Man, that was a lot of earnings reports…

2022 Results:

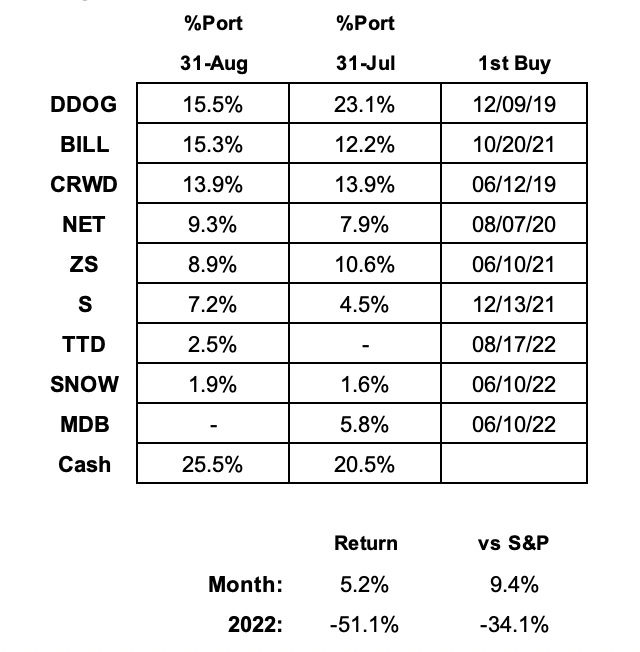

August Portfolio and Results:

2022 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2018 (the one that got things started)

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

December 2021 (contains links to all 2021 monthly report)

Stock Comments:

That was quite the rush. Every portfolio and watch list name reported this month except GitLab (September 6) and ZScaler (September 8). With a lot to cover, let’s get right to it.

BILL 0.00%↑ – I’ll admit to some nervousness about how quiet Bill.com was in the weeks before earnings. Thankfully, its August 18 report ended up doing plenty of talking. Revenue of $202M represented a healthy beat and was accompanied by strong guides for both Q1 and FY23. More importantly, BILL’s supporting metrics are holding up extremely well in the current environment:

A record 10.5 million payments and $60.7B in total volume ran through its platform.

Gross margin of 85.4%, which was well above the 79-81% guide.

A net retention rate of 131% after 124% last year (BILL only reports this in Q4). That’s a strong endorsement for the utility and stickiness of its platform.

Another 11,200 customers this quarter after a record 11,600 in Q3. That means BILL has added more customers in the last two quarters than it did in most full years previously, which bodes well as these new customers ramp up to full usage.

With the recent rise in interest rates, BILL earned $5.4M in Q4 float revenue versus just $760K last year. With a Q1 guide of $12M (vs $800K last year) and an initial FY23 guide of $55M (vs $8.6), float revenue will provide a nice little cushion going forward.

While management acknowledges “the macro environment is influencing business spend,” the combination of increased engagement, record customers, and stepped-up float revenue has kept business moving right along. BILL’s focus on operating efficiency is paying off as well with FY23’s $45.5M net income guide implying its first-ever profitable year.

All things considered this was a great quarter. We got a bigger beat, continued customer growth, and strong guides including an unexpected profit. Even in this environment the CEO sees “a number of tailwinds that are supporting the business” with the CFO “expecting a lot of good news ahead.” After reviewing these results, it’s hard not to share their optimism. I’m happy to keep BILL as one of our biggest positions.

CRWD 0.00%↑ – CrowdStrike had an interesting blog post early this month detailing how the last Fall’s $1T US government infrastructure bill would benefit the cybersecurity industry. The post outlines key provisions of the bill along with details on specific federal agencies targeted for upgrade. Cybersecurity investors have patiently waited for this spending to start hitting the books. This is a great primer for exactly what is going on.

