British TV series” geared toward local audiences. I’m speculating a bit, but Roku must have projected enough British viewers and more importantly enough advertiser interest to proceed with the launch. I view that as good news.

The second update was a positive preannouncement of Q1 results earlier today. I view that as even better news. The highlight was a raise in revenue guidance suggesting this quarter’s growth could end up around 54%. That would mean an acceleration both sequentially and year-over-year, which is very impressive at this scale. The company also estimates increases to 39.8 million accounts and 13.2 billion hours streamed. The kicker was this quote regarding the effects of COVID-19:

…beginning in late Q1 Roku started to see the effects of large numbers of people “sheltering at home”. For Roku, this has resulted in an acceleration in new account growth and an increase in viewing.

While the underlying circumstances are nothing short of gut wrenching, these developments underscore the strength of Roku’s platform and not surprisingly led to a healthy afterhours price gain.

The new numbers lend some credence to my persistent belief that the current global lockdown will only accelerate the move to digital media. Maybe I’ve just been stubborn, but I have continued to hold all my shares during what has been a lackluster 2020 thus far. Ad dollars eventually go where the eyes are, and right now the eyes are on streaming. Roku’s platform gives it optionality that TTD lacks while waiting for advertising budgets to recalibrate. Along those lines, CEO Anthony Wood stated:

We have been working closely with advertisers to help update their plans to reflect new viewing patterns and adjust their overall marketing mix which has been affected by social distancing. While we expect some marketers to pause or reduce ad investments in the near term, we believe that the targeted and measurable TV ads and unique sponsorship capabilities that Roku offers are highly beneficial to brands today.

When it’s all said and done, Roku appears to be in a great position to withstand the temporary decline in ad spending and come out stronger on the other side. I’ll get to dig deeper into that theory when Roku formally reports May 7. I stated last month I thought even mildly optimistic news could portend a rebound in stock. To that end the preannouncement has worked out in my favor. Nonetheless, I’ll have my fine-toothed comb ready for whatever additional info Roku reports.

I’ve now owned Roku for almost a year, and during that stretch it’s been my most volatile holding by far. Despite the stock zigzagging all over the place, management deserves credit for remaining laser-focused on its mission to become the world’s #1 digital content aggregator. While the market occasionally seems to get distracted by Roku’s hardware and in-house channel efforts, management has been crystal clear both are nothing more than vehicles for luring more eyeballs onto their platform. That’s good because that’s where the money is. Fortunately for long term investors, that platform continues to expand both domestically and abroad.

For anyone who would like more on the company, below is a timeline of my rollicking ROKU relationship:

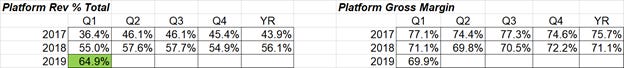

May 2019 – A new purchase. Roku has put itself smack dab in the middle of the seemingly unstoppable transition from linear TV to digital streaming. The platform and customer base they have spent the last decade building is ready-made for content providers looking to reach an ever-growing digital audience. My key takeaway after breaking them down is that Roku has evolved from a fancy cable box maker into a legitimate advertising platform with the potential to be the operating system for the majority of smart TV’s. The company’s higher margin Platform business – ads, smart TV OS licenses, and fees from its aggregator Roku Channel – is accelerating and becoming an ever-larger percentage of total revenues:

At the same time, their customer base is growing steadily and the time spent on their platform is exploding:

Roku’s self-described "strategy of trading player margin for account growth and platform revenue growth" appears to be paying off in spades. With 1-in-3 new smart TV’s running Roku’s operating system, they’ve passed Samsung as the #1 OS in the US. In addition, they’ve established a presence in 20 different countries. While they don’t expect any international contributions until 2020, their belief is the entire world will eventually move in the direction of digital consumption. That’s a whole lotta TAM goin’ on.

June 2019 – Roku briefly passed the $100 mark to set new all-time highs. It took a late dive when AMZN announced a two-day sale on its smart TV offering, but I personally view this as more of a market overreaction than any change in fundamentals or foreseeable business prospects. I might have considered adding if my allocation wasn’t already in my targeted range and everything else hadn’t dipped right alongside it. I don’t need to be a techie to understand that some people still dig watching TV and will likely access more and more of it through streaming platforms as we go. ROKU has put itself firmly at the forefront of that transition. I’m willing to let this story continue to play out.

