FIREWORKS!

(A most-excellent Canadian version can be found below. Clink the YouTube link that shows up in the middle of the screen if you’re interested.)

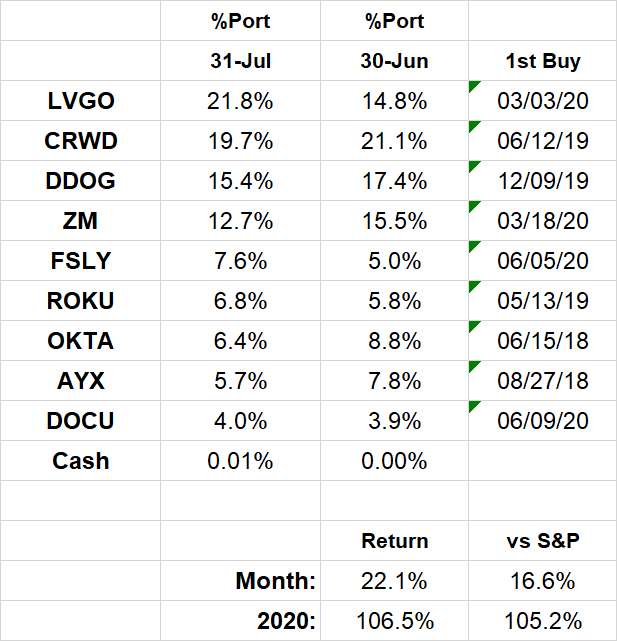

Truth be told I was using that lede regardless of July’s performance. It was simply a matter of whether I would be recapping a roman candle, sparkler or dud. It turns out I saw all three this month. My portfolio started off by rocketing roughly 20% through July 9. It then imploded -8% on 7/13 alone. It finished by flickering and flashing its way back to +22.1% by month’s end. In the end I’d say not too shabby.

While the gains were nice (and always beat the alternative), that wasn’t my main July focus. The lull between earnings is a great time to sit back and take stock of your holdings. Rather than eyeing the calendar and crunching numbers, you have a chance to think through allocations and backfill information gaps. That is ALWAYS a worthwhile exercise. This is particularly true in my case since 57.3% of my portfolio value reports either August 5 or August 6. Most of my companies have navigated COVID remarkably well thus far, and early earnings for similar names have been encouraging. Let’s see if that trend continues…

2020 Results:

July Portfolio and Results:

2020 Monthly Allocations:

Key:

darker green - started during month

lighter green - added during month

yellow - trimmed during month

blue - bought and sold during month

red - position exits

Past recaps:

December 2019 (contains external links to all 2019 monthly reports)

Stock Comments:

July is my fourth consecutive month with nine positions. The names are unchanged from June, though I did tweak my allocations for AYX, FSLY and OKTA. With a rush of new earnings right around the corner, here is how I see things heading into August.

AYX – Alteryx has been busy in the three months since its last report. Despite warning of short-term COVID headwinds, management expressed enthusiasm for some upcoming programs it felt would solidify the company’s future. Since then AYX has made several announcements detailing what it has in mind.

First, Alteryx announced a training program to “expand data literacy, upskill workers…and educate a new wave of citizen data scientists”. The company offered the course for free with the goal of certifying thousands of new data workers in 2020.

Next, Alteryx announced a new end-to-end platform for automating analytic processes. This new offering was designed “to put automation in the hands of all data workers”, allowing customers to create more efficient workflows and better optimize costs across their entire operations.

Finally, AYX recent released two new products – Alteryx Analytics Hub and Alteryx Intelligence Suite –augmenting its broader platform. As with the prior announcements, these offerings are geared toward making it even easier for citizen data scientists to navigate more complicated workflows.

I like these moves in aggregate but also view them more as consolidation before AYX’s next rise than steps paying immediate dividends. The wildcard is how long COVID headwinds will last, which continues to be anyone’s guess. In the meantime, Alteryx deserves credit for positioning itself to accelerate quickly once things return to some semblance of normal. Management has set a very low bar this quarter. Though I’m comfortable AYX’s 8/6 report should clear it, I did trim some shares to add to FSLY as my conviction in the latter continues to grow.

