Well, I’d have to call this a pretty productive month.

From a portfolio standpoint, June saw our last few holdings report earnings. It also brought an end to the portfolio Battle Royale conceived in April and contested throughout May. Ten companies made the cut with some final allocation tweaks made the last couple of weeks. I’m happy with the way things turned out and believe our portfolio is in a better spot because of it.

As for the market, investors seemed to shift their attention (and more importantly their money!) back to fundamentals and growth. All that possible rotation angst and possible inflation angst and possible interest rate angst fell by the wayside as favor returned to those firms leading the way in our ever-digital world. So, what exactly should we call this recent surge after the 3-month growth pullback from mid-February to mid-May? A growth rebound? A reverse rotation? A return to strong fundamentals? In the long run, does it even matter? Patient investors can find success using just about any style if they are willing to put in the work and stick to a plan. All I’ll say about this month is I love it when a plan comes together.

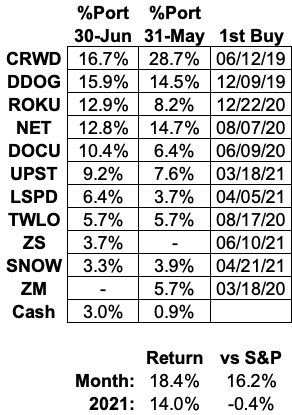

2021 Results:

June Portfolio and Results:

2021 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

Stock Comments:

After all that movin’ and shakin’, our portfolio consists of ten holdings. Seven solidified their spot in May. CrowdStrike, DocuSign and Zoom had their moment in the sun the first week of June. Two are sticking around while the other lost its place to make room for the return of an old friend. The whats, hows and whys can be found below.

CRWD – After ending May as our largest position by far, CrowdStrike released its eagerly-awaited (by me anyway) Q1 earnings June 3. The good news is management says the year is “off to a record start” in many ways. The just-OK news is this appeared to be one of CRWD’s less impressive quarters as far as meeting the market’s lofty expectations. “Less impressive” is all relative, of course…

CrowdStrike posted $303M in revenue for 70% year-over-year (YoY) growth and an acceleration to 14.3% quarter-over-quarter (QoQ). Subscriptions finished at $281M (+73% YoY) and a record 92.9% of total revenue. 77% total and 79% subscription gross margin remain strong versus 75% and 78% a year ago. CRWD added $144M in Annual Recurring Revenue (ARR) to bring that total to $1.2B (+74% YoY). Just $3.6M of that amount came from the Humio acquisition, which implies CRWD’s core business remains strong. Interestingly, we did not see the usual Q1 ARR seasonality dip. While it’s possible this is simply customers pulling forward future business in the rush to tighten security, the bet here is it’s an early sign of increased demand for CRWD’s products. Remaining Performance Obligation (RPO) – basically the amount of future revenue on the books – grew 80% YoY to $1.47B, so the pipeline’s in great shape. Said the CFO:

Similar to last quarter, demand for our solutions was well-balanced between new customers and expansion business and between large enterprises and mid-market and smaller accounts. We once again ended the quarter with a record pipeline, which we believe indicates a strong foundation for future growth.

On the customer side, a record 1,524 were added including 119 acquired from Humio. That brings the total to 11,420. CrowdStrike added three Fortune 100 clients for a total of 61, 37 Fortune 500 firms for 214, and another top-20 bank to get to 13. And all these customers are continuing to spend as dollar-based retention once again exceeded management’s 120% benchmark. CRWD has always touted its frictionless sales process with CEO George Kurtz stating its platform “is designed to sell itself and to get new customers.” The numbers certainly seem to back him up.

On the product side, CrowdStrike now offers 19 product modules. The number of customers using at least 4, 5 or 6 modules grew to 64%, 50%, and 27% versus 63%, 47%, and 24% last quarter. Management noted during its April analyst day the average new customer onboards with 4.3 modules, suggesting CRWD is quite sticky from the very first installation. The stickier the better as far as I’m concerned.

Not surprisingly, the strong execution produced a healthy bottom line. CrowdStrike generated $148M in operating and $117M in free cash flow, both records by a significant margin. That in turn generated $30M in operating (10% margin) and $23M in net income (8%). So, that gives us:

70% YoY growth with a strong 14% QoQ

Consistent profits

Record cash flows

A chance to challenge $1.5B in full-year revenue

I’m too lazy (and don’t know how) to set up a screen, but I’m going to go out on a limb and say there can’t be too many companies out there with that type of pedigree.

