November 2020 Portfolio Review

Total Return: +187.1% YTD (+175.0% vs S&P)

First off, I hope everyone had a Happy Thanksgiving and those of you forced to change traditional plans found an enjoyable substitute. We should all have something to be thankful for even if it takes an extra minute or two to figure it out because, you know, 2020.

Now back to our regularly scheduled programming…

Hey, did you guys know sometimes the market rotates sectors?!? Well, it does. In this case, November’s announcements of potential vaccines – which I sincerely hope become reality sooner rather than later – caused a panicked rush out of many growth stocks into the casinos, cruise lines, and movie theaters crushed by COVID. Unsurprisingly and very much in character for 2020, Mr. Market changed his mind lickety split and piled right back into these same growth names about a week later. It turned out to be just another abrupt head fake in what has been a totally head fakey kind of year.

When you have stocks that rise this much in such a short period, large pullbacks are a feature of a healthy market and not a bug. You simply need the stomach to endure the volatility. As soon as things settle – and they always do – the market will once again turn its attention to those businesses with the best execution. When it does, I have a strong suspicion the next leg up will be led by many of these same companies. At least that’s how it has gone in just about every other reset in recent history. In this case, it is hard to believe the market’s short-term reaction changes the world’s long-term trend. Things are quickly going digital, and there’s little to no chance we are going back. The only question is which companies will come out on top. Although no one knows exactly how it will pan out, I have a pretty good idea which firms I am betting on.

2020 Results:

November Portfolio and Results:

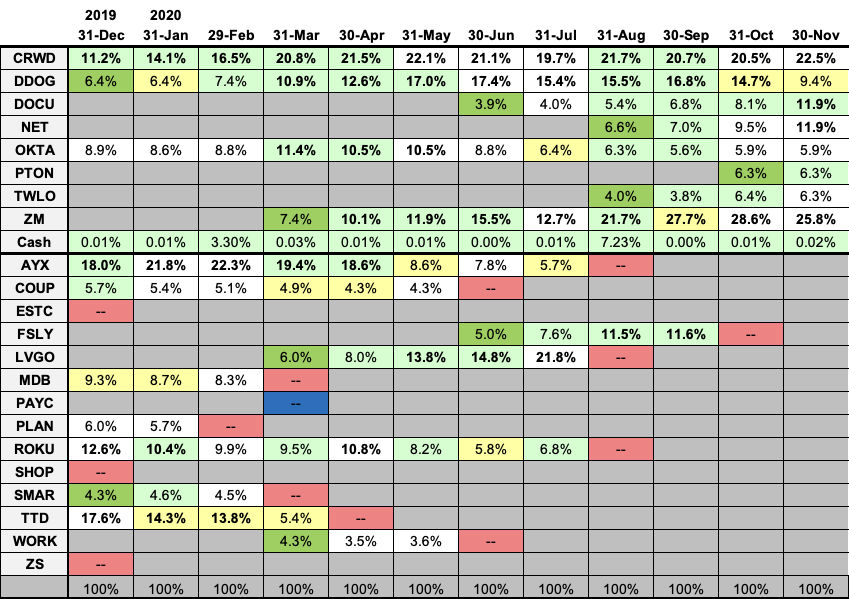

2020 Monthly Allocations:

Key:

darker green - started during month

lighter green - added during month

yellow - trimmed during month

blue - bought and sold during month

red - position exits

positions >10% in bold

Past recaps:

December 2019 (contains external links to all 2019 monthly reports)

Stock Comments:

I end November with the same suspects that started it. There were a couple of allocation tweaks, but this month’s earnings generally kept everyone in good standing. This week is a big one as Zoom’s earnings kicked off a stretch in which 66% of my portfolio reports over roughly 72 hours. I would love to exit 2020 with the same cast of characters, so I’ll have both fingers and toes crossed the next few days.

CRWD – This month’s main news was CrowdStrike being named a launch partner for Amazon’s new AWS Network Firewall. This arrangement will allow current customers to integrate CrowdStrike’s network protection services directly into their AWS deployment. The deal expands earlier integrations with AWS’s Gravitron, Workspaces, Bottlerocket, PrivateLink, and Control Tower products.

