October 2020 Portfolio Review

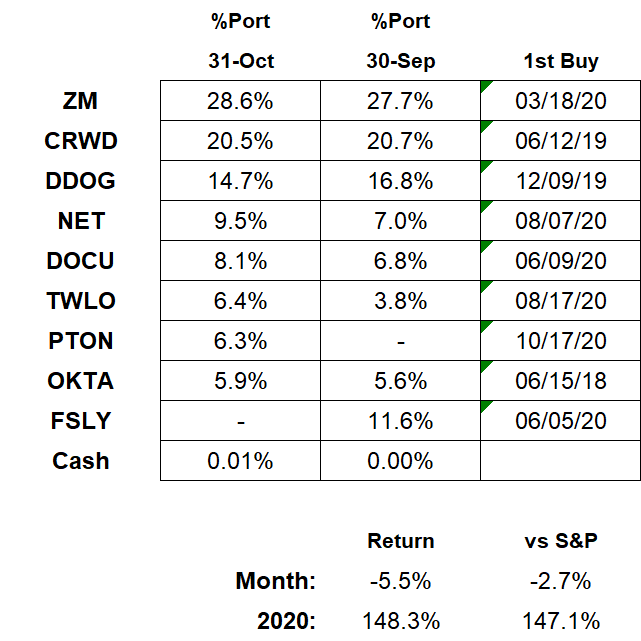

Total Return: +148.3% YTD (+147.1% vs S&P)

I entered October 99.99% certain this intro would be something kitschy about Halloween. It turns out my companies had other ideas. My plans to find that perfect dancing candy corn gif fell by the wayside as I furiously tried to keep up with my holdings’ newly-branded “Crazybusy Product Enhancement Month!!!”™ Everyone and their brother prattled on and on about all the great improvements they were making. Platform developments, product releases, big acquisitions, third-party accolades…you name it, they did it. It was corporate one-upping at its finest.

Being honest, I thoroughly enjoyed all the shameless humblebragging. It was like watching a bunch of classic overachievers jockeying for teacher’s pet. Only the best work was submitted, and there were plenty of attempts at extra credit. Sadly, one student chose not to participate and had to be kicked out of class. Fortunately, the waitlist had a transfer candidate with an excellent transcript ready to join right in. As the final bell rings, I am happy to report “Grades are in!”

2020 Results:

October Portfolio and Results:

2020 Monthly Allocations:

Key:

darker green - started during month

lighter green - added during month

yellow - trimmed during month

blue - bought and sold during month

red - position exits

positions >10% in bold

Past recaps:

December 2019 (contains external links to all 2019 monthly reports)

Stock Comments:

October’s changes were pretty straightforward.

Fastly faltered, so Peloton premieres.

DOCU and TWLO caught the non-PTON crumbs from FSLY’s trickle down wreckonomics.

Innocent bystander DDOG got nicked by a trim in the reshuffle.

Individual report cards below.

CRWD – CrowdStrike made several significant announcements at its Fal.con 2020 customer event.

Falcon Zero Trust Assessment (ZTA) lets CRWD formally join the Zero Trust party. According to the release, “most current Zero Trust solutions verify user authentication for network access and don’t take into account the security health of the device associated with that user.” Falcon ZTA solves that issue by tying endpoint protection directly to user identity. With an initial partner list including Okta, Akamai, Cloudflare, Google, Netskope and Zscaler, it appears this new release could move CRWD’s needle in a significant way.

Falcon Horizon is a new module protecting customers using multi-cloud environments. The pain point here is “nearly all successful cloud services attacks are a direct result of customer misconfiguration, mismanagement and mistakes.” Horizon automates much of this management, enabling customers to deploy applications with greater speed and efficiency.

A new unified console that “seamlessly integrates third-party threat intelligence data with Falcon detection and incidents.” Tying together data from various feeds will let customers view incidents under one pane and respond more quickly to identified threats.

Falcon Forensics to enhance visibility and automate analysis of incident investigations. When breaches do occur, this product provides deeper insights into the cause and helps customers get back on track more quickly.

An impressive list. As more and more companies embrace remote work, the need for top-notch cyber security becomes more and more obvious. By expanding into Zero Trust while simultaneously improving its core capabilities, CrowdStrike is doing an excellent job of staying at the head of the class.

