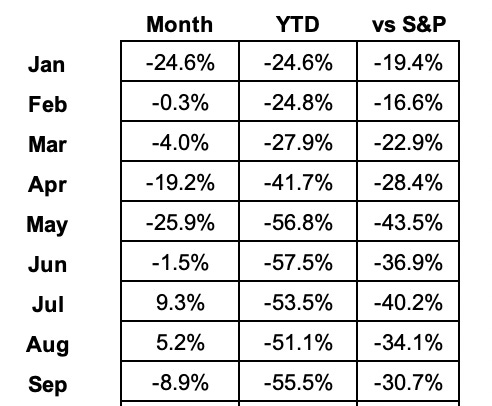

September 2022 Portfolio Review

Total Return: -55.5% YTD (-30.7% vs S&P)

Sometimes there’s nothing you can do except stay in your lane and keep going…

2022 Results:

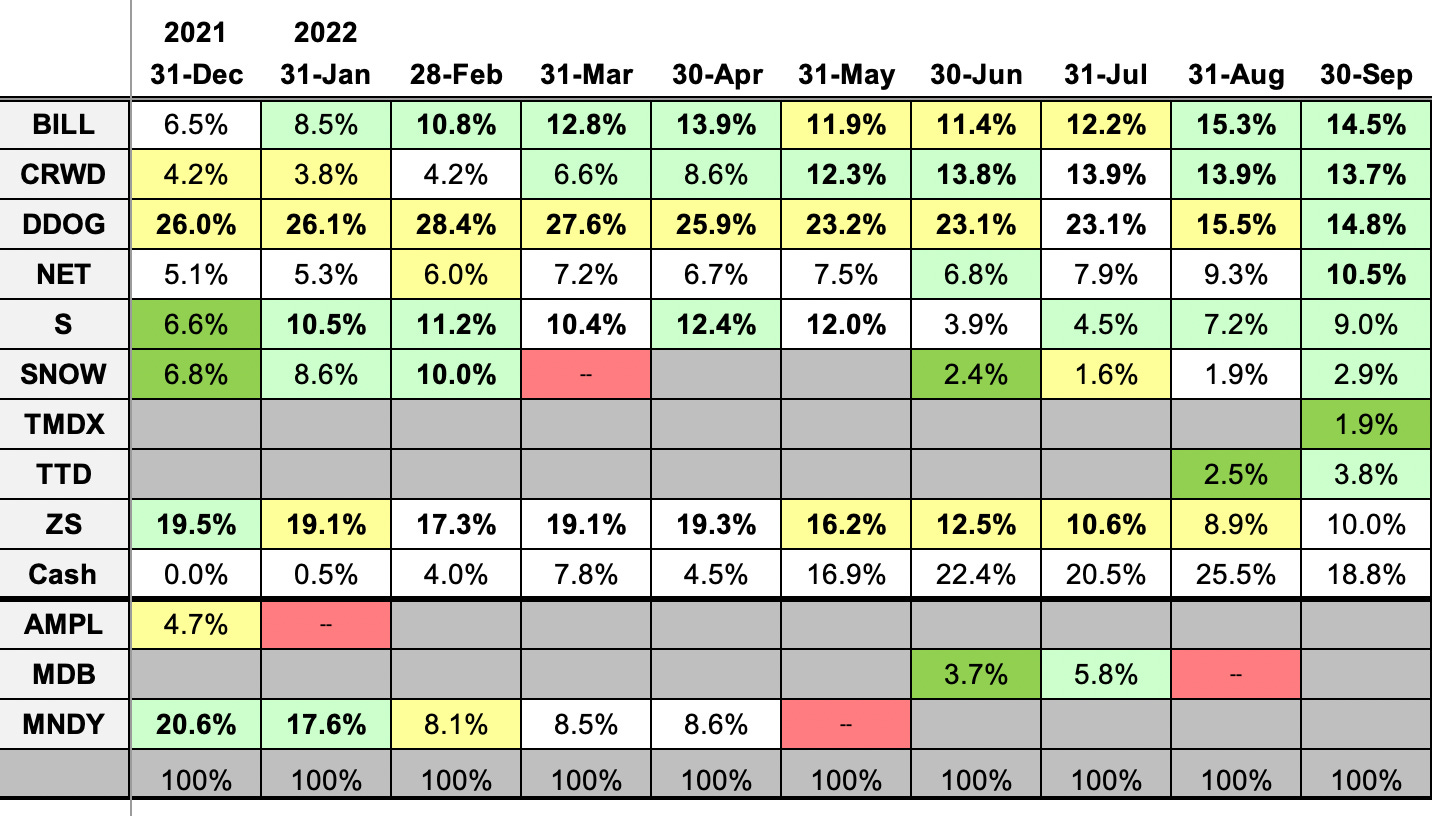

September Portfolio and Results:

2022 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2018 (the one that got things started)

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

December 2021 (contains links to all 2021 monthly report)

Stock Comments:

Though ZScaler was our only earnings report, September turned out to be a busy little month. A couple firms hosted customer conferences while Cloudflare gave us not one but two of its periodic rapid-fire update weeks. Below is the stuff that seemed worth mentioning.

