October 2021 Portfolio Review

Total Return: +57.4% YTD (+34.8% vs S&P)

Good ol’ trick or treat.

Entering October, you just never know if trick Mike Myers…

…or treat Mike Myers

…is going to show up.

Fortunately, it looks like most of us got to hang out with treat Mike Myers this time around.

2021 Results:

October Portfolio and Results:

2021 Monthly Allocations:

Key:

darker green: started during month

lighter green: added during month

yellow: trimmed during month

blue: bought and sold during month

red: position exits

positions >10% in bold

Past recaps:

December 2019 (contains links to all 2019 monthly reports)

December 2020 (contains links to all 2020 monthly reports)

Stock Comments:

I wrote last fall about using the following framework to assess companies:

I then described how I let that conviction create rough allocation tiers for our holdings. The basic premise is to make the biggest positions those in which I have the most conviction.

I recently received a thoughtful message referencing that post and requesting my current numbers/narrative outlook for a few of our names. Spurred by this ask (and frankly looking for something to write about in a month with no earnings), I figured this would be a great time for a conviction spot check on everything we own.

AMPL – A new position this month. Amplitude is a “digital optimization” software firm which just came public September 28 through a direct listing. Its platform is designed to track consumer behavior within a client’s digital offerings. AMPL’s products monitor and assess the entire consumer journey to identify behavioral trends, changes, and trouble spots. The software can then make marketing and/or design suggestions to improve consumer engagement, growth, and loyalty. Management calls it “a command center for businesses to connect digital products to business outcomes.”

Amplitude’s platform is powered by its proprietary Behavioral Graph database. This database contains years’ worth of consumer data and has grown from recording 100 billion events per month at the end of 2016 to over 900 billion monthly events at the end of last quarter. These events can be queried to gain real-time, data-driven consumer insights at any time.

Just what types of insights can Amplitude provide? Well, the slide below does a fantastic job of illustrating (full presentation here). The right-hand side represents the various paths a consumer might travel on a client website. The left-hand side lists just some of the queries that can be run using AMPL’s data. It’s easy to see how this could be valuable information for any company interacting with consumers through a digital interface.

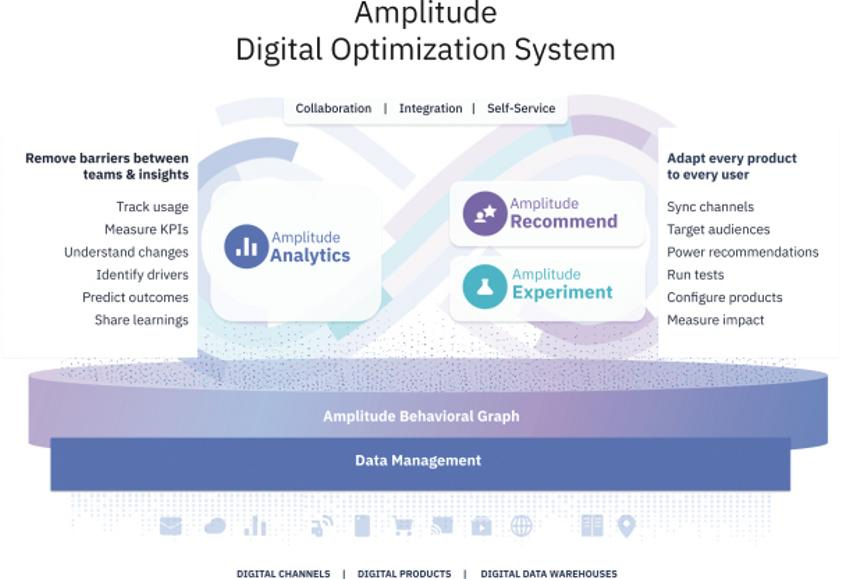

The flagship Amplitude Analytics product is designed to carry out the collection and query functions detailed above. In addition, the company just released two new modules. First is Amplitude Recommend to suggest personalized, data-driven engagement strategies for consumer subsets or even individuals. The second module is Amplitude Experiment to provide additional insight into testing and trials for new product designs. The basic interplay between the three modules is shown below:

The company’s recent performance suggests business is in very good shape. Last quarter Amplitude recorded $39.3M in revenue and an acceleration to 66% YoY growth. Gross profit grew 67% leading to 71% gross margin. Remaining Performance Obligation (RPO), which measures contracted business not yet on the books, was $138.9M for 79% YoY growth. Current RPO, meaning the portion expected to be recognized within the next 12 months, was $116.9M (+76% YoY). Current RPO growing faster than revenue is always a plus in my book. Although Amplitude’s net retention rate is lower than most of our holdings, it is still a very respectable 119%. Here’s hoping Recommend and Experiment help drive that number higher in the future.