DDOG – A serial enhancer the last few months, Datadog’s October contribution better identifies performance issues caused when deploying new code. According to the release, “functionalities” include:

Easily comparing performance between versions: quickly identifying bad deployments by comparing high-level performance and error data between releases.

Ensuring efficiency of targeted fixes: viewing granular performance data down to a single endpoint to ensure a hotfix is actually resolving the issue.

Starting troubleshooting in one-click: leveraging seamless correlation between version performance metrics and the associated hosts, traces, logs, code profiles, and processes to detect the root-cause faster.

I’m no developer, but those functionalities sound pretty sexy to me.

Datadog also got some mid-October love when Gartner recognized it it as a 2020 Customers’ Choice for Application Performance Monitoring. While there wasn’t much substance to the news, the gushing platitudes sure did give the warm and fuzzies. Customer quotes included:

Swiss army knife of software monitoring

“An incredible tool, visually rich and perfect for metrics and monitoring, we can act fast minimizing any business impacts due to software/infrastructure failures. The documentation is also really good.”- Software Engineer in the Services Industry

The best monitoring product in the market

“Datadog is a great product that is flexible enough to have metrics about our systems and product. The developers also love the product and it's easy enough to integrate it. It also gives me confidence as a CTO to take the decisions I need in terms of scalability.” - CTO in the Services Industry

Excellent solution to address modern end-to-end observability needs

"Strong technical solutions meeting today's cloud business requirements. Excellent partner who is open to business needs and feature developments to address those needs.” - Head of Cloud Operations in the Finance Industry

One can’t help but admire that kind of client enthusiasm. Here’s hoping the investor accolades are just as encouraging when Datadog reports November 10. 🤞

DOCU – DOCU’s October humblebrag was the release of DocuSign Analyzer for contract management. Analyzer uses – buzz term alert! – artificial intelligence to aid in organizing and reviewing incoming contracts. DocuSign considers this module a natural extension of its Insight product to find, search, and understand existing agreements. Analyzer is designed to assist in reviewing and negotiating agreements upon initial receipt. It will provide “clear and actionable insight into the risks and opportunities in the documents [users] are being asked to review and sign – before it’s too late to negotiate better terms.” My long-term DOCU thesis relies heavily on it being able to expand its current eSignature business into overall contract management. Analyzer looks like a huge step in the right direction.

FSLY – < Sigh > Oh well. There’s one in every class... 🙁

Fastly started in fine fashion but ended on a disappointing note. October began with a nice little boost after FSLY closed the Signal Sciences acquisition. The enthusiasm continued when FSLY drew additional attention for its recent Google Cloud collaboration. The partnership was officially announced September 10, but the market seemed more excited about an October tweet and company post with a few more details. The stock spiked roughly 40% over two weeks before crashing back to Earth on 10/14 due to a Q3 pre-announcement that revenue would fall short of management’s previous guide. The new range dropped to $70-$71M from $73.5-$75.5M. Management also withdrew guidance for the year. Two customer-specific factors were noted:

Due to the impacts of the uncertain geopolitical environment, usage of Fastly’s platform by its previously disclosed largest customer did not meet expectations, resulting in a corresponding significant reduction in revenue from this customer.

During the latter part of the third quarter, a few customers had lower usage than Fastly had estimated.

The first bullet point suggests management lost feel for its TikTok business, which is understandable given the recent machinations between TikTok and the US government. Also, let’s not forget India banned TikTok in late June, which clearly had an effect. The second bullet point is the bigger concern since it suggests management lacks insight into some of its other business as well. That is not a good look, and to be blunt is inexcusable given they already knew about the TikTok uncertainty. I understand usage-based pricing might be harder to estimate, but that hasn’t stopped Twilio or others from beating or even raising guidance as they go.

And there’s the rub. The need for these high growth companies to successfully play the beat-and-raise game is one of the worst kept secrets on Wall Street. Management botching this so soon after its surprising Q2 is a definite misstep. In less than a quarter FSLY rebranded itself from a 60%+ grower with present tailwinds and an intriguing new product coming to a likely low-40’s grower with a possible one-time revenue blip and new uncertainty about management’s handle on its business. Some might consider those differences subtle, but in my opinion Fastly’s story had changed enough to mean something. Apparently, that something started with a ~30% afterhours haircut.