CrowdStrike was also named a winner in the Best Security Company category at the 2022 SC Awards US. The SC Awards is an annual affair recognizing the best firms in the US cybersecurity industry based on “product strength, customer satisfaction and steadfast investment in research and development.” This is the fourth time in five years CRWD has won this award “outpacing all other vendors in the industry” and comes shortly after its Falcon XDR platform was recognized as a Best Emerging Technology at the 2022 SC Awards Europe.

As a shareholder, I was curious to see how much (if any) of this momentum would carry over to CRWD’s August 30 earnings report. In my opinion, what we received was typical CrowdStrike. The top line came in at $535M in revenue for 58.5% growth. The company added $218M in net new Annual Recurring Revenue to bring its total to $2.14B. CEO George Kurtz noted continued demand across all verticals and a record pipeline exiting the quarter.

Digging deeper, CRWD added a record 1,741 customers. This was a welcome uptick after being stuck just above 1,600 the last four quarters. It is especially encouraging considering many firms have referenced longer sales cycles in recent reports. As in past quarters the number of customers using 6+ and 7+ modules ticked up, which means customer continue adding services even in a tight economy. Kurtz says the increase is being driven by customers wishing to consolidate on CrowdStrike’s platform. The CFO supported this by pointing out net retention came in at its highest rate since 3Q21 (which was 128%).

On the bottom line, CrowdStrike continues to churn out cash flow and profits. Q2 saw $210M in operating and $136M in free cash with a record $87M in operating income. So, efficiency and profits? Can’t complain about that. One thing I’ll be watching going forward is Remaining Performance Obligation. After fading last quarter, I hoped RPO would return to a more seasonal 10% QoQ growth. It came up short at 6.4%. There’s admittedly some law of large numbers at play here – and when asked management pointed analysts toward net new ARR as a better metric – but I still would have liked a tick better.

I’d be more concerned about the lowish sequential growth in revenue and RPO if we hadn’t gotten such strong Q3 ($575.9M; +51.5%) and FY23 ($2.23B; +53.8%) guides. I wouldn’t be surprised if in the end Q3 was more like 57% and FY23 55%+. That’s pretty durable growth, especially with both Kurtz and the CFO reiterating they aren’t witnessing any significant macro pressure on the current business. Despite the post-earnings dip, I’m not seeing anything to imply CrowdStrike deserves less conviction than it had coming into this report. Overall, I’d call it another business-as-usual quarter.

DDOG 0.00%↑ – Shoot. I’d say Datadog’s August 4 report was its first mixed result since the fateful COVID pullback of 2Q20. While Q2 revenue growth remained strong, management made it clear the second half of the year looks a lot cloudier. Despite “no change to the long-term trends,” management noted “larger spending customers continue to grow but at a rate that was lower than historical levels” and “some customers beginning to manage costs in response to macroeconomic concerns.” I’d say that’s…uhh…less than ideal.

Not surprisingly for a company as strong as DDOG, there were several positives:

A 20th consecutive quarter of 130%+ NRR.

The usual steady increase in customers using 4+ and 6+ modules.

A record 1,400 new customers added (which was actually 1,600 accounting for the 200 Russian and Belarusian customers dropped at the beginning of the quarter).

Another quarter of strong profit and cash flow margins.

Unfortunately, for the first time in a long time, there were also some things to make investors take pause:

A negligible $10M dollar raise to the full year revenue guide after a healthy $90M last quarter.

Sequential RPO growth of an all-time low 2.7% with customers “being more conservative in their commitments”.

Only 170 new $100K+ customers after a record 240 in Q1. The 7.6% QoQ growth in this metric joins that 2Q20 COVID report as the only quarters under 10% in company history. Something to watch…

Numerous comments from management about the need to be “more conservative…than previous quarters” in forecasting its future business.

Customer optimization has always been a risk for DDOG given the usage-based component of its business. It appears those risks (especially with commitments) have come on faster than management anticipated and are affecting the short-term outlook right into some tough second half comps.