On the call Kurtz was his usual confident self. Never one to shy away from competitor comparisons, he highlighted wins against Microsoft and SentinelOne while taking minor swipes at Carbon Black and Palo Alto Networks as well. In addition to its core success, CrowdStrike continues its steady march into verticals beyond endpoint protection. Kurtz says CRWD is “seeing strong momentum in cloud workloads, IT operations, and our expansion into DevOps.” Becoming a one-stop shop for all digital solutions would be a huge competitive advantage, so it is easy to see why CrowdStrike is pursuing this strategy.

Along those same lines, we received what I believe are intriguing details on an expanded partnership with ZScaler. ZScaler’s CEO spent considerable time discussing the match on his call as well. Both CEOs describe the integration as a natural fit for customers seeking next-generation endpoint protection with next-generation network security. The collaboration is deep enough that both companies’ sales teams have been incentivized to help each other out where needed. Not only do the products align, but ZScaler’s top-down sales motion and CrowdStrike’s bottom-up success means the pair can hit potential customers from both directions at once when the opportunity presents itself. That could be useful as the US government explores upgrades mandated by the recent cybersecurity Executive Order. While both firms highlighted existing government wins on their calls, I’d have to think joining forces only helps in potentially opening doors to even more public sector business. This is an area to watch in future quarters.

By almost every primary measure, CrowdStrike churned out another great quarter. However, the market initially shrugged the stock downward before shoving it back to new highs during the recent surge in growth names. I’d guess at least part of the muted initial response was this being CRWD’s softest quarter yet in the beat-and-raise game. We can scoff all we want about sandbagging but beating expectations by a strong margin has become a SaaS requirement. Based on management’s history, I anticipated something around $306M with a top end guide of $325M+. The actuals were $302.8M and $324.4M. That’s not bad, but on a percentage basis it was management’s smallest ever beat. Even for hypergrowth names the law of large numbers inevitably makes upside surprises harder to come by. I can’t help but wonder if that’s part of what happened here.

As CRWD gets bigger and more visible, I’ve started to think more about this 2014 McKinsey article I’ve referenced in the past (sorry, I can’t remember the original poster to give proper credit). It suggests the sweet spot for true hypergrowth is between $100M and $1B in revenue. That range might be slightly different in 2021, but those levels still roughly jibe with my experience the past couple years. Sure, CRWD might hold off the law of large numbers better than most, but it eventually affects the comparisons for every company. If nothing else, it’s probably worth monitoring to make sure this dynamic doesn’t start creeping in around the edges. For now though, it’s hard to view CrowdStrike as anything but one of the most dominant companies around.

As for our position, I ended up trimming considerably after earnings. However, this is in no way meant to be a knock against CrowdStrike or the quarter it just posted. It was strictly a portfolio management call. We have been very fortunate to buy CRWD early and often since its June 2019 IPO. Even as it has grown to such an outsized allocation, our cost basis remains in the low-$70’s (exhibit A for what they mean by “let your winners run”). The last significant add at ~$145 in September pushed it to 20% of our portfolio. It subsequently bumped 30% several times on price appreciation alone. I’ve made multiple trims at that level but was content taking ~28% into earnings on the chance of an after-hours bump like sector mates ZScaler and Palo Alto Networks. While that didn’t occur, you’ll hear no complaints from me about the steady rise since. CrowdStrike retains its #1 spot. I’ve simply decided it’s time to keep it more in line with our other top holdings going forward. Most of the proceeds went into DOCU, ROKU, LSPD and ZS.

DDOG – Hmmm. All was quiet on the Datadog front this month. I didn’t see any announcements from the company, and a quick visit to the investor relations page shows no releases since May 24. In this particular case no news is apparently good news since the stock had a +14.3% June. 👍

DOCU – DocuSign entered its June 3 earnings fighting for its portfolio life. It responded by delivering a knockout quarter. Total revenue clocked in at $469M and 58% YoY growth. Subscriptions grew 61% to $452M and a record 96.3% of total revenue. Billings, always a key metric for DocuSign, grew 54% to $527M. More importantly, billings’ normal Q1 seasonal dip was almost nonexistent this time around. It fell only 1.4% sequentially versus declines of 6.8% in 1Q21 and 18.0% two years ago. The surprise strength helped produce a total gross margin of 81.3% (the best in 11 quarters) and subscription gross margin of 85.1% (best in 8). Not bad at all for a company seemingly battling the work-from-home narrative.