I initially considered trimming before ultimately choosing to exit completely while the smoke cleared. Fastly’s unexpected Q2 earned the stock a top-tier multiple and huge price run. This equally unexpected miss not only vaporized that premium but instantly switched FSLY’s general vibe from one of positivity to uncertainty. No one should be surprised the market responded negatively. Revising guides downward is simply not what top-notch growth companies do. This was a significant gaffe by rookie CEO Joshua Bixby’s crew, and my conviction level dropped accordingly. First, it was hard to see Fastly doing much to regain its mojo with its upcoming report. Second, I’d imagine future guides will be extra prudent (and therefore less attractive) since management would have zero interest in screwing up again. Putting it all together, I decided to book my gains at ~$90 and reassess after management got the chance to explain itself.

After reviewing that explanation, I believe dropping FSLY was the right personal decision. As pre-announced, revenue came in lower than anticipated at $70.6M. While most investors already knew TikTok’s US business would decline, TikTok apparently pulled its non-US traffic from Fastly as well. Communication remains open in case things change, but management assumes no TikTok dollars in future expectations. The CEO suggested the non-TikTok shortfall was simply a timing issue for new traffic that should have no impact beyond Q4. Not wanting to commit another unforced error, management goes to great lengths to outline potential headwinds and its plans to navigate them in its shareholder letter. I would strongly recommend anyone interested in Fastly give it a read.

Oh, the painful irony of those last two sentences. I wrote them October 29, the day after earnings. On October 30 Fastly released an update to the shareholder letter stating it miscalculated the $8M in Q4 revenue it expected from Signal Sciences. The original estimate included $8M in deferred revenue but didn’t back out purchase price adjustments from the acquisition. “These adjustments could materially reduce the amount of Signal Sciences’ deferred revenue that will be recognized in the fourth quarter.” Fortunately, management wasn’t forced to formally lower the guide as well, but my guess is this error just decreased whatever beat had been built into it. I also now fully expect the headline number for Signal Sciences’ Q4 contribution to be under $8M. This is yet another sloppy mistake. WTF Fastly?!? Foot meet mouth.

Unsurprisingly, this quarter’s execution stumble led to expanded losses and a decreased guide. For Q3, the revenue miss turned a projected $1M operating profit (which likely would have been beaten) into an actual $4M loss. FY20 guides now call for lower revenue and even wider losses. Top end FY revenue dropped $8M to $292.2M. Backing out the projected $8M from Signal Sciences makes the organic shortfall closer to $16M. Likewise, FY20 operating losses were raised $17M to $19.1M. That’s not chump change. And again, this is something the best growth companies are very rarely forced to do. As for Q4, management’s 42.5% top end growth guide must be adjusted for Signal Sciences this year and TikTok in 2019 to estimate an organic number. Here’s my back of the napkin math eyeballing 10% for TikTok in 4Q19:

4Q19: $59M – 10% TikTok = $53.1M

4Q20: ($80M-$84M guide) – ($8M Signal) = $72M-$76M guide

Organic Growth: 36%-43%

While that’s not bad, it is not nearly as attractive as some other options at higher run rates and better profitability. In addition, enterprise customer count continues to be a headscratcher. Q2’s net increase was just seven customers, though management said that total included a higher number of new logos offset by some existing clients in COVID-hit industries dropping below the enterprise threshold. This quarter saw just nine more adds consisting of “both new and existing large customers.” This implies another soft quarter as far as new logos. The saving grace is average enterprise spend for existing customers has jumped from $642K to $716K to $753K during 2020. I admit that’s super impressive – and led to a stunning 147% Q3 expansion rate – but I also wonder if at some point current customers simply max out. Signal Sciences’ 40+ new clients should help immediately, but this remains something to watch.

All this info suggests to me Q2 was indeed a one-time blip rather than a new level of performance. It is also fair to say Fastly has become a much more complicated story. Unsurprisingly, the market has drastically repriced the stock. Don’t get me wrong. There is nothing that says Fastly won’t be a good investment from here. In fact, I thought Compute@Edge being released for general availability was the runaway highlight of the report. Edge computing has a chance to be a big winner for Fastly. However, I just can’t get excited enough about its present execution to put money behind it while waiting to see if that future unfolds. Until Compute@Edge gains enough traction to be real, I believe FSLY fits better on my watch list than in my portfolio.

