September 2023 Portfolio Review

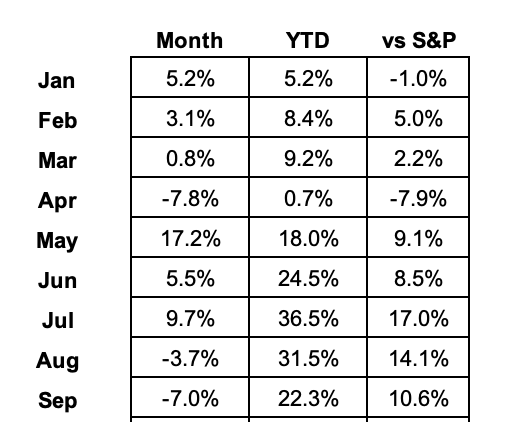

Total Return: +22.3% YTD (+10.6% vs S&P)

2023 Results:

2023 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2018 (the one that got things started)

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

December 2021 (contains links to all 2021 monthly reports)

December 2022 (contains links to all 2022 monthly reports)

Stock Comments:

Another earnings season here and gone. I can’t say I mind the temporary exhale…

AEHR 0.00%↑ – September’s big news from Aehr Test Systems was another new customer for its silicon carbide test-and-burn system. Sold to “a US-based multibillion-dollar semiconductor supplier serving several markets including automotive, computing, consumer, energy, industrial, and medical,” the system is scheduled to ship “per the customer’s requested accelerated schedule” by the end of calendar 2023. With Aehr’s customer concentration having always been a factor, it is a welcome development to see it land another potentially deep-pocketed client.

We’ll get our next formal business update when AEHR reports October 5.

AXON 0.00%↑ – Axon’s September update was being formally lauded by Great Place To Work for the second year in a row. According to the release, 87% of employees said Axon is a great place to work, which is 30 percentage points higher than the average U.S. company. As a shareholder, it’s always nice to see satisfied employees (as long as the performance is satisfying as well, of course).

BILL 0.00%↑ – I saw no formal September news from Bill, but management did present at four investor conferences between August 30 and September 14. I trimmed this position significantly the last few weeks to get our allocation closer to my conviction exiting what I thought was a mixed August earnings report.

CELH 0.00%↑ – Celsius Holdings issued no recent news but did follow its great August earnings with four September investor conferences. The stock pushed new all-time highs before fading with everything else the last couple of weeks. I’ve added shares in the downdraft and will likely look to add more as I continue to learn the company.

CRWD 0.00%↑ – CrowdStrike followed its steady August 30 earnings with the early-September release of Falcon Complete for Service Providers, a new program letting customers augment their current offerings with CrowdStrike’s 24/7 monitoring and remediation service. This program is designed to let customers scale, close skills gaps, and augment internal teams without worrying about sacrificing security along the way.

That release was followed by a slew of updates from the company’s annual Fal.Con customer conference:

The launch of a new “Accelerate” partner program for all areas of cybersecurity.

A new CrowdStrike Marketplace for compatible third-party security products. One of the highlights here is customers can purchase these add-ons directly through their CrowdStrike accounts.

The acquisition of Bionic. Don’t ask me exactly what this quote means, but “the combination will extend CrowdStrike’s leading Cloud Native Application Protection Platform (CNAPP) with ASPM [Application Security Posture Management] to deliver comprehensive risk visibility and protection across the entire cloud estate, from cloud infrastructure to the applications and services running inside of them. As a result, CrowdStrike will be the first cybersecurity company to deliver complete code-to-runtime cloud security from one unified platform.”

Released the next generation of its flagship CrowdStrike Falcon platform with faster, more-powerful features.

Unveiled new data protection, exposure management, and IT automation innovations making it easier for customers to consolidate security solutions.

Launched cybersecurity’s first no-code application development platform.

Achieved 100% protection, 100% visibility, and 100% detection in the MITRE Engenuity ATT&CK evaluations for enterprise users.

Was named a Customers’ Choice and one of the highest rated companies in Gartner’s 2023 Voice of the Customer report for endpoint protection.

Partnered with Amazon Web Services on a startup accelerator program to provide “mentorship, technical expertise, and partnership opportunities” to cloud-native cybersecurity companies in Europe, the Middle East, and Africa.

Lastly and maybe more importantly for investors, CRWD released notable upgrades to its long-term margin targets:

Subscription Gross Margin 82-85% from 77-82%

Sales & Marketing 28-33% from 30-35%

G&A 5-7% from 7-9%

Operating Margin 28-32% from 20-22%

Free Cash Flow 34-38% from 30%+

Those are significant bumps. After CrowdStrike’s last report, I wrote:

The truth is in recent quarters CRWD has shown more and more signs of a mature company as opposed to one with room for continued leverage and growth. Having now posted its first 20%+ operating margin, CrowdStrike has already reached most of its long-term performance targets. While that’s commendable for a company that has only been public since June 2019, the question becomes exactly where it can go from here.

With these new targets, management seems to see more upside in CrowdStrike’s business prospects than originally thought. That will likely keep me hanging around a bit longer than I originally thought coming out of last quarter.

DDOG 0.00%↑ – Datadog presented at a Goldman Sachs conference September 6 and a Citi conference September 7. Other than that, the market seems to be sitting around waiting until DDOG finally shows signs its customer optimizations are abating.

IOT 0.00%↑ – Samsara followed its strong August 31 earnings report with early-September recognition as one of the UK's Best Workplaces. This acknowledgement comes from direct feedback from employees “with 98% of its UK workforce saying they are treated fairly, regardless of their age, gender, race or sexual orientation. 96% agree that they are proud to work at the company, 94% say they can be their true selves at work, and 92% feel like they are making a positive difference to the wider community.”

