Well, growth stocks haven’t had a month like this in quite a while. Nothing wrong with celebrating the moment…

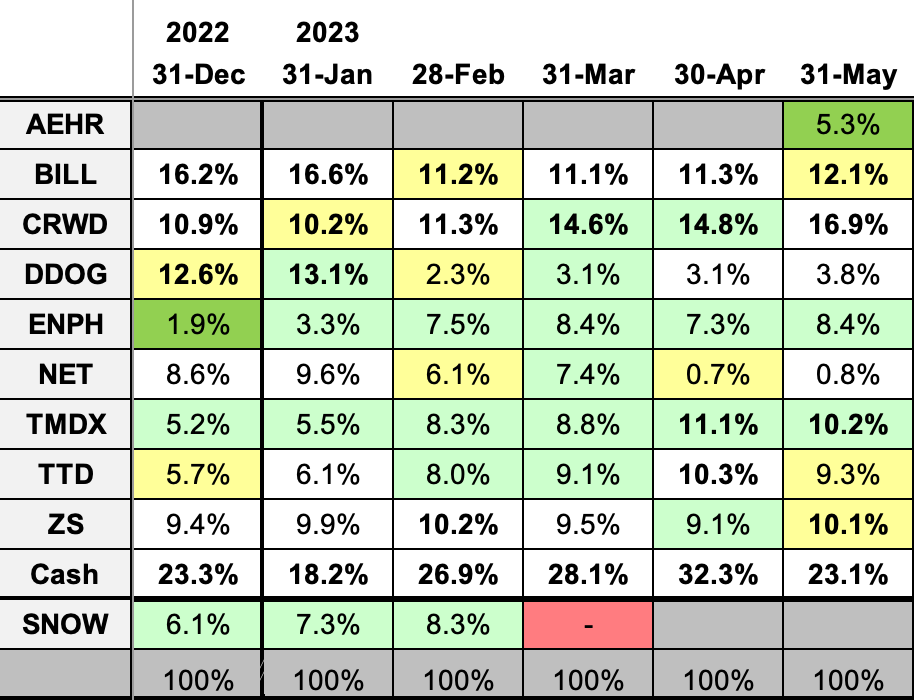

2023 Results:

2023 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2018 (the one that got things started)

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

December 2021 (contains links to all 2021 monthly reports)

December 2022 (contains links to all 2022 monthly reports)

Stock Comments:

Lots of earnings updates this month with a new name joining the fray. Details below the fold…

AEHR 0.00%↑ – Aehr Test Systems joins our portfolio this month. AEHR is a small company producing burn and test systems for semiconductor wafers. Its main markets are automotive, mobile, silicon photonics (optical sensors), memory/logic chips, and silicon carbide semiconductors. Aehr runs a razor-and-blades model selling initial testing units with follow up purchases of supply kits to run the tests. The technical appeal of its system is twofold:

its units burn multiple wafers at once rather than the traditional one at a time and

its test is sensitive enough to meet the failure requirements of electric vehicle manufacturers and other chip-heavy users.

While revenues are relatively tiny at present (just $17M last quarter), AEHR is already solidly profitable on both a GAAP ($3.8M, 22% margin) and non-GAAP ($4.1M, 24%) basis. Its main risk is customer concentration from its largest client (believed to be Onsemi). However, part of the upside here is two new customers currently testing Aehr’s system to ensure failure rates are acceptable. If these tests are successful, management believes each of these customers could scale to a similar size as Onsemi. That would produce a significant growth spike for what is already an efficient, profitable company.

With the rise in electronic vehicle chip production, I have seen speculation as to whether Aehr might eventually sell systems to Tesla. I don’t personally consider that part of the thesis since Tesla does most things in-house. However, there’s nothing in theory stopping Aehr from selling systems to chip suppliers for every automaker not named Tesla. That idea combined with Aehr’s other markets looks like plenty enough upside for me to start a small position and see where it goes.