That’s a whole lotta integrations, and it all sounds pretty impressive. However, I must admit I have zero idea exactly what any of these products do or how they work. That’s OK though. You see, I am not actually looking to purchase any network protection (thank goodness, or I’d be screwed). I am only trying to identify potentially dominant companies. Therefore, all I really need to know is one of the world’s biggest cloud providers has chosen CrowdStrike as a trusted partner. These types of deals and CRWD’s superb history of customer growth give me plenty of conviction even if I don’t quite understand the tech specs behind all the hoopla. For those more technically inclined, our next hoopla update is December 2 earnings.

DDOG – Shoot. I thought this might happen. Despite business results almost exactly in line with what I anticipated, the market disliked Datadog’s November 10 earnings and nicked the shares. Revenues of $154.7M kept growth above 60% (+61.3%) but could not meet Mr. Market’s expectation for a return to higher pre-COVID rates. Regardless, the report contained numerous positives suggesting DDOG is still an excellent company. First, customer metrics remain very strong. Datadog landed 1,000 new clients and now stands at 13,100. This was a significant bump from 600 in Q2 and 650 in 3Q19. It also added 92 with >$100K in Annual Recurring Revenue (ARR) for a total of 1,107 (+52% YoY). These customers helped set record quarterly ARR growth. 71% of clients currently use 2+ products versus 50% last year. 20% are using 4+ compared to 7% in 3Q19. DDOG saw ~75% of new logos land with 2+ products, and net retention was 130%+ for the 13th consecutive quarter. So, it seems customers both new and old remain very enthusiastic about Datadog’s offerings.

Perusing the secondary metrics, 79% gross margins declined slightly from 80% in Q2 but improved from 76% in 3Q19. Expenses crept to 70% from 69% of revenue in Q2, but the increase was almost solely because R&D jumped from 27% to 30% while S&M and G&A both declined. Given DDOG’s recent pace of innovation and hiring of engineers, an R&D increase makes sense. The CFO explained, “We continue to see a meaningful opportunity to innovate and expand our platform and therefore plan to continue to make meaningful investments in R&D.” I personally have no issue with that as long as S&M and G&A stay in line.

Another positive is recent COVID-related revenue pressure does not seem to be hurting the bottom line. Datadog recorded $13.8M in operating income and $16.0M in net income for margins of 8.9% and 10.3%, respectively. It also churned out record-high cash flows with operating at $36.3M (23.4% margin) and free cash flow at $28.7M (18.5%). In fact, this marked DDOG’s fifth straight quarter of positive operating income, net income, and operating cash flow. Even as top line growth is starting to slow, the profit spigot appears to be fully open.

Datadog had a solid operational quarter as well. As usual, it announced a gaggle of new products and features. It also introduced the Datadog Marketplace allowing developers to build apps on its platform. Last but not least, the company continues to strengthen some important partnerships. Following up on late September’s Microsoft deal, Datadog recently expanded its Google Cloud arrangement. The new benefits include:

Additional Datadog points of presence in Google Cloud regions

Extended go-to-market collaboration and deeper sales alignment with Google Cloud and Datadog sales teams

Access to Datadog’s 400+ integrations on Google Cloud’s scalable and secure infrastructure through a single-click deployment on the Google Cloud Marketplace, with consolidated billing that will allow customers to draw down on their Google Cloud committed spend

Continued investment into product co-innovation with more native joint solutions around Anthos, Open Telemetry and the Google Cloud operations suite.

While revenue from these deals might take time to kick in, Datadog is clearly establishing itself as a player on the major cloud platforms. Integrating directly with these titans reflects very well on the quality of DDOG’s products and services.

Going into the call, I was very interested to get an update on the COVID “cost optimization” which dinged large customer revenues in Q2. It was reassuring to hear both the CEO and CFO say the usage restriction started to ease in Q3. Said CEO Olivier Pomel:

Throughout the quarter usage growth of existing customers was robust which was a return to more normalized levels after slower usage expansion in Q2. To be more specific, the pace of user growth in Q3 was broadly in line with pre-COVID historical levels.

The CFO added a bit more color with:

While Q3 usage growth was back to pre-COVID levels, the pressure experienced in Q2 can still be seen in our year-over-year comparisons for a number of quarters.

I take this to mean while comps should see residual stress off Q2’s COVID-lowered base, it appears monthly spending increases are starting to loosen back up. That trend hopefully continues.