It followed up by announcing a partnership with M Group Services, a “leading essential infrastructure services provider operating within water, energy, transport and telecommunication sectors across the UK & Ireland.” This “industry-first collaboration combines Samsara's Connected Operations Cloud with a 360-degree camera solution from Motormax — warning drivers if a vehicle is being overloaded or if cranes, booms or stabilizers are stowed incorrectly. In the event of any issue, the driver is alerted immediately using visual and audible warnings via Motormax's Safetymax technology. Office-based transport managers are also notified immediately via automated email alerts sent to an online portal.” Samsara has done a nice job of positioning itself as capable of not only tracking vehicle fleets but creating smart, self-monitoring factories, worksites, and equipment. This partnership seems like an additional step in that direction.

TMDX 0.00%↑ – TransMedics sure isn’t wasting any time building out its plane fleet. It filed 8K forms on September 5, September 12, and September 21 detailing aircraft purchases. It now owns eight planes outright at a cost of $102.6M. I have no idea how long it takes to fit those planes for TMDX’s needs, but here’s hoping the turnaround time is quick enough to have a positive impact on organ transplant volumes in Q3 and more importantly Q4. We’ll find out in just a few weeks.

TTD 0.00%↑ – The only update I came across from The Trade Desk was the appointment of Rose Huskey as Senior VP of the South Asia region including Australia, New Zealand, Southeast Asia, and India. This staff update isn’t quite as significant as the August 30 announcement co-founder and CTO Dave Pickles was leaving the company. However, as I wrote then TTD’s current tech advantages and the fact co-founder/CEO Jeff Green is the main face of the company have me viewing Pickles’ departure as more something to monitor than something to be concerned about. I assume things are business as usual until proven otherwise.

ZS 0.00%↑ – Zscaler’s September 5 report was a great way to wrap up our portfolio’s earnings season. The highlights included a solid revenue beat of $455M and 48% YoY growth. Billings was also a pleasant surprise at $719M (+38% YoY and +49% QoQ). Management noted a one-time $20M bump from a multi-year contract, but this is still a strong outperformance. Billings has always been heavily seasonal to Q2 and Q4, so I’m happy to see the year end on such a positive note.

That Q4 push put FY23’s final billings growth at 37.4%. The initial FY24 billings guide is $2.56B and 25.8% growth. The CFO states the company will continue to extend ramp payments for some larger customers, which will stretch out the billings cycle but still eventually result in recognized revenue. Assuming management left its usual cushion, we will very likely see another year of 30%+ billings growth in FY24. That’s a good outcome at this scale.

Beneath the hood:

ZS added 177 new $100K+ customers (+7.3% QoQ) for 2,609 total. Not a blowout, but not bad. The customer highlight was the $1M+ category with a record 49 added this quarter. Zscaler now has 449 customers spending at least $1M annually including 43 at $5M+. Impressive.

Unfortunately, the company’s streak of ten consecutive quarters with a 125%+ net retention rate came to an end. However, when asked the CFO replied, “What we're seeing is that we're seeing more customers buying more of our platform upfront. So, when customers are buying more of your platform upfront, that will impact what they're going to purchase in the future.” I can live with that.

Operating income finished at record $86M and record 19% margin. In that respect, ZS continues to show leverage at scale.

We received several positive comments about future business. CEO Jay Chaudhry noted quarterly records in billings, $1M+ customer adds, number of $1M deals, operating profit margin, and size of the sales pipeline. I also noted Chaudhry saying “12 of the 15 cabinet-level agencies are our customers, and we are starting to see larger awards from these agencies.” The “larger awards” comment grabbed my attention. I know the two-year planning window from the 2021 US Executive Order mandating Zero Trust security ends within the next few months. I am curious to see if Zscaler and other cybersecurity firms start referencing more government wins as we get into calendar 2024.

I know I’ve used the phrase “boring good” to describe several past Zscaler reports. After dumping in the headline numbers, I thought I might be awarding my first-ever boring excellent. Alas, the $100K+ customers and slight decline in NRR bumped it back to plain-old boring good. The bottom line is Zscaler just keeps plugging along in its ever steady, efficient, and disciplined way. Given the initial guides, it looks like FY24 will be more of the same.

Zscaler followed earnings by announcing a partnership with Imprivata and CrowdStrike on a Zero Trust security solution for healthcare organizations. This new offering is customized to healthcare providers and meets all regulatory requirements including HIPAA and HITECH. I can’t say I’ve heard ZS single out its healthcare vertical in the past, so I’m curious to see where this might lead.

My current watch list…

…in rough order includes monday.com (MNDY), MongoDB (MDB), Super Micro Computer (SMCI), and Snowflake (SNOW).

And there you have it.

Well, September once again proved its reputation as a tough month for stocks. The market continues to have the macro jitters with interest rates and a possible US government shutdown responsible for the latest heebie jeebies. From a business standpoint though, I can’t complain. I felt our business updates this earnings season contained far more good than bad, and I’m cautiously optimistic Aehr will continue that trend as the next round begins. I feel that’s the best I can ask as the broader market continues to stumble, jerk, and lurch its way through 2023.

Thanks for reading, and I hope everyone has a great October.

Nice writeup as usual! I'm curious as to your reasoning for holding a small position in datadog - it has slowed dramatically over the past few quarters from 61% revenue growth to 25% and most folks on Saul's board have ditched it, at least for now. Can you comment?