Two steps forward, one step back.

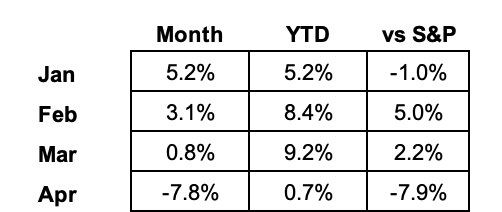

2023 Results:

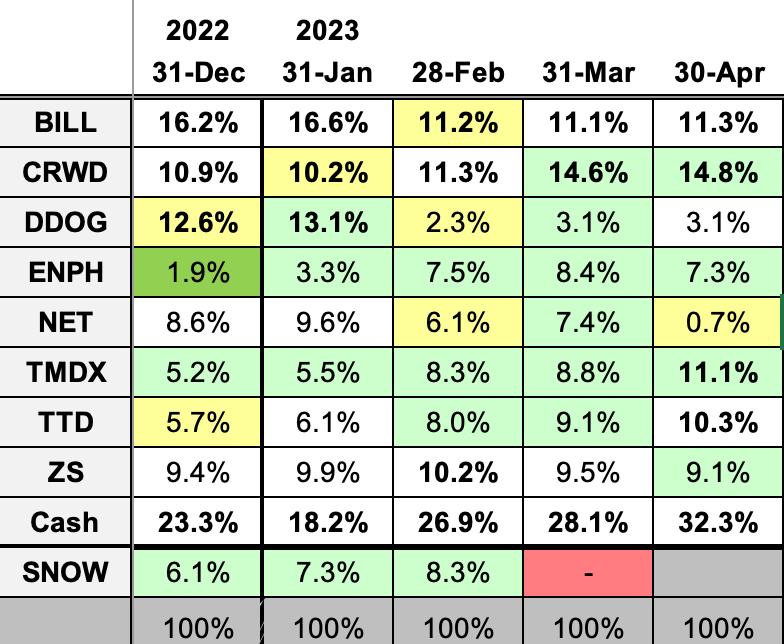

2023 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2018 (the one that got things started)

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

December 2021 (contains links to all 2021 monthly reports)

December 2022 (contains links to all 2022 monthly reports)

Stock Comments:

Earnings season has certainly started with a bang. Two of them to be exact…

BILL 0.00%↑ – Bill’s main update was the hiring of a new CTO. Ken Moss, who replaces the retiring Vinay Pai, joins Bill after three decades of experience including stints with Electronic Arts, eBay, and Microsoft. This seems like a strong addition as Bill continues to integrate and expand its offerings.

A more important update will be Bill’s May 4 earnings release. One thing I’m guessing we’ll hear about is Intuit announcing it will launch an internal payment service for its QuickBooks product. Since Bill’s current QuickBooks integration has been a steady source of customers, this is disappointing to hear. Frankly, it is hard to interpret this as anything other than Bill’s competitive landscape becoming more difficult. That also makes it a backdrop to how the market is likely to interpret the quarter.

CRWD 0.00%↑ – CrowdStrike gave us several updates this month. First, CRWD earned its third consecutive placement on Fortune Magazine’s 100 Best Companies to Work For. Next, it released “the world’s first and only” EDR/XDR solution to Extended Internet of Things assets. According to the release, this includes any “IoT, OT, medical devices, Industrial IoT and connected devices” across a customer’s entire organization. While I’m not sure exactly what that all means, I do know finding more endpoints to protect is right in CrowdStrike’s wheelhouse.

Toward the end of the month, CRWD introduced a new Falcon Complete XDR service extending its “24/7 expert management, threat hunting, monitoring and end-to-end remediation” services. Lastly, it expanded its Google partnership with the first native XDR protection service for devices using the Chrome operating system. This Chrome update offering will be generally available by June, hopefully adding another avenue for additional endpoints.

In addition to the steady flow of releases, CrowdStrike hosted an early April Investor Briefing (slide deck here). While most info was simply a recap from last month’s earnings report, I did see a couple new details worth noting.