Much of the outperformance appears to be driven by customer growth that has been nothing short of amazing. DocuSign gained a record 96,000 this quarter, an acceleration to 10.8% growth QoQ. The final Q1 tally was 988,000 (+50% YoY), a number CEO Dan Springer updated to 1M+ on the call. Think about that for a second – one million customers and growing. I’d say that’s pretty good. DOCU also added 11,000 enterprise clients, bringing that figure to 136,000 (+53% YoY). A record 74 joined the group spending >$300K per year. The 12.4% sequential growth in that category was the biggest in 7 quarters including those bolstered by COVID. That’s remarkable. It also suggests larger customers aren’t slowing down but rather increasing spend as they start to plan beyond COVID. Putting the cherry on top, the increased enthusiasm produced a record 125% retention rate, the fifth straight acceleration in this metric. Last I checked, more customers spending more money as they go along is a good thing. In that respect, DocuSign seems to have it nailed at present.

Another pleasant surprise (for me anyway) was the international update. This was DOCU’s first-ever $100M+ quarter internationally, representing 84% YoY growth and 21% of total revenue. Management noted particular strength in its Europe, Middle East, and Africa segment. DocuSign also extended its Spanish-language presence by officially entering Mexico. Springer has mentioned several times now that international growth is tracking very closely with DOCU’s early US results. Given the eventual US success, that’s great news. International growth the last five quarters has gone from 44% to 60% to 77% to 83% to 84%. Yes, that covers the COVID quarters. However, it also coincides with the former CFO shifting to a VP slot specifically dedicated to international growth. Fortuitous or not, that now looks like a very prescient move. As in the US, we are seeing signs international users will not be abandoning DocuSign as the world reopens. Apparently, “who the heck wants to go back to paper?!?” translates well in any language. That bodes well as DOCU attempts to become a truly global brand.

As one might expect, all this operational goodness led to a record bottom line. Expenses came in at a record-low 61.4% of revenue. The $136M in operating and $123M in free cash flow were records as well. That in turn produced a record 19.9% operating margin on a record $93M in profit. This was DOCU’s seventh consecutive quarter of accelerating operating margin and technically its first time meeting management’s long-term target of 20-25%. Net margin was also a record at 19.6%, the fourth consecutive acceleration in that metric. The beauty is the dynamic making this one of DocuSign’s best-ever quarters looks unlikely to end any time soon. A great explanation of the current bull case can be found in this exchange on the quarterly call:

Alex Zukin — Wolfe Research — Analyst

Hey guys. Thanks for that. Dan, one of the fears I think people have had historically on DocuSign is it’s just a COVID stock, you’re going to start decelerating as you start seeing these tough comps. But I think some people forget that you’re a capacity-based model. And therefore if you’re seeing these cohorts that you added last year grow at or above previous rates, which it seems like you are with the expanding dollar-based net expansion you are very well-positioned to actually grow right through this and be even better positioned on the other side. So just talk through that, what you saw this quarter around the growth rate of those cohorts and kind of how you’re positioned going forward?

Dan Springer — Chief Executive Officer

Yeah. Well, Alex, to your point, I don’t know how people are missing it. You’re right about it in every report. I see you make that point, which I appreciate by the way. So, hopefully, people will start to listen more to your insight but I think you nailed it. I think that’s exactly what we’re seeing. We’re seeing that the phenomenon of that strong customer growth is why you see the net retention rate so high. It’s why you see for the last question from Karl, he was able to talk about such a strong guide at rates we had not achieved previously for COVID from a billings standpoint and a revenue standpoint because we are seeing that underlying demand is so strong for our customers. And I really think the key to it is what we talked about at the beginning of the call.

So the phenomenon, the people, once they see the benefits of this digital transformation particularly around the Agreement Cloud from having opportunity to grow their business with us, they don’t go back. In fact, they look for additional opportunities to expand. And so I don’t think — we don’t talk about the Q1 pull forward like it was some fixed amount of pull forward that pays Peter and takes from Paul. We look at it as this increasing demand, and it really goes back as you and I have talked about in the past for the TAM. We are still in the early days even of just the signature business. Our penetration is so low that it’s a very, very large ocean from which we’re pulling forward that continued strong customer demand. So that’s how we look at it. I think it’s fairly straightforward.