Amplitude currently lists 1,280 total customers (+51% YoY) and 26 of the Fortune 100. That includes major brands like Ford, Walmart, Atlassian, and Anheuser Busch InBev. 311 customers finished Q2 spending >$100K per year (+40% YoY), and AMPL already boasts 22 clients spending >$1M annually versus 13 last year. It is also showing some early international traction with 35% of current revenue coming from outside the US. So, there’s lots to like and plenty of room to grow.

Operationally, expenses are reasonable at 77.5% of revenue last fiscal year and 81% last quarter. Unsurprisingly for a recent IPO, Amplitude is still posting negative profits and cash flows. However, early margins are trending in the right direction and are well within an acceptable range for a hypergrowth company (the 3Q21 and FY21 figures are current guides I would expect to be beaten):

As with September’s DCBO and MNDY additions, Amplitude is a broad bet much of the world’s 2020 online move is permanent. With more and more business being done electronically, it will be imperative companies have the right tools to monitor, measure, and improve those interactions. The fact AMPL is already doing that for some major players is more than enough to earn a starter position. We’ll get our next update November 9 with Amplitude’s first report as a public company. Fingers crossed.

Numbers: Super interesting and appearing to accelerate. Amplitude hits a lot of the check points for a young software firm that goes on to do bigger and better things. Given management’s top end Q3 guide of 67% growth, I wouldn’t be surprised if revenue accelerated from Q2’s 66% to 80%+. If that happens, I’d guess AMPL’s numbers will quickly garner a lot more attention.

Narrative: Considering AMPL hasn’t even posted its first public quarter yet, we don’t have much track record. However, management seems very sharp with investor materials that are clean and tight. The stock is by no means cheap, but the company itself appears to be flying a little under the radar. That could change quickly if Amplitude continues to execute.

CRWD – October was a solid news month for CrowdStrike. First was a partnership with UIPath. This is a first-of-its-kind integration bringing complete protection to automated and robotic endpoints. UIPath’s products mechanize many manual business functions. However, even automated functions need secure permissions and clearance to safely access corporate networks. This collaboration provides joint customers with additional protections regardless of whether man or machine is operating the endpoint. Sounds like a win-win to me.

Next was CrowdStrike’s annual Fal.Con customer conference. A complete recap including the entire list of announcements can be found here. The one most worth highlighting is CRWD’s new Falcon XDR product. This module extends “CrowdStrike’s industry leading Endpoint Detection and Response (EDR) capabilities to deliver real-time detection and automated response across the entire security stack.” Even better, the release came in conjunction with a new CrowdStrike XDR Alliance program. That means Falcon XDR hits the market already integrated with Google Cloud, Okta, ServiceNow, ZScaler and others. It also means CRWD exits Fal.con continuing its push beyond end point protection with even stronger partnerships.

Lastly, CrowdStrike announced a deeper integration with Amazon Web Services. The new features will “further protect customers from growing ransomware threats and increasingly complex cyber attacks.” Joint customers will have greater visibility, detection, and response capabilities across cloud workloads and the endpoints using them. This looks like a deal that should benefit both firms.

Numbers: Still strong but showing signs of slowing. Every company hits a large numbers inflection point, and CrowdStrike is coming close if it’s not there already. I’d expect it to perform well enough to remain a market-beating investment well into the future. The question, of course, is how long CRWD performs well enough to help lead a concentrated portfolio. For now, its numbers still fit the bill.

Narrative: I’d put CRWD’s narrative slightly ahead of its recent numbers. President Biden’s cybersecurity Executive Order should be a boon for the sector, and there is every reason to think CrowdStrike will benefit. The headscratcher is why other firms have reported surprises since that edict was announced while CRWD has not. Will it finally post numbers more in line with this narrative next quarter? I have no idea, but I sure as heck know that’s what I’ll be looking for.

DCBO – This month Docebo added two new products to its learning suite: Connect and Flow. Connect “enables customers to seamlessly connect Docebo to any custom tech stack, making integrations faster and more effective.” This makes it easier to link with clients’ existing software and get content to end users. Flow is designed to better incorporate educational content into regular daily workflows. According to the release, Flow easily lets clients create an “always-on” learning environment for employees, partners and customers.