First was CEO George Kurtz directly touting CRWD’s simplicity and technical advantages over Microsoft’s security offerings. This includes the statements “Microsoft Windows represents 95% of the compromised endpoints CrowdStrike remediates” and “when CrowdStrike’s IR team investigates a Microsoft customer that has been breached, 75%+ of the time Defender [Microsoft’s protection offering] has been bypassed.” Kurtz has never shied away from addressing competition directly, so kudos to him for leaning strongly into this one. Besides, it’s not as if CRWD is trying to sneak up on anyone anymore. Game on.

Next was CRWD reiterating it expects FY24 net retention above its benchmark 120% while remaining on track to hit $5B+ in ARR by FY26. The one minor disappointment in my opinion was management keeping all its other long-term goals intact:

As the graphic shows, CrowdStrike has already reached its current target in every metric but operating income. Having literally owned CRWD since its day of IPO, I give all it the credit in the world for performing as well as it has. The question, of course, is where it goes from here. With little left to squeeze in the way of leverage, it will be imperative CRWD continues to maintain growth. This month’s flurry of activity suggests CrowdStrike is aggressively trying to do just that. Carry on then.

DDOG 0.00%↑ – Datadog released quite a bit of April news. It began with the acquisition of Codiga. A “tool that helps developers write better code faster,” Codiga monitors code for errors as it is being written. Since catching mistakes earlier saves time, effort, and money for users, this seems like a smart add to Datadog’s product line.

Next Datadog moved its Application Vulnerability Management tool to general availability. This feature “expands Datadog’s application security capabilities by automatically uncovering and prioritizing the most important vulnerabilities in open-source libraries.” With so many applications using open-source code, this strengthens users’ ability to monitor, identify and resolve issues. This seems like a natural expansion for DDOG and should increase its stickiness with customers.

Datadog followed with the launch of a new data center in Japan. The significance here is the firm’s first Asian data center. This will help local customers “comply with local data privacy and security regulations.” All existing products will be available through the new center, so if nothing else this move extends Datadog’s sales reach in the region.

Lastly, Datadog moved its data streaming monitoring service to general availability. This feature “makes it simple for organizations to track and manage the performance of applications that rely on messaging systems.” This doesn’t sound like a gamechanger but does seem to fit with DDOG’s steady cadence of adding to its offerings.

Our next formal update occurs when Datadog reports before market open on May 4. Fingers crossed.

ENPH 0.00%↑ – Enphase started April with several business updates. First, it launched its battery in France, the Netherlands, and Switzerland. European business has been a key growth driver for ENPH the last few quarters. This hopefully keeps that trend going.

Next, ENPH expanded US deployments in Michigan and European deployments in Spain and Portugal. The more the merrier.

The company ended the month with its Q1 earnings release April 25. The market hated it, but I found it reasonable mostly because it was almost exactly what the company said it would be – seasonal US softness, continued strength in Europe, improved operational efficiency, and additional capacity coming online. The highlights included a record 45.7% gross margin, 25% sequential growth in Europe, and everything on track to produce 10M units per quarter by the end of 2023. The lowlights included disappointing battery sales and the admission of macro and interest rate headwinds in the US market. Management assures us the US blip is “temporary”, but the price reaction suggests the market isn’t buying it.

Stepping back, this seems to be a timing race between management’s visibility and how long it takes for the US economy to work through whatever it is working through. One thing I’ve learned though while studying ENPH is CEO Badrinarayanan Kothandaraman (yes, I copied and pasted that) really knows the business. To that end, he concluded:

Our strategy doesn't change. We are focused on working closely with our installers to address their issues, making new products and entering new markets and countries. The fundamentals are intact for our industry. 30% ITC for the next decade, the rising utility rates, the focus on climate change and the desire for resilience are all going to push the need for solar plus storage more than ever before. With our differentiated products, high quality and exceptional customer experience, we are in a strong position to capitalize on this trend.