My first impression after this exchange is DocuSign should immediately hire Alex Zukin to craft its messaging, and I say that only partially tongue-in-cheek. As I’ve commented in the past, I believe part of the reason the market has been slow to grasp this “fairly straightforward” story is because Springer and CFO Cynthia Gaylor are so painfully cautious in telling it. As I wrote in January:

…the longer I own DocuSign the more I notice management’s messaging is quite conservative even when delivering seemingly awesome news. Thinking about it, I’m starting to realize most management teams seem to have either a “hook” or a “hedge” in their messaging DNA. The more transcripts I read, the more I find management comments are structured one of two ways:

Hook – “While fully acknowledging the challenges ahead, we are very happy with our performance and remain 100% confident in our plans for the future.”

Hedge – “We are pleased with our performance and plans for the future but would be remiss if we didn’t also acknowledge the challenges ahead.”

While the content in these two statements is almost identical, the tone could not be more different. When I think of the hook, I think of Zoom’s Eric Yuan, Todd McKinnon at OKTA, George Kurtz of CRWD, or the best messenger of all the companies I’ve owned, TTD’s Jeff Green. Unfortunately, both Springer and Gaylor seem to have the hedge in their DNA. Don’t get me wrong. They ooze competence. Not to mention the fact that underpromising and overdelivering is very much a winning trait. I just wish they projected more of the confidence routinely exhibited by those other execs.

Even this quarter Gaylor couldn’t help herself, passing on the chance for the softball “it’s still very early for Contract Lifecycle Management (CLM), but we’re really happy with where it’s heading” to emphatically state CLM wouldn’t be moving the needle any time soon. Oh well. I guess I can find a way to live with it as long as Alex Zukin and the rest of the market keeps letting DOCU’s performance do more of the talking than management.

The bottom line is DocuSign’s quickly proving it is emphatically not a work-from-home company. As Springer has described, it is now a work-from-anywhere company:

DocuSign went from a crisis response solution last year to a business-as-usual solution today…We don’t believe our new or expanded customers will be going back to paper, even after the pandemic recedes…We call the products and services supporting this trend the ‘anywhere economy.’

I believe that concept really took hold this quarter. That made me revisit my thesis. Heading into this report, I had doubts about the remaining eSignature runway and was looking for signs of CLM kicking in to pick up the slack. Coming out of it, I admit I likely underestimated just how much eSignature potential remains, especially internationally. That has changed my outlook, and I now believe DocuSign deserves to stick around a while. I’ve built this position back up considerably as a result.

LSPD – Well, let’s see. After I noted last month Lightspeed’s model was very acquisitive, management turned around and…wait for it…made two more acquisitions. The first is Ecwid, a global eCommerce platform allowing users to create standalone businesses in minutes. Ecwid’s tech will improve LSPD’s ability to get new businesses up and running on its platform. According to the presentation, this purchase “enhances Lightspeed’s omnichannel offering with easy-to-use tools to quickly sell online, allowing merchants to unify digital and physical operations.” Ecwid adds 130,000 customers in 100+ countries to Lightspeed’s global footprint. It generated over $20M in revenue in the past year at a growth rate of 50% YoY. The cost of this deal, expected to close during the quarter ending September 30, is roughly $175M in cash and $325M in stock.

The second is NuORDER, an acquisition spurred at least partially by early enthusiasm for Lightspeed’s new Supplier Network. Management recently remarked current participants “want to go faster than we can go today.” NuORDER’s existing platform connecting businesses and suppliers will create “significant acceleration of Lightspeed Supplier Network, significant concentration of apparel brands and [business-to-business] financial services opportunity.” NuORDER serves 3,000+ brands and transacted $11.5B+ from 100,000+ retailers in the twelve-months ended March 31. It also generated $20M+ in revenue at YoY growth above 30%. This deal will cost ~$425M split equally between cash and stock. It is also expected to close by September 30, though the two deals are not contingent upon each other in any way.