The good news is the long-term appears intact. In addition to the record number of new customers, management continues to aggressively hire and invest. It continues to innovate as well evidenced by recently expanding its services with both Microsoft and Amazon Web Services. CEO Olivier Pomel stressed DDOG’s efficiency allows it “to invest in times like this that the rest of the market will not have.” When asked he also noted an eye toward possible acquisitions given reduced valuations in the current market. Along those lines, Datadog announced the acquisition of Seekret in conjunction with earnings to enhance its API observability. Datadog has done well with past tuck ins, so this could end up as a silver lining as this pullback inevitably resolves.

Ultimately, DDOG remains one of the stronger companies in our portfolio. However, I’d say this quarter has pulled it back toward the rest of the pack as far as conviction is concerned. That likely requires a little more patience, and I’ve adjusted our allocation as a result.

MDB 0.00%↑ – This was quite a busy month for MongoDB. First, I found its blog more active than usual this month. One of the more interesting posts outlines the many tools and features allowing Mongo to integrate into a Zero Trust security environment. With so many enterprises moving toward Zero Trust, it’s nice to see MDB making it easier for customers to take them along for the ride.

Another enlightening post gave additional insight into MDB’s partnership with Amazon Web Services (AWS). Given AWS once attempted to offer a competing product, it’s a testament to the strength of Mongo’s offerings Amazon decided it was better to partner instead. Score one for the little guy.

Based on that early info, things seemed to be lining up well for MongoDB’s August 31 earnings report. Unfortunately, that’s where the wheels fell off. The headline numbers of $303.6M in revenue for 53% growth weren’t bad. The issue was next quarter’s guide for $303M at the top end. A guide for 0% sequential growth is just not a good look in any economy.

What about the supporting info? Well, Atlas revenue as a percentage of total jumped to 64%, so at least the main product is chugging right along. My concern is customer growth. The 1,800 total customers added was the first figure under 2,000 in eight quarters. Making matters worse, 1,800 new Atlas customers was the first below 2,000 in nine (and down from 2,200 in Q1). That’s the bigger problem and significant yellow flag given the importance of Atlas to MDB’s thesis. In my opinion, the 83 new $100K customers isn’t much consolation given the broader deceleration.

While the $12.4M operating loss was palatable, cash flows took a huge turn for the worse. MDB burned through $45M in operating cash (-14.7% margin) and $49M in free cash (-16%). The raw dollars were the highest ever with margins the worst in at least 3 years. I know Mongo had a customer conference to pay for, but sheesh. And I heard nothing from management to ease my concerns on the call.

Being honest, I don’t see much to be excited about here. We were already warned about revenue pressure, but this quarter’s customer and cash flow headwinds were a surprise. It was:

The worst Atlas customer growth in nine quarters.

The worst free cash flow margin in 16 quarters with the -$49M total more than double any other figure over the last 5 years.

The worst net loss margin since 4Q21 six quarters ago.

Even worse, the secondary numbers and current sales environment make it difficult to see where operating leverage comes from any time soon. Yes, we’ve seen a tightening across the board with many companies. However, we’ve also seen many customer and other secondary metrics at least stay on trend. That’s not the case with Mongo. All in all, I’d label this the weakest performance of any firm I’ve followed this earnings season. MDB has lost its spot as a result.

NET 0.00%↑ – Good on you, Cloudflare! NET released a strong August 4 report while answering many of the questions raised after Q1. It posted $234.5M in revenue to slightly accelerate growth to 53.9% YoY. There aren’t many firms doing that in the current environment. Even better were multiple signs of resiliency in the underlying business:

A record 212 new $100K customers for 1,749 total. That’s a huge jump over the old record of 172 with these customers now accounting for a record 60% of total business. NET currently services 29% of Fortune 1000, a nearly 3X increase in three years, which bodes well for revenue durability going forward.