Unfortunately, this dynamic had an immediate effect on Q4’s guide of just 44% top-end growth. This would be a considerable drop off, though management admitted to being extra prudent against another COVID slowdown. Management’s approach can be best explained in this CFO quote:

While we saw usage growth in Q3 that was consistent with pre-pandemic historical levels, the pandemic is still ongoing and uncertainty remains. Therefore, we are being prudent by factoring into our guidance, usage growth trends below what we have seen in Q3 and conservative new business assumptions, as well as continued strong investment in R&D and sales and marketing.

…along with this exchange on the call:

Analyst:

And then lastly on your underlying assumption for some softness in usage in your 4Q guide, half pretty much into the quarter. It doesn't sound like there has been any unusual usage softness in that 1.5 months, correct me if I'm wrong. So aren't you just being a little bit too conservative here? I mean what is it the scenario that truly worries you with so little time left in the quarter?

CFO David Obstler:

Yes. I think just overall we've tended to be conservative in our guidance to incorporate usage growth rates that are lower than what we have seen and new logo accumulation that's lower. And I think we said last time, that given that velocity and the fact that we're in the pandemic and we can't predict what might happen around the world, we wanted to continue to roll that conservatism forward. So it's really that at the core of the guidance rather than anything that in particular that we've seen that's different than what we said on the call today.

Pomel expressed optimism as well, saying “the message you should get from this call is that we’re just getting started and we’re also very excited about it.” That sounds to me like everyone is leaving plenty of room for a Q4 beat. Let’s hope they can follow through on it.

I included more quotes than usual in this section, but I think it is crucial to review management’s thoughts given DDOG’s size in my portfolio. In the end, I see a quality company being extra cautious as it recovers from the Q2 slowdown. Its profitability trends are excellent, and a normal Q4 beat would keep growth above 50%. However, it does appear DDOG’s hypergrowth days are at least temporarily over. What does it all mean? Well, the most likely outcome is a slightly lower multiple is here to stay (and probably deserved). Given its consistent profits and cash flows, I could easily see DDOG holding a premium like say TTD, OKTA or SHOP. At the same time, it is probably done running with the ZM’s and SNOW's of the world. A profitable 50% grower is always attractive to the market. It is just not as attractive as the 70% grower everyone hoped DDOG would be. I have adjusted my own outlook accordingly, at least in the short term.

Fortunately, I had trimmed ~2% when the stock jumped above $110 since I felt there was a real chance this might occur. Now that it has, DDOG drops slightly behind DOCU and NET on my present conviction meter. Being content with my NET allocation after its recent run, I swapped ~4% of my portfolio from DDOG into DOCU to reflect the new levels. I trimmed another ~0.5% to bump up PTON when the latter dropped below $100. That put DDOG a hair under 10% of my portfolio (it has shrunk a bit since as other names have climbed around it). I plan to hold the remainder but am unlikely to add any new money until things shake out over the next quarter or two. I guess you could say Datadog is on a slightly shorter leash.

DOCU – This month DocuSign released enhancements to both its eSignature and Contract Lifecycle Management products. On the eSignature side, improvements included:

eSignature for Slack features a DocuSign chatbot that enables users to send and sign important documents from directly within Slack. This eliminates the need to switch between apps, saving time and increasing productivity.

SMS Delivery enables you to reach signers instantly wherever they are, with real-time notifications sent directly to their mobile device. This will help you accelerate business transactions while delivering an engaging, mobile-first experience. (We are targeting general availability of this feature for December.)

Agreement Actions allows admins to easily configure rules to automate common post-signature actions. This includes the ability to automatically archive completed documents to a cloud storage provider (e.g. SharePoint, Box, Dropbox, Google Drive), export data to Google Sheets and start workflows in CLM.

Drawing streamlines processes by enabling a sender or signer to upload an image and allows signers to leave free-form markups on the image—all directly within the document. For example, a car insurance company can request consumers to upload an image and highlight damages to their vehicle within the claim document.

Search enhancements to Organization Management help users find the agreements they need quickly and securely. Admins can create custom search experiences using advanced filters based on agreement field data, as well as control which agreements are discoverable by specific user groups.

Updates to [DocuSign’s] highly rated eSignature iOS app, which includes an improved user experience and new features (e.g. drag-and-drop tagging).