July 2019 – I used some SHOP cash to nudge my Roku allocation ~0.5% after a 15% decline due mainly to AMZN announcing a sale on its own featured smart-TV. Since Amazon wasn’t touting a new product but instead discounting a pre-existing one that hadn’t affected ROKU much previously, I viewed this as a buying opportunity and added a smidge at $91.90 on 7/2. I originally decided against this purchase since I was already in my 5-7% allocation zone but changed my mind after I viewed the discount as too attractive to pass up and Roku touched the bottom of that range.

I’ve now experienced a couple instances where an Amazon announcement causes one of my holdings to temporarily dip before bouncing back to challenge new highs. January’s MDB wobble is probably the most notable example. AMZN’s Open Distro gambit against ESTC appears to be ending that way as well. I’m fully aware that a handful of cases does not indicate a trend, but ROKU’s price has thus far followed a similar path by rebounding 14.1% since July 1 while touching new highs along the way. While I’m glad the opportunity to buy the dip has worked out thus far, I view Roku’s August 7 earnings as a MUCH more important indication of its future. Stay tuned…

August 2019 – Roku reported on 8/7 and I thought they knocked it out of the park. Revenue growth accelerated to its highest level since their 2017 IPO. The last four quarters are now 38.9%, 46.5%, 51.3% and 59.5%. Even more impressive, growth in their higher margin platform revenues has trended the same way – 73.9%, 77.2%, 78.7% and 85.6%. GAAP margins remain slightly negative as they focus on growth, but Adjusted EBITDA has now been positive for 5 consecutive quarters. Roku now has 30.5 million active accounts (+38.6%) that collectively streamed 9.4 billion hours (+70.9%) last quarter. The company is clearly finding ways to monetize those hours as average revenue per user jumped $2.00 sequentially to $21.06. In addition, the company highlighted the following in their shareholder letter:

Roku is the #1 streaming platform in the US by hours.

Roku’s operating system powers 41 million devices and smart TV’s in the United States. This is 36% greater than their closest competitor and is expected to grow.

Roku owns 39% of the US streaming media player installed base as of 1Q19.

Roku’s operating system powers more than 1-in-3 smart TV’s sold in the US during the first half of 2019.

In a nutshell, Roku appears to be delivering in spades. The company is out in front of a huge shift in the way viewers consume TV, and its rapid growth doesn’t look like it will slow any time soon. As for the stock, I was able to grab some at $105.50 immediately after earnings, then added a couple more lots over the next few days. At the time those buys put Roku just below my target allocation of 9-12%. It has now solidly appreciated into that range. I really like what Roku is doing and can’t see myself exiting any time soon.

(A current comment: For anyone interested in a deeper breakdown of how Roku’s platform revenues and margins fit in the bigger picture, I’d also recommend this external post I wrote on the Motley Fool from last August. It contains greater detail than the May numbers presented above.)

September 2019 – September (-32.8%) was a brutal month for ROKU after a ridiculously stellar August (+46.5%) that pretty much carried my portfolio. Being honest, the run from ~$100 on 8/7 to ~$170 on 9/6 was almost certain to elicit a pullback. As with any stock experiencing a similar burst, the question is always where the price finally settles. Unfortunately, in this case it settled just about where it started. Congratulations to anyone who was able to successfully trade in this window. I simply chose to ride it out since 1) I believe in the company longer term and 2) my ability to time the market has repeatedly proven to be terrible over the years.

Price action aside, there was quite a bit of news to digest during September. The first was an announcement that Roku has expanded its TV licensing program to Europe with Hisense as its initial European TV partner. Hisense was one of Roku’s early North American partners, so this seems like a natural expansion of an already successful relationship. The first Hisense/Roku TV’s will hit showroom floors in the UK during Q4.

The next pronouncements were the release of new and updated hardware. Early in the month Roku released a smart soundbar and wireless subwoofer that are both embedded with Roku’s platform. Mid-month the company released its refreshed lineup of Roku players and OS for Roku-powered smart TV’s, which happen to dominate Amazon's best seller list. The pessimist in me sees this as a further expansion into hardware, which I’m lukewarm about. The optimist in me sees yet more avenues for viewers to easily access Roku’s platform, and as luck would have it just in time for the holiday shopping season! The pragmatist in me – who I always try to heed most often – is perfectly content to stick around to see how things shake out as Roku aggressively pursues what it clearly sees as opportunities for continued growth.