As an aside, DCBO earned a 2021 Tech Cares Award celebrating “companies that have gone above and beyond to provide strong Corporate Social Responsibility.” Docebo received the award for creating its Docebo Women’s Alliance to “empower women in tech” and provide female employees with opportunities for growth. The most successful companies not only grow their business but their employees as well. As both a shareholder and person, it is nice to see Docebo making such an intentional and concerted effort.

Numbers: The main reason for the investment here. Though a relatively small company, many of Docebo’s trends show strong hints of acceleration. Personally, I’m looking for another quarter of 75%+ growth in its November 11 report. Since this is purely a tryout position, the results will need to be strong for DCBO to stick around.

Narrative: Super early. The broad trend I’m banking on is digital learning moving beyond its traditional HR-centric uses into more general onboarding, training, and certification programs. Given this is such a niche industry to begin with, I’ll be mostly letting the numbers dictate whether this is a story worth following.

DDOG – Datadog’s big event was its annual DASH user event on October 26-27 (presentation slides here). Day 1 saw a flood of new products and releases including:

the introduction of Datadog Apps allowing partners to build applications that connect seamlessly with DDOG’s platform;

the launch of Session Replay, a feature allowing customers to create a video-like playback showing how users interact with their applications;

general availability of DDOG’s Network Device Monitoring product providing a single view of a customer’s entire network whether on-premise, in the cloud, or a hybrid mix;

the release of Continuous Integration Visibility to “quickly determine and fix the root cause of issues detected in build and testing pipelines”;

and an improved Online Archives product letting customers keep log data for 15 months at the same price as one month’s current storage.

Unfortunately, anyone wanting more specifics on the tech will need to find another source. That’s way outside my lane. All I know is innovation and iteration are absolute musts in the software space. In that respect, I can’t help but like what Datadog is doing. We’ll get our next peek under the hood when DDOG reports November 4.

Numbers: Outstanding. Datadog’s numbers have gotten better and better as it has fully rebounded from the now infamous 2Q20 COVID reset. Revenue, RPO, customer count, module usage, cash flows, and profit margins have all been excellent even as management reinvests as aggressively as it can. I wouldn’t be at all surprised to see an acceleration to 70%+ revenue growth this quarter with the usual strong secondary metrics.

Narrative: Also outstanding. The ongoing digital transformation has created tailwinds in each of Datadog’s three main operational areas: observability, log management, and security. With its rapid pace of enhancements and upgrades, DDOG appears to be confidently positioning itself as a true one-stop shop for that entire spectrum of services.

DOCU – Aaaaaaaand…I’m out.

I sold DocuSign during an early October pullback when it only dipped slightly while everything else went down more. Most of the proceeds went into LSPD, MNDY, DCBO and ZS, all of which I believe have better prospects going forward. DOCU was a market-beating investment for us, and my guess is it will continue to be one. In this case, names I liked better simply squeezed it out.

LSPD – This was an interesting month for Lightspeed. On October 1, it formally closed the Ecwid acquisition. Ecwid’s tech includes a super-simple platform allowing users to create a standalone online business in minutes. The combined companies “will help merchants reach shoppers where they are, whether on social media or digital marketplaces, ushering in newfound selling flexibility and omnichannel experiences.” The deal also lets Lightspeed potentially leverage Ecwid’s recent TikTok partnership giving merchants seamless access to TikTok’s ad features. As with its other acquisitions, LSPD will have to prove it can successfully merge operations. However, it’s not hard to see how these ease-of-use features could benefit Lightspeed customers.

Mid-month was the launch of Lightspeed Restaurant, the company’s new end-to-end solution for restaurant and hospitality merchants. This platform merges years’ worth of best practices in commerce and point of sales from multiple acquisitions. Key features include:

Best-in-class Analytics and Reporting

Lightspeed Restaurant tells operators what brings their customers back, who their best servers are and why, and makes them feel like they're on the floor every day even if they manage several locations.Data at your Fingertips

Restaurant owners, chefs and managers receive a daily email detailing everything they need to know before doors open, and a shift prep email detailing reservations, VIP guests, and notes for the service ahead.Comprehensive Integrated Inventory

Track and automate inventory without breaking the bank. Know exactly how much product was sold, how much is still on hand, and how much is needed from a supplier for the next order.Easy-to-Use and Train Workflows

Optimized by years of user testing, Lightspeed Restaurant is easy to use and train on, key for hiring and retaining new staff and running smoother shifts.Contactless ordering and payments with Order Anywhere

Fully integrated with Lightspeed Restaurant, Order Anywhere provides contactless ordering and payments for dine-in, and commission-free ordering for takeout, with the flexibility to either pre-pay online or pay at pick up, while avoiding expensive third-party fees.