A Net Retention Rate of 126%. While that’s a slight downtick from Q1’s 127%, CEO Matthew Prince says he “won’t be satisfied until it’s above 130%.” That’s good to hear since Prince usually delivers on his promises.

Remaining Performance Obligation of $760M (+57% YoY) continued to grow faster than revenue.

A modest enough raise to the full year revenue guide to imply some strength to the revenue floor.

There are also signs customers are finding their equilibrium in the current economy. Said Prince:

In Q1, our pipeline generation slowed, sales cycles extended, and customers took longer to pay their bills. We watched those metrics closely throughout Q2 and saw them all at least stabilized. They’re not where we throw up hooray yet, but the metrics are trending in the right direction.

In addition, he added:

As I look at our wins in the first half of the year, I believe it's fair to say that it's harder today than it was a year ago to sign up a new customer, but it's gotten easier to talk to our broad set of existing customers about doing more with us. And customers are leaning forward to hear about how we can save the money, reduce their IT complexity, all while increasing their security, performance and reliability.

That second quote is markedly different from firms suggesting current customers are looking to tighten spend. It also suggests a dynamic which should only help in trying to attain that 130%+ NRR target. Regardless, it appears management has a firm grasp on where its business is going.

The biggest development – and the one I’d guess led to the big post-earnings jump – was the surprisingly strong reversal of last quarter’s cash flow shortfall. Cloudflare churned out $38M in operating cash flow to get back to positive on the year. Free cash flow came in at -$4M with management repeatedly emphasizing its “heightened focus” on being positive the rest of year. Kudos to management for heeding the market’s message on that one.

One thing I’d call not-so-great was beating Q2’s $1M operating loss guide by only $100K (even if it was balanced slightly by a $1M profit guide for Q3). I also couldn’t help but notice the full year operating income guide was lowered from $14M to $11M on the top end. While I’m glad to see management so quickly address the market’s cash flow concerns, I’ll personally be looking for underlying signs of profit leverage as well as we pass through and more importantly exit this downturn.

In many ways this was a standard Cloudflare quarter. It showed continued innovation, 50%+ growth, breakeven profits, and a strong enough guide for a chance to do it all again next time around. That’s a great outcome in most environments but especially this one. I wrote last month I hoped this quarter’s numbers would be strong enough to let management focus on the future. Mission accomplished.

S 0.00%↑ – As it has most of the year, SentinelOne keeps churning out partnerships and updates. First was an integration with security firm Armis to increase “visibility across endpoints, cloud, mobile, IoT, OT devices, and more.” Next was an enhancement to S’s data analytics platform improving the ingest and search functions for security data. Last was a partnership with Proofpoint to provide unified protection on ransomware and other email threats.

The question, of course, was whether these moves would positively impact SentinelOne’s August 31 earnings report. As it stands, I thought they did very well. Revenue came in at $102.5M and 124% growth. Gross margin was a record 72%, meeting the 70% threshold two quarters earlier than management anticipated. That led to the full year margin guide being raised to 71% implying the improved leverage is going to stick. In addition:

A record number of organic customer adds.

Including Attivo, the $100K cohort jumped to 755 (+117% YoY).

Net retention jumped from 131% to a record 137%, which shows S’s products are resonating with customers and current upsell efforts appear to be working.

Progress on expenses, cash flows, and profits all ticked firmly in the right direction.

I’d call it a solid showing overall. SentinelOne backed triple-digit revenue and ARR growth with record customer adds, a record net retention rate, and its “largest ever pipeline.” While operating leverage might be coming a tad slower than predecessors like CrowdStrike or ZScaler, S is making progress there as well even in this tighter environment. I believe SentinelOne hit more than enough checkpoints to keep its thesis intact and decided to add a few more shares.