I bumped LSPD a decent amount after earnings but plan on being a bit more cautious on any adds from here. I’d already written this company has a lot of moving parts. Now it has two more, and fairly large ones at that. These acquisitions look pricier than last Fall’s, which is not surprising given more certainty around COVID reopenings. The catch is those higher prices leave less wiggle room for missteps or delays in bringing all this new business in-house. I want to make sure this position stays sized appropriately while management proves it can turn all these “synergies” into bottom line success.

NET – As usual, Cloudflare spent most of its month churning out even more features and updates for its customers. First, NET further strengthened the Zero Trust capabilities of its Teams platform. The new features will let customers establish a Zero Trust network based on identity and not IP address. According to the post, it also seamlessly enforces the same access rules whether the end user is connected through the internet or a private network. This should greatly enhance the productivity of remote teams “wherever your users work, without slowing them down.”

Next, Cloudflare announced an expansion of its data center partnerships. Since initiating this program in August 2020, NET has increased its accessible network from roughly 200 data centers to 1,600+ worldwide. Clients could already create secure connections with any device from any place at any time. These partnerships further extend the geography where Cloudflare’s usual levels of speed, privacy and security will be maintained. That sounds like more of a behind the scenes improvement to me, but I’d have to think it’s one that will appeal to developers. It’s also one that should increase the stickiness of Cloudflare’s platform.

Finally, Cloudflare announced deeper security and infrastructure integrations with a host of heavy hitters. The partner list includes Microsoft, Splunk, Datadog, and Sumo Logic. Since most IT departments use products from multiple vendors, it only makes sense for Cloudflare to play nice with as many as possible. The more, the merrier I say.

If nothing else, Cloudflare deserves full credit for following through on CEO Matthew Prince’s boast that “going into 2021 look out we’re a lean, mean innovation machine, and we have no intention of slowing down.” Like most shareholders, I’m looking forward to some of these initiatives starting to pay off in upcoming quarters.

ROKU – It was an extremely busy month for Roku. Things kicked off with the launch of a new series called “Roku Recommends”. The show will be a “fifteen-minute weekly entertainment program that uses exclusive Roku data to highlight best bets and hidden gems across the Roku platform.” It will feature a weekly top-5 list of titles to watch across the thousands of Roku channels. Several national advertisers are already on board as debut sponsors including Walmart. At first glance this looks like another smart way for Roku to monetize its in-house real estate and extensive first-party viewer data.

Roku also leveraged its recent Quibi acquisition by signing up for a second season of Kevin Hart’s “Die Hart” series. This is significant because it marks the company’s first major in-house program renewal. Die Hart has been a strong performer for Roku, and the company clearly feels comfortable enough with the risk/reward to commit for another season. This is exactly what management hoped to do with Quibi’s content, so it’s nice to see some early return on that investment.

Later this month we learned The Roku Channel logged a record two-week streaming period after releasing its Roku Originals programming. This included a selected list of 30 Roku-owned titles. Said VP of Programming Rob Holmes:

The first two weeks have surpassed our expectations, with millions of people streaming Roku Originals, and provided a further demonstration of The Roku Channel flywheel, with great content driving record engagement that’s appealing to advertisers seeking to reach the streaming audience.

Management has consistently sold The Roku Channel as potentially being a nifty little revenue stream. Things seems to be off to a good start towards making that happen.

June also included two hardware updates. The first was manufacturing partner TCL announcing it will release several Roku-powered smart TV models in the UK. This fits well with Roku’s plans to expand internationally while further engaging and monetizing US customers. Though Roku is still in the early stages of gathering international eyeballs, having one of its main partners assist in the effort can only be a good thing.

The second was a June 30 New York Post report of Apple purchasing a branded button on Roku remotes for its Apple TV+ streaming service. According to the article, the button was revealed in a picture on Roku’s website without either company making a formal announcement. The article states, “It is believed that this is the first time Apple has put its branding on a competitor’s hardware.” Even if that’s not the case, this is a big win for Roku. The fact these branded buttons are now claimed by Netflix, Disney, Hulu and Apple is strong validation of Roku’s platform and viewer base.

All things considered Roku’s on quite the hot streak. It seems almost every seed the company has planted the last couple years is starting to bear fruit. The bull thesis here is all about operating leverage and profitability kicking in as its platform scales. Fortunately, we are seeing more and more signs of that as we go. The market seems to be noticing as well with the stock soaring 32.4% in June. That price appreciation and some additional shares have pushed ROKU back to a double-digit allocation for us.