On the Agreement Cloud side, DOCU announced the following:

DocuSign Analyzer helps you negotiate better agreements, faster. It applies the AI-powered advanced contract analytics of DocuSign Insight to the pre-execution stage, streamlining contract review and negotiation and automatically analyzing inbound contracts to help manage risk.

DocuSign CLM+ adds AI-driven analytics from DocuSign Analyzer and Insight to our market leading CLM. This combination empowers organizations to automate manual tasks, orchestrate complex workflows and eliminate unnecessary risks more intelligently by embedding analytics and machine learning across every stage of the agreement lifecycle.

DocuSign Monitor helps protect your agreements with round-the-clock activity tracking. It uses advanced analytics to provide near real-time alerts—empowering security teams to detect unusual account activity, investigate incidents and respond to verified threats.

DocuSign Quote Gen for Salesforce CPQ+ allows Salesforce CPQ customers to leverage Gen for Salesforce as their document generation solution within CPQ+.

With all the recent vaccine updates, many work from home companies have seen pressure on their stock. DocuSign somehow gets lumped in that category even though I’m not sure that’s entirely fair. Does anyone really believe the world will rush back to printing, scanning, and overnighting business documents post-COVID? The recent acceleration in both total and enterprise customers strongly suggests not. At some point, DocuSign’s reputation should move past “work from home” into “the efficiency and convenience of a digital future.” When that happens, the stock should once again take off. At least that’s what I am betting on. Our next update on the current state of affairs is December 3 earnings. I would not be surprised to see another set of accelerating numbers with positive tailwinds. As outlined in the Datadog section, I have bumped up my allocation as a result.

NET – Cloudflare spent most of October dazzling us with platform enhancements and product releases. November 5 earnings was our first chance to see if there was any steak behind all that sizzle. I’m happy to say it turned into an all-you-can-eat affair.

CEO Matthew Prince summed it up by stating:

Our third quarter represented many significant milestones including surpassing $100M in revenue, crossing 100,000 paying customers, and releasing more than a dozen new products and features.

Cloudflare posted a record $114.2M in revenue for 54.4% growth, accelerating from 47.9% last quarter and 47.7% last year. Even excluding a one-time catch up of $1.9M, revenue grew 51.9%. Management credits half the jump to existing customers and half to new logos, which suggests sustainable revenue momentum rather than just a one-time bump. Total customers grew 25% to roughly 101,000. The 99 new clients spending >$100K was Cloudflare’s largest quarterly add ever and brings the total to 736 (+63% YoY). NET also added its first $10M customer on an annual run-rate basis. What’s most impressive here is this Fortune 500 customer joined Cloudflare in 2016 after one of its employees used a free version on his personal site and then introduced it to the firm on a $60K contract. I’d say that is a pretty good example of scaling with a client. Seeing as net retention ticked to 116% vs 115% last quarter and 111% in 3Q19, this type of scaling seems to be increasing. Remaining performance obligations (RPO) jumped 25% sequentially and 81% YoY to $342M, reinforcing the current popularity of NET’s offerings. That total includes a $50M deal which won’t contribute significantly until 2021, but even excluding that puts RPO growth at 73% YoY. That obviously bodes well. Gross margins remain strong at 77%. Said Prince:

Even though we charge almost exclusively on a fixed subscription basis, we were able to meet our gross margin target…without depriving our customers with burgeoning bills.”

Given the enormous spike in usage and capacity demands during 2020, I view this as an underrated comment and a strong tribute to Cloudflare’s ability to execute at scale. Overall, that’s pretty sexy top-line stuff.

As you’d expect, the improved execution is positively affecting the bottom line as well. Expenses have steadily decreased as a percentage of revenue and were a record-low 81% vs 86% in Q2 and 103% last year. In addition, check out this margin progression so far in 2020:

Operating Cash Flow: -15.6%, 4.0%, 1.7%

Operating Income: -15.8%, -9.5%, -4.0%

Net Income: -13.5%, -9.6%, -5.0%

Free Cash Flow: -33.5%, -20.2%, -15.6%

If you are going to own an unprofitable company, this is exactly the kind of trend you want to see. Cloudflare guides for 41% Q4 growth and 47.5% for the year. Its usual beat would move both these rates closer to 50% exiting the year. Hmm, a 50% grower on the verge of profitability with multiple avenues to continue expanding its business? Sign me up.