BILL 0.00%↑ – Bill delivered in a big way in its May 4 report. It beat on both the top and bottom line with a $35.5M bump to its full year revenue estimate. Even better, the supporting metrics showed impressive strength:

A record 87.0% gross margin due to outperformance “across our multiple revenue streams” and not just float revenue.

Another 15,200 total customer adds with 3,700 core additions and 11,500 through financial institution (FI) partners. The relative strength difference between the two cohorts remains a factor (core is much stronger), but kudos to Bill for continuing to fill the front end of its funnel. One thing to note is management expects lower net FI adds next quarter as Bank of America sunsets a Bill-powered legacy product. This doesn’t change Bill’s overall agreement with BofA though, and management noted most of its more active BofA customers have already transitioned directly to Bill’s platform.

Total payment volume of $61.0B, which is a nice uptick from management’s ~$55B expectation. The CFO credited it to more customer TPV stabilization than expected this quarter. Whatever the reason, this is a welcome development.

A record $33.1M in float revenue. While I dislike what higher interest rates might be doing for me, I can’t complain about the effects on Bill’s float revenue.

Bill crushed its $29.5M net income guide with a record $58.7M and 21.5% margin.

It also pocketed $34M in operating and $23M in free cash. In the current interest rate environment, float revenue alone should let Bill hold this trend for the foreseeable future.

In addition, I couldn’t help but notice a more confident tone from management on the call. While we aren’t totally out of the economic woods, it does sound like Bill’s customers are finding their equilibrium. Overall, I find it hard not to like this quarter a lot. We know Bill’s small-and-medium business customers are among those most tested by the current environment. Against that backdrop, I can’t help but feel encouraged. I like the groundwork Bill is laying as we continue to move through this cycle.

CRWD 0.00%↑ – CrowdStrike gave us several May updates. First, Gartner Research ranked CRWD #1 globally in Managed Detection and Response (MDR) market share for the second year in a row. Forrester Research followed up by placing CrowdStrike in it Leader category in its Leader category for those same MDR offerings.

CRWD then joined the generative AI rush with two pre-earnings announcements. First was the release of Charlotte AI, a new feature letting customers ask natural language questions in dozens of languages to better help with incident detection and response. Next was an expanded partnership with Amazon Web Services developing additional tools for customers to navigate their AI journey.

Last was an announcement CrowdStrike achieved IL5 Authorization to secure US Department of Defense data. This is the highest level granted for handling unclassified information and should expand CRWD’s appeal to US defense, intelligence, and other federal agencies.

Everything above paled in comparison though to CRWD’s May 31 earnings. The question into this report was whether CrowdStrike could maintain Q4’s surprising business momentum. My initial feeling is more no than yes. The $692.6M in revenue, $727.4M Q2 guide, and bump to an estimated 35.5% full year growth were a reasonable start. So was the usual 120%+ NRR and uptick in the percentage of customers using 5+, 6+, and 7+ modules. The bottom line was solid as well with CRWD’s usual crazy-strong cash flows, a record 19.7% non-GAAP net profit margin, and its first-ever GAAP profit. So, why was the initial market reaction mostly sour toward the print?

Well, my guess is Q1’s net new ARR and RPO results. Net new ARR of $174.4M was not only CrowdStrike’s first-ever YoY decline (-8.5%), but the sequential drops of -$47.4M and -21.2% were record lows even with the usual Q1 seasonality. Management said it expects a continued -10% YoY headwind during the first half with the expectation of a “return to year-over-year growth in net new ARR” by the end of the year.

RPO growth followed a similar trend. After an acceleration to 48.7% YoY last quarter, it dropped to 40.8% this time around. Of bigger concern in my opinion is the -$53M and -1.6% sequential growth are the first QoQ declines ever. I totally get management’s “shift from multi-year deals to 1-year deals” means “deal durations are getting shorter,” but that doesn’t mean I have to like it. Combined with net new ARR, that’s somewhat disappointing in terms of future commitments.