SNOW 0.00%↑ – Snowflake began August with the launch of its Sales Development Academy. According to the post announcing the move, this academy “includes four weeks of intensive onboarding, fifteen months of advanced sales skill development, and continued mentorship from a management team with over one hundred years of combined Sales Development leadership experience.” CEO Frank Slootman was adamant last quarter SNOW would aggressively hire to take advantage of its opportunity. This certainly fits that bill.

SNOW finished the month with a strong August 24 earnings report. After seeing some revenue pressure the last two quarters, things got back on track with $466M in product revenue for 83% YoY growth. The 6% beat was more in line with Snowflake’s historical average and a welcome development after Q1’s disappointing 1.7%. Even better, the top line outperformance was backed by some quality secondary numbers:

Continued gross margin strength at 71% total and 75% product gross margin.

A decline in expenses as a percentage of revenue to 67% from 71% last quarter.

476 new customers for 6,808 total. This was an uptick from last quarter’s 367 and last year’s 464. It also marked the first time in four quarters SNOW exceeded the prior year’s figure. In addition, SNOW added a record forty $1M+ customers versus 22 in Q1 and 12 last year. Customer adds are a big deal for all companies, but especially one growing into the law of large numbers so quickly. Honestly, these figures were a bit of a relief after the Q1 decline.

A $17.5M operating profit (+3.5% margin) versus a -$18M guide. With a FY operating margin guide of 2% (~$40M in income), it appears Snowflake has turned the profitability corner. That’s a welcome development.

$64M in operating cash and $56M in free cash added to SNOW’s $5B war chest.

Remaining performance obligation, which management continues to highlight as an important metric, was more muted at just 4% QoQ growth. However, the amount expected to hit the books in the next 12 months climbed 12% QoQ from $1.38B to $1.55B. That should provide a nice revenue buffer while workload migrations (hopefully) stabilize the next few quarters. We should also see a significant bump in RPO during Q4 when a significant number of existing clients renew their contracts.

Management supplemented the strong results with its usual confidence on the call. It also revealed the pending acquisition of Applica to improve support for unstructured data on Snowflake’s platform. Both CEO Frank Slootman and CFO Michael Scarpelli expressed strong enthusiasm for where things are headed. Neither sees a slowdown in Snowflake’s opportunity or their plans to aggressively pursue it. In fact, over 1,000 employees have been added year-to-date to meet the challenge. God speed, guys and gals.

I like where Snowflake sits exiting the quarter. Management ideally would have raised the FY guide more than $15M (especially after a $26M beat this quarter), but the optimist in me guesses it wanted to hold back some “prudence” for future outperformance. It also helps that Scarpelli reiterated no change to management’s assumptions toward increased workloads in the second half. While I wouldn’t call this report a blowout, it clearly answered whatever questions investors had coming in. Product revenue surprised, customer growth ticked back up, and net retention remains an incredible 171%. Slootman & Gang clearly know what they are doing and deserve a ton of credit for the continued execution. I decided to pass on the after-hours hoopla because I wanted to hear and review the call. Now that I’ve done so, this is a position I’ll look to build going forward.

TTD 0.00%↑ – An old friend rejoins our portfolio. The Trade Desk was a core holding from June 2017 until April 2020 and a leading contributor to our 2018/2019 returns. TTD is a self-service advertising platform helping clients purchase targeted ads on digital media like connected TV, internet, and mobile devices. Its “data driven buying and measurable results” lets buyers maximize ROI in any macro environment (which seems particularly relevant right now).

Why is it making a return? Well, first and foremost The Trade Desk has always been an excellent business at the forefront of its space. Unlike other ad-driven firms like Google, Facebook, and Snapchat which posted softer quarters, TTD surprised with another strong report. It earned $377M in Q2 revenue for 35% YoY and 20% QoQ growth. While that annual rate is slower than most of our holdings, TTD paired it with $139M in adjusted EBITDA, $99M in net income, and $0.20 in earnings per share. Always an efficient and profitable operator, it also has $1.2B in cash and no debt on the books. What piques my interest most, however, is the fact TTD continues to “gain market share despite macroeconomic uncertainty.” Management attributed this to three key elements:

An ongoing trend away from traditional television to streaming and connected TV (CTV). TTD has anticipated this move for years and positioned itself accordingly. The change is “growing faster than anyone predicted” and now accounts for a low-40’s percentage of total revenue.