Kothandaraman (yes, pasted again) is adamant things will free up in the second half. Given his track record, I don’t have significant reason to doubt him (yet). Maybe I’m simply chasing fool’s gold after recent prediction gaffes by NET’s Matthew Prince and SNOW’s Frank Slootman, but this selloff feels overdone. I’ve swallowed hard and added a few shares. We’ll see. 😬

NET 0.00%↑ – Our initial news on Cloudflare was its addition to the 2023 Gartner Magic Quadrant in the Security Service Edge (SSE) category. Cloudflare joins nine other firms in the report and is the only new vendor added to the list. If interested, more info about NET’s position in the report along with customer comments can be found here.

Our more important update was NET’s April 27 earnings release. Unfortunately, it stunk. All we really need to know is the quote near the top of the release:

Increasing macroeconomic uncertainty over the course of the first quarter resulted in a material lengthening of sales cycles and a significant backend-weighting of linearity. Despite the continued reacceleration of our new pipeline generation and our sustained high win rates and renewal rates during the first quarter, our guidance assumes these external headwinds will persist through the end of the fiscal year.

That led to management restating its initial FY23 guide down to $1.284B from $1.342B. That’s a huge no-no in any market, and the stock has been hammered accordingly. That’s also a humongous credibility loss for a management team that was supposed to be one of NET’s selling points.

To make matters worse, most secondary metrics moved in the wrong direction. Net retention has dropped from 127% to 126%, 124%, 122%, and now 117% the last four quarters. Likewise, the 6,073 new customers marked the fourth consecutive quarter of fewer adds than the prior year. I also couldn’t help but notice the revenue contribution from large customers went from very specific 61% and 63% figures in Q3/Q4 to a more generic “>60%” this time around. Honestly, that feels sneaky combined with the customer and NRR declines.

Shockingly, Matthew Prince absolutely torched the sales team by calling out 100+ salespeople who “consistently missed targets” in his opening remarks. That’s not a good look, especially after all his we-know-our-levers comments the last few quarters. Prince knows the sales lever ultimately stops with him, right? Maybe it’s just me, but he could have simply stated NET is extremely unhappy with its sales structure and aggressively fixing it including firing underperformers. Instead, his comments sounded blaming and petty. I found it way out of character for what is usually a smooth presenter. Kudos to the analyst who basically asked (paraphrasing here):

Maybe I’m ‘a little dense’, but if you keep bragging about identifying this economic softness first and your must-have customer ROI, why so far off on these Q1 results and your FY outlook?

I think that about sums it up.

After all Prince’s recent visibility bravado, I can’t call this quarter anything other than an epic fail in both numbers and narrative. Hindsight is always 20/20, but the customer adds and declining NRR never suggested the acceleration needed to meet the FY guide. It was all based on the belief and trust that management knew what it was talking about when stating the initial figure. That trust is now gone as far as I’m concerned. Not to mention the fact that lowered guide might still be tough to meet given the declining trends. It’s never a good sign to say I’m hoping we’ve gotten our worst report of the season out of the way early, but there you have it. Ugh.

I sold our entire position afterhours other than a small number of shares covered by $63 calls into earnings. Those will be gone soon as well. I just don’t see much upside here until Cloudflare pokes its head out of the hole it just dug for itself. My condolences to fellow shareholders. Reports like these never feel good.

SNOW 0.00%↑ – A top watchlist name, Snowflake’s first April announcement was naming the ten semifinalists in its annual startup challenge. This contest features businesses built on SNOW’s platform and awards up to $1M in prizes to the top three. The three finalists will be announced in May and compete for the Grand Prize by pitching to the judges during the Snowflake Summit annual conference in late June.

The follow up and probably more significant news was the launch another industry-specific data cloud, this time for manufacturing. This initiative “enables companies in automotive, technology, energy, and industrial sectors to unlock the value of their critical siloed industrial data by leveraging Snowflake’s data platform.” This joins several other industry-specific verticals including finance, healthcare, and retail. Part of Snowflake’s appeal is its ability to let customers share and leverage combined datasets for additional insights. This should be another strong step in that direction.

