2024 Results:

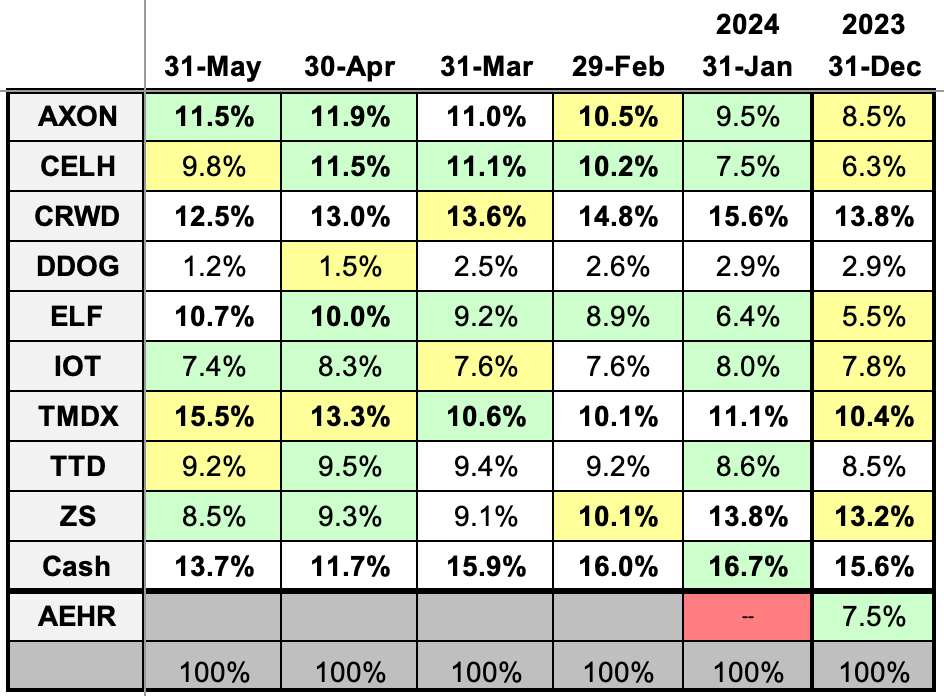

2024 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

*Please note: I rolled an old 401K worth ~2.5% into the cash balance of this portfolio to start 2024. I’ve shaded the January cash cell to make sure the new cash is represented accurately (and honestly to remind myself as well).

Past recaps:

December 2018 (the one that got things started)

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

December 2021 (contains links to all 2021 monthly reports)

December 2022 (contains links to all 2022 monthly reports)

December 2023 (contains links to all 2023 monthly reports)

Stock Comments:

Gotta love a strong wave of earnings reports…

AXON 0.00%↑ – I’d call Axon’s May 7 report a rock-solid showing. Its flagship Taser continues to lead the way while its body cameras, digital evidence offerings, report writing software, and drone applications all have the potential to massively increase stickiness with current customers. In conjunction with earnings, Axon acquired Dedrone to accelerate its drone solutions. Management highlighted Dedrone’s international exposure as an attractive component of this deal, which is expected to close over the summer and contribute one full quarter to the fiscal year. With plenty of international runway, this seems like a smart move.

All in all, I exit this quarter feeling the thesis is fully intact. Axon’s never been a huge beat-and-raise company. It simply plows ahead doing a little bit better than expected every time out. This was another one of those times.

CELH 0.00%↑ – Celsius’s May 7 report was an interesting one to write up. While the secondary metrics looked great, CELH also posted a significant revenue shortfall due mostly to the timing of some inventory purchases by distribution partner PepsiCo. Even giving back PepsiCo’s $20M impact left Celsius short of analyst consensus. I’m wondering if that lumpiness is simply par for the course in a business where inventories are managed at multiple checkpoints between Celsius’s production and the final sale. This will be especially true as CELH enters new markets. That being said, how hard can you knock a company that grew 9.6% sequentially during a quarter in which its overall category shrunk 0.4%?

Stripping it down to what Celsius controls, the business seems fine. Any dings on the quarter are almost entirely due to Pepsi’s inventory adjustment and the 0.4% sequential energy drink decline. Hopefully, both are temporary. In the bigger picture, the numbers say Celsius grabbed a significant amount of market share in what happened to be a slow quarter for the industry. The only real risk I see is if energy drinks somehow go out of favor. Otherwise, everything seems to be going to plan. I did, however, cut our allocation a bit on the run back to $90 to reflect a slightly lower (though still healthy) conviction level.