The third bit of news was AAPL’s unveiling of pricing for its Apple TV+ product. This led an already skittish market to dump pretty much every stock associated with streaming in any way. Frankly, Apple’s forays into these types of services never quite seem to pan out the way they’d like, so I’d say the market’s reaction was a little overblown. It’s not like Apple created a new device to compete against Roku, and its own release said, “The Apple TV app…will come to Amazon Fire TV, LG, Roku, Sony and VIZIO platforms in the future.” So, Apple basically stated it was releasing a new service for a pre-existing app and one of the main ways to access that service is through Roku. Isn’t that what we want? I see nothing wrong with letting everybody else split up the content pie while Roku serves as the aggregating platform that pulls it all back together for easy access by consumers. The market reaction reminded me of the dip a couple months ago on AMZN’s smart TV flash sale, which turned out to be a great buying opportunity. I thought ROKU’s 10% haircut on the Apple news was a bit excessive, so I added about ~1% more at that level.

The final volley was Comcast and Facebook both releasing streaming options to existing customers on 9/18. This is the one that started the real hit to Roku’s stock. Comcast is offering its internet-only customers – a quick search turned up ~27.6M of them – a free first OTT box with a monthly charge for any additional boxes. Given those customers must rent Comcast’s modem to qualify and can only outfit one TV before seeing their bill increase, I can’t see this being a game changer. Facebook’s offering will be $149 and have streaming capabilities as well. As with the Apple announcement I’m not surprised others want a piece of the rapidly growing streaming market, but I don’t view either of these moves as disrupting Roku’s short-term prospects or overall business given Roku’s continued advantage of being a neutral platform in the streaming arms race. Sadly, my lack of time travel skills prevented me from cancelling my purchase on the AAPL dip so I could take advantage of this one instead. I believe those who added here will eventually be rewarded (although you’re on your own if it turns out I don’t know my ass from my elbow).

Despite this month sharp pullback, I remain convicted in my Roku thesis. For now, I will continue to hold Roku as a healthy part of my portfolio, though I’m guessing that’s easier for me than some others who have purchased it recently since a large number of my shares still sit firmly in the green. At the same time, I’ll be watching the next couple of quarters closely to make sure the expanding competition isn’t hurting Roku’s margins or prospects for future growth. This is a case where I’m not trying to overthink things. I’m intent on owning the company until the growth and platform revenue numbers tell me it’s not worth following any longer.

October 2019 – LAAAAY-DEEEEEEES AND GEN–TLE–MEN! DON’T BE SHY!! STEP RIGHT UP TO THE ROKU ROLLERCOASTER!!!

Whoa. This is the exact opposite of drama-free. The stock’s exhilarating August (+46.5%) and vomit-inducing September (-32.8%) have now been followed by a thrilling +44.7% October. That means Roku has basically carried my portfolio for two of the last three months and has now leapfrogged into my biggest holding. While the company’s November 6 earnings should no doubt be interesting, those results are likely just a prelude for what has traditionally been HUGE seasonality during the Q4 holiday season. That’s when we should really see just how well Roku has positioned itself as the default OS and viewing platform for the ever-increasing number of eyeballs migrating to streaming TV. For those who have dared to enter this ride, please check your safety bar and remember to keep your arms and legs inside the car at all times. The rider assumes all risks and no refunds will be given.

November 2019 – Face it people, ROKU is a volatile little scamp. The company reported good numbers on 11/6 with small beats in several areas and a FY raise. Active accounts and streaming hours continue to climb, with Roku now serving 32.3M users who spent 10.3 billion hours on their platform last quarter. Average revenue per user (ARPU) climbed sequentially from $21.06 to $22.58 and ARPU growth accelerated to +30.2% YoY. This tells me they are clearly finding ways to monetize their eyeballs. Operating expenses climbed a tick, but they do not appear to be overpaying for the growth they are creating. And despite guiding all year toward breakeven EBITDA they are likely to end up closer to +$35M when all is said and done. On the whole I believe Roku continues to deliver on its promises with plenty of room to continue outperforming.

Unfortunately, a finicky market for highfliers didn’t seem to immediately share my opinion. The stock dropped ~15% after hours, which wasn’t a shock to me considering the smoking hot ~40% rise the month or so leading into the report. I’m also not surprised it has rebounded quite nicely as the news has settled in, even with Roku announcing a very small secondary offering mid-month to help cover a recent acquisition. I’m perfectly happy with the results and believe Roku has lined itself up well heading into its seasonally large Q4. Ultimately, their stated plan of “trading player margin for account growth and platform revenue growth” appears to be very much on track, and a strong holiday season in smart TV and/or player sales could fuel continued hyper growth in platform revenues during 2020. Their recent release of Roku TV's in the UK should help in that regard. A reasonable Q4 beat would have Roku exiting 2019 as a 50%+ overall grower with >$1.1B in revenues and plenty of tailwinds behind it. I trimmed ~.5% just before earnings while rebalancing accounts after last month’s TWLO sale, but have no problem keeping the remaining shares as one of my largest positions.