SNOW – Most of Snowflake’s June news came in conjunction with its annual Snowflake Summit. Anyone interested in a recap of the entire event can find it here.

The individual announcements which stood out to me included a set of tools designed to make it easier for customers to use SNOW’s platform. The new features will give developers greater flexibility in setting up workflows regardless of programming language or whether the targeted data is in a structured or unstructured format. The upgrades also include tighter governance capabilities, improved storage, and a streamlined usage dashboard to better link and understand costs across multiple Snowflake accounts.

We also received an update on SNOW’s rapidly growing data marketplace. The exchange now has over 500 data listings available for purchase or collaboration. The service lets users quickly share, analyze, and interpret data for deeper insights across industries. Management sees huge potential in data sharing, so it’s not surprising to see its efforts ramp up in this area.

Finally, the company launched a "Powered By Snowflake” initiative to help customers build applications in its data cloud. The founding partners include BlackRock, Adobe, Instacart, and Lacework. The program is designed to assist customers with the entire API process from design to development to adoption to optimization. Obviously, the more traffic Snowflake steers to its platform, the more money to be made. Therefore, making it as easy as possible to navigate that platform seems like a no-brainer.

As we reach 2021’s midway point, Snowflake lines up as one of my most dominant businesses. It also happens to be one of my most expensive stocks by far. At this point I’m content to hold the small amount I have and see how things shake out for a while. This month’s allocation decrease had nothing to do with any change in shares. It was simply due to everything else rising more than SNOW in recent weeks.

TWLO – Much has been made the last few months of Twilio’s possibilities since acquiring Segment and its powerful customer analysis tools. This month saw hard evidence of that potential with the release of Journeys, a tool specifically designed to let users create customized personal communication with consumers. Journeys contains over 300 customer engagement applications, including communications, advertising, analytics, and more. We know every customer is different. Journeys is designed to meet those customers at whatever time and over whatever channel they prefer. This could be a major driver of future revenue and aligns very well with the vision expressed at the time of the acquisition. If nothing else, we certainly can’t say management is not aggressively pursuing its stated goals.

The balance, of course, is making sure Twilio’s future plans are firmly supported by present performance. While I appreciate management’s vision, I must also admit TWLO is currently tethered to one of my shorter leashes. Its intriguing upside is at least partially offset by the lack of consistent profits. Since Twilio already sports one of my highest market caps and lowest gross margin profiles, I’m giving it a little less leeway than say Cloudflare on the wait for operational leverage to start finding the bottom line. TWLO will remain a smaller allocation until it proves it can clear that hurdle.

UPST – Let’s start with the business. Upstart began June with a nice little win when it was named a preferred AI lending partner by the National Association of Federally-Insured Credit Unions (NAFCU). According to the release, the “partnership was approved following a rigorous, independent review and voting process by credit union CEOs.” That’s a compelling vote of confidence for Upstart’s platform and services. NAFCU has roughly 800 member organizations nationwide. Although I couldn’t find a dollar figure for total assets under management, I did find this:

At the end of 2020, NAFCU’s membership represented 56 percent of federally-insured credit union assets, 35 percent of federally-insured state-chartered credit union assets, and 76 percent of federal credit union assets – all increases from the previous year.

Upstart’s management has identified increasing its lending partner network as a major goal for 2021. This looks like a significant step in the right direction.

That announcement was followed by a new technology partnership with NXTsoft, a company specializing in “secure, comprehensive and complete API connectivity.” This arrangement lets financial institutions more easily integrate Upstart’s platform into their existing services. The release notes NXTsoft’s OmniConnect offering works with virtually all US-based core banking systems, and it currently has over 1,000 financial institutions utilizing its API solutions. This exposure should be a nice boost for Upstart as it continues building out its partner network.

OK. Now that that’s out of the way, we can turn to the stock. UPST’s last six weeks have been about as volatile a run as any shares I’ve ever owned. From a post-earning dip below $85 in mid-May, UPST briefly rocketed above $190 in early June as buyers and short sellers placed their bets around the company’s June 14 share lockup expiration. It routinely saw daily swings of +/- 10% during this stretch as the market tried to guess the outcome. It ultimately ended the month at $124.90, which oddly enough isn’t that far off the $120 per share Wall Street paid for the oversubscribed mid-April secondary offering. Now that the lockup excitement has passed, I’d expect Upstart’s business performance to have greater influence on future stock returns. Fortunately, that performance projects to be strong the next several quarters at least. I wasn’t nearly as active as many trying to trade this month’s volatility but did add a significant chunk on the last dip below $120. I figure if that price is good enough for Wall Street, it’s good enough for me. If next quarter is another blowout, I can easily see pushing this allocation even higher during the back half of the year.