[If interested, a much more detailed look at the specific thought process behind selling rather than trimming can be found here.]

NET – Cloudflare kicked off October with a slew of releases during its Birthday Week 2020. The party included a Launch Day video of industry experts sharing insights into many of the new offerings. Most were developer tools integrating with Cloudflare’s Workers platform, including:

a scheduling product allowing developers to route workflows to quiet or underutilized machines;

enhancements to NET’s serverless storage features;

a free web analytics module with enhanced privacy;

a collaboration with Google Chrome to let website owners analyze load times, responsiveness and visual stability;

additional analytics tools for examining “the mind-boggling, ever-increasing number of events…logged by Cloudflare products every day”;

Cloudflare Radar for real-time visibility into internet traffic and security trends;

API Shield to provide encryption for mobile applications and IoT device traffic;

Automatic Platform Optimization to let websites created with WordPress use Cloudflare’s edge compute capabilities to boost site performance;

Expanding its Access offering to provide service to SaaS apps.

As if that wasn’t enough, NET’s subsequent Zero Trust Week proved an even bigger event. The major news here was the unveiling of Cloudflare One, “a platform to connect and secure companies and remote teams anywhere, on any device.” This Zero Trust offering enables fast and safe connections from anywhere in the world without exposing users to the public internet. It makes personal devices safe for business in any environment with any cloud provider. This release was paired with several partnerships including CrowdStrike, VMware Carbon Black, SentinelOne and Tanium. From a tech standpoint, this suggests Cloudflare One should integrate seamlessly with several best-in-class partners. From a story standpoint, such an impressive list of initial collaborators gives NET instant street cred in the security realm. One particular Street seemed especially smitten, immediately pushing the shares up 20%+ on the news. Make no mistake, this new security layer is a major addition to Cloudflare’s product line. Some key features include:

Cloudflare Gateway to create a fully secure gateway inspecting all internet traffic for incoming threats. Think of it as a cloud-based solution replacing traditionally clumsy VPN’s for secure access from remote locations (I think I have that right. Open to correction if I don’t.).

Cloudflare One Intel to streamline security by analyzing data across Cloudflare’s entire network to create actionable insights for keeping users secure.

Isolated Browsing, which is currently in beta. This allows browsers to operate on the edge in the safety of a Cloudflare data center rather than on the end user’s machine. This could solve a major pain point for companies with remote employees who need to safely access the internet.

Magic Firewall, a network-level firewall securing enterprise customers through Cloudflare’s services. This feature works with Cloudflare One to protect remote users, branch offices, data centers and cloud infrastructure under one roof.

And finally:

Intrusion Detection System, a product to monitor entire networks and alert users to suspected attacks. This feature works on all traffic in both directions regardless of whether it came from outside or inside your network.

Phew! That’s an awful lot to process. All I can say is when Cloudflare implied it was rolling out the red carpet for its 10th anniversary, it wasn’t kidding. Further details on all of the above and more can be found on the company blog. Cloudflare has consistently emphasized its desire to be developer-centric and customer-driven. These enhancements suggest NET has very much put its R&D money where its mouth is. The company exits October on a pleasingly high note, and I very much look forward to hearing what management has to say when it reports November 5. My current Trust is greater than Zero the news could be good.

OKTA – Okta held its annual Showcase event October 7. While the announcements weren’t quite as dramatic as some other firms, there were still several intriguing enhancements:

Embeddable developer tools to simplify passwordless login.

A new feature allowing developers to use one ID verification for clearance across the entire software stack.

Enhancements to its Advanced Server Access feature making it easier to integrate identity and access management into existing infrastructure.

A new partnership pairing its Identity Cloud with Salesforce’s Work.com product. The Work.com product is designed “to help businesses and organizations around the work reopen safely, which includes shift management; manual contact tracing; emergency response management; and more.” With so many companies shifting to hybrid or permanent work from home set ups, it is easy to see the potential benefit of this alliance.

A general announcement on Okta’s Partner Connect program highlighting a 400%+ increase in its channel partner ecosystem since 2018.

As usual, OKTA trudges merrily along on its boringly good, boringly effective, boringly profitable (+82% YTD) way. You do you, Okta.