TMDX 0.00%↑ – I saw no releases for TransMedics, which is not unusual at all for our smallest holding. However, @Zoro found the following article out of the UK. It references "a US-made device called an Organ Care System – better known as the ‘heart-in-a-box’ machine – helps restart the heart, keeping it healthy for longer." Given the timing, I can't help but think this news and/or the research behind it contributed to TMDX’s recent spike to $90 before settling back into the end of the month. It’s possible we’ll learn more when TMDX reports May 1.

TTD 0.00%↑ – No real news to report on The Trade Desk other than earnings on May 10. The stock has seen a recent rise as the market digested ad-related results from Facebook, Google, and Snapchat. This hopefully bodes well.

ZS 0.00%↑ – Zscaler’s initial April news was the wrap up of its One True Zero Live customer event in London. This marked the first live gathering in four years with “the engagement, enthusiasm, and support on behalf of attendees, customers, partners and speakers reminded us why events like this truly matter.” A quick recap of the highlights can be found at the link above.

Next was Zscaler being named a Leader by Gartner Research in its Magic Quadrant rankings for Security Service Edge. This was the second year in a row it made the Leader category. The release notes this follows Zscaler’s prior recognition by Gartner in it 2022 Customers’ Choice report, in which ZS was the only vendor to be classified as a leader in all eight judging segments. If interested, ZS is offering a free copy of Gartner’s Magic Quadrant report here (email address required).

One thing I noted in the accompanying comments of the report is Zscaler did not get credit for some recent platform enhancements since they were released too late to be included in this report. However, it’s clear ZS has some fellow Leaders to watch in the competition space.

My current watch list…

…in rough order includes Semsara (IOT), Aehr Test Systems (AEHR), Snowflake (SNOW), monday.com (MNDY), SentinelOne (S), and MongoDB (MDB).

And there you have it.

I’d call April a decent start with a sour finish. Our first wave of tech reports received mixed responses, which only extends the market’s ongoing skittishness with the sector. That will only be exacerbated by the Fed’s upcoming May meeting and probable interest rate hike. As with most of these meetings in the last 18 months or so, Jerome Powell’s comments will likely drive the market more than any company news in the short term. At some point we’ll get back to fundamentals. However, it doesn’t look like that time is just yet. And so the cycle continues…

Thanks for reading, and I hope everyone has a great May.

I haven't, mostly because I'm not entirely comfortable with the business model. It's subject to consumer fickleness, and I'm not exactly sure how to track the deal with SHOP. If I were to get into something in that space, I'd probably lean toward MELI even though it has a fintech component to it.

In general I do believe it's time to get more of our cash back into play but will likely wait until after all our earnings reports are in to reassess. FWIW, I did start a 1% position in AEHR with some May 19 $25 and $30 puts that could push it into the 4-5% range depending where we are in a couple weeks.

Sorry I don't have more, but I hope that helps at least a little.

Great many thanks for this informative update. I went down -6.2% in April with a completely different port....YTD I am now trailing QQQ as I fell to 17.5% from nearly 30% a week ago! And I did not even have NET but AYX lost nearly as much despite what I thought was a much better report. I will phase AYX out for now though I think they will perform better than people expect throughout the rest of 2023.

Random thoughts:

While long a Prince doubter, I was still taken aback by his comments about the workers. ENPH: it is crazy to me that ENPH lost more than NET, it is bonkers when you look at ROE and ROA and profits not to mention that the entire ENPH business is somewhat visible to the outsider. Who really knows what NET is actually doing with what. Finally Fooling has found a way to peek under the hood but even so...there is no clarity what revenue line is doing what.

I sold my TMDX starter for a small profit but remains on short list. I opened a MASI starter which I will grow to very small position before earnings and double it if I like the earnings. I am considering a NARI starter before their earnings.

Anyway, sorry for some disjointed remarks: busy day :)