CRWD – July’s main CrowdStrike news was the release of a third party study concluding CRWD has nearly doubled its market share over the last year. As noted last month, CrowdStrike’s customer count has at least doubled in every quarter on record. The company now boasts 6,261 subscription customers with YoY growth that looks like this the last six quarters:

4Q19 – 103%

1Q20 – 105%

2Q20 – 111%

3Q20 – 112%

4Q20 – 116%

1Q21 – 105%

Yeah, yeah…I know the law of large numbers will eventually shrink these rates. The broader point is there’s no reason to think this aggressive market share grab will end any time soon. I remain very long CRWD.

DDOG – It was a quiet month for Datadog, and the stock was fairly muted as well until a decent run the last couple of days. Things should pick up on 8/6 when we get to see if DDOG’s stellar business performance continues. The bet here is results will be good enough to justify my allocation. 🤞

DOCU – The main DocuSign news this month was the $38M all-stock acquisition of startup Liveoak Technologies. The companies already had a partnership in which DOCU was integrated with Liveoak’s agreement-collaboration platform. According to the release, this acquisition will “accelerate the launch of DocuSign Notary…where audio-visual technology is used to complete a notarial act when the signers and the notary public are in different places.” In that respect, this acquisition appears to be a perfect fit for DocuSign’s stated intent to move beyond eSignatures into end-to-end contract lifecycle management. As a shareholder, I think this is a great move.

FSLY – Fastly has been white-hot lately. The stock has exploded from below $11 at its March lows to $100+ in early July. The impetus is management’s guide for Q1 revenue growth of 38% to hit 56% at the top end in Q2. Given FSLY’s history, I am anticipating something 60%+ with improved gross margins as well. The recent price surge suggests A LOT of folks are thinking similarly, so the pressure is on. I tacked on 0.6% mid-month by swapping some OKTA when FSLY dipped back below $79. I trimmed AYX and more OKTA to add another 2.25% over the last couple days after Fastly customers Shopify and Amazon trounced earnings (I hadn’t yet seen that Pinterest did the same when I made the purchase). There is a reasonable chance SHOP and AMZN’s outperformance bumps FSLY’s revenue even more than anticipated. I would gladly take that outcome.

We will finally get to see what all the hubbub is about when Fastly reports August 5. Buckle up and hang on tight, everybody. My guess is Fastly won’t stand very still once the release hits the wire. Either way, I’m comfortable continuing to build out this position.

LVGO – Wow. A +69.2% month shot Livongo from my #4 spot to the top of my portfolio without adding a single share. The spark was a Q2 earnings preannouncement with a significant raise in LVGO’s revenue guide. The new range is $86-$87M up from $73-$75M. It includes $2-3M considered “one-time in nature”, which doesn’t dampen the news at all in my opinion. LVGO made a similar announcement last quarter and ended up beating their revised guide by an additional $2.5M. Coming in at the new $87M top end would be 113% YoY growth. Anything above $87.8M would mean an acceleration from last quarter’s 114.7%. We will know for sure August 6, but regardless of the final numbers it appears Livongo had a monster quarter.

In addition to the pre-release, LVGO continues to build momentum outside its core diabetes offering. Blue Cross Blue Shield of Western New York expanded its partnership by making Livongo’s behavioral health app myStrength available to its nearly one million members. Priority Health in Michigan did the same for its 300,000+ customers. These moves come after an American Psychiatric Association poll showing increased anxiety among Americans due to COVID-19. With behavioral health in general getting more attention these days, Livongo’s ability to engage remotely would seem to be a valuable option for both providers and patients.

Livongo also published research this month detailing measurable benefits for its weight-loss offering. In an analysis of 2,037 users:

“Overall, participants lost on average 5.15% of their starting weight. Highly engaged participants lost 6.6% of starting body weight, with 25% losing >10% at 12 months.”

Breaking the program down into individual components showed food logging, nutrition education and personalized coaching all contributed to the success. While this is admittedly a company study, it is yet another example of LVGO attempting to quantify its value add.

Livongo’s broader thesis revolves around two main developments:

greater adoption of remote health monitoring and

expansion beyond the company’s core diabetes offering.

In my opinion, the above information suggests both are happening at a rapid pace. I stated last month “it is hard to find much of a chink in LVGO’s armor right now”. Yeah, I think I’ll stick with that for now.

OKTA – Not much to report here. Okta is still a solid position for me, but management’s comments last quarter lumped it firmly with the COVID headwinds crowd. As noted elsewhere I trimmed a bit to add to Fastly, which has not hinted at any such issues.