PTON - Bon jour, Peloton!

Peloton joins my portfolio pack after grabbing most of my FSLY proceeds. Being honest, having a name as strong as PTON on my watch list made the switch that much easier. Coming into this, I must acknowledge right upfront Peloton differs from my other holdings in three significant ways:

It sells widgets rather than software.

Its main customers are the general public rather than other businesses.

Its products are completely discretionary rather than business critical.

These factors create different risks than my other companies, but there is no denying Peloton’s results thus far. The company is coming off a profitable year of 99.6% revenue growth with top end guides of 242.1%(!!!) this quarter and 99.9% for FY21. Given Peloton’s insane popularity and overflowing waitlist, it is hard to see how the year doesn’t end solidly north of 100% growth.

While the bulk of PTON’s sales is exercise equipment, what intrigues me more is the subscription revenue collected from all those madly pedaling enthusiasts. FY20 saw $363.7M in subscriptions at 100.8% growth. This rate is accelerating right along with hardware sales and is now creeping toward 20%+ of revenues as the company scales. Subscription programming has even been expanded to customers using non-Peloton equipment. That clearly increases the number of customers PTON can reach with its higher margin business. In essence, Peloton has found a way to successfully sell its blades even to those who haven’t purchased the razor. This could lead to a virtuous little cycle of new hardware sales bumping subscriptions while new subscriptions bump hardware. That would be a neat little trick indeed and doesn’t even touch upon potential expansion into treadmills, strength classes, sportswear, etc.

Given the business model oddities outlined above, I plan on tracking PTON a little differently. I see most of my other firms as leading-edge disrupters in a major technological shift. In Peloton’s case, I feel I am purchasing 100% FY21 growth and watching closely to ensure the story stays intact. While PTON’s existing backlog and continued COVID influence are powerful tailwinds, I do not consider them as durable as those gusting behind say ZM or CRWD. Given the fickle nature of Joe and Jane Consumer, I will likely be less forgiving if Peloton somehow falls short of expectations. At its simplest, 2020 has created a perfect storm for Peloton to sell a ton of expensive razors along with a healthy supply of recurring blades. As long as that’s the case, I have no problem mounting up and pedaling along for a while. My first scenic overlook is November 5 earnings.

TWLO – In what was a busy month for everyone, Twilio just might have been busiest of them all. If you’ll remember, the shares saw downward pressure at the end of September when Microsoft announced it was entering the market. Twilio responded with an early October filing upping its previous Q3 revenue guide of $401M-$406M. How much higher, you ask? Well, we couldn’t tell since revised numbers weren’t issued. Regardless, management obviously felt it pertinent enough to merit a pre-announcement. The market totally dug the news and shoved the shares up as much as 15% the next day.

That announcement was a great lead into Twilio’s first-ever virtual customer conference, which saw 10 times the attendance of prior years. SIGNAL 2020 included a star-studded lineup of speakers ranging from former President Barack Obama to personal favorite Bill Nye the Science Guy. CEO’s from major clients like Nike and Delta Airlines detailed how they use of Twilio to improve customer engagement. There were several product announcements along with a well-received Investor Day (slides here). Some highlights:

Twilio now has 10M+ Developer Accounts and 200K+ Active Customers;

Twilio’s customers are spread fairly equally between small, mid and enterprise customers. This gives it plenty of room to grow alongside its client base;

Messaging growth is reaccelerating at scale rising to 59% in 2Q20 from 58% in 1Q20 and 49% in FY19. Twilio handled 63B+ messages in the first half of 2020, which is nearly as many as all of 2017 and 2018 combined;

Application services have rocketed. In 1H20 video services grew 599%, messaging software 208% and engagement cloud 94%. This represents some of Twilio’s higher margin business and now accounts for 12% of total revenue;

Revenue from the Flex cloud contact center product grew 184% in 1H20;

Even revenue from the SendGrid acquisition – boring old email messaging – has accelerated from 31% in FY18 to 36% in 1H20;

Customer churn remains in the low single digits even as Twilio’s customer base continues to expand. COVID-19 does not appear to have had any significant effect here;

Dollar-based net expansion holds steady in the 130% range even as the company scales;

The company expects 30%+ organic annual revenue growth over the next four years.