December 2019 – I used my regular monthly contribution to add a teeny amount when Roku opened December down ~15% on a Morgan Stanley downgrade with a $110 target. Of course, a Needham analyst sent the stock up the very next day with an upgrade that included a Street-high target of $200. That’s quite a difference of opinion. I’m siding with Needham on this one since I make a point of never trusting anyone with two first names (my apologies to everyone out there with two first names). Here’s hoping the bulk of this holiday’s smart-TV upgrades end up powered by Roku’s OS.

January 2020 – Roku kicked off the year with three interesting pieces of news. The first was an announcement that 15 brands will be rolling out Roku-powered TV’s in the US, UK, Mexico and Canada during 2020. Those brands now include ATVIO, Element, Hisense, Hitachi, InFocus, JVC, Magnavox, onn., Philips, Polaroid, RCA, Sanyo, TCL and Westinghouse. The second was a release detailing a new verification program which “allows third-party consumer electronics products to work seamlessly with Roku TV’s”. These products will be specifically labelled “Roku TV Ready” on packaging and marketing materials to identify they are certified to work with Roku’s operating system. This will “make it super easy to setup and control soundbars and audio/video receivers using just a Roku TV remote”. Finally, the company expanded its long-awaited international push by debuting its platform in Brazil. This includes an OS deal with TV manufacturer AOC as well as a content partnership with Globoplay, Brazil’s largest streaming service. This deal potentially benefits all involved, and Globoplay will be prominently featured with a shortcut button on Brazilian Roku remotes in the coming months. I like this move and view local partners as a smart, measured way to increase the odds of a successful rollout.

Unfortunately, these positives were overshadowed by a piece of negative news just this morning. It appears Roku and Fox are in a contract dispute which caused Fox’s apps to be removed from Roku just two days before the Super Bowl. Even though both companies supplied alternatives for accessing the game, it’s not a good look for either before such a premier event. While fee disputes between carriers and content providers are fairly common in the cable world, this looks like the first major disagreement of the streaming era. Considering the unrelenting shift of viewers from cable to streaming, it almost certainly won’t be the last. As with most of these squabbles I’d expect an eventual resolution reestablishing the partnership. In the meantime, I view this drop as FUD and nibbled at another ~0.4% this afternoon. Welcome to the big leagues, Roku. Please be smart and don’t overplay your hand.

The end-of-month stumble notwithstanding, I view the earlier pronouncements as excellent examples of Roku’s burgeoning popularity. The company is continually finding innovative ways to worm into more and more home entertainment systems. In addition, these releases suggest third parties are becoming quite eager to access Roku’s platform and customer base. The more the merrier as far as I’m concerned. Despite the stock zigging down 9.7% this month while literally everything else I own zagged higher I have no reason to think the overall business or thesis has faltered. Roku’s 2/13 report on their traditionally large Q4 should go a long way toward clarifying just how well-positioned they are for continued success. I plan on holding tight at least until then.

February 2020 – And the volatility continues. After being my only market-trailing stock in January, Roku charged out of the February gate. It surged right away when Roku settled its Fox dispute and then continued to climb into midmonth. While the Fox agreement was certainly a welcome (and anticipated) development, I viewed it as nothing more than a prelude to a pretty significant earnings report on 2/13. The company spent most of 2019 very aggressively expanding its viewing platform and OS footprint. This report would shed some initial light on just how well those efforts had positioned the company for 2020 and beyond.

I personally thought things looked pretty good. Roku posted 49.1% total revenue growth with its higher-margin platform growth coming in at 71.5%. For FY19 those rates finished at 52.0% and 77.7%, respectively. Active accounts (+36%), streaming hours (+60%) and average revenue per user (+29%) all continue to grow at strong rates. Platform as a percentage of revenues has increased from 43.9% to 56.1% to 65.6% the last 3 years and is expected to be ~75% for 2020. Roku not only ended 2019 with its OS in roughly 1/3 of US smart TV purchases but also laid the groundwork for additional expansion into North America, Europe and Brazil. The call was confident, and I didn’t sense any unanticipated headwinds on the horizon. Finally, Roku’s top-end 50% Q1 revenue guide would mean sequential acceleration, and even a moderate beat would also be YoY acceleration vs 1Q19’s 51.3%. Accelerating 50%+ growth coming off a $1.13B revenue year? Sounds good to me.