ROKU – Ah, Roku. My volatile little friend. Where the heck ya been? I wrote in June I felt the stock was due for one of its periodic surges and even turned a few shares into options to increase my exposure. I added another tiny option at the beginning of July with my regular contribution. [Insert the usual disclaimer about my limited use of options and how you should avoid them if you don’t know what you are doing.] As luck would have it, Roku delivered right on cue. With this month’s showing the stock has now done this for me within the past year:

August 2019: +46.5%

October 2019: +44.7%

April 2020: +38.6%

July 2020: +32.9% (for the shares and +108.7% for the options)

Of course, those spikes have been strongly offset by some harrowing drops over the same span. That is why Roku has lagged the rest of my portfolio and is up only 15.7% YTD. Overall, it has been quite the journey.

On the business side Roku saw a couple intriguing developments. The first was the addition of a Peleton channel so users “can enjoy studio-style workouts in their living room”. What I find notable is Peloton is not TV content but rather an interactive experience. That is a new concept for me. I guess I had mentally limited myself to viewing Roku solely as an alternative TV option for cord cutters. I had never considered it a potentially neutral platform for any and all streaming media. Hmmmm…interesting if true.

The second was a company blog post announcing CoComelon – “the world’s most watched YouTube channel” – is coming to Roku. A popular educational channel for preschoolers, Cocomelon will now be available as part of the Kids & Family offering on the The Roku Channel. It has often been noted Roku makes little to no money from its relationship with YouTube. It is nice to know that relationship apparently doesn’t limit Roku from working directly with YouTube content providers exploring additional distribution. It is hard to view this arrangement as anything but a positive for all parties (except possibly YouTube, of course). I’m curious to see if Roku can expand this effort.

I continue to learn a lot from owning Roku. For one, I now better understand some of the differences between the B2B (business-to-business) and B2C (business-to-consumer) business models. Most of my holdings are B2B, and there is a quiet certainty to their recurring revenue and mission critical products that B2C firms lack. Rather than certainty, B2C companies seem to have a fickle or fad quality mostly tied to consumer tastes. That uncertainty apparently leads to more volatility and a lower multiple, at least in Roku’s case. In some ways I believe Livongo could eventually fall into the same bucket since its success is ultimately driven by individual patient adoption rather than its number of corporate clients. However, LVGO’s numbers are small enough and the company early enough in its trajectory I’m not yet worried about it. However, this is something I will monitor for both companies in the future.

Back to the present, Roku continues to stand up some interesting dominoes. Hopefully, August 5 earnings will show it is ready to start knocking some down as well. In my opinion this is a key moment for Roku, and I see enough uncertainty around it I plan to convert half my options back into shares on Monday. I will keep the same weighting into earnings but prefer to lessen the leverage. Something-something bulls, bears and pigs. **

** “Bulls make money, bears make money, pigs get slaughtered.” ~ old Wall Street adage

[As an aside, I thought I’d quickly share a strategy I used this month. My small regular contribution goes to a taxable account. I wanted to buy a ROKU option but preferred it in an IRA to eliminate tax implications. To do this I purchased some taxable DDOG I plan to hold long-term and sold an equal amount of DDOG in an IRA. I then used that cash to buy the option. I often consider the same strategy when I want to add more shares to a name that might be getting too sizable in my taxable account. I’ll buy something else I like long-term in the taxable and sell an equal IRA amount to free up the cash for my intended target. That lets me better control my allocations vs tax exposure between taxable and IRA accounts. I can’t remember where I stole the idea but have found it handy.]

ZM – Zoom released multiple pieces of notable news this month. The first was a formal agreement with the Los Angeles Unified School District to use Zoom’s services. The deal makes ZM the default virtual classroom option for “nearly 30,000 educators and more than 600,000 students”. The district will also use Zoom for “school board meetings, professional development, community outreach and other large-scale events”. Since the company had already made nice with New York City public schools in May, it appears Zoom is becoming the platform of choice for many considering virtual learning. In my opinion being the platform of choice for just about anything in today’s virtual world is an enormous tailwind. I am sure I join other shareholders in hoping Zoom can continue taking advantage of these opportunities.