The slide I found most interesting was #17 detailing Twilio’s verticals:

It illustrates not only the breadth of TWLO’s offerings but also just how much room there is to expand. Many of these industries will see exponential growth over the next few years, and Twilio has smartly planted seeds in all of them. The COO states:

“…our research shows that this digital transformation is being accelerated by up to six years…So, at every level, I think that this is not just a temporal thing, but part of a new way for companies to engage.”

It is no wonder MSFT has shown interest in tagging along. That suggests there is room for multiple winners, and I would have to think Twilio is as well-positioned as anyone to grab its fair share of these markets.

Twilio kept the momentum going with a mid-month acquisition of customer data company Segment. This $3.2B all-stock purchase is expected to close in Q4. Segment’s platform “collects user events…and provides a complete data toolkit to every team in your company.” According to the investor presentation, this acquisition will let Twilio provide “a single view of a customer across channels for more effective engagement.” Segment brings 20,000+ customers, including Atlassian, Google, Peloton, Instacart, Reuters and IBM. It also brings impressive metrics with 50%+ growth, ~75% gross margins and a subscription revenue model of mainly 1 year+ contracts. At first glance, this looks like a smoking-good fit.

Twilio estimates the acquisition increases its TAM from $62B to $79B. Given the success of TWLO’s current communications offerings, bolting on a firm specializing in customer analytics makes total sense. Adding premium customer insight tools to Twilio’s existing lineup should only strengthen the platform. As CEO Jeff Lawson stated:

“The one thing that’s always been missing from Twilio…is understanding of the end users themselves.”

If integrated properly, this acquisition could result in a one-stop, end-to-end customer engagement platform. That could be a huge winner.

Signal and Segment were nice preludes to what I thought was a strong earnings report on October 26. Revenue growth accelerated sequentially from 46% to 52%, which is especially impressive at a ~$1.8B run rate. Even backing out roughly $10M in seasonal political spending, revenue grew 48%. Gross margins fell a tick from 56% to 55% due mostly to $10M in Verizon pass-through fees. However, the CFO stated:

“As you’ll recall from our recent Analyst Day, we discussed that gross margins would be negatively impacted in the short term as the growth of our messaging product has been re-accelerating, a trend that continued in Q3. To reiterate, this is a trade-off that we will gladly take as it adds gross profit dollars which we can continue to reinvest, delivering elevated levels of growth.”

Taking a look, gross profit growth did indeed accelerate this quarter, and TWLO’s long-term gross margin target remains unchanged at 60-65%. Customer growth held relatively steady while expenses continue to shrink as a percentage of revenues on both a GAAP and non-GAAP basis. Net expansion rose to 137% from 132% both sequentially and YoY, an excellent sign for a firm pursuing new use cases with existing customers. The bottom-line result was Twilio’s usual small profit despite management’s continued emphasis on “investing in our products, out platform and our people.” Overall, a quality showing.

Looking ahead to Q4, management guides for 37% top end growth. TWLO’s normal beat would push that number back toward 45%. It is worth noting this guide includes no contribution at all from the Segment acquisition, which is scheduled to close during Q4 and deliver “a modest top and bottom-line impact.” Along those same lines, the strong Segment metrics referenced earlier could provide a nice little burst as we end 2020 – thank goodness – and head into 2021. Twilio might not be quite as exciting as some of my other names, but it continues to do an excellent job of lining itself up as a long-term winner. I am happy to have it in my supporting cast.

ZM – The big news here was October’s Zoomtopia customer event. It included keynotes on the Zoom Phone and hybrid working along with vertical discussions on Telehealth, Government, Education, and Financial Services. My inner glutton for punishment would pen a long, flowing Zoomtopia summary. My inner sloth would simply link to someone else’s work. And so, here’s this excellent recap from someone else.

I did, however, want to make some personal notes on a few of the announcements. One of the more interesting ones is the release of OnZoom, a “comprehensive solution for paid Zoom users to create, host, and monetize events like fitness classes, concerts, stand-up or improv shows, and music lessons on the Zoom Meetings platform.” Broadly speaking, augmenting Zoom’s core enterprise offerings with a small business platform could create an enormous increase in TAM even with the risk of additional customer churn. COVID-19 has pushed a slew of business online around the globe. This solution puts Zoom at the forefront of tools specifically designed for this new generation of video entrepreneurs. I like this move.