BILL 0.00%↑ - A couple management changes hit the radar this month for Bill.com. First BILL named Loren Padelford Chief Commercial Officer responsible for sales and strategic partnerships. Padelford joins BILL after a stint as COO for business software firm Podium. Before that he was General Manager of Revenue for Shopify. According to his Twitter feed, he’s pretty excited about the move:

The other change was Divvy founder Blake Murray stating he would be transitioning to an advisory role as he evaluates his future:

Murray had been Chief Revenue Officer for the unified sales team since February. I’d assume Padleford takes on at least some of these responsibilities. This is not entirely surprising since many acquired founders eventually gravitate toward new opportunities rather than settle into a lesser role. One thing I noticed is both Podium and Murray are based in Lehi, Utah, so it’s very possible there’s a pre-existing relationship. Regardless, I hope the split is amicable and Murray keeps contributing before he leaves.

CRWD 0.00%↑ - The big CrowdStrike event was its September 19-21 Fal.con customer conference. Over 100 sessions were held covering:

Log Management and Observability

The Future of Endpoint Security and SecOps

Identity Protection

Journey to Cloud

Security Architecture and Strategy

Security Services

Threat Intelligence

Zero Trust

That’s a lot of areas beyond endpoints for CrowdStrike to expand its business. The main tech advancement (as far as I can tell) was the release of enhanced log management and observability tools. CRWD had been building these capabilities ever since its March 2021 acquisition of Humio. Now rebranded as “Falcon LogScale” and presented as a standalone module, this appears to be CRWD’s most concerted effort yet in the observability space.

In conjunction with Fal.con, CrowdStrike announced the acquisition of Reposify to better protect against internet-based risks. As more and more work gets done online, it makes sense for CRWD to extend its protection from the endpoint itself to the data/work being done on the device. At 22 product modules and counting, it’s encouraging to see CRWD pursuing every avenue it can.

DDOG 0.00%↑ - Datadog's most interesting news was a series of posts detailing its integrations with a trio of heavy hitters: Amazon, Salesforce, and Snowflake. The main thrust is customers of all three can easily monitor and manage their workloads using Datadog. While fully acknowledging management’s stated risk of short-term usage headwinds, it’s not hard to see these integrations benefiting all parties as more and more data inevitably finds the cloud.

I expect we’ll hear more from Datadog during its Dash customer conference on October 19.

NET 0.00%↑ - After a shaky September start Cloudflare rallied at the end. The company unfortunately found itself making the wrong kind of news early after being identified as a service provider for Kiwi Farms, an online forum known for stalking and harassment. Following the first stories linking the two, CEO Matthew Prince personally outlined NET’s abuse policies, how they evolved, and general thoughts on the role of companies versus governments in regulating online speech. When the added attention led to threats of violence on Kiwi, Cloudflare notified authorities and blocked the site. A second provider did the same just a couple days later. While this is undoubtedly a complicated issue for any firm, I’m glad Cloudflare made the choice it did. Now it can hopefully get back to focusing on the business at hand.

Thankfully for the business at hand, Cloudflare started a more positive streak when it was named an industry Leader for Web Application and API Protection products by Gartner research. This is NET’s first Leader designation recognizing its “ability to execute” and “completeness of vision.” With so many irons in the fire, it’s nice to see one earn a little third-party validation.

Cloudflare followed that announcement with GA Week, the latest installment of its Innovation Week series. The event detailed a slew of products being moved from beta to general availability (GA). Cloudflare’s beta products are typically sent to a subset of customers for rapid testing, feedback, and updates. GA products are available to everyone with the understanding most of the kinks have already been worked out. This (hopefully) leads to wider adoption and better monetization. The GA releases included:

An expansion of services for its Zero Trust platform.

The R2 storage service made available to all users. R2’s differentiator is the elimination of egress fees letting “developers…focus on innovation rather than worrying about the cost of storing and accessing data.” This is a smart use of the extra capacity on Cloudflare’s network as long as it leads users to purchasing other NET products and doesn’t stress capital expenditures too strongly if the network needs to be expanded.