Walled gardens are becoming much less attractive to advertisers. “Walled gardens” are platforms like Google and Facebook which have total control over both inventory and tracking. This leaves customers with little choice or flexibility in the purchasing arrangement. With no CTV platform large enough (yet) to wall off its ad space, The Trade Desk benefits from partnering with anyone and everyone.

Worldwide regulatory pressure on Google for its hard-nosed tactics has ad buyers seeking alternatives where they can. This has helped The Trade Desk increase engagement with both new and existing customers exploring other ad channels.

CEO Jeff Green has forecast these developments for years, and his positioning looks primed to pay off. Green has likewise preached an inevitable move from pure subscription-driven entertainment to more ad-supported services. Recent announcements by Netflix, Disney, and HBO suggest this tailwind will eventually benefit TTD as well.

Exiting the quarter, The Trade Desk appears to not only be weathering the macro storm but lining up to benefit strongly as things clear up. As in every even-numbered year, we should see a surge in second half revenue as US political spending hit TTD’s books. Likewise, its increased market share creates a potential tailwind as the economy recovers and ad budgets return. Could growth even reaccelerate as things loosen up? I wouldn’t rule it out. Regardless, history tells us the best companies not only withstand cyclical downturns but often exit in even better shape. The early signs suggest TTD might be adding itself to that list. I’m happy to restart a small position while seeing if that’s indeed the case.

ZS 0.00%↑ – The lone holding which didn’t report in August. ZScaler started the month by achieving FedRAMP High Authority designation for its internet and apps protection platform. According to the release:

This federal government certification enables ZIA to meet civilian agencies’ high security requirements, as well as those of the Department of Defense (DoD) and other intelligence organizations. ZIA is currently the only Secure Access Service Edge (SASE) Trusted Internet Connections (TIC) 3.0 solution that has achieved FedRAMP’s highest authorization.

With ZS’s data center and network offering already High certified, this means its entire Zero Trust Exchange is now available at the highest security clearance. That’s a great position to be in as the US government moves ever closer to implementing last May’s Executive Order on tightening cybersecurity. We’ll get an update on that and more when ZScaler reports its Q4 on September 8.

My current watch list…

…right now is some jumble of Enphase (ENPH), Gitlab (GTLB), monday.com (MNDY), TransMedics (TMDX) and ZoomInfo (ZI). Neither MNDY nor ZI impressed enough this quarter to earn a spot. I’d still like to see better operating leverage from MNDY. In ZI’s case, I’m not yet convinced it has a big enough market or enough optionality in its product line to maintain organic growth (52% to 49% to 42% the last three quarters). ENPH and TMDX did impress, but I’m still working through them. I’m a hold on GTLB at least until its September 6 report.

And there you have it.

August was a productive month. Not necessarily from a stock standpoint, which was choppy as heck. I’m talking more from a business standpoint, which matters more. This was an important earnings season for determining just how well these companies are navigating the tightening economy. I’d say most info suggests they are holding their own so far (other than MDB, of course). That’s encouraging.

As for the broader market, well there’s not much we can do about that. I continue to carry more cash than I’d like, but that’s only because I’m trying to stick to my plan. On every name I consider I ask 1) is this a company I want to own and 2) how much am I comfortable holding (general guidelines here)? Right now, eight names clear the bar at roughly the present allocations. I’m OK keeping the rest in cash while I try to find more names and/or give a current holding a larger spot. In the meantime, I’m looking forward to the post-earnings exhale.

Thanks for reading, and I hope everyone has a great September.

Nice recap, Joe! The color coded chart is suh-weet.