Unfortunately, the market didn’t share my enthusiasm for very long. The stock initially spiked up ~8% at the open ( *wistful sigh* ) before crashing down to finish the day at -6.5%. And Roku’s been stuck in the mud ever since. The decline was apparently spurred by analyst concerns about the below consensus FY20 guide for breakeven EBITDA and GAAP losses, due mostly to integration of the dataxu acquisition. As a reminder, this is the very same EBITDA guide they made for most of FY19 before finishing at +$36M. Management has been very explicit about their growth intentions, and the returns have been positive so far. They state they are “well positioned for the new streaming decade”, and I can’t really argue that point. Given the guide and underlying metrics, it’s not hard for me to picture strong revenues and positive EBITDA in 2020…

…but what I see is only part of the puzzle. Despite believing Roku has an excellent plan, I must admit disappointment in the post-earnings action. The early month climb and initial earnings pop made sense to me (ownership bias maybe?). The subsequent action has not. That’s led to a bit of a gut check. While Roku’s been a profitable buy, I can’t ignore most of my position has basically been dead money for six months while trailing the market significantly. At some point that means something. Not because I’ve soured on the business, but because holding such a condensed number of stocks really highlights the effect of opportunity cost for any “wait it out” portion of your portfolio. I’m all for Roku’s continued expansion, and in theory their shift to maximizing platform revenues and ARPU should have some coiled spring effect once it kicks in. It obviously didn’t with this quarter’s earnings, so the challenge becomes determining the acceptable hold time and allocation for a stock that might stagnate further while I await signs of the payoff.

Being brutally honest with myself, I’ve previously found ways to trust NTNX, SQ, TWLO and ESTC’s numbers a little too long even though the market was telling me otherwise. Simply put, I don’t need to fight city hall when there are other options available. After all, I’m not here to prove the market wrong. My only goal is maximizing returns. Given that, I’m beginning to question how committed I am to ~10% of my portfolio potentially drifting for another quarter at least. I can’t see myself abandoning Roku since I still like the business very much, but it does enter March as a candidate for a lower allocation depending on my remaining earnings results.

March 2020 – There’s simply no sugar coating it. After being a portfolio standout through Fall 2019, Roku’s been a serious drag since. I spent most of February trying to figure out why since I thought earnings were fine and the overall thesis remains intact. In early March the price finally reached a point where I felt the market began to throw out Roku’s platform baby with the hardware bathwater. I think some of the initial hit was supply chain concerns for Roku TV's and sticks, then it was compounded by concerns over ad sales. I also believe their international expansion might take a slight pause given the current climate. However, TV’s and Roku sticks are not where the money lies. They are just the gateways to eyeballs. Ads will decrease but won’t disappear, and streaming hours are very likely to skyrocket. Ad impressions through The Roku Channel should surge as well. I shook the couch cushions to add a tiny 0.1% in my taxable account when the stock dropped below $80. I know others have added as well. Despite Roku’s terrible YTD, I can’t see how there’s not room for considerable upside from these levels. With the shares this beaten down I see no harm in holding through early May’s earnings and reassessing. I’d expect some rebound with an even moderately optimistic outlook. If not, it’s likely time to move on. Hopefully people won’t decide to stop streaming television while they are on lock down between now and then. 😏

April 2020 – Well, it’s not like I haven’t said on occasion that Roku is volatile. Roku soared as much at 47% this month before finishing at +38.6%. Unfortunately, that shows just how rocky Roku’s 2020 has been since even that gain still leaves it down 9.5% YTD. There were two big pieces of news this month which elevated the stock. The first was the continuation of the company’s UK expansion with the British release of The Roku Channel. As in the US, the channel is free for viewers and supported by ads. The UK version features “10,000+ free movies, TV episodes and documentaries [including] a selection of popular global and British TV series” geared toward local audiences. I’m speculating a bit, but Roku must have projected enough British viewers and more importantly enough advertiser interest to proceed with the launch. I view that as good news.

The second update was a positive preannouncement of Q1 results. I view that as even better news. The highlight was a raise in revenue guidance suggesting this quarter’s growth could end up around 54%. That would mean an acceleration both sequentially and year-over-year, which is very impressive at this scale. The company also estimates increases to 39.8 million accounts and 13.2 billion hours streamed. The kicker was this quote regarding COVID-19:

…beginning in late Q1 Roku started to see the effects of large numbers of people ‘sheltering at home’. For Roku, this has resulted in an acceleration in new account growth and an increase in viewing.