On the whole, I found this report just OK. While the quarter itself was steady, the outlook sounded less optimistic than some other firms and definitely less enthusiastic than last quarter’s comments. However, I think this is one of those cases where it’s important not to get too caught up in the after-hours price action when gauging the results. In the two weeks into earnings, CRWD ran from $140 to $160. The after-hours slide pushed it all the way back to…$141. So, the market basically said CRWD didn’t live up to the pre-earnings hype. I think the kids these days call that a great big nothing burger.

In the end, CrowdStrike is a strong business holding up fine (which the post-earnings drift up seems to support). The new question becomes just how much of an allocation that deserves. I had done very little with this position in recent months and seen it grow to almost 17% on this strong run. I leave this quarter feeling it now deserves something smaller, though I don’t know exactly where that settles yet. Ask me again after I’ve had a chance to chew on it a bit.

DDOG 0.00%↑ – Mr. Market breathed a huge sigh of relief after Datadog's May 4 report. Being honest, so did I. While the market clearly priced in a worse quarter, I found the report about what I expected. The headline $482M in revenue was a decent beat, especially considering a March outage caused roughly $5M in lost revenue. The $10M bump in the full-year guide also move expected growth back above 25% (25.3% to be exact).

Digging deeper, Datadog was able to run its streak of consecutive quarters with a 130%+ NRR to 23. However, as management has told us that streak is expected to end next quarter. That’s not surprising since most companies are seeing recent pressure on NRR. More encouragingly, the number of customers using 2+ (81%), 4+ (43%), and 6+ (19%) remains strong. Optimization or not, DDOG’s products remain sticky for current users. Customer growth and RPO were passable with the usual strength in cash flows and profits. All in all, a reasonable quarter.

This report became a nice springboard for DDOG’s post-earnings release of a ChatGPT integration letting organizations track AI usage, costs and performance. While this integration isn’t about using AI as much as monitoring it, the release seems right up Datadog’s alley as customers inevitably increase the number of applications which will need to be observed and optimized using this new technology.

Lastly, Datadog announced a deeper integration allowing Microsoft Azure users to better manage and monitor AI models in cloud-based workloads. Yes, it’s way too early to identify the market’s future AI winners. Good on DDOG, however, for continuing to release features that appear to be staying on trend.

ENPH 0.00%↑ – Enphase’s May continued its steady cadence of product and deployment news. First it launched home energy systems using its microinverters and batteries in Australia. Next, ENPH began microinverter sales in Poland, the firm’s latest European market. It followed with expanded deployments in Mexico and the UK. Then Enphase launched “its most powerful home battery to-date” in the US and Puerto Rico. The whirlwind ended with an expanded partnership with European distributor Natec. If nothing else, ENPH certainly isn’t standing still.

I know the stock price has lagged recently due to concerns about US softness, but Enphase’s international business continues to be on an absolute tear. The bet here is the combined numbers will gel nicely once the US finds its equilibrium. Management suggests that should start to show up in the second half. I’m willing to wait a bit to see where things go.

NET 0.00%↑ – As I wrote last month, I wasn’t a fan of Cloudflare’s most recent report. However, I still have the tiny amount of shares I didn’t sell immediately after the print. I decided to hold them at least through mid-May’s Developer Week. Not surprisingly, the week encapsulated why Cloudflare is becoming a bit of a battleground stock. As usual, it released a flood of updates during the week including ten (!!!) grouped in the very sexy “AI announcements” category. I can’t help but note though NET plans to storm into AI with a host of free offerings intended to lead to future business rather than contribute now.