Management’s call comments were just as positive as the numbers. The highlight was the usage of NET’s Workers platform. More than 27,000 developers actively wrote code on or deployed Workers in Q3, up from 15,000 a year ago. Take this statement for what it’s worth, but Cloudflare believes more developers are using Workers to write and deploy code than every other edge computing platform combined. This type of adoption can only be viewed as great news in today’s developer-led environment.

I was also pleased with management’s update on Cloudflare for Teams. Teams, a virtual VPN service launched in January, was in the right place at the right time when the entire planet rushed online in March. NET offered Teams for free through September 1 and had “a couple thousand” companies take them up on the offer. I believe an underappreciated aspect of this program is it gave Cloudflare an intensive six-month period to tweak a new product under live conditions with clients eager to lend a hand. The conversions to paid during the last month of Q3 would provide some early insight into just how useful and sticky this product might be. I was happy to hear management say 75% of clients transitioned from free to paid including some significant new logos. It also extended the free version for select customers who are still limited by COVID but likely to convert when “they can get their feet back under them.” The immediate revenue effects were deemed immaterial since they came so late in the quarter, but this new revenue stream should provide a nice boost in coming quarters.

Cloudflare also noted positive reaction to its recent releases. Prince said sales leads more than doubled during October’s Zero Trust Week. He also announced plans for one more release week before year’s end centered around privacy and compliance. Cloudflare sees those areas as its next logical step given:

…what the folks at TikTok are living through, what Facebook is increasingly facing in Europe, that comes to every business that is operating on a global basis, where the data for their customers is required to be kept in market and processed in market, then there really isn’t another platform on the market than can provide the solution without cobbling together a bunch of things. And if in the future, you’ve got 100 different laws in 100 different countries, then you need a network that spans 100 different countries.

That sounds like an ambitious undertaking, but the specificity of the statement suggests Cloudflare is listening very closely to its customers’ needs.

Taking it all in, Cloudflare is quickly angling to become the “most programmable and configurable” platform for establishing, maintaining, and securing a digital presence. Prince implied 2020’s rush online could end up being an incredible opportunity for those companies best supporting the move. He seems ecstatic about NET’s position, observing “Sometimes you hit on all cylinders. We had one of those quarters.” I appreciate the clarity, Matthew. And just so you know, we’ll gladly take as many more of those quarters as you can give. Carry on, my friend.

OKTA – < Yaaaaawwn. > November saw Okta receive yet another sneaky-excellent accolade by being named a Gartner leader in Access Management for the fourth consecutive year. That was part of a sneaky-excellent +16.8% month which now puts the stock at a sneaky-excellent 112.4% YTD. Here’s hoping this is all prelude to another sneaky-excellent report on December 2. Man, Okta sure has been a sneaky-excellent holding.

PTON - November 5 was my first earnings report as a Peloton owner. I was glad to see results supporting my initial thesis. Total revenue of $757.9M and 232% YoY growth “[exceeded] expectations across all geographies.” Believe it or not, that amount represents an almost 7X revenue increase in just 24 months. Connected Fitness revenue, which includes equipment, came in at $601.4M (+274% YoY) and 39.4% gross margins. Subscriptions were $156.5M (+133% YoY) at 58.5% gross margins and 20.6% of total revenue. Gross profit growth accelerated for the third consecutive quarter to 213% as PTON gains efficiency at scale. It now has 1.3M+ connected fitness subscriptions (+137.1% YoY) and 510K digital subscriptions (+61% QoQ). Madly pedaling users logged 77.8M+ workouts this quarter (+306% YoY!!!) even though it was the traditionally slower summer months. Net monthly churn, which has never been a problem even pre-COVID, remains very low at 0.65%. People sure do like their Pelotons.

The recent surge in popularity has led to huge gains in operating leverage, cash flow, and profits. Expenses as a percentage of revenue have plummeted the last two quarters and sat at 34% this quarter vs 68% in 1Q20. Operating cash flow was $312.1M for a 41.2% margin. GAAP operating income came in at $68.9M (9.1% margin) and net income $69.2M (9.1%). Adjusted EBITDA was $118.9M (15.7% margin). The TL;DR version of the numbers says Peloton is making money hand over fist for products seeing insatiable demand. Given its performance, I’d say PTON remains very much at the front of the pack.