The second development was ZM launching a Hardware as a Service (HaaS). This new service “will make Zoom Rooms and Zoom Phones more accessible by minimizing friction around hardware procurement.” It basically allows customers to “scale video conference rooms and phones with budget-friendly hardware options and simple technology upgrades at an affordable, fixed monthly price.” According to the release, the program offers the following:

Low upfront costs and predictable budgets: Deploy your Zoom solution with the hardware you need without the large initial investment, saving budget for other IT projects

Streamlined purchasing: Include your Zoom software and Zoom HaaS devices on a single invoice for simple end-to-end procurement

Scalability: Add hardware as your business evolves with high-quality devices that provide a turnkey experience for Zoom Phone and Zoom Rooms

Managed support options: All Zoom HaaS solutions will be supported through Zoom. IT teams will also have the option to be able to add professional and managed services for installation and enhanced end-to-end management. Zoom will expand its implementation of ServiceNow’s Customer Service Management to provide HaaS customer support

In conjunction with this new HaaS service, Zoom launched "Zoom For Home", a one-stop hardware device for those using the service remotely. According to the release:

“Features for the all-in-one 27-inch device include: three built-in wide-angle cameras for high-resolution video; an 8-microphone array for crystal-clear audio in meetings and phone calls; and, an ultra-responsive touch display for interactive screen sharing, whiteboarding, annotating, and ideation.”

This aligns perfectly with Zoom’s it-just-works mentality, and the device’s compatibility with Zoom Rooms should make it a seamless experience for meeting participants Zooming in from home. Writing that last sentence was a minor epiphany for me. I almost typed “dialing in from home” but realized that wasn’t the right word. Hmmm…Zoom really has become a verb.

These hardware offerings appear to be a classic razor and blades offering. By releasing an affordable line of hardware, Zoom can easily introduce new customers to the benefits of its higher-margin video and communications products. As noted last quarter, Zoom experienced 354% (!!!) YoY growth in customers with 10+ employees to 265,400. This program allows Zoom to grow and scale right along with those customers even after things go back to “normal” (whatever that means). I know some people aren’t crazy about forays into hardware, but it’s hard to see how this doesn’t have the potential to be a long-term positive for everyone involved.

Finally, Zoom announced the company “will expand its presence in India by opening a new technology center in Bangalore, where it will hire key talent over the next few years”. This will augment Zoom’s office in Mumbai – which is expected to triple in size – and the two data centers already in the country. Last I checked India is a fairly large market (1.4 billion people can get you that reputation). It is also one in which free users grew 6700% – yes, 6700% – from January to April according to the release. I know some of these users need to be converted to paid at some point, but does any company on the planet have as big a pool of potential customers to draw from as Zoom right now? Talk about shooting fish in a barrel. Sheesh.

As COVID-19 continues to reshape our entire world, it is mind-bending to contemplate just how incredible Zoom’s 2020 might end up being. This is becoming the ultimate right place at the right time story, even while fully acknowledging the terrible circumstances behind it. The market has always marveled at global, iconic companies. There is a chance we are watching one develop in real time at the fastest pace ever. Me and my shares don’t plan on going anywhere for a while.

My current watch list…

…in rough order is NET, TWLO, SHOP, COUP, TTD and MDB. Former holding WORK exits after announcing it will slog it out in the courts with Microsoft rather than just beating them in the field. I prefer my companies focus their time, effort and money on growing the business instead. There are too many other attractive options to consider that uncertainty with Slack.

And there you have it.

Most of July was a two-man show featuring LVGO and ROKU. They powered my portfolio to a 2020 double with a July 9 close of 103.5% YTD. It pulled back through the middle of the month before reclaiming the hundredth meridian July 30 (more prime Canadiana below with the same link instructions).

One final July 31 kick leaves me at 106.5% YTD and a new all-time high. Gaudy stuff. This is the first time I have ever had my entire portfolio double within a calendar year, let alone just over six months. Technically, I guess the rise is something closer to 150% from the March lows. 2020 has been that bizarre.

Shockingly, my performance is still well behind several others I follow. That just goes to show there are many ways to build a market-beating portfolio. It also suggests there are more companies than you’d think generating outsized 2020 returns. It is simply a matter of finding a process you trust to identify, purchase and hold the right names. It certainly helps to be part of a group sharing similar goals and ideas, and I once again thank all those willing to share their work so freely. While no one knows where 2020 ultimately lands, I can only say it continues to be a heck of a ride in more ways than one.

Thanks for reading, and I hope everyone has a great August. Oh, and don’t forget to wash your hands before you put on your mask.

I enjoy reading your posts on here and Saul's board. Keep it up. IMHO, the one thing I think is missing from your portfolio is e-commerce. I am doing quite well with a nice basket of sea limited, jd, meli, and Etsy. I love SaaS and my portfolio is very SaaS heavy but don't sleep on ecommerce! The margins are lower but the Moat is wide.