The launch of a data localization suite in Asia. This service lets customers in Australia, India, and Japan easily set rules and controls to maintain compliance with local data and privacy regulations in each country. Cloudflare announced this service some time ago, but this is the first announcement I’ve seen of it being available in a specific region. I’d expect others to follow as we go.

A more thorough and tech-heavy GA Week breakdown can be found here. This recap contains roughly 20 more links with specs for almost every release. Needless to say, Cloudflare continues to innovate at a furious pace.

GA Week was immediately followed by Birthday Week, which included a Founders' Letter updating the business. Staying true to form, Birthday Week saw a few tech announcements as well:

The first Zero Trust SIM for mobile devices. Designed for corporate customers, this feature protects “every packet of data leaving mobile devices” by securely connecting employee devices to Cloudflare’s global network. To drive adoption NET has created a partner program allowing any wireless carrier to easily offer these tools to existing customers. Given the number of remote workers today, this sounds like a potential winner.

The unveiling of a VC-backed Workers Launchpad program helping startups build their business. Partnering with 26 (yes, 26!) leading venture capital firms, any company building its business on Workers can apply for a cash investment along with mentorship and support from Cloudflare. According to CEO Matthew Prince, Cloudflare started this initiative planning to raise $250M before overwhelming interest pushed the final amount to $1.25B. While many tech companies have similar seed programs, this is the largest from a company I’ve owned. I’d call this a significant feather in Cloudflare’s cap, especially considering the $1.25B worth of third-party confidence being shown in its Workers platform.

Cloudflare being named a category Leader in Web Application Firewalls by Forrester Research.

For the more technically inclined, there are plenty more updates to skim on the company blog. I count over two dozen entries for the two Weeks combined. While most of the nitty-gritty is well over my head, management’s intent is not. I continue to be impressed with Cloudflare’s laser focus on pushing its products in a way that should benefit and grow its customer base.

S 0.00%↑ - I saw two interesting pieces of news from SentinelOne this month. First, the company launched S Ventures Fund to “invest in the next generation of category-defining security and data companies.” While the $100M in seed money might seem small potatoes compared to Cloudflare’s fund, the implications are the same. Real businesses are being built using SentinelOne, and helping these companies along is a nice way to leverage its ecosystem. This is especially true in a funding environment where S should be able to negotiate favorable terms in any partnership.

Next, SentinelOne hosted the inaugural LABScon conference on cybersecurity research. I couldn’t help but notice for such a small firm SentinelOne landed some big speakers:

Mark Russinovich, Microsoft Azure CTO, presents the story of his seminal malware analysis toolkit, which transformed malware analysis and forensic investigation

Dmitri Alperovitch, Executive Chairman of the Silverado Policy Accelerator and CrowdStrike Co-Founder and former CTO, discusses cyberwarfare and effective policies

Morgan Adamski, Director of NSA’s Cyber Collaboration Center, keynotes “Operational Collaboration: The Realities of Success”

Chris Krebs, the first director of the Department of Homeland Security’s (DHS) Cybersecurity and Infrastructure Security Agency (CISA) and Partner of the Krebs Stamos Group, shares in-the-trenches perspectives on cybersecurity and government

M.J. Emanuel, CISA Incident Response Analyst, delves into recent cyberattacks targeting satellite communications and critical infrastructure

Mauro Vignati, International Red Cross, discusses the line between combatants and digital collaborators in war

Thomas Rid, Professor of Strategic Studies and founding director of the Alperovitch Institute for Cybersecurity Studies at Johns Hopkins SAIS, debuts cybersecurity discoveries

Kim Zetter, world-renowned cybersecurity author, facilitates fireside chats and shares perspectives on cyberwar

Kris McConkey, PwC’s Global Cyber Threat Intelligence Practice Lead, releases research detailing new activity emanating from Chinese advanced persistent threat (APT) groups

Combined with its strong August 31 earnings report, I like the direction SentinelOne appears to be heading. I challenged myself to redeploy some cash this month after a string of quality earnings reports was followed by a broader market swoon. S was the position I bumped the most.

SNOW 0.00%↑ - Snowflake’s main September effort was presenting at the Piper Sandler and Goldman Sachs investor conferences (webcasts here). Unsurprisingly, CEO Frank Slootman and CFO Michael Scarpelli were their usual confident selves. After SNOW’s strong August earnings report, it’s not hard to see why.