During Q1 PTON launched its higher-end Bike+ and announced its lower-priced Tread (its treadmill offering). Demand for the Bike+ has been even greater than anticipated, and the company has shifted manufacturing capacity to Bike+ to meet the crush. Tread is the much anticipated follow up to the successful Tread+ launch this summer. Tread was available for viewing in showrooms prior to Thanksgiving and hits the UK market December 26, which is Boxing Day (a huge UK shopping day along the lines of Black Friday in the US). It will be available to US and Canadian customers in early 2021 with a German release scheduled later in the year. The treadmill is “historically the biggest category in fitness,” so management is understandably excited about the potential. It expects Tread to be a strong 2021 contributor with its biggest impact in 2022 and beyond. Anything even remotely close to Bike’s popularity could mean a long runway for Peloton’s continued success.

Beyond equipment, Peloton has expanded its class selection to include Barre workouts and full body Boot Camps. This variety lets users turn home workouts into more of a full gym experience. The new workouts have been a hit with 500K+ Barre workouts and 350K+ Boot Camps within the first few weeks of availability. Yoga and meditation classes have also been created. While management must be mindful not to branch out too quickly, these efforts are all very natural extensions of its core business. Peloton is positioning itself to become not just a bike membership but a virtual home gym that holistically meets any fitness need. In my opinion “holistically” has recently become an annoyingly overused buzzword, but I do think it applies here.

The monster numbers and expanding product line are all good news. The only real bad news is those numbers would be even bigger if Peloton wasn’t struggling mightily to keep up with demand. CEO John Foley described wait times as “unacceptably long” and the company noted “substantial backlog…[with] supply constraints for the foreseeable future.” In response, Peloton has increased its manufacturing capacity “several fold” and expects to grow its supply through both third-party partners and the opening of its new Taiwanese factory by the end of 2020. The factory will produce both Bikes and Treads with a capacity of ~1.5M units, allowing for flexibility based on demand. Management expects Bike will return to its normal two-week wait relatively soon, but Bike+ is likely to lag into Q3 before meeting the same timeframe. In the meantime, PTON is “incurring outsized additional shipping related expenses in Q2 in order to alleviate some of the delays ahead of the holiday period.” Most of this cost is air shipping inventory in an attempt to reduce delivery times. Management sees the short-term expense as the right move to get its bikes to as many new members as possible. I would agree.

Going forward Peloton guides for $1B in Q2 revenue, which would be 114% growth. I’d anticipate something closer to 125%+. PTON also expects 1.63M subscriptions (+129%). That number is probably light as well. I am also encouraged management expects “modest sequential revenue growth as we progress through FY2021” and manufacturing expands. That suggests a significant portion of any missed holiday sales won’t disappear completely but rather get pushed into 2021. That is a huge testament to Peloton’s brand since it implies many customers aren’t even considering alternatives that might be delivered before Christmas. Are some people canceling orders? Unfortunately, yes. However, more seem to be making the buy knowing there could be a lengthy gap before delivery. Management expressed the same, saying “we think people just wait for the Peloton…and that’s what all our data has shown.” I think it is important to note delays are already baked into the above forecasts, so any loosening of supply chains should positively impact both the top and bottom lines. For FY21, management raised its revenue guide from $3.6B (+100% YoY) to $3.9B (+114% YoY). It also raised the FY subscription estimate to 2.17M (+99% YoY). So, PTON basically expects to double subscriptions and more than double revenue in a year where it likely rakes in $4B+. Eyeballing it, I would also guess they come close to tripling EBITDA to something near $350M for the year. That would be a pretty neat trick for any firm.

You know a company is in a good spot when its biggest problem is it can’t make its products fast enough to sell them. Software firms admittedly never have this issue, but I was fully aware of this dynamic before buying in. Besides, can I really complain because Peloton is limited to hypergrowth rather than superduperridiculousgrowth for a quarter or two? Not everyone can be Zoom after all. The supply constraints limit PTON to being a secondary holding for me, but it is one I still believe worth having. I’ll just have to be content knowing Peloton – and Beyonce!!! – are doing their darndest to reach as many members as possible looking to pedal off those holiday pounds.