While the underlying circumstances are terribly unfortunate, these developments underscore the popularity of Roku’s platform and have not surprisingly led to a healthy uptick for the stock.

The new numbers lend some credence to my belief COVID-19’s lockdown will only accelerate the move to digital media. Maybe I’m just stubborn, but I have continued to hold my shares despite Roku’s mediocre YTD. My thesis is ad dollars should eventually go where the eyes are and right now the eyes are on streaming. Roku’s platform also gives it optionality TTD lacks while waiting for virus-affected ad budgets to recalibrate. Along those lines, CEO Anthony Wood stated,

We have been working closely with advertisers to help update their plans to reflect new viewing patterns and adjust their overall marketing mix which has been affected by social distancing. While we expect some marketers to pause or reduce ad investments in the near term, we believe that the targeted and measurable TV ads and unique sponsorship capabilities that Roku offers are highly beneficial to brands today.

When it is all said and done, Roku appears to be in a great position to withstand the temporary decline in ad spending and come out stronger on the other side. I’ll get to dig deeper into that theory when Roku formally reports May 7. I stated last month I thought even mildly optimistic news could portend a rebound in the stock. To that end the preannouncement has worked out swimmingly so far. Nonetheless, I’ll have my fine-toothed comb ready for whatever additional info Roku releases.

May 2020 – Roku gave us two updates this month. The first was the company following through on its dataxu acquisition by launching the OneView Ad Platform. This new product lets advertisers plan, buy and measure ad campaigns across Roku and other platforms including OTT, desktop and mobile. In the release Roku estimates OneView’s reach as 4 out of every 5 homes in the U.S.

Roku had previously used a more traditional direct sales model to handle most of its ad inventory. This new platform will allow marketers to directly monitor and optimize their own campaigns. The main features are below:

Better identity solutions – access more accurate TV audience data powered by Roku’s direct consumer relationships

Deeper consumer insights – plan and measure using unique linear TV data from ACR on North America’s #1 licensed TV OS

Proprietary audiences – activate more than 100 unique segments based on data from the No.1 TV streaming platform in the U.S. by hours streamed according to Kantar

Instant OTT forecasting – calculate OTT ad inventory availability in seconds to buy advertising sold by both Roku and other publishers across OTT

In-flight attribution tools – optimize reach, frequency and performance across OTT, linear TV, desktop, and mobile campaigns

Guaranteed outcomes – guarantee demographic delivery or business outcomes such as website visits or mobile app downloads

As Roku continues to gain both mind and market share, OneView should be a valuable tool for optimizing exposure and monetizing its userbase. Anything that increases efficiency and stickiness is fine by me. I like this move.

That announcement was followed by Roku’s 5/7 earnings release. The headline numbers were strong and in line with their April preannouncement. Total revenue of $320.8M represented 55.2% growth, which is a significant acceleration both sequentially (vs 49.1%) and YoY (vs 51.3%). In fact, it was Roku’s largest Q1 revenue growth rate in five years. Platform revenue growth also accelerated sequentially to 73.4% and now accounts for a record 72.5% of total revenue. Streaming hours, active accounts (now >40M) and average revenue per user all continue to increase steadily. Roku did post income and EBITDA losses, but the final numbers came in better than expected even as the company continues to fund platform and international growth.

On the hardware side, player revenue came in ahead of expectations and “…sales of both Roku players and Roku TV models remained very healthy year-to-date, despite some supply chain and retail disruptions.” The company noted that after some early factory closings current production is close to normal capacity. Roku’s operating system continues to power more than 1-in-3 smart TV’s sold in the US and more than 1-in-4 in Canada. The company is also pleased with its early international efforts in Mexico, Canada, Brazil and the UK. As pointed out multiple times, hardware is not a revenue driver for Roku but rather an avenue for increasing platform access and in turn the number of viewers. In that respect, COVID-19 doesn’t appear to have drastically affected Roku’s operational plans for acquiring more eyeballs.