TMDX 0.00%↑ - TransMedics makes its first appearance in our portfolio. TMDX is "transforming organ transplant therapy for end-stage organ failure patients" through its proprietary Organ Care System. Its main service is a turnkey solution retrieving, managing, and delivering organs for transplant centers. Rather than the traditional process of storing organs on ice, TransMedics’ technology uses blood to maintain organs in a functioning state to allow for longer storage and more accurate patient matching. It currently has approved systems for hearts, lungs, and livers with a kidney trial tentatively scheduled for the second half of calendar 2023.

While its business has traditionally been lumpy – especially during COVID – TransMedics has shown clear signs of traction in recent months. Growth has been 125% and 151% the last two quarters (though against admittedly easy comps). Management didn’t issue a Q3 guide, but I wouldn’t be surprised by 200%+ growth given its full year estimate. GAAP gross margin bounces around the 70% mark with a mid-70’s target, so there seems to be some pricing power here as well. Best of all, management has raised the top end of its FY guide from $55M to $65M to $75M so far. When asked specifically about that guidance, CEO Waleed Hassanein replied:

[We] are not experiencing any -- or we don't -- we are not aware of any definitive headwind or a negative situation other than that demand is ramping up and far outpacing our original forecast and updated forecast. That's all I know. Because of that, I want to be prudent, I want to be cautious, and I want to be conservative. Because again we take guidance very seriously.

And I want to reiterate that $75 million is not the absolute ceiling for '22, if the prudent number that we standby to make sure that as we are scaling up and we're growing that we're not inadvertently causing any disruption or any issues that may negatively impact our growth ability in '23. Again our laser focus right now is to be able to be in the same situation in '23. So that's why we are being very deliberate and very cautious and giving the centers the time they need to make sure that we have a solid foundation exiting 2022.

TransMedics is still burning cash, but expenses, cash flows, and losses are all creeping in the right direction. More importantly, Hassanein implied hypergrowth could continue for quite some time as the company scales. In a comment about maintaining transportation access (mostly charter flights) as demand increases, he stated:

…we know we're in a pace to doubling our revenue '22 over '21. We want to be in the same situation in '23 and '24 or very close to it.

I’ve always considered the medical space tricky investing. However, I know some firms can see a significant jump in growth and/or leverage when its product switches from clinical to commercial use. With regulatory and insurance clearances already in place, I believe TransMedics fits that rough profile. Current demand is “far outpacing our highest demand plan” with management working hard “to execute and fill in that gap.” I can’t say there’s a huge S-curve here, but TMDX does seem to be in the right part of whatever one it has. It’s also possible its current heart/lung/liver curve could extend “several years to the future” if kidneys are eventually added to the list. Given our large cash position, I’m OK grabbing some shares and seeing where this one goes.

TTD 0.00%↑ - The Trade Desk had a sneaky-interesting September. First it announced Proctor & Gamble (P&G), one of the world’s largest advertisers, is the latest large firm to adopt its Unified ID program for protecting consumer privacy. P&G joins Disney, Albertsons grocery, Vox Media, and Amazon Web Services as major companies using Unified ID as part of their digital advertising protocols.

Next were posts on how the National Football League, Major League Baseball, and the Big Ten Conference are approaching live streaming and programmatic advertising. With live sports remaining some of the highest-priced real estate in advertising, it’s nice to see TTD keeping its finger on the pulse here.