CRWD 0.00%↑ – CrowdStrike had another busy month. First, it announced an expanded partnership with Amazon Web Services unifying Amazon’s own protection on CRWD’s Falcon platform. CrowdStrike now protects Amazon “from code to cloud and from device to data.” With Falcon being both built and sold on AWS, Amazon should be as familiar as anyone with what the platform offers. I can’t see this as anything but a ringing endorsement.

Next, CRWD announced a strategic partnership with Tata Consultancy Services (TCS), a global consulting firm serving clients in 131 countries. TCS is a major player in the space with $29.1B in revenue last year and $42.7B in future orders on its books. Under this agreement Tata’s managed detection and response services will now be powered by CRWD’s Falcon XDR platform. Given the dollars involved, this deal will hopefully move the needle for both parties.

The following week CrowdStrike kept itself extremely busy at the RSA Conference for cybersecurity professionals. At this event CRWD:

Released to general availability an Application Security Posture Management tool to deepen its cloud security offerings.

Upgraded its Cloud Detection and Response offerings to expand visibility for cloud security. The first version has been designed for customers using Microsoft Azure as their cloud home.

Released new Security Information and Event Management (SIEM) features using generative AI and workflow automation to facilitate faster detection and response to security incidents.

Announced that same SIEM platform “now supports the largest ecosystem of ISV data sources of any pure-play cybersecurity vendor.” Data from over 500 security and IT leaders can now be seamlessly integrated with CRWD’s platform to better identify and stop threats.

Expanded SIEM partnerships with several systems, service, and security providers including Deloitte, Ernst & Young, HCLTech, and more.

Launched Falcon for Defender to augment and elevate the security posture of endpoint devices running Microsoft Defender.

Expanded its partnership with Google Cloud, which will now use CRWD’s Falcon platform to power its Incident Response and Managed Detection and Response services.

CrowdStrike followed RSA with:

its own event honoring European partners;

an expanded distribution partnership with Ignition Technology bringing Falcon to Ignition’s customers in Denmark, Sweden, Norway, Finland, and Iceland;

a strategic partnership with eSentire using Falcon for eSentire’s managed detection and response services;

a partnership with Cloudflare using CrowdStrike to power the Cloudflare One Zero Trust product.

Having owned CrowdStrike almost five years now, I must say this is as active as I’ve ever seen it as far as new products and features. We’ll get our next update on how all these news bells and whistles are impacting the business when CRWD reports June 4.

DDOG 0.00%↑ – I was admittedly skittish heading into Datadog’s May 7 report, especially when the company decided about 12 hours before earnings to announce the launch of an IT Event Management product in its “AIOps” suite. I’m always nervous when companies release “good” news prior to earnings since this is often nothing more than an attempt to soften a disappointing report.

In this case, I wouldn’t call DDOG’s report disappointing as much as underwhelmingly passable. A somewhat encouraging customer rebound was unfortunately paired with another flat NRR and a surprising decline in RPO. While Datadog is far from an old company, it continues to act more and more like a mature one. The initial question is just how much growth DDOG has left. And the follow up is exactly how that fits in a growth-oriented portfolio. For now, I continue to hold a very small position in our taxable account.

ELF 0.00%↑ – I viewed e.l.f. Beauty’s May 22 report as a great quarter and slightly disappointing guide from a company with a long history of ultra-conservative estimates. For context, this year’s initial $720M (24.4% YoY) organic growth guide finished closer to $970M (67.6%) after backing out the $50-55M likely added by the Naturium acquisition. FY23’s 12% initial guide resulted in 48% actual growth while FY22 was 10% and 23%. Those are huge outperformances. The good news is this quarter’s market share, shelf space, and international trends seem to support a similar outcome for FY25.

So, why the worry? Well, the initial FY25 revenue guide of $1.25B (+22.1% YoY) still makes me take pause, especially when a $1.27B analyst consensus was out there for anyone to see. The CFO addressed it in her opening remarks by saying:

“As we look out to the remainder of the year, we remain bullish on the cosmetics category and our ability to gain share. At the same time, we are mindful of macroeconomic uncertainty and believe it's prudent to take it a quarter at a time. Our guidance approach remains consistent, serving us well as we've navigated a dynamic operating environment to deliver 21 consecutive quarters of net sales growth.”