ZM – Zoom entered June hanging onto its portfolio spot by a thread. That thread snapped by the end of the very first bullet point in its June 1 earnings release. The $956M in revenue was almost $20M less than I needed to see to even consider Zoom’s growth story intact. It marked ZM’s slowest sequential growth ever, and it’s not even close. So, even with the eye-popping profits, the slowdown means ZM is no longer one of my best ideas.

I finally got it through my thick skull Zoom has evolved from a smaller, faster grower to a bigger, slower one. While the videoconferencing business has become a massively profitable cash cow, Zoom Phone and the new Zoom Events just aren’t ready yet to keep the growth party going. ZM is still a great company for a lot of investing styles. It just no longer fits mine.

From an allocation high of 30%+ after last September’s earnings pop, I trimmed ZM significantly in December, January, March, April, and May. Even if that means I subconsciously saw this coming, I still kinda half-assed my way out of it. Being honest, my main screw up occurred immediately after last quarter’s release. ZM missed my revenue expectation then as well but only by $8M. I was happy with the 10%+ rise into earnings but in no way thought ZM deserved the additional 10% spike after hours that pushed the price from $373 to $450 on the day. Unfortunately, I hesitated on selling even though that’s what both my gut and brain told me to do. After it cratered the very next day all the way back to $373, I spent the next three months anchored to that rise and hoping for a bounce. That’s a lot of opportunity cost left on the table based mostly on hope.

I recently came across an excellent observation from investor Ian Cassel:

Oddly enough, I thought of Zoom the moment I read that quote even though it took me an extra six weeks to actually do something about it. In the end, I gave Zoom too much credit for being a phenomenal past investment without the proper rigor for whether it would be a great future investment. Thinking it over, I let Q4’s exciting after hours rise override both my process and intuition. I won’t make that mistake again. Until I do, of course. At least next time I might have a better chance of recognizing and avoiding it as it happens.

Zoom was a wildly successful investment and a major reason for my 2020 gains. However, even wildly successful investments can produce a mistake or two along the way. Lesson learned. Again.

ZS – My on-again, off-again relationship with ZScaler is back on again. I sold it in April to make room for Snowflake after determining I had enough cybersecurity exposure with CRWD and NET combining for >40% of our portfolio. With ZS’s strong May report and this month’s significant CRWD trim, I decided there was plenty of room to add Zscaler back to the mix.

Part of my interest here is the budding relationship with CrowdStrike, our longtime top holding. ZS and CRWD have worked very closely the past 18 or so months to integrate their offerings. Like CrowdStrike CEO George Kurtz, ZScaler CEO Jay Chaudhry gushed about the benefits of CRWD’s endpoint protection combining with ZS’s cloud services. Chaudhry also confirmed the joint incentive program encouraging the companies’ sales teams to work together on closing deals. That could be a powerful one-two punch in landing new business.

This arrangement is particularly intriguing when considering upcoming government contracts. ZScaler already has many of the certifications needed for selling at the top levels of the US government. As the CFO stated:

We've invested significantly in federal. As Jay talked about, the FedRAMP certifications, FedRAMP High for ZPA. And also, we are moving toward FedRAMP High for ZIA, which puts us in a completely different position than other companies.

That should be an advantage as state and federal agencies stress test their security systems. We know a flood of public sector upgrades is coming, and sooner rather than later. ZScaler is in position to win a considerable amount of business when it does. Being able to bundle CRWD’s endpoint protection when needed should be a huge benefit.

In addition to the CRWD deal, ZScaler released deeper integrations with ServiceNow. The enhancements will give security teams better visibility, access, and protection for cloud workloads. It will also enable faster threat detection and incident response. This flexibility and ease of use with a growing number of partners should be very appealing to potential customers wanting to make their end-to-end security systems as seamless as possible.