Shortly after was the release of Lightspeed eCommerce for retail customers. What’s most impressive here is many of Ecwid’s best features have already been integrated into the platform. In explaining the benefits, CEO Dax Dasilva said:

Commerce has evolved beyond a basic online store or a single-function POS. True modern commerce is meeting your buyers where they are, whether that's on TikTok or Main Street. Lightspeed eCommerce represents the omnichannel vision that we have believed in for years: that retail merchants need to be able to scale and customize tools to fit their unique business without compromise, whether they operate primarily online, in-store, or both. We're proud of the rapid progress we've made on this integration to further improve our offering for our customers.

Highlights of this platform include:

Easy to use and set up

Lightspeed eCommerce is a great fit for retailers who have minimal to no eCommerce experience. Setting up an online business is incredibly easy, with advanced features every merchant can take advantage of to grow their business.So much more than just a web store

Designed to perform in a world of ever-changing online consumer behaviour, Lightspeed eCommerce empowers merchants to sell directly on social media, online marketplaces, and search engines. This includes a direct partnership with TikTok, allowing Lightspeed's merchants to seamlessly access core functions of TikTok For Business Ads Manager without leaving the platform.Simplify and unify omnichannel operations

Connecting the online and in-store platforms, Lightspeed retail merchants will be able to reduce the time spent on managing inventory, orders, and product details. Elevate the shopping experience with a suite of customer management features that are proven to boost sales (like abandoned cart recovery) and customer communication tools.

Just last quarter Desilva stated Lightspeed was transitioning to two core products: one for retail and one for hospitality. In fact, the former CEO’s of acquisitions ShopKeep and Vend were placed in key roles to hasten and streamline the effort. Well, here we are with two entirely revamped platforms just a short time later. That’s quite an achievement. Lightspeed has certainly moved fast the last 12-18 months, and last quarter was an encouraging glimpse at the early results. We’ll see if LSPD can keep that vibe going when it reports pre-market November 4.

Numbers: A quality baseline with acceleration in several areas. While the +220% YoY jump in total revenue was acquisition-aided, the organic figure was still a notable 81%. Gross Transaction Volume was +202% YoY and a stunning +51% from the previous quarter. Total merchants and those now using LSPD’s in-house payment solution were both up significantly. Even as it specifically mentioned being COVID conservative, management expects triple-digit growth in multiple metrics. So, all the present signs we have point to continued strong performance.

Narrative: A bit of a whipsaw recently. With Lightspeed being a reopening play, rebounding economies made the narrative smoking hot during September as LSPD surged from $90 to $125. That came to a crashing halt September 29 when a short report came out noting discrepancies in some investor materials issued prior to Lightspeed’s 2019 Canadian IPO. The subsequent ice-cold narrative pushed the stock back below $90 where I added quite a bit. The stock’s next leg will almost certainly be driven by its upcoming quarterly results. Here’s hoping smoking hot returns in short order.

MNDY – October’s monday.com highlight was its Elevate 2021 customer conference. The main page has the complete agenda along with links to breakout sessions and use cases. There is also a presentation on upcoming products and features intended to meet the company’s goal of being “the only tab you have open at work.” Motley Fool user rmtzp provided an excellent recap of the new features here. It’s well worth the read. We’ll get our next update when MNDY reports on November 10.

Numbers: So far, monday.com hits just about all the checkpoints of a potential hypergrowth winner. Last quarter saw 94% revenue growth at a $280M run rate. Not many companies are able to maintain that kind of growth, let alone at that scale. It was backed by an 89.7% gross margin and 226% (!!!) growth in customers spending >$50K a year. Losses and cash flows are narrowing rapidly, which is exactly what should happen as operating leverage kicks in. I’ll be looking closely for continued signs of that leverage in Q3.

Narrative: Still TBD, though in my opinion further along the TBD path than Amplitude or Docebo. Collaboration software has been around a while, and most of MNDY’s predecessors have struggled to leverage top line growth into bottom line profit. MNDY must prove it can buck that trend. Like AMPL and DCBO, monday.com is a bet these types of software will become more critical in the post-COVID workplace. Since that landscape is still unclear, I’m keeping the allocations sized accordingly. That being said, I could easily see one or all of these companies being a much larger part of our portfolio at some point down the road.