Digging deeper on the platform side, the underlying trends are about as expected. Ad dollars have been pressured while content distribution and user engagement have surged. Management stated the acceleration in accounts and viewership seen in the final month of Q1 has continued into Q2. They also noted some virus-related ad cancellations have been offset by new business coming from the elimination of live sporting and entertainment events on traditional TV. While remaining uncertain about the future, management did remark that March’s initial cancellation surge had stabilized in April. They now expect “our ad business will continue to grow substantially [bolding mine] on a year-over-year basis, albeit at a slower pace and lower gross profit than we originally expected for the year”. Platform gross margin of 56.2% was slightly lower than anticipated due in part to COVID-19’s impact on video ad sales and sponsorships. As with several recent tech trends, ROKU does see a possible virus silver lining where these temporary ad declines are more than offset by “accelerating the shift to streaming by both viewers and the industry”. As CEO Anthony Wood wrote in his closing statement of the Q1 shareholder letter:

“Much uncertainty remains, but a few things are increasingly clear to us: streaming, and the ease and value it provides, is more relevant to consumers than ever; overall advertising expenditure in the U.S. is likely to fall in 2020, but we expect our ad revenues to still grow substantially year-over-year; Roku is well positioned to be an increasingly valuable partner as brands decide how to invest marketing resources most effectively; and, our outstanding talent is keeping our company highly productive. Although the Streaming Decade began differently than anyone could have imagined, we are confident the fundamental shift to streaming will continue, perhaps even faster than previously expected.”

That statement is as thorough an explanation as any as to why I plan on holding shares at least through the next report. We all get caught up in stock price – myself included – and Roku’s has been all over the place in the year-plus I’ve owned it. Roku helped lead the charge for my 2019 returns but has been a notable drag in 2020. The bears seem to focus on the steady losses and the bulls seem to focus on the notable revenue and platform growth at scale. Personally, I am still intrigued enough by how the company sticks to its plan and has executed on just about everything it has initiated. Listening to the call it doesn’t sound to me like they are letting any short-term macro issues affect their long-term vision.

In the big picture I continue to bet on Roku’s persistence eventually paying off as we pass through and then out of COVID-19. I’m banking on the continuing viewership surge translating to better bottom line leverage starting next report. If that doesn’t come to pass, I’ll be seriously revisiting this position. Roku is becoming similar to my 2019 Square and Twilio experiences in that my interpretation of the numbers just does not match what the market is telling me. As this post on a Motley Fool message board so eloquently puts it – and I would have to agree – Roku’s story just doesn’t seem to be holding up the way I think it should. At some point the opportunity cost of waiting this out will be simply too hard to ignore given my other choices. However, I’m choosing to hang in there for now.

June 2020 – Anyone reading my recaps the last few months knows Roku has become a personal battleground stock. That internal battle heated up again after I read this excellent write up on Roku’s Q1 results. While I was fully aware of everything mentioned, this post tied it together in a way I had not considered before. In my opinion, this is one of the best parts of sharing ideas. Different perspectives can really clarify your own thinking. While I’d always understood the bear case, this breakdown left Roku even more vulnerable than I’d originally thought.

After thinking it through, I began chipping away at this allocation by shaving 2% to add to ZM after Zoom’s – *foreshadowing* – somewhat interesting earnings report. I also converted a small portion of my shares into an equal dollar amount of long-dated calls since I feel Roku has one of its periodic surges coming at some point. Subsequent rises in ZM and ROKU have made both moves worthwhile so far. It is important to point out I do not use options very often AND YOU SHOULDN’T EITHER IF YOU DON’T KNOW WHAT YOU ARE DOING. I chose that route here because I still have enough faith in the company to keep a decent amount of skin in the game. However, Roku’s leash is shortening as it continues to lag YTD. Next quarter’s earnings will have major sway on this position.

July 2020 – Ah, Roku. My volatile little friend. Where the heck ya been? I wrote in June I felt the stock was due for one of its periodic surges and even turned a few shares into options to increase my exposure. I added another tiny option at the beginning of July with my regular contribution. [Insert the usual disclaimer about my limited use of options and how you should avoid them if you don’t know what you are doing.] As luck would have it, Roku delivered right on cue. With this month’s showing the stock has now done this for me within the past year:

August 2019: +46.5%

October 2019: +44.7%

April 2020: +38.6%

July 2020: +32.9% (for the shares and +108.7% for the options)

Of course, those spikes have been strongly offset by some harrowing drops over the same span. That is why Roku has lagged the rest of my portfolio and is up only 15.7% YTD. Overall, it has been quite the journey.

On the business side Roku saw a couple intriguing developments. The first was the addition of a Peleton channel so users “can enjoy studio-style workouts in their living room”. What I find notable is Peloton is not TV content but rather an interactive experience. That is a new concept for me. I guess I had mentally limited myself to viewing Roku solely as an alternative TV option for cord cutters. I had never considered it a potentially neutral platform for any and all streaming media. Hmmmm…interesting if true.