TWLO – A slow and steady +14.7% month. The main news was Twilio completing its Segment acquisition just three weeks after announcing it. I covered most of the Segment details in last month’s recap and think this will be a strong addition to Twilio’s product line. TWLO has plenty of interesting things lined up for the next few quarters. It just needs to keep executing. This is most likely a set it and forget it position at least until January’s earnings.

ZM – Since I’m just about out of superlatives for Zoom’s 2020, here’s the TL;DR recap of the raw numbers in November 30’s report:

.

For those who still want the details, this is now the third consecutive quarter ZM has posted borderline obscene growth in just about every area you can name. At some point the law of large numbers and eventual passing of COVID will catch up with Zoom, but this quarter was not that time. Just take a gander at some of these Q3 figures and corresponding growth progressions:

That’s some crazy stuff right there, especially for a company this large. No matter how you slice it, Zoom has been on a historic run. The only thing I could even consider an operational glitch is a gross margin decline to 68% from 72% last quarter and 83% last year. However, that drop is justifiable and even commendable when you consider much of it is due to Zoom providing free service to over 125,000 K-12 schools forced online when classes resumed this Fall. Management says the decrease will last only a few quarters and still expects 80%-82% gross margins long term. It is also fair to point out this is free publicity in an education space that was Zoom’s second fastest growing paid vertical in Q3 behind government. This tradeoff has been more than enough to maintain a healthy bottom line:

Again, stellar stuff. The question, of course, is just how long ZM can maintain this insane level of performance. We all know Zoom’s business will recalibrate at some point. The moment of truth is quickly approaching as we move closer to a vaccine. This exchange on the call best represents the challenge:

Analyst:

Hey, Kelly and Tom. Thanks for taking the question, and congrats on a good quarter. I guess Kelly, we haven't talked a lot about next year. I know you're not guiding to next year. But you can imagine the question we get all the time from investors is, how does Zoom grow post-pandemic, was this a pull forward? And as people go back to work, do they turn -- school, do they turn off their Zoom?

So given the commentary that you that you talked about with respect to churn rate for the business being better than you expected, given the commentary around Zoom Phone attach? Again, not asking for specific guidance, but at a high level, how would you think -- how would you kind of talk to us about calibrating growth for next year? Is it more going to be swung by churn, is it more going to be swung by Zoom Phone attach, any clarity you can provide, I think would go a long way.

CFO Kelly Steckelberg:

Sure, I think a couple of things. First of all, the remote working trends that started pre-pandemic have certainly accelerated during this period of time. And while we all hope for a vaccine as soon as possible, I think that remote work trends are here to stay. And we're excited about some of the features and functionality that we announced at Zoomtopia, for example, to enable this and to support customers and employees that are thinking about potentially going back to work likely in some sort of a hybrid work environment.

So these are things like Smart Gallery, which are really meant to enable better communications when people -- some of the employees are working remotely and some of them are in the office. So we're really looking towards supporting an environment like that, and believe that our -- especially our up market, customers are going to continue to want to provide that flexibility to their employees.

And then, in terms of key growth drivers, absolutely. Zoom Phone is one of the key drivers for next year. It was absolutely the fastest growing product in Q3. So excited to see that momentum. And if you think about this significant base of Zoom meetings customers that we've acquired in Q1, Q2 and Q3, they are there to continue to support our strategy of selling into our install base. And we absolutely expect that to be a key driver for next year.

Along those same lines, Steckelberg noted “when we’re looking forward and thinking about Q4 and into next year, you should think about that our reps are returning to more normalized pre-COVID sales productivity levels.” That implies to me ZM expects to hold much of its COVID-elevated baseline with sequential growth more in line with pre-virus levels. Considering Zoom’s performance has always been excellent, there’s not much to quibble with here. It’s just not what the market has come to expect the last two quarters.

It is clear many are already nervous about what Zoom will do for its next act. Most analysts seemed focused on customers with fewer than 10 employees (the greatest area of likely churn) and updates on Zoom Phone (the most obvious new revenue stream). Churn was better than expected “across all segments of the business,” and management noted early success converting smaller customers from monthly to annual contracts to create more lock in. Zoom Phone is now available in 44 countries with the company’s biggest ever deal signed in Q3. The difficulty for investors is Zoom does not yet break out numbers for this product. Asked specifically about this, Steckelberg replied:

As we said about Zoom Phone metrics, we’ll continue to look at opportunities for milestone metrics along the way. And that could be something we would disclose in the future. We just haven’t done it yet today.