Entering ZS’s May earnings report, I felt there was minor risk its recent growth uptick was due mostly to lapping softer comps. However, this quarter’s revenue (+60% YoY), billings (+71%) and RPO (+85%) growth suggests the business is in excellent shape. Chaudrhy remarked:

Our core ZIA [internet and apps protection] and ZPA [internal data center and public cloud protection] business has never been stronger. And we are excited about the early traction of ZDX [remote work protection] and ZCP [cloud workload protection], the next growth engines for the company.

Management also identified enterprise as its fastest growing business segment, which is nice to know as we wait for government spending to hopefully kick in. In the big picture ZScaler is lining up as a strongly profitable 50%+ grower the next few quarters at least. Any surprises in government business would simply be icing on the cake. That’s a very attractive combination, and one I am glad to welcome back to our portfolio.

My current watch list…

…is led by FVRR (Fiverr) and ZoomInfo (ZI). Being honest though, I see a noticeable gap between our present holdings and even these two firms. If a current company faltered, I’d more likely shrink to fewer names than add a new one. Frankly, I see that as a positive side effect of tightening up my standards.

And there you have it.

June marked the end of a pretty intense six-week window. During that time, I scrutinized well over a dozen earnings reports and then stepped back to try to figure out how it all fit. For better or worse, our current portfolio is the result of that exercise. Some lessons learned:

First and foremost, you can never pay too much attention to your holdings. All companies have somehow convinced us they deserve our money when we first buy them. There is nothing wrong with making them verify they should keep that money as we go. In fact, our returns will likely be better for it.

It’s totally worth it to think about what you expect from your companies BEFORE they report. It helps immensely in controlling your emotions, rationalizations, and biases upon seeing the results. YOUR expectations are what matters, not management’s or Wall Street’s. It’s your financial future at stake after all, not theirs.

The best way to run a concentrated portfolio is to keep your standards somewhere between demanding and ruthless. Some decisions will work out. Some won’t. Unfortunately, there’s no way to tell in the moment. However, one thing I keep learning the hard way is waffling in-between is almost always a losing strategy. Hold high standards, be decisive, and don’t take a chance on excusing or rationalizing your way into lesser returns. That’s just bad process.

Do not half-ass your way out of positions in which your conviction falters. Though I touched on this with ZM, I’d like to take a moment to reflect further. Now that I’m fully aware of it, I realize I’ve limited our returns multiple times by trying to ease out of companies I no longer had full faith in. It started with Square in 2019. Same with The Trade Desk, Roku (my first stint), and Alteryx in 2020. I did it again with Peloton in April before this month’s epiphany with Zoom. Every single time I’ve left money on the table by dragging my feet on exiting a position I ended up taking to zero anyway. It’s not that these companies are bad investments. They just no longer fit for me, and I believe keeping them around too long only served as a distraction from the rest of our portfolio. To add insult to injury, I had better options available almost every time but chose not to take them. It is important to note in none of these examples did I consider the change in business a temporary stumble that didn’t affect the underlying thesis, like say Datadog’s 2020 COVID dip. Instead, in each case the business performance fell short of my expectations with no foreseeable way to regain what I believed were hypergrowth levels. I guess the lesson here is to make sure yellow flags for your holdings are indeed only yellow. Failing to recognize sneaky shades of red can be quite costly.

So, what’s my main takeaway from all this? Well, I’d already known for quite some time I’m not a simple buy-and-hold investor. What I now fully understand is I’m a buy-and-verify-the-crap-out-of-it-until-it-no-longer-fits type of guy instead. And the instant it doesn’t, it needs to go. No ifs, ands, or buts. A big thank you to Ian Cassel for the initial observation which led to this conclusion. Occasionally you need someone else to articulate a notion you can’t quite express yourself. That’s certainly the case here, and I’ll almost certainly be a better investor for it.

Thanks for reading, and I hope everyone has a great July.

Thank you for sharing your thoughts, Joe! I always appreciate your insights.

The Ian Cassel tweet and the lessons learned were an eye-opener for me, especially when I'm still hanging on to my remainder of Fastly shares (after trimming them last quarter).

I was curious to know the importance of taking taxes into consideration when you sell out of a position with huge gains. Do you ever consider that or your situation is different in a way that you've got a majority of your portfolio in non-taxable accounts?

Thanks!

Great insights as always. Thx for sharing!

You wrote a post a while back explaining how to best calculate portfolio returns. I just cannot find it. Can you please tell me which one it was. Pardon my ignorance.

Thx!