The second was a company blog post announcing CoComelon – “the world’s most watched YouTube channel” – is coming to Roku. A popular educational channel for preschoolers, Cocomelon will now be available as part of the Kids & Family offering on the The Roku Channel. It has often been noted Roku makes little to no money from its relationship with YouTube. It is nice to know that relationship apparently doesn’t limit Roku from working directly with YouTube content providers exploring additional distribution. It is hard to view this arrangement as anything but a positive for all parties (except possibly YouTube, of course). I’m curious to see if Roku can expand this effort.

I continue to learn a lot from owning Roku. For one, I now better understand some of the differences between the B2B (business-to-business) and B2C (business-to-consumer) business models. Most of my holdings are B2B, and there is a quiet certainty to their recurring revenue and mission critical products that B2C firms lack. Rather than certainty, B2C companies seem to have a fickle or fad quality mostly tied to consumer tastes. That uncertainty apparently leads to more volatility and a lower multiple, at least in Roku’s case. In some ways I believe Livongo could eventually fall into the same bucket since its success is ultimately driven by individual patient adoption rather than its number of corporate clients. However, LVGO’s numbers are small enough and the company early enough in its trajectory I’m not yet worried about it. However, this is something I will monitor for both companies in the future.

Back to the present, Roku continues to stand up some interesting dominoes. Hopefully, August 5 earnings will show it is ready to start knocking some down as well. In my opinion this is a key moment for Roku, and I see enough uncertainty around it I plan to convert half my options back into shares on Monday. I will keep the same weighting into earnings but prefer to lessen the leverage. Something-something bulls, bears and pigs. **

** “Bulls make money, bears make money, pigs get slaughtered.” ~ old Wall Street adage

[As an aside, I thought I’d quickly share a strategy I used this month. My small regular contribution goes to a taxable account. I wanted to buy a ROKU option but preferred it in an IRA to eliminate tax implications. To do this I purchased some taxable DDOG I plan to hold long-term and sold an equal amount of DDOG in an IRA. I then used that cash to buy the option. I often consider the same strategy when I want to add more shares to a name that might be getting too sizable in my taxable account. I’ll buy something else I like long-term in the taxable and sell an equal IRA amount to free up the cash for my intended target. That lets me better control my allocations vs tax exposure between taxable and IRA accounts. I can’t remember where I stole the idea but have found it handy.]

August 2020 – Last month I expressed some uncertainty surrounding Roku’s August 5 earnings. Unfortunately, for the second consecutive quarter Roku left me feeling lukewarm. Despite active accounts, player revenues and streaming hours all reaccelerating, monetization remains as elusive as ever while advertisers wait for COVID to pass. As many familiar with Roku know, player sales are not meant for profit but to increase the number of viewers on its platform. Platform fees and ad sales always have been and always will be the major drivers of Roku’s thesis. Unfortunately, the pandemic continues to heavily pressure both. Platform revenue growth tumbled from 73% to 46%. Not surprisingly, platform gross profit growth sank as well from 39% to 26%. Video ad impressions were up 50% YoY, which sounds impressive until you consider management has been loosely trumpeting this metric as “more than doubled” for several quarters. It is very likely just a large numbers slowdown, but it is hard to tell for sure since management does not break this out specifically. Regardless, it is clear the general woes in the advertising market continue.

Beyond the headlines, secondary metrics lagged as well. Platform gross margin was 57% and remains down sharply due to ad pressure and revenue mix. Platform revenue as a percentage of total decreased sequentially from 72.5% to 68.7%, which means Roku will almost certainly fall well short of its initial FY20 goal of 75% platform share. International efforts continue (as they should) but have yet to show any real traction. Even this quarter’s EBITDA beat was somewhat tainted since it was driven mostly by reduced expenses rather than business growth. Despite the continuing march of consumers toward streaming, turning additional viewers into bottom line success remains a struggle.

I still believe Roku has a bright future, but the ongoing uncertainty suggests its time might be further off than I thought. I don’t disagree with management’s comment we are “very early” in a global move to streaming. The problem is the ever-lengthening path to profits hints it might also be too early for Roku to create the business leverage I have been waiting for. Simply put, I feel other companies are executing better. Through my lens Roku’s numbers have barely supported the narrative the last couple of quarters. This quarter I feel they disconnected. With the drastic platform slowdown and a warning “it will be well into 2021 before TV ad investment recovers to pre-pandemic levels”, I decided my money is better off elsewhere. I could very well be back, but not until Roku proves it can better leverage its bottom line.

(Current me again: If you’ve made it this far, I can’t tell you how appreciative I am. I also think you are a tremendous glutton for punishment. If interested further, my Roku story picks up again starting December 2020. You can find more by heading here.

Thanks for reading and good luck out there.)