NET – Cloudflare’s big October news was a collaboration with Microsoft and others to streamline internet search. Through this initiative, any Cloudflare client can automatically notify search engines of website changes to ensure the most timely and relevant search results reach consumers. If I’m reading it right, this will bring greater efficiency to roughly 45% of present internet traffic while also letting Cloudflare cast its net (pun intended) a little wider.

That was followed by general release of the Cloudflare for SaaS product. An initiative begun during April’s Developer Week, Cloudflare for SaaS was an expansion of NET’s enterprise infrastructure solution to any SaaS company at any stage of development from startup on. This would let developers focus on core products rather than creating in-house security for each customer or application. As the original blog post put it:

By marrying Cloudflare for SaaS with Workers, SaaS companies can unleash their developers — we’ll take care of not just certificate management, security, and performance, but also the burden of infrastructure. You write the code, and we’ll take care of the rest.

This move makes Cloudflare for SaaS available to virtually any company. Now let’s see how well NET monetizes it.

Lastly, Cloudflare got some third-party love when it was named a Leader in the Edge Development category by Forrester Research. Its Workers platform ranked highly in multiple categories including developer experience, programming model, integrations, and roadmap. Most everyone owning Cloudflare understands edge programming is a huge part of the thesis. To that end, it’s great to see NET get such positive recognition for its efforts.

Numbers: Steady but not spectacular. Top line growth has hovered in the 50% range for ten consecutive quarters, and it’s reasonable to expect an 11th is on the way. Gross margin has settled in the hi-70’s. Net retention has accelerated from 115% to 124% the last four quarters, which bodes well. However, cash flows and profits remain negative with CEO Matthew Prince emphatically stating losses will continue for the foreseeable future. Don’t get me wrong. Cloudflare doesn’t have bad numbers. It’s just not as dynamic on either the top or bottom line as many of our other holdings.

Narrative: OMG!!! CLOUDFLARE IS GOING TO RULE THE WORLD! As long as the market keeps feeling that way, I’d expect NET to remain super expensive. But there’s no use complaining about it. You’re either willing to own it at these prices or you’re not. As for me, I trimmed a smidge at $185 this week but am content taking the rest into November 4 earnings.

ROKU – I initially drafted a long section detailing why I considered Roku’s November 3 earnings a binary event. In essence, will the likely Olympic viewing bump and enthusiasm for the upcoming Shopify app be enough to override general ad skittishness, hardware supply chain fears, last quarter’s customer weakness, and a recent escalation in the ongoing spat with Google?

Then I thought, “Why the heck would I expose over 5% of our portfolio to a report that seems to be trending toward a coin flip at best?” Even if the Q3 numbers are strong, management will likely be forced to mimic ad firms like Snapchat, Facebook, and Google in hedging enough about Q4 to keep the market in suspense. Given Q4 is seasonally Roku’s biggest BY A WIDE MARGIN, I’m just not comfortable where the comps are heading. Therefore, I decided there are better places for our money.

(Amateur journaling tip: When an initial draft has something like five sentences of potential upside and multiple paragraphs on risk, it might be time to revisit your thesis. 🤢)

UPST – October was a continuation of Upstart’s recent strong news run. First, the company released Upstart Auto Retail, its AI-enabled platform for car loans. This has been the plan ever since acquiring Prodigy’s auto sales platform in March, so it’s nice to see a formal release. Upstart loans will now be available directly through Prodigy, letting dealerships instantly offer affordable financing to more customers. Upstart Auto will be rolled out immediately to a limited number of dealers with availability to all Prodigy users in early 2022. This lines up well with management’s consistent comments that a) it expected the first Upstart-powered loans to be facilitated by the end of calendar 2021 and b) the auto offering would start to contribute significantly in 2022. Kudos to management for being right on time if not a tick early in meeting those milestones. As CEO Dan Girouard remarked regarding inefficiency in auto loans:

Next were three more partnerships. First was Abound Credit Union. Abound is Kentucky’s largest credit union with 18 locations, $1.9B in assets, and over 113,000 members. This appears to be another win likely helped by UPST’s alliance with the National Association of Federal Credit Unions.

Second was Berkshire Hills Bancorp. What’s notable here is Berkshire itself made the announcement rather than Upstart. Berkshire Hills is a publicly traded bank (NYSE ticker: BHLB) with roughly $11.7B in assets and 107 branches throughout New York and New England. The release notes the partnership started in August, so Berkshire is obviously pleased enough with the program to make the public aware.