After being asked specifically about the guide in each of the first three analyst questions, she added:

“And so if I take you back to last year, last year, we started our guidance at 22% to 24% range, ended the year at 77%. And I'm not saying that we're promising 77% this year for sure. But what I will say is that it gives you a little bit of insight into our guidance philosophy and what -- has worked well for us over these last 5 years, taking it one quarter at a time, which is why we indicated that we do love the momentum that we're seeing out of Q1 and feel great about our overall guidance range at this point.”

Yes, that guidance philosophy has a long history of big beats and raises. After all, that’s not unusual for good companies. However, I tend to get cautious when big beats become almost a requirement to make ends meet from a growth thesis standpoint. I feel like ELF leaves this quarter nimbly straddling this line, especially off a $1B revenue base. That’s a big number, and I’d prefer a little more straightforward math as we continue through the year. I mean, if you want to go “one quarter at a time,” then for Pete’s sake issue only quarterly guides like TTD. Oh well, at least we don’t have to worry about the nonsense of another initial FY guide for another four quarters.

In the end, I see no real flaws in ELF’s quarter. The only question is whether the company can continue its traditional guide outperformance during the upcoming fiscal year. Both history and more importantly the secondary numbers say it has a darn good chance. I’m more than willing to hang around and see where this one goes.

IOT 0.00%↑ – Samsara releases earnings June 6. I’m expecting another quality quarter.

TMDX 0.00%↑ – I haven’t seen any TransMedics news since its awesome April 30 report. The stock, however, continues to bask in the afterglow as it keeps pushing new highs. Fine by me.

TTD 0.00%↑ – The Trade Desk released another solid report May 8. Some companies underpromise and overdeliver. Others do the opposite. TTD does neither. It simply delivers exactly what it says it will over and over and over again. The company remains at the forefront of the move to digital advertising while continuing to grab both growth and market share along the way.

Yes, it is subject to the whims of the advertising cycle. Fortunately, we are in a period where advertisers don’t seem to have a problem spending to get their message out. This year’s Summer Olympics and upcoming US elections will provide seasonal strength as well. As CEO Jeff Green stated, “we are better positioned than ever to deliver premium value to advertisers and continue to gain market share.” While management always paints an optimistic picture, I see nothing in this report to disagree.

ZS 0.00%↑ – Zscaler started May with the announcement of a collaboration with Google on a joint Zero Trust architecture platform. The deal joins Zscaler’s Private Access offering with Google’s Chrome Enterprise Premium product to protect customers’ private applications.

Next, it announced AI upgrades to its data protection platform. This sounds more like an enhancement than a new product, but it continues Zscaler’s recent moves to better leverage the enormous amount of data transactions it tracks and facilitates on a daily basis.

Then, in the spirit of Datadog above, Zscaler announced a deal with IT services brand Persistent the morning of its May 30 after-close earnings release Uh oh. Was this really a piece of good news or just an attempt at lipstick on a pig? Even Persistent’s 22,800+ employees in 21 countries couldn’t keep me from feeling queasy.

Fortunately, the report was a steady one. The market was laser-focused on billings, and I’m glad to say Zscaler outperformed in that area. In fact, the 0.1% QoQ gain to $628M was ZS’s first positive sequential growth from Q2 to Q3 in the data I have going back to 2017. Customer growth and net retention rate held firm while the company earned a record $121.8M in operating income for a record 22% operating margin. Zscaler also posted its first-ever GAAP positive net income earlier than anticipated, though the company isn’t necessarily expecting that to be an immediate trend.

I’ll admit to a sigh of relief on this one. Zscaler’s pre-earnings price slide suggested the market was expecting the worst from this report, especially after competitor Palo Alto Networks failed to impress with its results and billings outlook. The initial reaction suggests ZS’s billings outperformance eased a lot of doubts. More importantly, it appears the company’s underlying business remains on firm footing. I wouldn’t call this report a world beater, but I do believe Zscaler exits with its boring-good reputation firmly intact.

My current watch list…

…remains just monday.com (MNDY) and Super Micro Computer (SMCI) with outside interest in MercadoLibre (MELI) and NVIDIA (NVDA). I sure would like the IPO market to pick up again at some point to find some smaller, less covered names.

And there you have it.

I consider a string of good earnings reports the sign of a good month regardless of how the market might treat our portfolio. Business performance drives stock price after all, and in this case a large majority of our businesses are doing just fine. CRWD and IOT wrap up earnings when they report next week. Here’s hoping the string continues…

As usual, thanks for reading, and I hope everyone has a great June.

I love your memes! Hope you are well, my good sir.