There are other products in the pipeline, most notably the OnZoom and Zoom Apps platforms unveiled at October’s Zoomtopia conference. While both clearly have potential, they are also in the early development stage with limited information on management’s monetization strategy. Regardless, these products are much more likely to contribute significantly during calendar year 2022 than 2021.

Managements top-end Q4 guide of $811M in revenue and 311% growth suggests Zoom isn’t going away any time soon, but it is at least worth considering where things might be heading in 2021 and beyond. The immediate avenues for growth are Zoom Phone and Zoom Rooms, which the company continues to push with enterprise customers. Both are impressive products started well before COVID, and it was easy to see how they could be accretive when ZM was making under $200M a quarter. With ZM now projecting $800M+, will they be enough to move the needle? And if so, just how long will it take to get there? That is still very much to be determined. The 130%+ net expansion rate should help growth as well, but it is worth pointing out that number only includes customers with 10+ employees. With the crush of smaller customers this year, that expansion rate only applies to 62% of ZM’s current revenue. Not knowing exactly what happens with 38% of your business is a pretty big wild card. And I guess that’s the rub. It is important to remember Zoom was a thriving business before COVID, and there is little reason to think it won’t thrive after. I guess it all boils down to your definition of “thrive” in a post-pandemic world.

It is hard to fathom labelling a company quadrupling its business as a disappointment, but that has indeed been the market’s immediate take. In the short term, I think it is safe to say Zoom has at least one and maybe two more quarters of monster YoY numbers. After that, the expansion of Phone, Rooms, and its other services will be heavily pressured to maintain growth as COVID hopefully wanes. There is little doubt Zoom will remain a dominant global company post-COVID. The question is how much air is left in the stock. I haven’t done anything with my allocation yet, but this is a question I will definitely be pondering as we head into December.

My current watch list…

…in rough order is ROKU (amazing quarter!), SHOP, FVRR, and TTD. A few others are hanging around – FSLY, COUP, ZS, MDB – but in my eyes those first four have separated themselves. For what it’s worth, I believe this list is as strong as it has been in several months and any of these companies is worth owning. It is always comforting to feel you have a strong stable waiting in the wings just in case.

And there you have it.

I might be a little slow on the uptake, but I am beginning to sense a teeny bit of volatility in my 2020 performance. My portfolio jumped 13%+ in just 8 days to start November before cratering -12.2%(!!!) on 11/9 alone. It plummeted another -8% midway through the next day before clawing back to close at -4.1%. That meant a -15.8% loss in just two days and a max drawdown of -30%+ from my October 13 high. That now marks the fourth -30%+ drawdown of my entire portfolio in the last two years. Quite the rollercoaster.

Lucky for me I’ve been to enough amusement parks to know how rollercoasters work. At some point the gravity-induced scare has to end if only so the car can start its next upward slog. That’s exactly where my current ride seems to be. A 5.5% bounce on November 11 pulled me back to flat for the month, and my portfolio has climbed steadily since. The rise might be due to completion of the US election. Or maybe the market fully digested the vaccine news. Or possibly Saturn’s fourth ring aligned with the Big Dipper in a way that floods money into tech stocks. Who the heck knows really? Me and my biases prefer to think it is simply the market recognizing good companies doing exciting things.

I rebounded enough from early November’s plunge to avoid my first consecutive negative months since the February/March COVID crash. A late rush also kept me from trailing the S&P 500 for consecutive months since September/October 2018. Oddly enough, that 2018 period was another notable rotation away from SaaS and other high-growth names. Fortunately, sticking with strong business execution has won the day many times over in the two years since. Zoom’s performance generally continues that trend (the post-earnings stock move notwithstanding). I’m cautiously optimistic CRWD, OKTA, and DOCU can do the same. At least I hope so because I am a strong believer early Christmas gifts are never a bad thing.

Thanks for reading, and Happy Holidays no matter which one you might be celebrating. If you plan on waiting for Santa, please remember to leave the cookies far enough from the carrots that he and Rudolph can stay socially distanced while enjoying them. Until next time, I wish everyone a joyous and peaceful end to what has certainly been a memorable year.