Last was Four Corners Community Bank (FCCB), which joined the Upstart Referral Network in July. FCCB is headquartered in Farmington, New Mexico with seven locations servicing the greater “four corners” region where Colorado, Utah, Arizona, and New Mexico intersect. Since building out its partner base was one of Upstart’s key goals for 2021, it’s nice to see three more in the fold.

Numbers: Uhhh…ridiculously awesome? I mean, what else can you say when most of the comps in your most recent quarter are 1,000%+ YoY? Even discounting the COVID quirk which goosed the annual figures, most of the sequential rates that matter jumped somewhere between 50% and 70%. That’s almost unheard of for a company of any size, let alone one likely to pass a $1B run rate as early as this quarter. Even better, there is little reason to suspect UPST’s November 9 report won’t include yet another batch of exceptional numbers.

Narrative: Just as exciting as the numbers. Adding partners? Yup. Making progress with auto loans? Check. Seeing macro lending tailwinds? It sure seems that way. I know “hitting on all cylinders” is frequently overused, but I can’t think of a better way to describe what this company is doing right now.

There’s a reason UPST has grown to such an outsized #1 position the last few months. Occasionally you find a company where the numbers and narrative feed off each other in a way that almost exponentially drives the stock. It’s like hitting the sweet spot of the S-curve. Zoom had a stretch like this in 2020. So did Livongo. I’d argue Upstart is in one of those windows as we speak. There’s no telling how long it will last, but it’s not unreasonable to think another blowout quarter could produce yet another rise in the stock. Regardless, UPST deserves credit for flat out executing its way to the top of our portfolio. My current plan is to stay the heck out of the way and let UPST do its thing until something in the company performance tells me otherwise.

ZS – It was a steady month for Zscaler. First was an expansion of its partnership and integrations with CrowdStrike as a member of CRWD’s new XDR Alliance. The two companies had already aligned their products and sales teams to jointly approach customers whenever appropriate. This should only deepen that relationship.

Next, ZScaler’s Private Access product (ZPA) achieved Impact Level 5 security clearance with the Department of Defense. This means ZPA can now be used by government agencies and contractors to manage their most sensitive unclassified information. This is another feather in ZScaler’s Zero Trust cap, and management deserves a ton of credit for so aggressively pursuing every government clearance it can get. That only bodes well for future public-sector business.

Numbers: Rock solid. Zscaler just keeps zipping along as a profitable 55%+ grower with strong cash flows and accelerating customer and RPO numbers. More importantly, it looks like it should be able to hold most if not all its current levels for some time to come.

Narrative: ZS continues to build a tailwinds vibe. Everyone knows massive US government cybersecurity spending is coming. The problem is no one knows exactly where it’s going. ZScaler should benefit from this narrative as much as anyone. All it needs to do is win its fair share.

I continue to think ZScaler is as well-positioned for the next few quarters as any company we own. In fact, it’s not hard to imagine an uptick in both numbers and narrative at some point. I really like where ZS sits after this exercise and would even consider it an early sleeper for a big 2022. Consequently, a few more shares and a 22% October gain have bumped it up our allocation pecking order. Its next earnings update should come in early December.

My current watch list…

…in rough order is Snowflake (SNOW), Global-E (GLBE), ZoomInfo (ZI), and Asana (ASAN).

And there you have it.

It was another upbeat month for both the market and our portfolio. The personal highlight was a new all-time high of 61.9% YTD on October 18. Unlike the UPST-driven highs of August and September however, October was more of a team effort. Every single position finished in the green – including DOCU and ROKU when sold – with six of our current nine posting a market-beating month. If nothing else, that’s encouraging heading into November earnings.

I had whittled September’s 6.2% cash to under 2.5% even with the DOCU sale, but this week’s ROKU exit pushed it right back up. I figure I’ll let upcoming earnings tell me where the proceeds should go. After all, someone’s numbers or narrative should be good enough to step up and take the money.

Thanks for reading, and I hope everyone has a great November.

Thanks for your excellent information. I’m ready to learn more about investing. Found your name through Sauls and although truly a novice’s novice, enjoy reading in depth information like yours. Thanks for sharing your knowledge.

Great update. I completely agree with you on ROKU and I am curious to see the next ER. I exited all my CTV and ad-tech plays earlier this year. There is too much noise in that area. Plus, they all face difficult comps from last year. Oh, and happy Halloween.