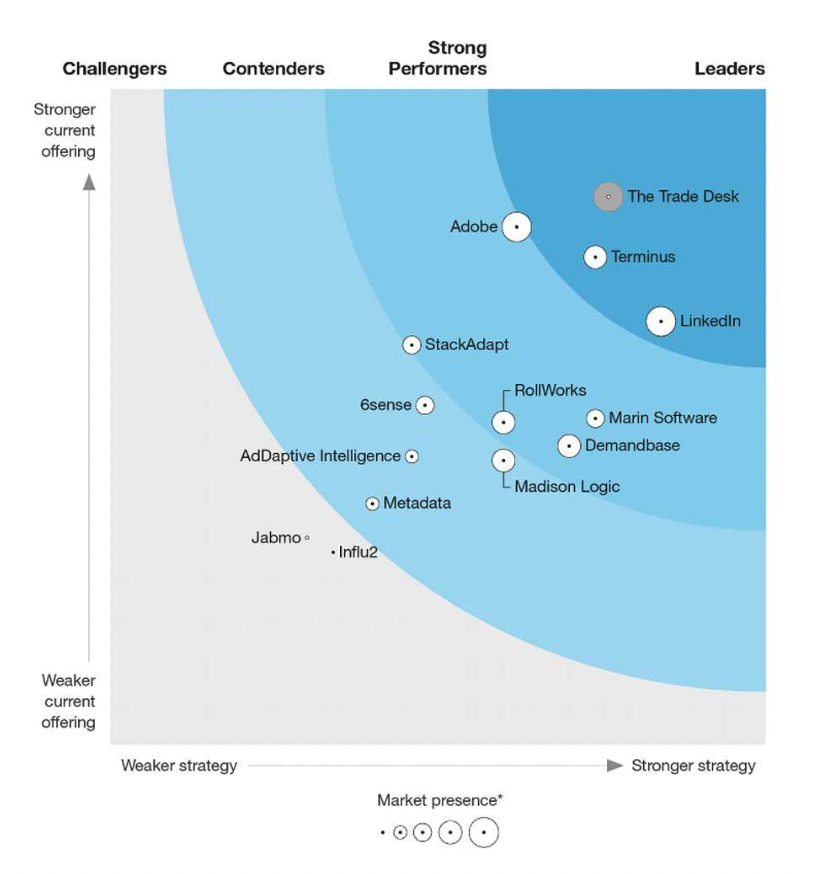

The month ended with TTD being recognized as a Leader in B2B Advertising Solutions by Forrester Research. For the long form details, Forrester’s full report can be downloaded at the link above. If you prefer the simpler route, just take a gander at the strength of TTD’s positioning:

With 2022’s political advertising season just ramping up, I’m happy to sit back and let The Trade Desk do its thing.

ZS 0.00%↑ - As anticipated, ZScaler’s September 8 earnings release wrapped up an extremely consistent FY22. Revenue of $318M meant 61% growth for Q4 and 62% for the year, which was right in line with what I was hoping for. The question, of course, was whether billings would bounce back and how things lined up for FY23. Luckily, both worked out.

ZS crushed both its own and the street’s billings estimates with $520M for 51% QoQ growth. After slowdowns in Q2 and Q3, this was a huge number and very welcome relief. The initial FY23 guides for 37.5% revenue and 31% billings growth were a bit less than I expected, but management cited extra prudence due to less visibility than usual into the second half. The silver lining is ZScaler reported $2.607B in Remaining Performance Obligation with 49% of it current. That means roughly $1.277B in revenue should land within the next 12 months. I'd have to think Zscaler will be able to scrape up significantly more than the $223M needed to reach its initial $1.5B guide. So, it appears there’s plenty of room for the usual beats and raises along the way.

Customer growth remained strong with a record 198 added to those spending $100K+ annually. The number of $1M+ adds was a repeat of last year’s record 39. Individually, CEO Jay Chaudhry noted a large Australian government win along with 25 new US federal customers. The highlight was a 5-year, $46M contract covering 100,000 users with a US cabinet agency. ZS earned the win over “all the obvious names you would expect.” It now has “10 of the 15 cabinet-level agencies as customers with plenty of opportunities for upsell at these large organizations.” Combined with a seventh consecutive quarter of 125%+ NRR, it appears ZScaler’s biggest clients are continuing to spend on its products. Good to know.

ZS backed the top line with $103M in operating cash, $74M in free cash, $38M in operating income, and $36M in net income – all records. Post-earnings it kept the momentum going by announcing a deeper integration with CrowdStrike and the acquisition of ShiftRight to bolster the automated response capabilities for its Zero Trust Exchange.

While I can’t say ZScaler is our most dynamic holding, it’s certainly one of our most consistent. I see no reason to think that will change during the upcoming fiscal year. The initial guides weren’t quite enough to want to bump this allocation, but I’m perfectly content holding what we have for now.

My current watch list…

…has Enphase (ENPH) at the front with some mix of Gitlab (GTLB), monday.com (MNDY), MongoDB (MDB), and ZoomInfo (ZI) in the next tier. At this point, I’d say ENPH is the only one with a chance to sneak into a spot before next earnings season.

And there you have it.

On the surface September was yet another tough month. Despite a string of quality earnings, our portfolio once again drifted down with the broader market. I can’t help but notice, however, it was also our fourth straight month outperforming the market. While the S&P 500 continues to retest its 2022 lows, our portfolio sits roughly 20% above. Relatively speaking, I can’t complain about that.

Don’t get me wrong. Our 2022 returns have been a market-trailing trainwreck literally from day one. However, the gap between our portfolio and the S&P has shrunk considerably since the depths of May. I have no idea if that trend will continue but do feel encouraged by the strong set of reports we just received. At some point prices will bottom and company fundamentals will take over. That’s why I want to stay focused on owning the most fundamentally-sound companies I can.

Thanks for reading, and I hope everyone has a great October.

👌

Interesting that you bought Transmedics. Color me intrigued. I will need to revisit them to check how they are doing after last years fintwit pump and dump. Hope you are well. Cheers!