So, the Week basically served up something for everyone. Whether you run with the “OMG, the innovation!” gang or the “Yeah, but when is it going to show up?” crowd, Cloudflare didn’t disappoint. NET remains a crazy-innovative company with some self-inflicted issues to fix. Full disclosure, I’ve sold calls covering my last handful of shares at these prices. Since I have enough cash already, I plan to keep rolling them for credits or lose the shares, whichever comes first.

TMDX 0.00%↑ – In my opinion TransMedics posted about as good a quarter as could be expected May 1. The best thing a smaller, faster-growing company can do is maintain hypergrowth while steadily improving operating leverage and the bottom line. In that respect, TMDX nailed it. The company posted 162% YoY growth while bumping the FY guide from $145M all the way to $170M. Management continues to hit its increased capacity milestones and aggressively look to expand its market. The more I listen to CEO Waleed Hassanein, the more I appreciate his attention to detail and drive to execute. Yes, TransMedics must juggle multiple supply and logistics variables to pull this off. The good news so far is management has proven up to the task.

The catch here is TransMedics’ will need to revamp its transportation network to fully meet demand. While its technology can preserve organs over national distances, the current delivery network still reflects the regional limits dictated by storing organs on ice. Management suggests purchasing its own charter company as the most efficient solution for eliminating this bottleneck. To address this issue, TMDX announced a $300M convertible note offering shortly after earnings which eventually raised north of $400M. The bulk of these funds will undoubtedly be used to strengthen transportation. The market didn’t like the announcement initially but seemed to settle in once terms were announced. A 1.5% interest rate is pretty darned good in this environment with the shares backing it given an initial conversion price of $94 and cap of $141.88 (versus that day’s $70.94 close). If nothing else, it seems institutions are willing to put their money behind their mouths as far as TMDX’s upside. I’m good with that.

TTD 0.00%↑ – Even as this market consistently forces us to reassess what a “good” quarter looks like, The Trade Desk keeps delivering good quarters. My main takeaway from its May 10 report is TTD appears to be coiling every spring it has at its disposal. It produced a solid beat on both the top and bottom line with next quarter’s guide suggesting a possible re-acceleration of revenue growth. In addition, TTD “is still growing well in the double digits [21% YoY] while others are contracting or in the low single digits.” That only bodes well when (not if) the broader advertising tide turns, especially given what I’m sure is going to be enormous political spend in late 2024. I’m comfortable continuing to hold our medium-sized position.

ZS 0.00%↑ – Zscaler hasn’t officially reported yet (June 1) but nonetheless gave itself a “good quarter” bump May 8. ZS pre-announced that day raising its Q3 guide from $398M to $419M. More importantly, management also raised the full year revenue and billings guides. Since I was expecting something around $418M for the quarter, you’ll hear no complaints from me. At the same time, that doesn’t stop me from hoping management left a million or two in the till to get us to $420M+ when the final number is released.

Zscaler followed up with the release of enhancements to its Digital Experience monitoring and troubleshooting solution. The details read more like expanded features than anything new, but kudos to management for at least putting the obligatory “AI-Powered” in the headline to show it is keeping up with the times.

It ended the month appointing a new Chief Technology Officer. Syam Nair brings 25 years of experience mostly with Salesforce and Microsoft. I’m sure we’ll hear more about Nair’s role in helping the company scale when we get that June 1 update.

My current watch list…

…in rough order includes Semsara (IOT), Super Micro Computer (SMCI), monday.com (MNDY), SentinelOne (S), Snowflake (SNOW), and MongoDB (MDB).

And there you have it.

I’ll double up on the fist pump at the top. It’s been a long time since our portfolio saw a month with double-digit gains – October 2021 to be exact. Even better, the market sentiment driving this surge has mostly been backed by encouraging business performances. With this week’s debt ceiling “crisis” at least temporarily solved, the market has been doing some fist pumping as well. I’m perfectly content to sit back and enjoy the ride as long as it lasts…

Thanks for reading, and I hope everyone has a great June.

Nice report, sir!

I love disruptive tech stock IPO's