Another is the release of Zapps. Due by the end of 2020, Zapps is a platform allowing third-party apps to be used within Zoom to increase productivity and engagement. Zoom has over 25 launch partners currently building Zapps for:

Collaboration, like Atlassian, Asana, Box, Dropbox, Slack, and Wrike

Education, like Coursera, Kahoot!, and Kaltura

Enhancing the meeting and webinar experience and expression, like Cameo, Exer for Exercise classes, and Slido for polls and QA

Personal productivity, like Superhuman for email, Woven for calendaring, Pitch for presentations, Smartsheet for spreadsheets, and Coda for living documents

Sales and marketing, like HubSpot, Chorus, and Gong

Whiteboarding on a Zoom Room touchscreen device, including Lucidspark, Miro, and Mural

Support and incident response, like ServiceNow and PagerDuty

The next enhancement was customizable Software Development Kits (SDK). SDK’s allow developers to easily integrate Zoom into new and existing applications. This update gives developers even more freedom and flexibility when building Zoom’s features directly into their apps. I’m no coder, but I do know combining “developer” and “customizable” usually results in an increased number of use cases. That’s perfectly fine by me.

Last but not least Zoom officially rolled out an end-to-end encryption (E2EE) feature. Encryption capabilities were a white-hot topic for Zoom during a very public and somewhat uncomfortable review of its security features in May. This “technical preview” release is aimed at soliciting user feedback and is Phase 1 of 4 in Zoom’s effort to eventually provide best-in-class E2EE. CEO Eric Yuan touts this development as “another stride toward making Zoom the most secure communications platform in the world.” Yuan personally guaranteed Zoom would get security right during the negative publicity this spring. It is nice to see him following up so strongly on his word.

Though it seems almost anticlimactic compared to everything above, I would be remiss if I didn’t mention Zoom also held a Financial Analyst Meeting as part of this event. For anyone even moderately familiar with the company, there really wasn’t much new (super impressive slides here though if interested). Let’s just say Zoom continues to hit on just about every cylinder imaginable. That only bodes well for the remainder of 2020. I know the stock remains pricey, but it is extremely hard to find a chink in Zoom’s armor right now. I will continue to let this oversized winner run as long as that appears to be the case.

My current watch list…

…in rough order is SHOP (what a crazy good quarter), ROKU, TTD, ZS and MDB. FVRR is intriguing, but I have concerns whether freelancing’s recent popularity will hold post-COVID. I don’t doubt many independent contractors love the freedom of choosing projects. Still, I’d have to think many in the US will gladly take the security and especially health insurance of a full-time gig if and when hiring bounces back. I am totally open to being told why that view might be incorrect because Fiverr’s recent numbers are pretty damn impressive.

And there you have it.

The ridiculous volatility continues. After sitting solidly in the green almost the entire month, my portfolio gave up the ghost at the very end. My 20%+ pullbacks in August and September both occurred early enough to rebound completely by month’s end. Sadly, October’s ~21% dip slams right into this recap giving me my first market-trailing month since March. Stepping back though, it was reassuring to see the market respond positively to much of the quality news my companies churned out this month. In fact, the initial reactions pushed my portfolio to a YTD high of 213.9% on 10/13 before FSLY’s fumble and general market jitters started the downward slide into today’s finish. While none of us can avoid paying at least some attention when our returns take a hit, it is important to remember long-term business execution ultimately wins the day. In that respect I couldn’t be more optimistic. I believe my businesses handed out waaaaay more treats than tricks this month, and that is always an enjoyable way to end October.

Thanks for reading, and I hope everyone has a great November. Wash your hands, wear your mask, cast your vote and most of all don’t forget to be thankful.

Extra Special Bonus!

I ended up finding that dancing candy corn gif anyway. You’re welcome.

Fantastic write up TheStockNovice. Thoroughly enjoyed it!

Great write up and congratulations on your return! What do you see will keep ZM growing at this pace once people are back to office? I know some companies won’t stop work from home until next year but that has to end sometime in 2022. And that’s where the majority of ZM revenue comes from. Business use of ZM won’t stay like DOCU which is a permanent trend of shifting to electronic contract, as most companies just won’t have their employees work from home forever.